Founded in 1866, General Mills (NYSE:GIS) is one of the best-known historical companies in the consumer staples industry. Its ready-to-eat foods are sold all over the world, however, a large part of this company’s revenue comes from the North America Retail segment, precisely 63%.

Generally, it is considered the classic boring company that is never in the spotlight, yet over the years it has proven to be an excellent investment. It is certainly not a company that can guarantee a huge return in 1 or 2 years, but it is a company that from a long-term perspective can offer moderate returns with equally moderate risk. Like most consumer staples, General Mills also issues a dividend, and the latter will be the main focus of this article.

Dividend analysis

Sustainability

The first aspect to evaluate when analyzing a dividend is its sustainability, since an unsustainable dividend is only a problem, both for the company and the shareholders.

In the case of General Mills the dividend yield [FWD] is 2.53%, let’s see if it is sustainable.

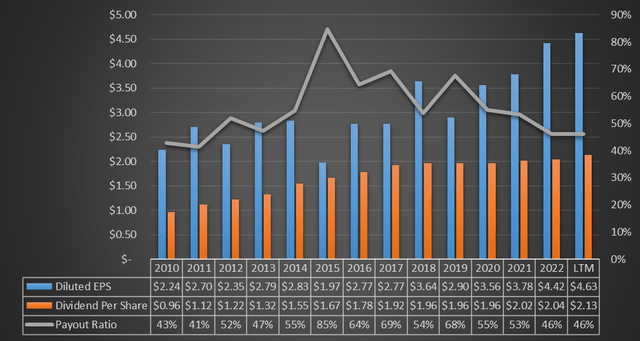

TIKR Terminal

By relating dividend per share to diluted EPS we can see that the dividend has always been sustainable; moreover, in recent years the payout ratio has been decreasing due to a major improvement in EPS. In any case, when I evaluate the sustainability of a dividend, I do not rely only on earnings but also on free cash flow, as the latter more accurately reflects cash inflows and outflows.

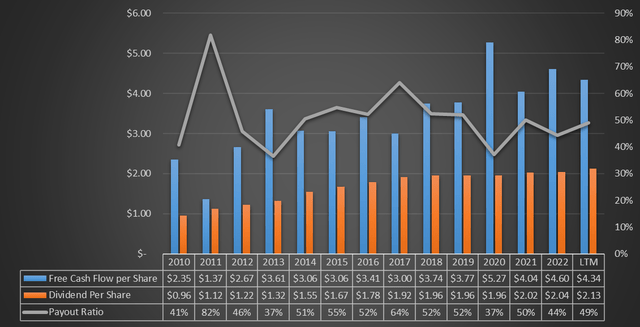

TIKR Terminal

Except for some minor differences, even under this other approach General Mills’ dividend is largely sustainable.

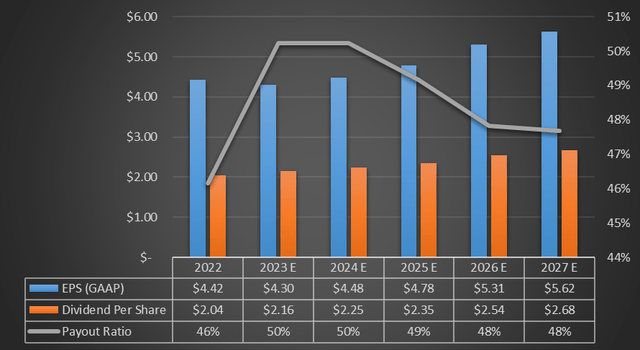

But how will the payout ratio evolve in the future? Here are the predictions of TIKR Terminal analysts.

TIKR Terminal

A CAGR of 4.90% is expected for EPS and a CAGR of 5.60% for dividend per share. This results in a higher payout ratio in 2027 but no doubt still sustainable.

Seeking Alpha analysts also agree with these estimates, at least until 2025.

