All figures are in United States Dollars unless otherwise stated. G/T refers to grams per tonne of gold or silver. AISC refers to all-in-sustaining costs. GEOs refer to gold-equivalent ounces.

Q1 Results

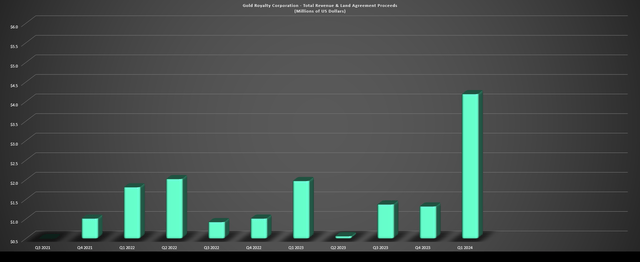

Gold Royalty Corp [“GRC”] (NYSE:GROY) released its Q1 results in mid-May, reporting royalty revenue of ~$2.9 million (289% growth year-over-year), total revenue, land agreement proceeds and interest of ~$4.19 million, and ~$0.33 million in operating cash flow. These represented records for the company and were helped by new royalty revenue from Cozamin, increased royalty revenue from Borden and Canadian Malartic, partially offset by no contribution from Jerritt Canyon (moved into care & maintenance in Q2 2023) and reduced contribution at Isabella Pearl which is nearing the end of its mine life (expectations are that Isabella Pearl will be fully mined out by year-end).

Additionally, land agreement & other proceeds increased due to pre-production payments from Borborema (recent acquisition) and $1.0 million in proceeds from Blackrock Silver to acquire the Tonopah West Project (previously under option agreement) for $1.0 million in cash, a 3.0% NSR royalty, and advance minimum royalties of $0.05 million/year. And while this $1.0 million payment related to Tonopah West will not benefit future periods, it’s positive that GRC like some of its smaller peers continues to see success in its (*) royalty generation model (*) given the increased competition in the royalty/streaming space regarding bidding for newly originated royalties and streams.

(*) As it stands, GRC has nearly 30 projects subject to land agreements and under lease generating land agreement proceeds. (*)

Gold Royalty Corp Total Revenue, Land Agreement Proceeds & Interest – Company Filings, Author’s Chart

Overall, this represented a significant quarter of growth for the company and investors can look forward to continued growth on deck. This is because the company recently completed one of its larger transactions to date, adding a copper stream on the Vares Mine in Bosnia operated by Adriatic Metals (ADT.ASX) (OTCPK:ADMLF). Simultaneously, Iamgold (IAG)is ramping up its new majority owned Cote Gold Mine in Ontario where GRC should see near-term revenue contribution from its partial royalty that covers zones 5 and 7. And on the back of the Vares stream acquisition, GRC updated its 2024 outlook to $13.0 to $14.0 million in total revenue, land agreement proceeds and interest ($2,000/oz gold price assumption, $4.25/lb copper).

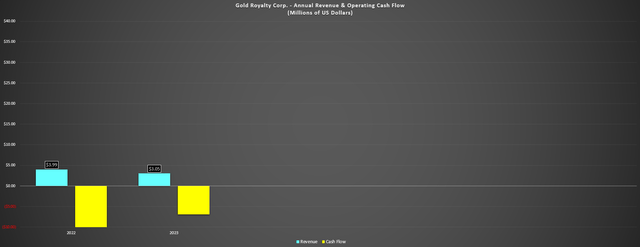

Gold Royalty Corp – Annual Royalty Revenue & Operating Cash Flow – Company Filings, Author’s Chart

