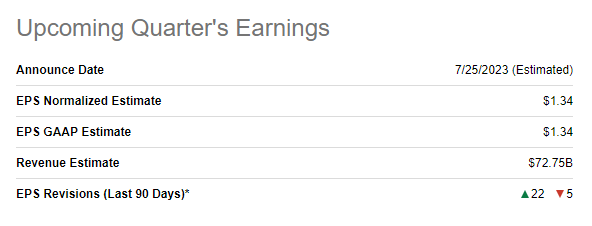

Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) is expected to report results for its Q2 that ended June 30th, 2023, post-market on Tuesday, July 25th. Analysts expect Alphabet to report an EPS of $1.34 on revenue of $72.75 billion. Should Alphabet meet these numbers, that would represent an EPS growth of 10.74% and revenue growth of 4.40% on YoY basis.

GOOG Earnings Estimate (Seekingalpha.com)

My last coverage on Alphabet was after its Q1 earnings, buoyed by a buyback announcement. I had rated the stock a “Buy” after Q1, despite being a little skeptical about the impact of buybacks in the face of stock based compensation and ensuing dilution. The stock has since returned nearly 14% compared to the market’s 11%.

With that background out of the way, let’s preview Alphabet’s Q2 without any further ado.

Seesawing Expectations

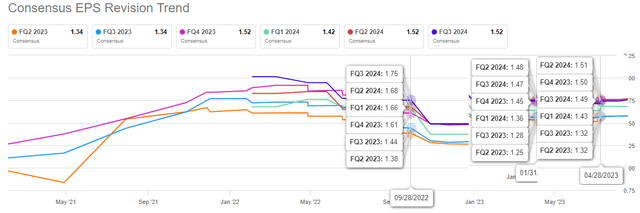

EPS Expectations for Q2 has been through a (small) roller coaster of sorts, starting at $1.38 last year to as low as $1.25 at the beginning of the year to $1.34 as we head into earnings. Undoubtedly, the lowest expectation was after Microsoft Corporation (MSFT) looked like severely damaging Google’s search engine dominance through a combination of Bing and ChatGPT. However, with this threat receding, if not eliminated, estimates have been revised to the upside.

GOOG Q2 EPS Revisions (Seekingalpha.com)

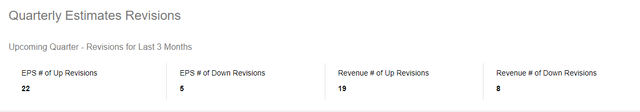

22 out of 27 EPS revisions have been to the upside and 19 out of 27 revenue revisions have been to the upside as well. This makes sense given the overall, slight uptick in expectations since April as shown in the chart above.

GOOG Revisions (Seekingalpha.com)

Overall, although the expected revenue growth is a little disappointing at less than 5%, the expected EPS growth of nearly 11% looks attractive enough. Especially when you factor in stock valuation as covered in a section below.

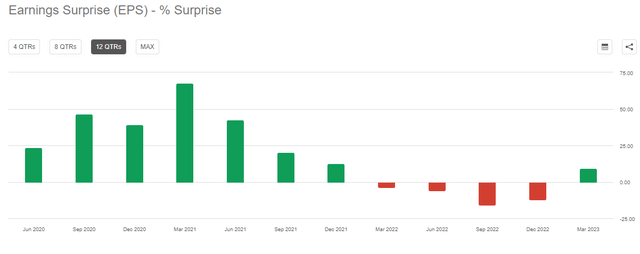

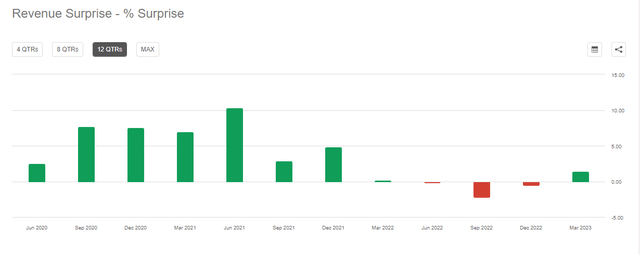

Beat or Miss? Trend Is Not Google’s Friend

In the last 12 quarters, Alphabet has beaten EPS estimates 8 times and revenue estimates 9 times. While that sounds encouraging on paper, the trend is not encouraging. 4 out of the last 5 quarters have seen an EPS miss while 3 out of the last 5 have seen a revenue miss. Alphabet managed to eke out a small revenue beat in Q1 2023 to break a series of three consecutive revenue misses.