Growth and consistency

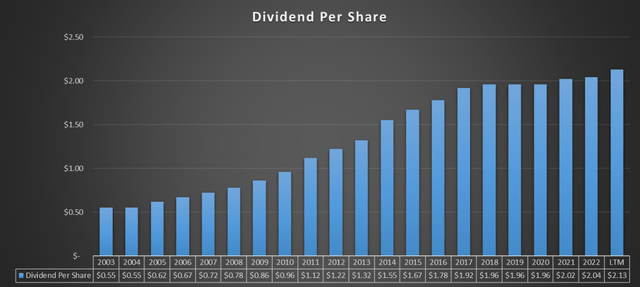

As just mentioned, TIKR Terminal analysts expect for the dividend per share a CAGR of 5.60% 2022-2027, but let us now see in the past decades what its performance has been.

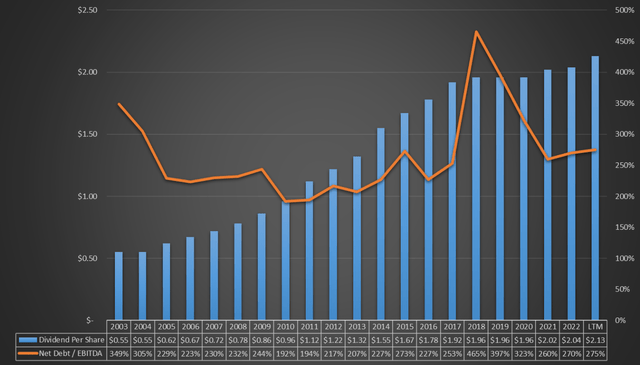

TIKR Terminal

Over the long term it is clear that the trend is upward, however we can see that over the past 20 years there have been some years when the dividend per share has remained unchanged, which is why General Mills is not a dividend aristocrat. But why not increase the dividend every year if growing EPS allows it to do so? Let me show you a chart to clarify this.

TIKR Terminal

As we can see from this graph, the times when growth is paused correspond to those where debt reaches too high levels. Specifically, whenever net debt/EBITDA exceeds 300% we can expect a dividend that will not grow. Typically, this phase occurs when General Mills makes acquisitions of a certain magnitude, as it did in 2018 by paying $8 billion for Blue Buffalo. In these cases, the company prefers to pay down debt and lighten the financial structure rather than pay a higher dividend. Not all companies follow this approach, but in my opinion it is more than reasonable; in fact, the price per share seems to have proven management right.

TradingView

The long-term price-per-share trend is decidedly bullish, and until recently had reached an all-time high despite the current macroeconomic environment. According to the latest quarterly data, General Mills’ market power has allowed it to raise prices without reducing demand too much, which is why inflation has weighed little and dividends are stronger than ever. Moreover, contrary to what one might expect, margins are even improving for General Mills.

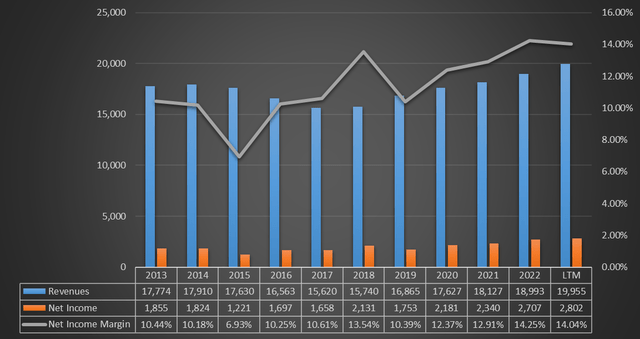

TIKR Terminal

Revenues have not grown that much compared to 10 years ago, but profits have, thanks to an improving profitability. Obviously this benefits EPS and consequently the potential increase in dividend per share.

So, overall, dividend per share growth is good, as is its consistency. However, for the latter aspect, one must keep in mind that a dividend increase will be put on the back burner if debt increases too much, which is why General Mills is unlikely to become a dividend aristocrats.

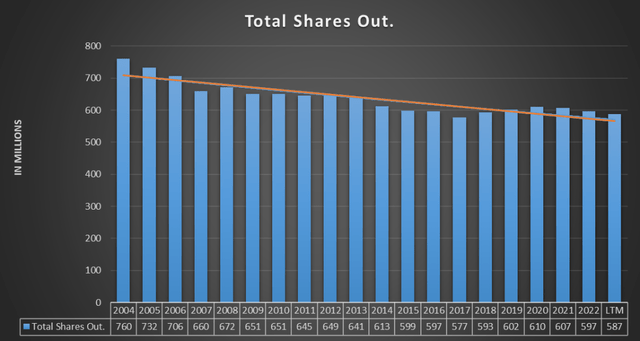

Finally, I would like to cover one last aspect, which has only indirectly to do with the dividend, and that is the purchase of treasury stock. This is an alternative method of remunerating shareholders and it has a positive impact on dividend per share.

