Introduction

As an investor focused on dividend growth stocks, I always seek new investment opportunities in income-producing assets. I usually add to existing positions when I find them attractive. I also use market volatility to my advantage by starting new positions to diversify my holdings and increase my dividend income for less capital.

The defense sector is becoming more prominent today. The war in Ukraine reminds us all how important it is for countries to be able to defend themselves against aggressors. The war has initiated a spike in defense spending among Western countries, and defense contractors may be able to capitalize on it. A leading and prominent company in the sector is General Dynamics (NYSE:GD).

I will analyze General Dynamics using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

General Dynamics operates as an aerospace and defense company worldwide. It operates through four segments: Aerospace, Marine Systems, Combat Systems, and Technologies. The Aerospace segment produces and sells business jets and offers aircraft maintenance and repair, management, aircraft-on-ground support and completion, charter, staffing, and fixed-base operator services. The Marine Systems segment designs and builds nuclear-powered submarines, surface combatants, and auxiliary ships for commercial customers for the United States Navy and Jones Act ships. The Combat Systems segment manufactures land combat solutions, such as wheeled and tracked combat vehicles, Stryker wheeled combat vehicles, piranha vehicles, weapons systems, munitions, mobile bridge systems with payloads, tactical vehicles, main battle tanks, armored vehicles, and armaments. The Technologies segment provides information technology solutions, mission support services, mobile communication, computers, and command-and-control mission systems.

Fundamentals

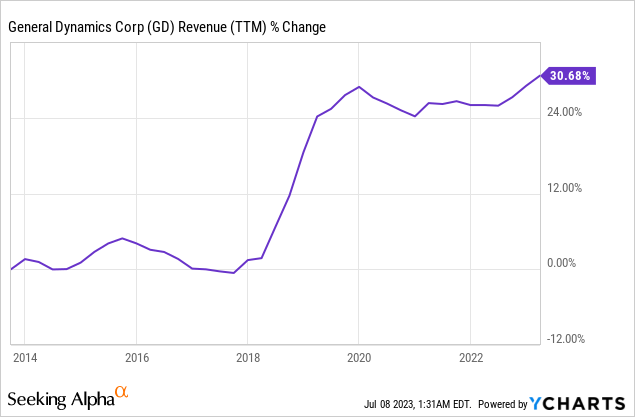

The revenues of General Dynamics have increased by 31% over the last decade. Defense contractors rely heavily on the U.S. government for their sales and tend to grow steadily yet modestly. The company grows by gaining more government contracts and acquiring other contractors, like the CSRA acquisition in 2018 for $10B. In the future, as seen on Seeking Alpha, the analyst consensus expects General Dynamics to keep growing sales at an annual rate of ~5% in the medium term.

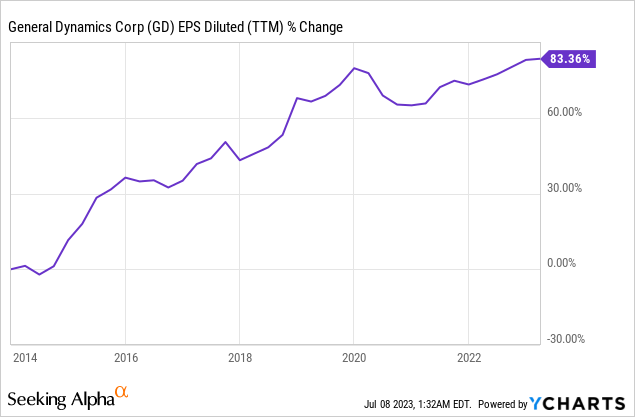

The EPS (earnings per share) has increased much faster than the sales. Over the last decade, the EPS increased by 83%. General Dynamics achieved EPS growth due to its sales growth and aggressive buybacks. The margins have stayed mostly stable, with operating margins hovering between 11%-13% during that decade. In the future, as seen on Seeking Alpha, the analyst consensus expects General Dynamics to keep growing EPS at an annual rate of ~10% in the medium term.

