After taking the stock to “Strong Buy” in May, GEO Group (NYSE:GEO) has continued to underperform. Let’s catch up on the name.

Company Profile

As a refresher, GEO owns, leases, and manages detention facilities. Its operations are primarily in the U.S., but it also serves facilities in Australia and South Africa as well. It also offers other services such as electric monitoring and post-release support.

U.S. Immigration and Customs Enforcement, or ICE, is GEO’s largest customer and represented about 44% of its revenue and 29% of its beds in 2022. States account for about 23% of GEO’s revenue, with Arizona and Florida the biggest contributors.

Q2 Results

For the quarter, GEO saw a 1% increase in revenue to $593.9 million. That was ahead of the $588.3 million consensus.

Owned and Leased Secure Service revenue climbed 1% to $279.3 million, while the net operating income was $77.0 million, down -11%. Owned and Leased Reentry Service revenue was $40.3 million versus $40.8 million a year ago, while its NOI slipped -11% to $12.3 million.

Managed Only revenue jumped 9% to $137.8 million, while its NOI rose nearly 14% to $12.5 million. Electronic Monitoring and Supervision Service revenue dropped -11% to $108.0 million, while its NOI edged up $0.1 million to $62.3 million. Non-residential service revenue jumped 20% to $28.5 million, but its NOI slipped -11% to $6.2 million.

Adjusted EBITDA dipped -2.5% to $129.0 million. Adjusted EPS came in at 24 cents versus 42 cents a year earlier, as high interest rates weighed on the bottom line. Interest expense doubled from $27.7 million to $55.4 million. Analysts were looking for adjusted EPS of 20 cents.

During the quarter, the company reactivated its 1,900-bed Great Plains Correctional Facility under a new lease agreement with the State of Oklahoma. It expects to generate annual revenue of $8.5 million from the facility.

GEO saw some weakness in its electronic monitoring service this quarter, as a decline in ISAP participants continued into Q2 and beyond. Notably, this also tends to be a higher margin segment for the company. And while it did see a 20% increase in population in ICE processing centers since early May with the end of Title 42, occupancy was still below historical levels. Expenses were also on the rise.

Overall, GEO beat expectations, but it was a pretty low bar and it just cleared it. While the quarter itself was fine, there was also nothing to get investors excited.

Outlook

Looking ahead, GEO guided for Q3 revenue of between $588-603 million. Analysts were looking for Q3 revenue of $612.6 million.

The company forecast adjusted EBITDA to be between $115-130 million. It is projecting Q3 net income of between $19-26 million.

For Q4, the company guided for revenue of between $595-$601 million, with adjusted EBITDA of between $115-130 million and net income of between $19-27 million.

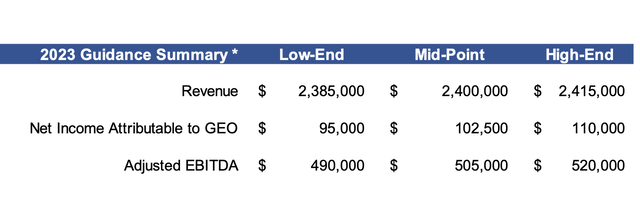

For the full year, GEO narrowed its revenue guidance to be around $2.4 billion versus a prior estimate of between $2.38- $2.46 billion. The analyst consensus was for revenue of $2.43 billion.

The company is looking for adjusted EBITDA of between $490-530 million versus a prior forecast of $507-537 million. It’s looking for net income of between $95-110 million, compared to prior guidance of $105-$125 million.

Company Presentation

Discussing the current environment on its Q2 earnings call, Founder and Chairman George Zoley said:

“The number of participants in the federal government’s Intensive Supervision and Appearance Program, or ISAP, has declined since the beginning of this year. However, we have recently seen a slower rate of decline in ISAP participants. Additionally, we believe that recent policy decisions could result in an increase in the number of participants being enrolled in ISAP. While the decline in ISAP participants continued throughout July and early August, which was longer than we previously estimated, we continue to believe that the ISAP participant count is likely to stabilize then to begin to increase moderately. With respect to our ICE processing centers, we have experienced a 20% increase in population since early May. Our occupancy rates remain below historical levels…. If a new budget is not approved when Congress reconvenes, Congress could, as we’ve seen in prior years, approved funding for the federal government in federal fiscal year 2024 under a short-term or long-term continuing resolution. We believe that under a continued resolution, ICE is most likely to be provided appropriations consistent with the agency’s current funding levels for ’23.”

When asked why it was confident ISAP numbers would stabilize or go back up, the company said that while it was not allowed to discuss DHS policy, that it was aware of policy shifts that should lead to the lead to wider use of alternatives to detention and the type of devices used.

In July, meanwhile, the company began offering primary health services at 13 public prisons in Australia. The deal with state of Victoria started July 1st and is expected to generate $33 million in annual revenue.

GEO’s lowered guidance was disappointing, as the ISAP declines extended into Q3. Hopefully, the policy shifts the company discussed will indeed materialize and stabilize this higher-margin business. The company should see a boost with the Australian health care contract and the reactivation of Great Plains.

The end of Title 42 did increase ICE populations, but didn’t lead to a flood of illegal immigrants. Many of GEO’s facilities have minimum guarantees, which it is still below for many. Profitably starts to increase meaningfully per detainee once it gets past those minimums.

Valuation

GEO trades at a 5.5x EV/EBITDA multiple based on the 2023 EBITDA consensus of $509.7 million (down from $524.6 million when I last looked at it). Based off of the 2024 EBITDA consensus of $541.4 million (was $551.2 million last time I looked at it), it trades at around 5.2x.

It trades at 8.3x forward EPS, with analysts projecting 2023 EPS of 88 cents (down from 94 cents when I last looked at it).

It’s projected to grow revenue 1.2% in 2023, accelerating to 4.9% growth in 2024.

GEO’s EBITDA multiple hasn’t changed much since I first looked at the stock; however, EBITDA estimates have drifted lower as has the stock.

Conclusion

GEO has been a disappointment since I’ve covered the name, with the Title 42 catalyst not fully coming through, and ISAP headwinds lasting longer than expected. The stock remains inexpensive, and the valuation appears to be around a floor, so the question becomes more if the company can start to grow and reduce debt.

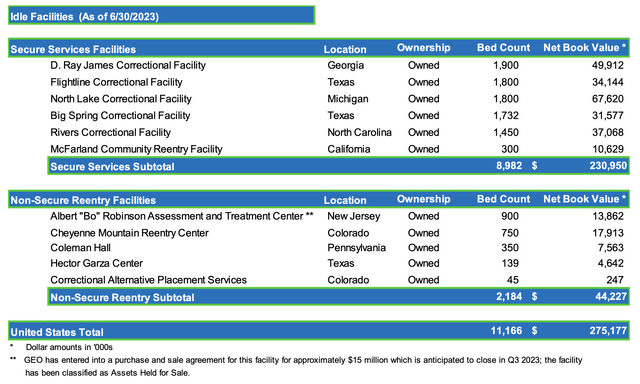

There are still some opportunities for the companies, including the activation of idled facilities; the sale of non-core assets to reduce debt; the stabilization and then rise in ISAP participants; and then getting ICE populations above minimum guarantee numbers. The company currently has around $275 million in idled facilities that can be sold or reactivated.

Company Presentation

While I’m disappointed, the stock is still cheap and there are still a number of things that can reignite growth for GEO. A modest 8.2x multiple on 2024 EBIDTA numbers is still gets the stock to $20, which is significant upside from here. As such, my “Strong Buy” rating remains unchanged at this time.

Read the full article here