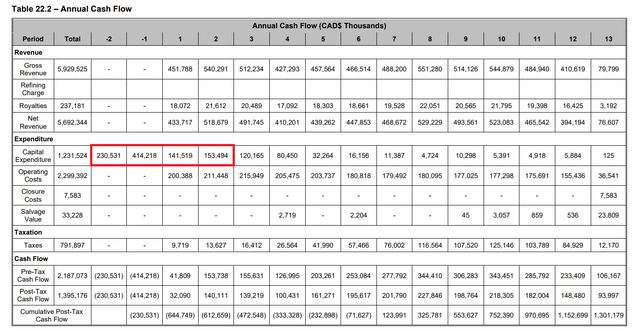

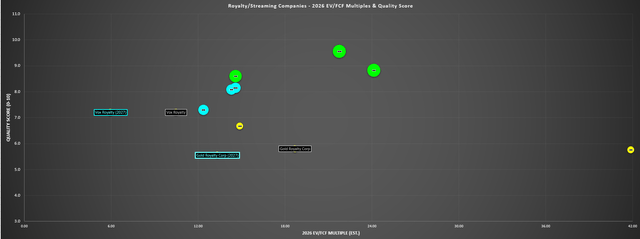

Importantly, this annual figure should increase further in 2025, benefiting from a full year of production at commercial levels at Vares and Cote, which are both in the ramp-up phase currently. Additionally, 2025 will benefit from initial royalty revenue from Borborema which is currently in construction with GRC holding a 2.0% NSR (dropping to 0.5% after 725,000 ounces of payable gold are produced). Hence, while the recent Vares deal provides a significant increase in near-term revenue and cash flow, the full benefit of these recent acquisitions (Borborema royalty, Vares stream) and attributable royalty revenue from Cote Gold won’t show up until next year.

Vares Stream Acquisition

While the past several months have been busy for the company with the acquisition of the SOQUEM portfolio (21 Quebec royalties) and the Borborema Project financing in December and the acquisition of the Cozamin royalty in August, the most recent deal has been one of the largest in years. In fact, the $50 million purchase price for the Vares Mine 100% copper stream (30% of spot payment) came at roughly the same value of the purchase price of the NGM royalty portfolio ($27.5 million in shares or ~9.4 million shares), Cote royalty (~$15.9 million), and Cozamin ($7.5 million) combined. This copper stream was acquired by GRC from Orion Mine Finance and was initially part of a debt financing package with Adriatic and Orion in 2022 that included $120 million in senior secured debt and the copper stream ($22.5 million).

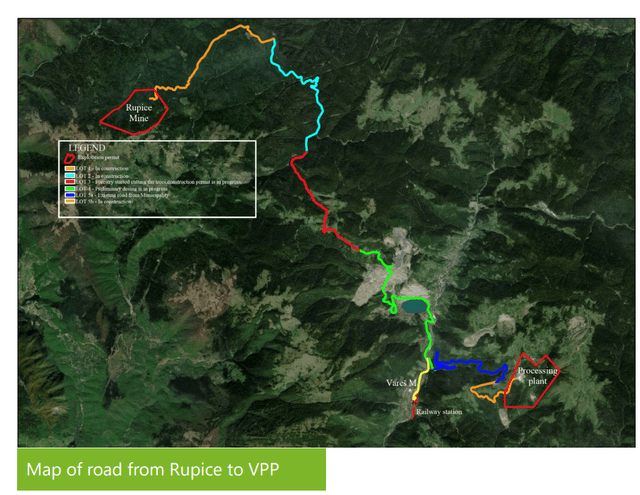

For those unfamiliar with Vares, it is a polymetallic mine in Bosnia and one of the world’s lowest-cost silver mines which just reported first concentrate production. As it stands, the project is home to a reserve base of ~13.8 million tonnes at 187 G/T of silver, 8.5% zinc/lead, 1.4 G/T of gold and 0.50% copper, while resource tonnes have grown to ~21.1 million tonnes (87% indicated) at an indicated grade of 168 G/T of silver, 7.5% zinc/lead, 1.3 G/T of gold and 0.4% copper. And while inflationary pressures will undoubtedly push operating costs higher, the asset was expected to operate at below $8.00 per silver-equivalent ounce based on the 2021 DFS, with commercial production expected in Q4 of this year.