TIKR Terminal

For the past two decades, the company has always tried whenever possible to reduce its outstanding shares, except in particular periods when it was focused on an expensive acquisition.

Overall, shareholders of this company are well rewarded through a sustainable dividend yield of 2.53% and buybacks over the long term. In addition, capital gains, which have definitely been important in recent years, cannot be ruled out. However, in my opinion this company has only one flaw: it is too expensive.

Valuation through dividend

Dividend yield, by comparing it with its historical values, can also be used to understand whether a company is overvalued or undervalued. It is obvious that this reasoning can only be done with companies whose dividend yield is consistent and sustainable.

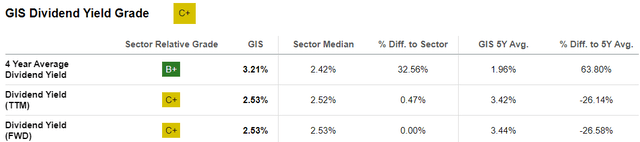

Seeking Alpha

According to this table belonging to Seeking Alpha, the dividend yield of 2.53% is in line with the sector median, however it is significantly lower than the historical average for General Mills.

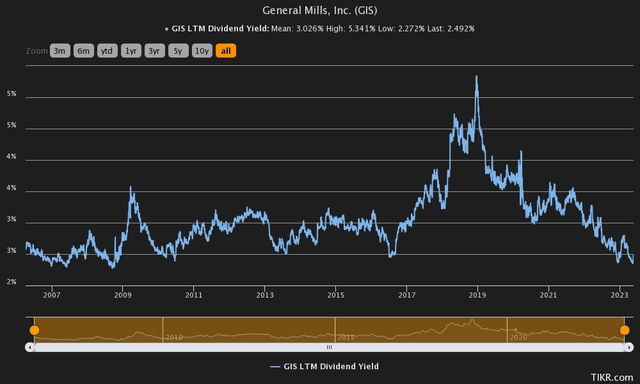

TIKR Terminal

Since 2006, the average dividend yield is 3.02%, thus higher than the current one. In particular, the current dividend yield is near historic lows, certainly not a good signal for those who want to buy the stock now. Historically, the best bargains to buy General Mills have been when the dividend yield has crossed the 3.50% threshold, so it is still too early. It is possible that in this complex macroeconomic environment investors have preferred to invest in reliable defensive stocks such as General Mills, and this may have momentarily caused the price to rise sharply. Both rises and falls of a certain magnitude are often accompanied by returns to the mean, and I expect this to be the case for General Mills in the coming months.

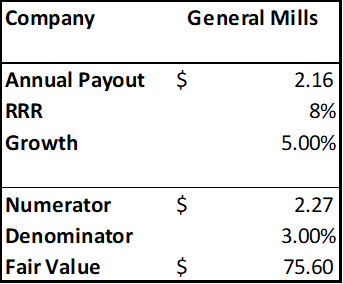

Moreover, not only the dividend yield, but also the dividend discount model suggests overvaluation. This is a rather simple model, but it can give good insights. The inputs will be as follows:

- Annual Payout [FWD]: which is the dividend per share estimated to be issued this year.

- RRR: return that I personally would like to achieve in this investment.

- Growth: annual dividend growth rate over the past 10 years.

Author’s creation

According to these assumptions, to get an 8% annual return we would have to buy the stock around $75.60 per share, so General Mills is now overvalued. It has to be said that a return of 8% is probably even too little considering the current money market rates, so for the time being I prefer not to invest in General Mills.

In any case, the fact that it may be overvalued is not a good reason to think about a sell rating. This company has a centuries-old history, growing earnings over the long term, sustainable and growing dividends as well as a brand that is appreciated worldwide. I consider General Mills a company to buy from a long-term perspective, and when it is overvalued simply wait until it is at a discount again. Of course, it rarely happens to be at a discount being a great company, but it is worth the wait.

Read the full article here