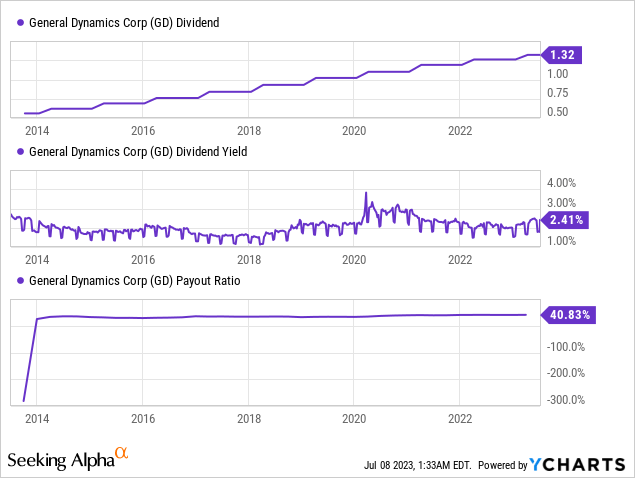

General Dynamics is a dividend aristocrat that has been increasing the dividend annually for the last 31 years. When I last wrote about the company in 2015, it was on the verge of becoming an aristocrat, and the dividend was still one of its primary goals. The company pays a solid 2.4% yield, and the payout ratio stands at 41%, which means that the dividend is relatively safe as the company relies on stable clients like the U.S. government. Investors should expect additional increases to be in the mid-single digits range and in line with the EPS growth.

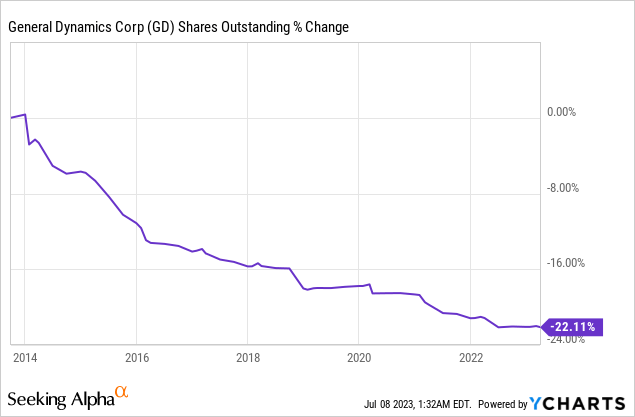

In addition to the dividends, General Dynamics also returns capital to shareholders via buybacks. These share repurchase plans are beneficial as they support EPS growth by lowering the number of outstanding shares. Over the last decade, General Dynamics has repurchased almost a quarter of its shares, thus increasing the EPS significantly. The buybacks are highly efficient when the share price is low, and every dollar has more purchasing power.

Valuation

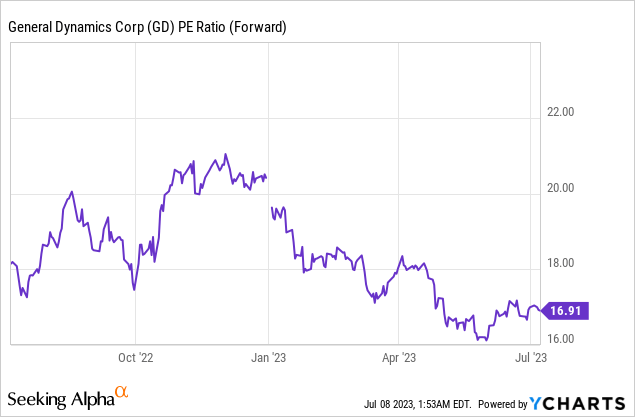

The P/E (price to earnings) ratio of General Dynamics, when using the 2023 EPS estimates, stands at almost 17. The company’s current valuation is the lowest over the last twelve months. Paying 17 times earnings for a very stable company with a growth trajectory is not expensive. However, when the risk-free interest is 5%, and the growth is modest, the current valuation seems fair but not extremely attractive.