Digging into the asset a little closer, the Rupice Mine is expected to provide 800,000 tonnes per annum of ore for the Vares Plant over an 18-year mine life, with the production of a silver-lead and zinc concentrate. Like Eldorado’s (EGO) Olympias Mine in Greece and i-80 Gold’s (IAUX) Ruby Hill Project in Nevada, the Vares Mine will benefit from a significant gold credit on top of its silver and base metals production. In fact, silver and gold will make up nearly 50% of project revenue, with the remainder made up of lead, zinc, copper and antimony. This is important because it means that the copper stream will not encumber the asset or materially affect project economics, with copper making up barely 2% of revenue over Vares’ life of mine.

Rupice Mine Road to Vares Plant – Adriatic Website

From an operator quality standpoint, Adriatic Metals achieved the incredible feat of going from exploration/development to production in less than eight years, suggesting strong community/government support for the project and an efficient team here. In addition, this is Adriatic’s only producing asset and with a market cap of ~$900 million, Adriatic has the balance sheet and liquidity to drill aggressively and potentially grow production at Vares. Plus, being a single-asset producer, this is an asset that is clearly important to the company which will benefit GRC in terms of drilled meters and ultimately future reserve growth/mine life extensions. Hence, from an asset quality (high-grade and low-cost polymetallic mine now in production) and operator standpoint (solid track record and this being a key asset to Adriatic), I see this as a positive deal for the company.

As for the contribution to GRC, Adriatic plans to mine ~800,000 tonnes next year and is in the process of switching to owner-operator mining that should reduce costs and lower productivity. Plugging in the higher copper grades in the earlier years of the mine life and the fixed effective payable copper rate of 24.5% for the stream, GRC should see an average contribution close to 1,000 of copper per annum in with a cost for these ounces of 30% of spot prices. This would translate to over $6.0 million in annual cash flow, with GRC paying ~0.90x NAV for the Vares stream, a reasonable valuation considering that we tend to see transactions upwards of 1.0x P/NAV on producing assets.

So, was this deal good news overall?

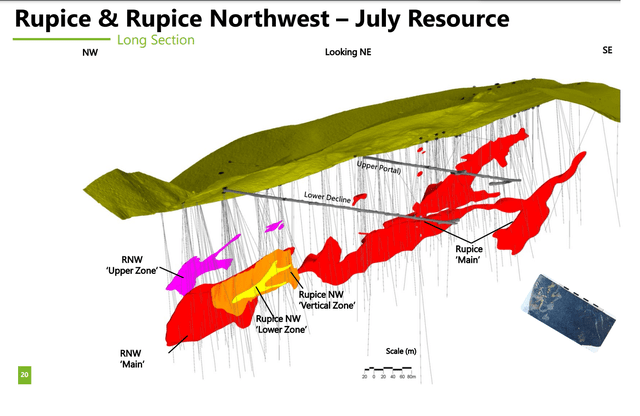

While I think GRC picked the right asset and paid a reasonable price to add a key royalty/stream to its portfolio, the deal unfortunately came with significant share dilution to finance the deal. This included ~20.0 million shares sold at US$1.72 for $34.5 million and also included a full warrant with a 3-year expiry at US$2.25. Not only does this increase Gold Royalty Corp’s diluted share count to ~200 million, but with shares being sent out the door at less than 0.80x NAV, this doesn’t do much from a NAV per share growth standpoint. And while there’s no doubt that this asset has significant exploration upside (RNW Lower Zone saw high-grade intercept in Gap area of 8.3 meters at 479 G/T of silver, ~29% lead/zinc, 4.86 G/T of gold and 1.08% copper) at Vares, the significant share dilution does hurt.

