Introduction

On May 11, 2023, the Vancouver, British Columbia-based Canadian Gold Royalty Corporation (NYSE:GROY) announced its operating and financial results for the first quarter of 2023.

Gold Royalty Corp. was incorporated in Canada on June 23, 2020, and is domiciled in Canada. GRC is primarily engaged in acquiring gold-focused royalty and mineral stream interests.

The Company was a subsidiary of GoldMining Inc. (“GoldMining”) until the Company completed its initial public offering (the “IPO”) on March 11, 2021.

Note: This article uses some elements taken from the 2Q23 Presentation.

GROY Assets Presentation 1Q23 (GROY Presentation)

The company owns 222 Royalties as of March 2023.

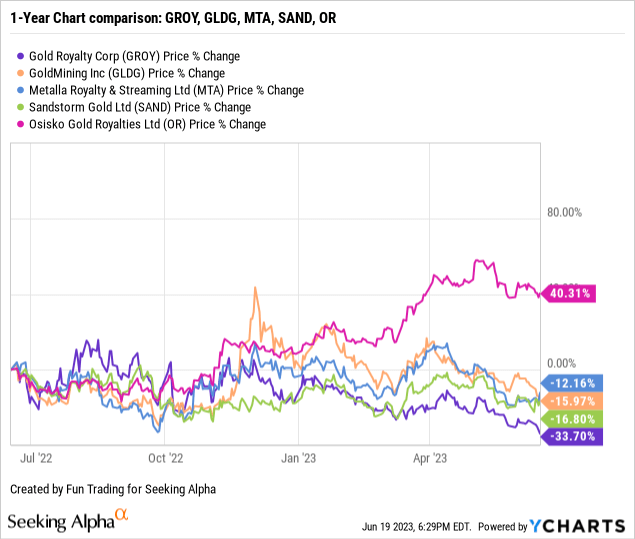

1 – Stock performance

GROY has significantly underperformed the group and is now down 34%.

Important: GROY’s main shareholder is GoldMining Inc. (GLDG), with a 15% ownership.

2 – Investment thesis

Gold Royalty is very similar in size and strategy to Metalla Royalty & Stream (MTA) or, to a certain extent, to Sandstorm Gold (SAND).

Thus, I have identical reservations about the business model based on an aggressive acquisition propensity that severely hurt the stock valuation.

GROY remains in a development phase, albeit with 222 royalties often acquired through acquisitions (Ely Royalty and others). Still, the ratio of producing assets versus the total assets is at 3.2% (including Jerritt Canyon!). It is far from sufficient to generate free cash flow.

GROY Assets classification (GROY Presentation)

Important note in the press release (emphasis added):

On March 20, 2023, First Majestic announced it is temporarily suspending all mining activities and reducing its workforce at Jerritt Canyon effective immediately. During the suspension, First Majestic announced the intention to process aboveground stockpiles through the plant and continue exploration activities throughout 2023. The Company considered the temporary suspension of mining activities to be an indicator of impairment and conducted an impairment analysis as of March 31, 2023 to estimate the recoverable amount of its royalty assets.

Hence, the risk of dilution for Gold Royalty Corp. shareholders is very high because of the financing need for expansion. The company has an ATM program.

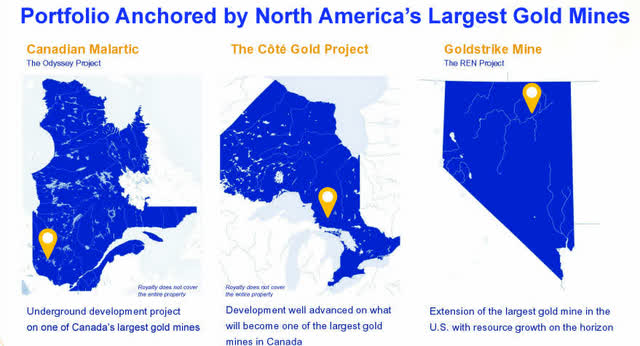

One positive is that the assets owned are located in the Americas and mostly in North America, and a few strong assets are about to produce.

Three substantial assets are the Odyssey Project at the Canadian Malartic, owned by Agnico Eagle (AEM); The Côté Gold Project, close to completion, owned by IAMGOLD (IAG); and the REN project at the Goldstrike Mine, owned by Barrick Gold (GOLD).

GROY Main Assets (GROY Presentation)

Unfortunately, GROY is not generating free cash flow and needs financing to expand its assets portfolio, creating dilution. GROY shares outstanding diluted increased 7.8% YoY.

The development stage will take several years to be sufficiently advanced to stabilize the matter. However, the stock is turning attractive even if the drop could suffer another downside leg before stabilizing.

Gold Royalty Corporation: 1Q23 Financial Snapshot History – The Raw Numbers

Note: The numbers are indicated in $US.

