Investment Rundown

To start, Generac Holdings Inc (NYSE:GNRC) experienced a 22% decrease in sales, down from the Q1 2022 levels of $1.14 billion. As higher inventory levels in the field caused lower sales, the performance was mixed in my opinion. With a broad set of products, however, I think that GNRC will eventually see a recovery as the residential side of its business begins to grow in demand. By 2025 GNRC expects their SAM to have 5x over the last 7 years, as it reaches $72 billion in value.

The shares of GNRC have taken a steep dive from the highs of $498 back in November 2021 as almost all energy or renewable energy companies saw massive valuations. Right now, trading at around the 20x forward earnings range, the price doesn’t necessarily constitute a strong buy. I would like to see a recovery in the sales and backlog of the business before making a buy rating. With that said, GNRC is rated a hold from me.

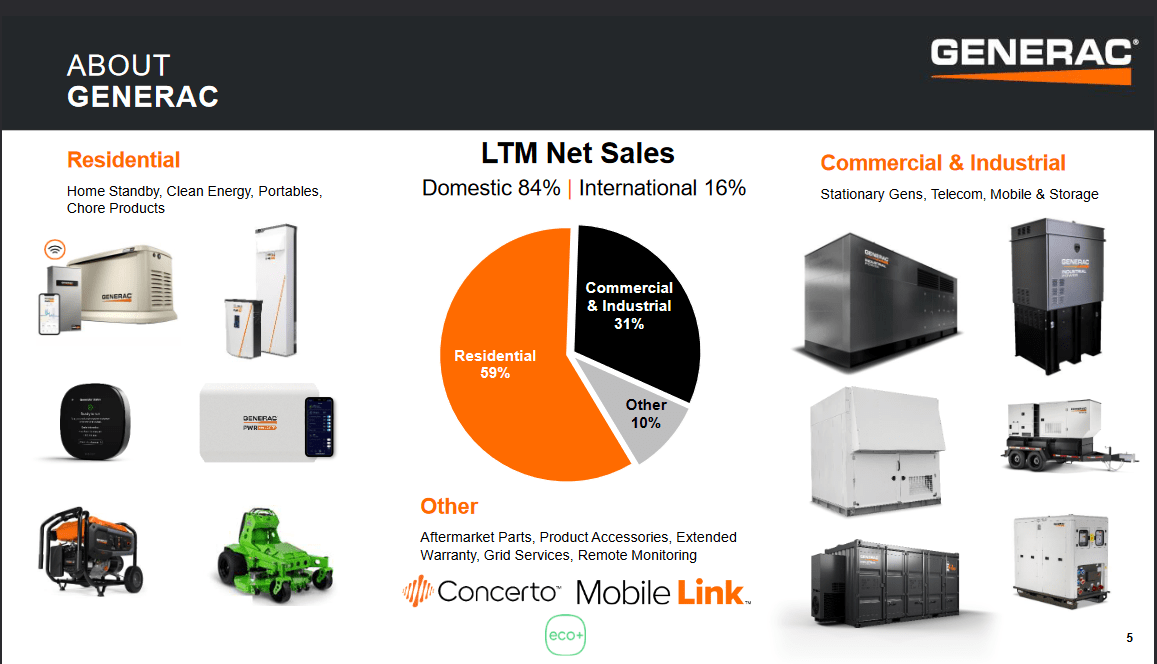

Company Segments

Within GNRC they focus largely on both the residential and the commercial side of power generation equipment, energy storage systems, and energy management devices. The residential side of the business makes up a majority of the sales, around 54% to be exact.

As for their residential product, it mostly revolves around portables and chore products and their commercial side focuses on energy storage and energy management.

Company Products (Investor Presentation)

The discrepancy between the two parts of the business is however shrinking, as the last quarter for GNRC showed residential product sales decrease by 46%, a devastating result I think. The commercial side however saw an increase of 30% which helped offset a lot of the otherwise losses to the quarter. As stated by the management from the last quarter, they entered 2022 with a very strong backlog for home standby products, which has resulted in this YoY decrease. GNRC wasn’t able to maintain the same backlog and the consequence is what I’d call alarming results, like this.

Mega Trends (Investor Presentation)

But the future does seem brighter, and estimates suggest that GNRC will eventually reach back to previous revenue levels as they are impacted by several megatrends. Most of the revenues that GNRC generates are from domestic sales, but 16% are also international. I still see most of the potential presented in the US as investments into the telecom market will be a major tailwind that GNRC can benefit from. But with the shift towards renewable energy and more and more people wanting to have solar panels on their roofs, GNRC could market itself here with its power outages range of products, for example.

Outlook For 2023

One of the burning questions on investors’ minds has to be whether GNRC can recover its inventory levels and build up the backlog once again. The company benefits from extreme weather conditions as their standard generators grow in demand and become widely used. But the record-breaking snow and rainfalls in the western part of the US have fueled the usage of hydropower generation, and 2023 is expected to see a 72% increase of it.

As for what GNRC themselves sees happening, the shipments of residential products are expected to remain soft during the second quarter as standby field inventory levels are normalizing. That sounds a lot like we won’t see any major catalyst in the near term. The full-year sales are also expected to see a 6 – 10% YoY decline. If we see a negative surprise in the coming quarters, I can see this revised further downwards, and would most certainly drag the share price with it.

Risks

Perhaps the primary risk right now with GNRC is the decreasing sales, which makes the current valuation not seem very good to buy in at. Trading far below its 5-year average p/s of 3.5, paying 1.9 for sales is still a bit much, especially when the performance in the first quarter has been so mixed.

But making note that GNRC also has negative cash flows I think is important. 2020 and 2021 were fantastic years for the company but with the result of 2022, it took a deep dive into the negatives, $77 million to be exact. That sort of inconsistency makes it hard to make out the value of the business. If GNRC can build up its backlog better, I think that it could see more consistent positive cash flow results which could justify the current multiple it receives. The expectations for 2023 are that the adjusted net income conversion to free cash flows will be well above 100%. I think the results remain to be seen and if they come true, and we don’t see an upswing in the share price, then paying 9x FWD p/fcf might be fair. But I argue again that proof is needed before I would make a buy rating, we have seen already what happens when the company has high expectations, and it doesn’t always live up to them, the stock price plummets nearly 75%.

Industry Comparison

Looking at nVent Electric plc (NVT) and GNRC together, I think that NVT comes out ahead on some remarks. It wasn’t as affected as GNRC in 2021 with a massive run-up in its share price, instead, it has remained rather consistent in a steady uptrend. With a p/e of 17 and a yield of 1.47%, it looks interesting. Offering slightly different products, they still benefit from some of the same megatrends, like residential demand for power outage capabilities and the necessity to build out the grid network.

Where NVT pulls ahead is in the margins department, where the levered FCF margin sits at 12% TTM, far above the negative 2.6% for GNRC. This strong margin is helping fuel the dividend but also a decent buyback program. Looking at the financials briefly, I think that NVT is the winner here too with a debt/cash ratio of 3.5 compared to GNRC with 10.9. The point I want to highlight here is that there seem to be far better options in the same market as GNRC that offer better entry points and more value for shareholders.

Final Words

GNRC is an interesting play as the revenues are very much affected by extreme weather conditions. But the shares have fallen significantly from their highs and the cash flows reached negative in 2022. With inventory levels normalizing, I don’t see any major catalyst in sight that would justify the current valuation. There also seem to be better options in the market that also offers dividends and has strong FCF margins, like NVT, benefiting from similar megatrends. Right now I am rating GNRC a hold and wouldn’t upgrade my rating until I see more firm quarterly performances by the company.

Read the full article here