Rupice Drilling & Resource Growth – Adriatic Website

Obviously, I can appreciate that junior royalty companies are limited for options when it comes to growth, but it’s much easier to see shares go out the door at ~0.80x NAV for assets being purchased at ~0.1x NAV like the Red Hill deal by Vox Royalty (VOXR) than it is to see this level of share dilution for GRC with minimal growth in NAV per share. On a positive note, this new cash-flowing asset has moved Gold Royalty Corp a step closer to the close where it can start transacting using primarily cash flow and credit following this deal. Therefore even if the stream came at a high cost, this is a transformative deal in the sense that GRC has a clear path to 10,000+ GEOs per annum or over $20 million in annual revenue following the Vares stream acquisition.

Other Recent Developments

Looking at other recent developments, Nevada Gold Mines LLC continues to hit high grade mineralization at the REN Project as part of their Carlin Complex in Nevada, with an intercept of 4.7 meters at 24.9 G/T of gold. The operator noted that this intercepted targeted the Corona dike at 900 meters depth in a gap between historic surface drilling in the northwest and underground drilling to the southeast of hole REN-23001B. For those unfamiliar, REN is home to ~1.66 million ounces of high-grade gold REN looks to be a high priority opportunity for Nevada Gold Mines’ 10-year production plan at Carlin and with it set to be one of GRC’s largest annual contributors next decade.

Carlin Complex, Nevada – Google Earth

As for the Cote Project (now mine) in Ontario, Canada, first gold pour arrived just on schedule in Q1 and Iamgold (IAG) expects to ramp up to 90% of total throughput as of year-end. Meanwhile, Aura Minerals (OTCQX:ORAAF) recently noted that Borborema construction was 25% complete (low-cost open-pit gold project with production of 80,000+ ounces in peak years) where GRC holds a 2.0% NSR and will benefit from commercial production in 2025. Hence, with three new assets Cote Gold (Canada), Vares (Bosnia) and Borborema (Brazil) all expected to be in commercial production by Q4 2025 or earlier, we should see Gold Royalty Corp generate upwards of $10 million in cash flow next year and see improved diversification with multiple producing assets in Borden, Malartic, Cote, Vares, and Borborema.

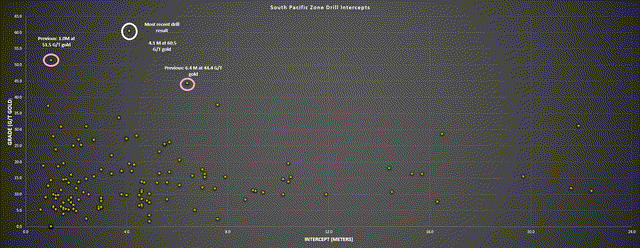

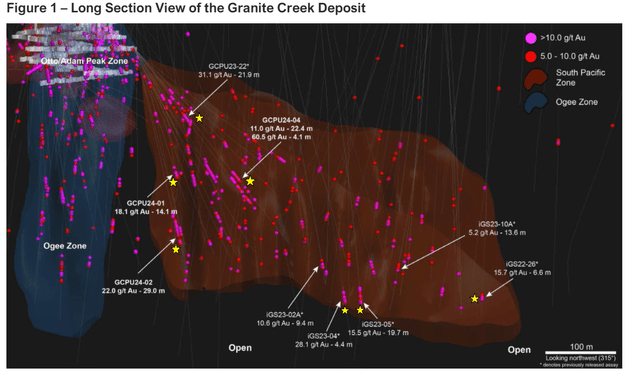

Looking at other meaningful future contributors to Gold Royalty Corp’s annual GEO production (GRC holds 10% NPI), i-80 Gold released new drilling results last month which included highlight intercepts of 7.0 meters at 17.7 grams per tonne of gold, 4.0 meters at 27.2 grams per ton of gold, 14.4 meters at 18.1 grams per ton of gold, 29.0 meters at 22.0 grams per ton of gold, 22.4 meters at 11.4 grams per ton of gold and one of the highest-grade intercepts to date on the property of 4.1 meters at 60.5 grams per ton of gold. These are phenomenal intercepts and GCPU-24-04 (4.1 meters at 60.5 grams per ton of gold) bested the previous two highest-grade intercepts I’m aware of at the South Pacific Zone from all IAUX’s drill logs which were 1.0 meter at 51.5 G/T gold, and 6.4 meters at 44.4 grams per ton of gold.