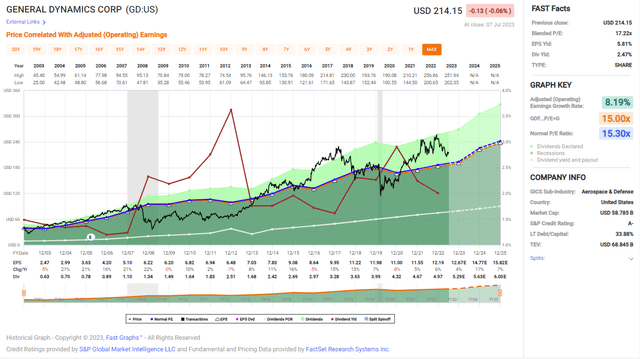

The graph below from Fast Graphs also shows that shares of General Dynamics are not attractively valued at the moment. The average P/E ratio of the company was 15.3 over the last twenty years. Today the P/E ratio stands at 17. The expected growth rate in the medium term is higher than the historical growth rate, so I believe the shares are fairly valued when considering the faster-than-average growth.

Fast Graphs

Opportunities

Diversification is the first growth opportunity for General Dynamics. The company has four business segments that allow it to offer services and products in the air, water, land, and cyber realms. It also has a developed commercial business in the aviation realm with its renowned Gulfstream jets, which allow it to lower its dependence on government contracts. Having four roughly equal size segments and having some commercial sales gives General Dynamics more access to different opportunities.

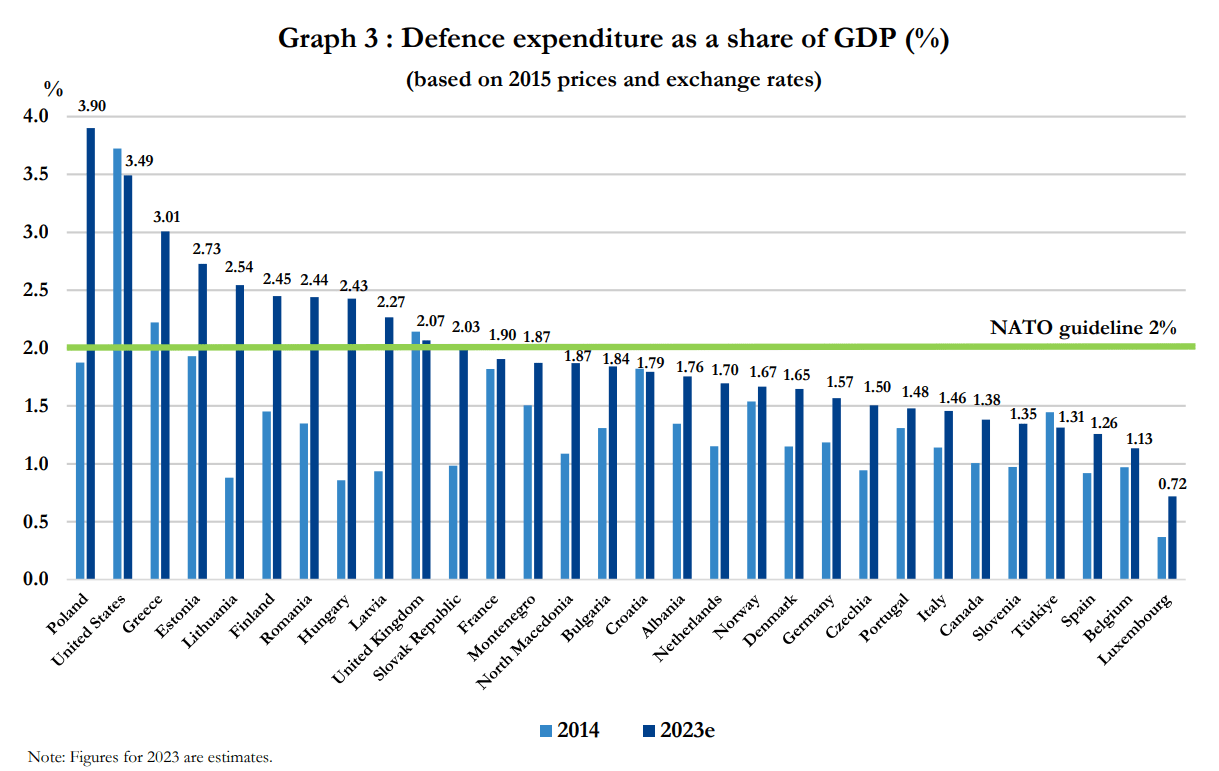

The war in Ukraine has alerted more NATO members, who see Russia as a threat and not an ally. Therefore, we see a vast increase in defense expenditure by NATO members. In 2014, only three countries met the alliance guidelines of 2%. In 2023, the number of countries has grown to eleven. These are all allies of the United States, and General Dynamics can capitalize on that increased spending.

