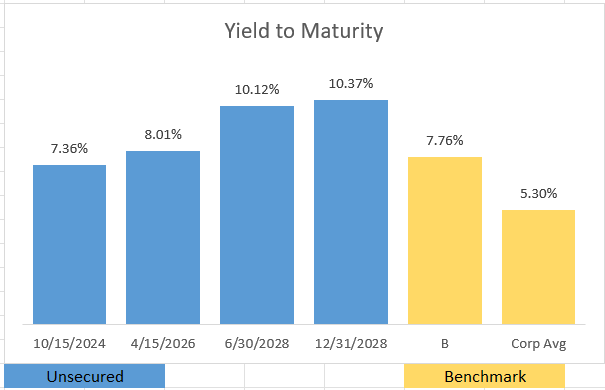

The GEO Group (NYSE:GEO), a rehabilitation facilities company, has seen its share of adversity of the past few years. The company had to switch its corporate structure from a REIT to a C Corp, and consequently eliminated its dividend. Additionally, GEO has had to endure regulatory challenges and last year, the company completed a debt exchange to provide it more financial flexibility. Back in December of 2022, I wrote how Geo Group’s bonds were an attractive investment. Today, with two of GEO’s long dated maturities still yielding above 10% to maturity and will provide great income for noteholders.

FINRA

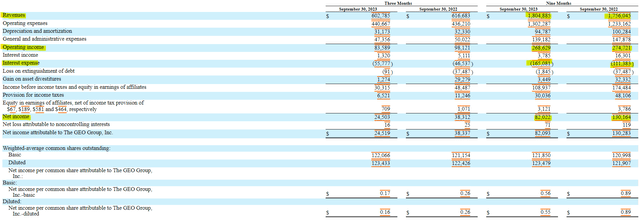

For the first three quarters of 2023, Geo Group’s revenue grew by approximately $50 million, or 3%. Unfortunately, operating expenses grew by slightly more than revenue. The growth in operating expenses led to operating income dropping to $268 million from $274 million the previous year. It’s important to note that even though interest expenses increased by $54 million, the company was able to cover those costs with operating income and still retain $82 million as net income.

SEC 10-Q

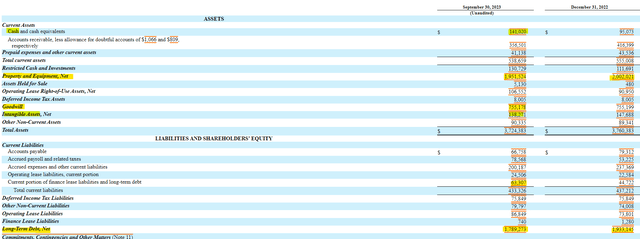

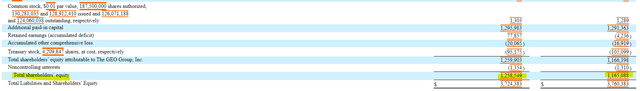

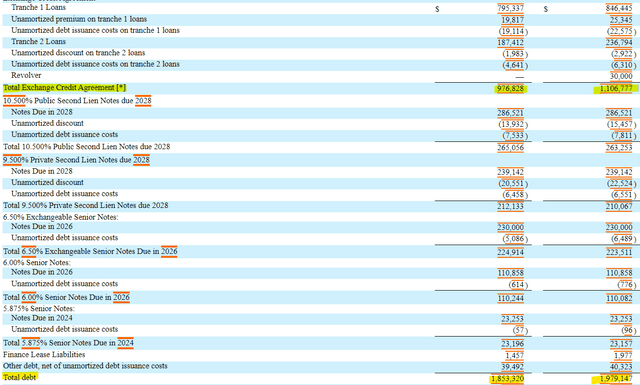

On the balance sheet side, Geo Group spent the first three quarters of 2023 strengthening its capital position. The company was able to increase its cash position from $95 million up to $141 million while simultaneously decreasing its long-term debt from $1.93 billion down to $1.79 billion. Shareholder equity has increased by approximately $100 million from $1.16 billion to $1.26 billion.

SEC 10-Q SEC 10-Q

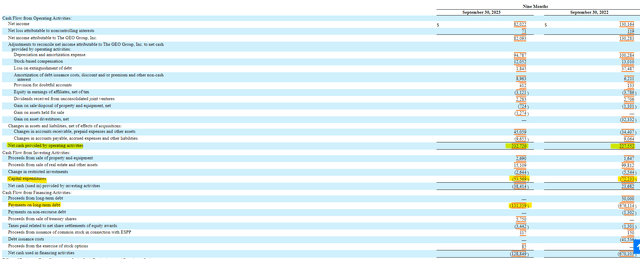

The most compelling case for investing in Geo Group’s bonds comes from analyzing the cash flow statement. For the first three quarters of 2023, Geo group generated $232 million in operating cash flow, which was $5 million higher than the same period a year ago. After deducting capital expenditures, free cash flow was also higher at $179 million versus $155 million a year ago. The generation of strong free cash flow has allowed Geo Group to simultaneously build its cash balance and pay down long-term debt.

SEC 10-Q

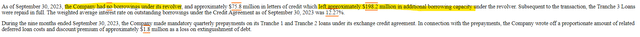

Geo Group used the free cash flow to pay off its revolving line of credit and reduce the balances on two of its tranche loans. The company has a modest amount of debt due in 2024 and $340 million in exchangeable and senior notes due in 2026. Between the company’s cash balance and nearly $200 million in capacity on the revolving line of credit, Geo Group has approximately $340 million in liquidity. Their liquidity, combined with the pace of free cash flow generation, should require no refinancing until the tranche loans come due in 2027. By then, the level of debt reduction should place Geo Group into a better credit rating and able to receive favorable refinancing terms.

SEC 10-Q SEC 10-Q

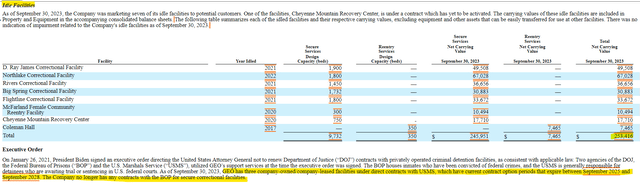

One risk that Geo Group has been managing for the last three years has been the loss of the federal government contracts related to the business. In January 2021, President Biden signed an Executive Order eliminating the ability of the Department of Justice to conduct business with private correctional facility owners. Geo Group has managed to eliminate its Bureau of Prisons contracts and is down to three USMS contracts. Despite the loss of business, Geo Group is still demonstrating the ability to generate the cash flow necessary to reduce debt principal.

SEC 10-Q

Geo Group continues to generate healthy cash flows to navigate a difficult industry. The company has been able to build cash and pay down debt following its debt exchange. Additionally, the company’s liquidity is sufficient to carry it through 2026. Investors should expect the company’s fourth quarter results to show additional free cash flow generation, sufficient to clear the liquidity threshold through 2026 maturities. With a greater than 10% return priced into both 2028 notes, fixed income investors should find an attractive return with Geo Group’s long-term debt.

CUSIP: 36162JAD8

Price: $96.75

Coupon: 9.5%

Maturity: 12/31/2028

Yield to Maturity: 10.37%

Credit Rating (Moody’s/S&P): B3/B

Read the full article here