South Pacific Zone Drilling – Company Filings, Author’s Chart

Overall, these recent drill results exceeded my expectations and carry exceptional grades even at 10-50% true widths. In fact, the average intercept drilled at South Pacific Zone (including those intercepts with no significant intercepts with a zero value) is ~5.0 meters at 14.1 grams per ton of gold, up from 4.8 meters at 13.4 grams per ton of gold previously, a minor upgrade and well above the average grade of Granite Creek resources (~11 grams per ton of gold).

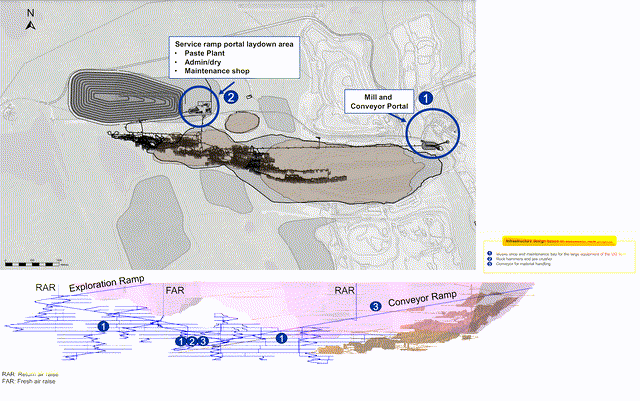

As shown in the image below, i-80 continues to release world-class 250-500 gram-meter intercepts at its newly defined South Pacific Zone (Granite Creek Mine), including 19.7 meters at 15.5 grams per ton of gold in one of its deepest holes, and 6.6 meters at 15.7 grams per ton of gold in its most northern hole, with it drilling along strike from the massive 500,000 ounce underground mine to the north. And to put the size of this mine in perspective, it currently has a resource base of ~15 million ounces (M&I) at 9.7 G/T of gold. As it stands, the South Pacific Zone looks like it could be an 800,000 ounce opportunity from a resource standpoint at higher grades and there’s an opportunity to grow the resource meaningfully given what the Turquoise Ridge Mine directly north has churned out from a production standpoint to date.

South Pacific Zone Drilling – Company Website

As of the most recent update, i-80 expects to deliver first stope ore this year while work is underway to declare maiden reserves and complete a Feasibility Study on the project. Not only will this de-risk the project for i-80 and significantly increase its annual cash flow generation, but it suggests that Gold Royalty should see its first contribution at some point in 2026 once the 120,000 ounce production threshold is hit. I have assumed mining rates of 700 tons per day at 11.0 G/T of gold to be conservative, translating to annual production from Granite Creek Underground of 65,000+ ounces per year, and up to 90,000 ounces depending on grades, throughput and recoveries.

As for other recent developments, Agnico Eagle Mines (AEM) recently published a PEA for its Detour Lake Mine with the recent study contemplating adding an underground component which would increase production to 1.0 million ounces per annum. While this does not directly affect Gold Royalty Corp. does not own a royalty on Detour Lake, I see this as a slightly negative development for Fenelon. This is because not only has Agnico Eagle’s medium-term budget increased by up to ~$800 million, but Fenelon has become much less of a priority this decade to Agnico Eagle which already has a very busy pipeline. And with an abundance of mid-grade mill feed at Detour next to the mill that’s set to contribute, any potential for a high-grade milling strategy incorporating Fenelon material at the Detour Mill looks less likely.

