Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Globalisation in its current form “may have now run its course”, according to HSBC chair Sir Mark Tucker, who said trade and geopolitical tensions would lead to stronger economic ties between regional groups and trade blocs.

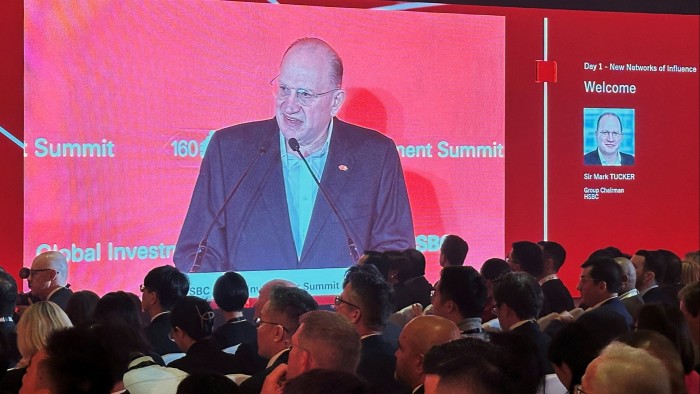

In a speech at the bank’s Global Investment Summit in Hong Kong on Tuesday, Tucker said trade tensions created uncertainty that posed a “serious potential risk to global growth”.

Since taking office in January, US President Donald Trump has slapped tariffs on key trading partners, including China, Canada and Mexico, and is expected to impose more on April 2, when his administration unveils “reciprocal tariffs” on countries around the world.

The world is experiencing a “period of deep and profound change” in trade, economic policy and international security arrangements, said Tucker.

“As we consider present developments . . . we believe that globalisation as we knew it may have now run its course,” he said.

“Economic considerations guiding optimally efficient supply chains led to one of the world’s greatest periods of wealth creation we have ever seen. The balance of economic power changed as a result, and what used to be sustainable no longer is,” he added.

Tucker said this did not mean the world would “regress or geo-fragment and de-globalise” but that there would be new opportunities and stronger economic ties between different “political groupings and trade blocs”, including the “Brics-plus group of countries”, which would increasingly trade with each other.

HSBC is a key participant in global trade finance. Its trade business has been ranked first by revenue for the past seven years, according to its most recent annual report, which cites figures from Coalition Greenwich Competitor Analytics.

It has in recent months overhauled its operations, including separating its business along geographical lines into two units, one focusing on Asia and the Middle East and the other on Europe and the Americas.

Tucker said economic connectivity between Asia and the Middle East, a key focus for the bank, was likely to “soar” in the coming years.

The Brics group, made up of Brazil, Russia, India, China and South Africa, has expanded to include Iran, the United Arab Emirates, Egypt, Ethiopia and Indonesia.

“The rising trade and financial linkages of these economies with the rest of the emerging world suggests there could be notable growth spillovers,” Tucker said.

He said the Brics group was building institutions that would have implications for energy, trade, finance, supply chains and technology, adding that “amid geopolitical tension it is likely that more emerging markets will join Brics to foster closer ties and have a stronger voice on the world stage”.

Read the full article here