Overview

I recommend a hold rating for GoodRx Holdings (NASDAQ:GDRX) as I expect the stock to remain rangebound until investors see more signs of growth inflection in FY24. This is a reiteration of my rating for GDRX previously, in which I believed a lot of investors were waiting on the sidelines until 4Q23, when GDRX should start to show a pick-up in growth.

1Q23 performance

It was encouraging to see the company get off to a good start this year with strong Q1 results that exceeded both revenue and adjusted EBITDA expectations. The $184 million in revenue was higher than the expected $182 million. Due to the ongoing impact of the grocer issue, which was a headwind in the quarter, prescription transaction revenue fell by 13% year over year. Manufacturer solutions fell by 13% as vitaCare’s positive impact was more than offset by decreased customer expenditure and a greater emphasis on recurring revenue contracts. That said, even though the number of members dropped by almost 20% as a result of the price hike, subscription revenue continued to enjoy excellent growth momentum, reporting 26% growth in the quarter. GDRX also exceeded consensus expectations with an adjusted EBITDA of $53.2 million. The reduction in operating expenses, particularly in sales and marketing, was a major contributor to the EBITDA beat.

Early signs of new strategic moves

The GDRX stock story centers on stabilization and the revival of growth. While it is still early, I like that GDRX is already making new strategic moves. In his new role as interim CEO, Scott Wagner is focusing on strengthening the company’s direct connections with retail pharmacies and addressing the weaknesses the company’s large grocery store division showed last year. While in the past GDRX has established relationships with retail pharmacies via Pharmacy Benefit Managers [PBMs], the company is currently developing a direct strategy to form partnerships with certain pharmacies and drugs. My guess is that this will increase GDRX’s take-rates in the direct model and maybe boost margins by allowing the company to keep the profit margin that PBMs were previously keeping from GDRX. However, the relationship between PBMs, which are still responsible for some of the distribution today, is likely to become strained. Technically, these PBMs could choose to squeeze (charge higher to compensate for loss of business as GDRX goes direct) GDRX in the meantime, which will hurt margins.

In the near term, I believe the path to more linear growth and normalized margin levels will function as a cloud over the stock price. In the long run, I still view GDRX as a growing, multi-sided, and multi-product platform that is providing cost savings and increased convenience for consumers while also generating significant volume for its industry partners in the highly competitive US healthcare sector.

Continue to stay caution for FY23

Earnings for GDRX are due to be released on August 9th, 2023. Since FY23 guidance has been less than expected (and the consensus), I will continue to exercise caution. The new strategic efforts will not be favorable from a headline standpoint in the near term, as the FY23 EBITDA margin guidance of 25% indicates margin compression in 2H23 compared to 1Q23. Because of this, it’s likely that investors will stick with their current “wait and see” strategy for a little longer. Since non-recurring Pharma Manufacturer Solutions deals are being deprioritized, GDRX will also face harder comps in the upcoming quarters. Recall that some of these deals are from prior periods, and as such, the loss of these revenues in the coming quarters will make headline revenue look weak. Finally, management lowered the low end of the 2023 revenue range for the Pharma Manufacturer Solutions division. This, I believe, is a consequence of the shift in model (from flat charge to pay-for-performance) and the lengthening of the deal cycle.

Valuation

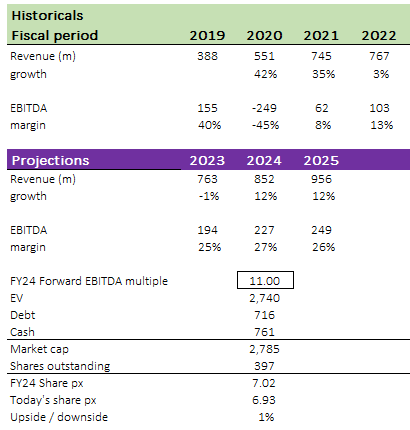

Own model

I reiterate my belief that the GDRX share price will only start to reflect its true value if the market gains confidence that growth is going to inflect in FY24. Until then, as I have mentioned above regarding the FY23 uncertainties, I think the stock will remain rangebound in the meantime. Using the updated consensus estimates, I value GDRX at $7.02. In my model, I assumed GDRX would be worth 11x forward EBITDA multiple, which is a premium to the other health care supply chain players trading at a median of 9x forward EBITDA, such as Option Care Health, AmerisourceBergen, Henry Schein, AdaptHealth, McKesson, Cardinal Health, Patterson Cos., Premier, Owens & Minor, and Procept Biorobotics Corp. GDRX should trade at a premium as its expected EBITDA growth over the next year is substantially higher than the group average of 30%.

Risks

Competition is a risk

New, more accessible ways of drug delivery made available by corporations like Amazon, Startups like SingleCare, and Walmart may pose a challenge to adoption rates.

Regulation

Currently, GDRX’s main selling point is the price differences amongst pharmacies. If pricing for generic drugs were lowered or were more uniform among pharmacies, GDRX may be impacted.

Conclusion

I recommend a hold rating for GDRX with cautiousness towards FY23. Although GDRX showed encouraging Q1 results and has begun making strategic moves to stabilize and revive growth, there are uncertainties in the near term. The shift in the business model and the impact of the grocer issue may affect margins and headline revenues. Investors are likely to adopt a “wait and see” approach until clear signs of growth inflection appear in FY24.

Read the full article here