Agnico Eagle Underground Expansion Infastructure – Agnico Eagle Website

Second, with Agnico looking at multiple growth projects across its portfolio, the potential acquisition and development of Wallbridge/Fenelon does not appear to be a priority this decade. To summarize, even if the recent Detour Lake PEA does not directly affect the Fenelon royalty, recent developments have downgraded the outlook for this asset with the best case from a timing standpoint for initial royalty revenue (which was an acquisition by Agnico Eagle and accelerated development of Fenelon by 2029) now looking to be off the table.

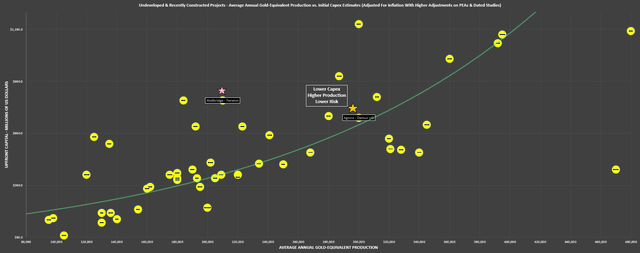

Fenelon Project vs. Detour Underground Expansion & Other Undeveloped Projects – Company Filings, Author’s Chart & Estimates First 4 Year Capex ($C) Fenelon Project – 2023 TR Fenelon

It’s important to note that this development comes at no financial cost to Gold Royalty Corp, there is no additional holding costs for these royalties if they don’t go into production in the desired timeline, and there is no reason to believe that (*) another operator (*) can’t acquire Wallbridge and develop this asset at some point. Still, with the most likely suitor having its hands full with more attractive opportunities from a risk-adjusted return standpoint, I think it’s best to model conservatively on this asset. This is especially true given that there are still far more attractive undeveloped projects (held in producers’ portfolios or held by juniors) out there that rank ahead of Fenelon which I would expect to have a better chance of getting developed this decade.

(*) While there are other potential suitors that might be interested in a ~200,000 ounce per annum asset, the significant capex bill in the earliest portion of the mine life ($1.0+ billion adjusted for inflation) made this a better fit for a larger operator than Agnico and disqualifies most producers from getting interested in the project. As highlighted above, capex in the first four years at Fenelon is estimated at C$938 million or ~$700 million, but I think US$870 to US$900 million is a more realistic estimate when factoring in inflationary pressures and the fact that this is an early-stage study that incorporates less rigid cost estimates. (*)

Growth Potential

As the below chart highlights, GRC has one of the strongest organic growth profiles sector-wide, with the potential for revenue to increase to $35+ million in 2027 and $45+ million in 2028 based on conservative gold price assumptions of $2,250/oz and $2,100/oz, respectively. Importantly, these revenue estimates do not include longer-term upside from other key assets like Fenelon, Jerritt Canyon or Gold Rock, with the potential for these assets to contribute up to 5,000 combined GEOs per annum post-2030 in what I think is a more realistic timeline for these assets.

Gold Royalty Corp Annual GEO Sales & Revenue – Company Filings, Author’s Chart & Estimates

So, while Gold Royalty has built a base of 15,000+ GEOs per annum from its aggressive acquisition spree since going public, the portfolio has exposure to some world-class assets and also has depth (Malartic, Cote), something which quite a few of its junior royalty peers lack – such as Elemental Altus. To summarize, while this growth hasn’t come cheap and has benefited from major acquisitions at the onset with well-priced currency [GROY shares], Gold Royalty has one of the better royalty portfolios today among its junior peer group.