The company relies heavily on the U.S. government for its government sales. Foreign governments account for roughly 20% of their sales. However, as many NATO members significantly increase their spending, this 20% can become a major opportunity. Germany, for example, plans to invest more than 100B Euro in modernizing its military, and American contractors are poised to benefit from it. Other countries like Poland and Finland, which showed a significant increase in military spending, are likely to rely on American technology together with the rest of NATO.

NATO

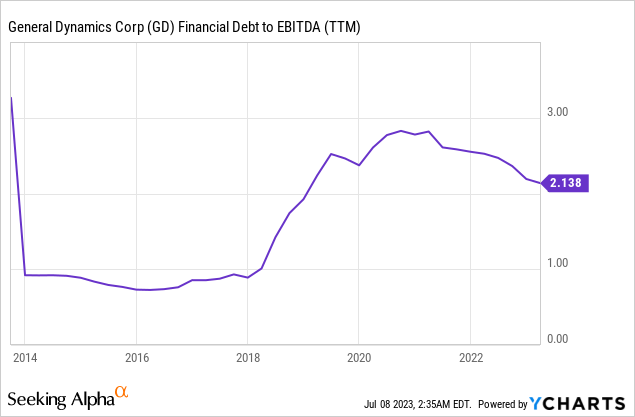

Improving the balance sheet is another opportunity. The company has taken more debt to fund the CSRA acquisition, and since then, it has been slowly deleveraging. That process is crucial in the short-term and the long-term. In the short term, it will lower interest expenses as the rates are higher, thus supporting EPS growth. It will clear its balance sheet in the long term, so there is more room for future acquisitions as the company improves its value proposition.

Risks

Client concentration is a significant risk. The company relies heavily on the U.S. government for its sales. The American government is responsible for 70% of the company’s sales. Such a large portion of the sales from one client makes you vulnerable. Every future change in defense expenditures, or even stagnation, may hurt General Dynamics’ growth prospects and hinder its ability to grow.

In addition, since there is one significant client, there is also harsh competition for its contracts. The barriers to entering the defense contractors realm are high. However, the incumbents include, in addition to General Dynamics, giants like Raytheon Technologies (RTX), Lockheed Martin (LMT), and Northrop Grumman (NOC). All companies are competing for the same U.S. government contracts, and it’s highly competitive.

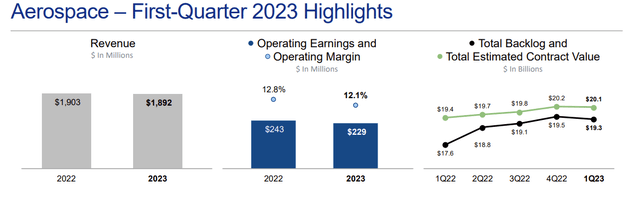

We see some weaknesses when we look at the aerospace segment, which offers commercial products such as the Gulfstream business jet. The backlog has declined compared to the prior quarter, and more importantly, the margins have reduced from 12.8% to 12.1% in just one year. The company blames supply chain disruption for that weakness. While that may be a short challenge, investors should follow that figure in the coming quarters.

General Dynamics

Conclusions

To conclude, General Dynamics is a dividend aristocrat and a blue-chip company. The company steadily grows its sales and earnings and rewards shareholders with buybacks and dividends. The company has several growth opportunities, as Western countries are increasing their defense spending, and its diversification will allow it to capitalize on it. Therefore, the company is well-positioned for the future.

There are several risks to the investment thesis, as the company relies heavily on the U.S. government for very competitive contracts. The company’s current valuation is fair, and therefore, I believe shares of General Dynamics are a HOLD at the moment. Investors may consider slowly buying into the company and gradually building a position over time.

It will be a BUY when the P/E ratio is 14-15, which is slightly below the average valuation. At a P/E ratio of 17, it will be fairly valued, but with interest rates higher than they were during most of the past decade, I require a more attractive valuation to call it a BUY.

Read the full article here