Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

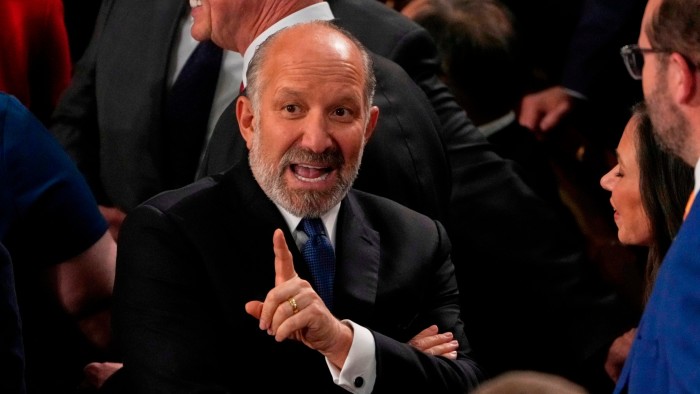

Global markets appeared set for a rebound following comments from US commerce secretary Howard Lutnick that implied tariffs could be lowered on America’s neighbours.

Stock markets rebounded during the Asian morning on Wednesday. Futures contracts tracking the US S&P 500 index were up 0.7 per cent, while those for the Nasdaq 100 were up 0.8 per cent.

The Stoxx Europe 600 was set to open 1.2 per cent higher, and Germany’s Dax futures were up 2.1 per cent.

Speaking on Fox Business on Tuesday, Lutnick said Trump was “considering” offering relief and was going to “work something out”.

“It’s not going to be a pause . . . but I think he’s going to figure out, ‘You do more, and I’ll meet you in the middle some way,’” said Lutnick.

His comments were, however, followed by a warning from US President Donald Trump that tariffs would cause “a little disturbance” in his first major policy address to Congress.

The US president on Tuesday hit imports from Canada and Mexico with a 25 per cent tariff and imposed an additional 10 per cent tariff on Chinese imports, on top of a 10 per cent levy set last month.

US stocks on Tuesday closed below their level on November 5, marking the erasure of all their post-election gains amid fears about the impact of a trade war on the US and the global economy.

India’s Nifty 50 index was up 1.3 per cent on Wednesday, although it remains down almost 1 per cent over the past five trading sessions. Japan’s exporter-heavy Nikkei 225 rose 0.2 per cent, while South Korea’s Kospi index was up 1.2 per cent.

Chinese markets were buoyant after the government released its annual “work report” and maintained an economic growth target of “around 5 per cent”. Hong Kong’s Hang Seng index rose 2.6 per cent, while the mainland’s CSI 300 index advanced 0.5 per cent.

“The Chinese market has been pulling back over the past few days,” said David Choa, BNP Paribas Asset Management’s head of greater China equities.

Read the full article here