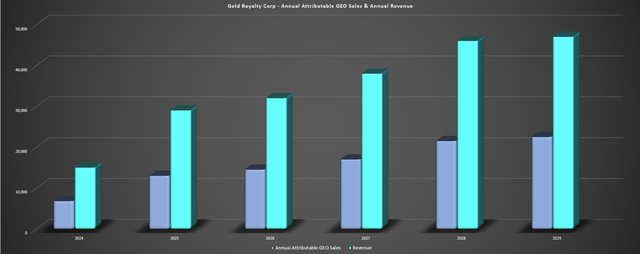

Valuation

Based on ~199 million fully diluted shares and a share price of US$1.52, Gold Royalty trades at a market cap of ~$300 million and an enterprise value of ~$330 million, making it one of the higher valued names within its peer group. And while it will see industry-leading growth in revenue and cash flow over the next few years, some of this is already priced into the stock today looking at where it trades vs. other peers in the space. In fact, some junior royalty companies like Vox Royalty trade at just ~6.0x FY2027 EV/FCF estimates and are also set to see industry-leading growth (Gold Royalty Corp trades at twice the multiple today), suggesting Gold Royalty Corp. has much less re-rating potential than Vox.

Royalty Streaming Companies 2026 EV/FCF Multiples – Company Filings, Author’s Chart & Estimates

As for Gold Royalty’s valuation from a NAV standpoint, the stock is trading at a deep undervaluation relative to peers, sitting at just ~0.55x P/NAV vs. an estimated net asset value of ~$460 million. This compares favorably to most of its royalty peers and Gold Royalty Corp’s NAV multiple should increase as we see development updates across the portfolio. Overall, the slight decline in my estimated NAV vs. previous assumptions can be tied to higher long-term gold price assumptions offset by a lower value related to Fenelon based on the less clear potential production start date discussed earlier (“Other Recent Developments”).

So, what’s a fair value for the stock?

Using what I believe to be fair multiples of 0.90x P/NAV and 15.0x 2025 cash flow estimates, I see an updated fair value for Gold Royalty Corp. of US$2.05, pointing to a ~35% upside from current levels. However, I am looking for a minimum 33% discount to fair value to justify entering new positions in junior royalty companies, and ideally closer to a 35% discount to fair value. And while GROY may bottom out here, I don’t see enough of a margin of safety just yet. Hence, I would need a deeper pullback in GROY to US$1.29 or lower to become interested in starting a new position in the stock.

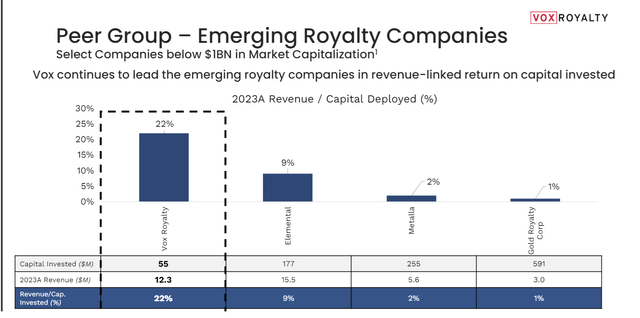

Vox Royalty – Revenue / Capital Deployed % vs. Peers – Vox Presentation

All that being said, I think the clear winner in the junior royalty space is Vox Royalty due to its differential model which has allowed it to transact at significantly lower multiples than its peers. In addition, Vox Royalty has a much cleaner share structure and balance sheet (no warrants, no debt) and 20% insider ownership, resulting in strong shareholder alignment. Hence, with Vox Royalty trading at a significant discount to Gold Royalty Corp on 2026 and 2027 EV/FCF estimates and with a clearer path to per share growth for VOXR vs. its peers, I see Vox Royalty as the superior investment today and a far more attractive name to accumulate on dips.

Summary

Gold Royalty Corp has significantly boosted its near-term cash flow outlook following the recent Vares stream acquisition and is now much cheaper from a P/CF standpoint vs. Metalla (MTA) which continues to trade at the highest multiple within the peer group. Unfortunately, this was overshadowed by significant share dilution and while the Vares deal was a case of paying a fair price for a stream on a high-grade polymetallic asset with significant mine life upside, the benefits were mostly offset by issuing additional shares with its share price at a significant discount to NAV.

To summarize, I don’t see a low-risk buying opportunity for the stock just yet at US$1.52 and I continue to see more attractive bets elsewhere in the market.

Read the full article here