| GROY | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 |

| Total Revenues $ million | 0.638 | 1.907 | 0.866 | 0.582 | 0.770 |

| Quarterly Earnings in $ million | -2.39 | -3.44 | -4.68 | -2.20 | -3.08 |

| EBITDA $ million | -2.43 | -2.13 | -3.91 | -2.11 | -2.74 |

| EPS (diluted) $ per share | -0.02 | -0.03 | -0.04 | -0.02 | -0.02 |

| Operating Cash Flow $ million | -7.62 | -4.21 | 0.62 | -4.53 | -2.06 |

| CapEx in $ | 15.14 | 3.61 | 0.66 | 0.01 | 0.03 |

| Free Cash flow | -22.75 | -7.81 | -0.04 | -4.54 | -2.09 |

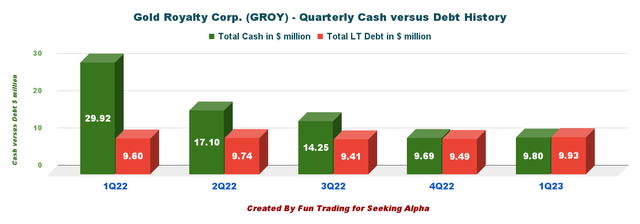

| Total Cash in $ million | 29.92 | 17.10 | 14.25 | 9.69 | 9.80 |

| Total LT Debt in $ million | 9.60 | 9.74 | 9.41 | 9.49 | 9.93 |

| Dividend $/ share | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

| Shares Outstanding (diluted) | 134.02 | 134.37 | 134.90 | 143.91 | 144.29 |

| Production in GEOs | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 |

| Gold Equivalent Production GEO | 345 | 1,004 | 517 | 336 | 406 |

| Gold Price $/Oz | 1,877 | 1,899 | 1,675 | 1,732 | 1,889 |

Data Source: The company’s financial report.

Gold Production and Balance Sheet Details

1 – Revenues were $0.767 million for the first quarter of 2023

GROY Quarterly Revenues History (Fun Trading)

Revenues for the first quarter of 2023 were $0.767 million, up from $0.638 million in the same quarter a year ago and up from $0.582 million in 4Q22. Net loss was $3.08 million in 1Q23.

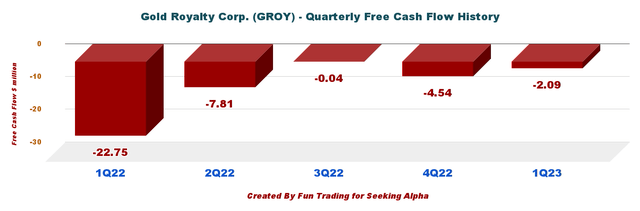

2 – Free cash flow was a loss of $2.09 million for 1Q23

GROY Quarterly Free Cash Flow History (Fun Trading)

Note: Generic free cash flow is the cash from operations minus CapEx.

GROY is in the expansion phase, which will probably last several quarters. Thus, the company is not generating free cash flow on a one-year basis.

During the quarter ending March 31, 2023, free cash flow was a loss of $2.09 million. Trailing 12-month free cash flow is now a loss of $14.48 million.

However, the company is paying a quarterly dividend of $0.01 per share despite a lack of free cash flow.

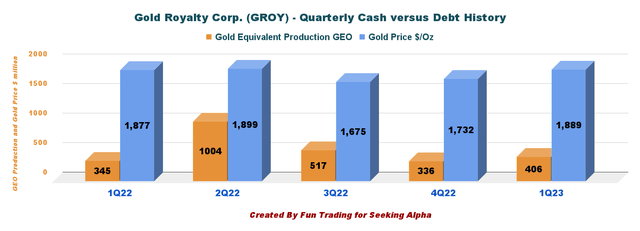

3 – Gold equivalent production details. Total production was 406 GEOs in 1Q23.

GROY Quarterly GEO Production and gold price associated. (Fun Trading)

The gold equivalent production was 406 GEOs in 1Q23, sold at $1,889 per GEO. The production is extremely weak and shows a lack of producing assets.

4 – Cash and debt

GROY Cash versus Debt History (Fun Trading)

Cash on hand is $9.80 million, and long-term debt was $9.93 million at the end of March 2023.

At-The-Market Program a source of concern:

On August 15, 2022, the Company entered into an equity distribution agreement with a syndicate of agents, providing for the issuance of up to $50 million shares of GRC from the treasury to the public from time to time pursuant to an “at the market” equity program.

During the three months ended March 31, 2023, a total of 415,728 GROY Shares at an average selling price of $2.55 per share.

Technical Analysis (Short Term) and Commentary

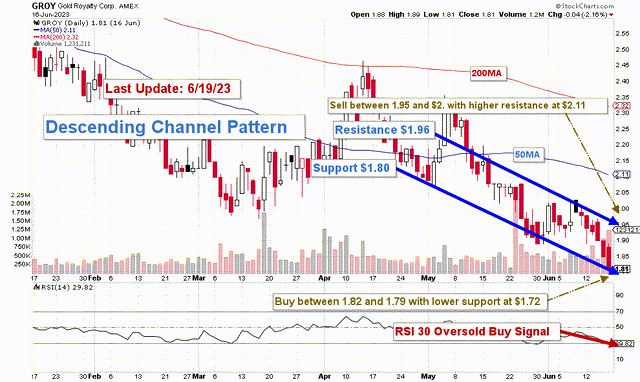

GROY TA Chart Short-term (Fun Trading StockCharts)

Note: The graph is adjusted from dividends.

GROY forms an ascending channel pattern, with resistance at $1.96 and support at $1.80.

Descending channel patterns are short-term bearish in that a stock moves lower within a descending channel, but they often form within longer-term uptrends as continuation patterns. Higher prices usually follow The descending channel pattern but only after an upside penetration of the upper trend line.

The basic strategy I usually promote in my marketplace, “The Gold and Oil Corner,” is to keep a small core long-term position and use about 85% to trade LIFO while waiting for a higher final price target to sell your core position. GROY is a very small streamer and fluctuates significantly. Hence, trading a large part of your position is perfectly adapted to this development phase which could take many months or years.

I recommend selling a part of your position at $1.95 to $2.00, with a potential higher target of $2.11. Buying between $1.82 and $1.79 is reasonable, with possible lower support at $1.72-$1.70.

Watch gold like a hawk.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here