There is no crystal ball in investing but trend is usually your friend but it doesn’t appear to be Alphabet’s friend right now. I predict a slight revenue beat and the EPS beat/miss will come down to how disciplined the company was with its operations (aka expenses) as I don’t expect any of the divisions to have had a growth driver in Q2.

GOOG Eps Surprise (Seekingalpha.com) GOOG Revenue Surprise (Seekingalpha.com)

Advertising and AI – The Two Main Stories

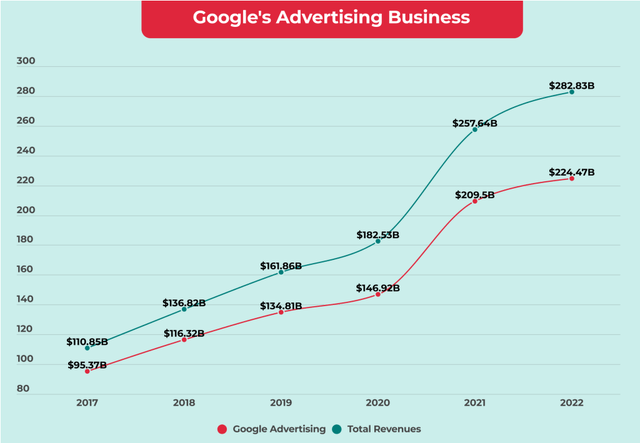

Alphabet has always been heavily reliant on advertising revenue. And I don’t mean that to be a knock on the company but stating the fact. In 2017, advertising was 86% of the company’s total revenue. Thanks to the company’s efforts in other initiatives including productivity tools and Cloud, this percentage has fallen to 79% recently. That is still significant and hence the panic when the company was initially caught napping by Microsoft’s aggressive move towards AI.

But sticking to advertising, prior to the COVID induced jump in 2021, advertising revenue growth had fallen from 22% to 15% to 9% in the prior three years. Clearly, we are back to the same trend as 2022 showed just a 7% revenue growth in ads compare to the 2021 spike. Q1 2023 showed the company was still facing the heat on its search/advertising business and I predict advertising to be a hair below 80% (around $57 billion) of the total revenue of around $72 billion.

Alphabet Revenue (fourweekmba.com)

As Seeking Alpha reported recently, the AI race is in full swing at Alphabet with the company finally showing some urgency to the threat to its search business, not just from Microsoft but AI in general. And what better way to get Wall Street excited about something than bringing back your (venerable) co-founder to lead an initiative. I will be surprised if the Q2 conference call does shed further light on the company’s plans for Gemini and how it plans to integrate its AI developments with the rest of the Google Ecosystem from productivity apps to Google Cloud. And of course, the search.

Lastly, Google Cloud is looking like an “also ran” in terms of its contribution to the company as well as in the overall market. But the division reported its first profitable quarter in Q1. Whether this was a one-off or a trend will be interesting to see. I expect Google Cloud to have a bigger role in the long-term future but for Q2, I am skeptical if it is matured enough to turn in two consecutive profitable quarters.

Valuation – Best Among The Big Boys

- Heading into earnings, Alphabet at a forward multiple of 22 is much cheaper than Apple Inc. (AAPL) at 32, Microsoft at 35, and Amazon.com, Inc. (AMZN) at 82.

- The valuation gets more attractive when you factor in the expected earnings growth rate of nearly 16%/yr over the next 5 years. That gives the stock a price-earnings/growth (“PEG”) of 1.40. While that is a bit higher than what Peter Lynch would like, Apple’s PEG is >4 and Microsoft’s is >3. Only Amazon has a PEG comparable to Alphabet here but that is based on a lofty earnings growth expectation of nearly 65%.

- The mega-cap technology stocks have been on such a magical run this year that Alphabet at 34% is the worst performer with Microsoft at 43%, Apple at 53%, and Amazon 51%. Given the relative undervaluation and under-performance, Alphabet is going into earnings with moderate expectations and surprises to the upside on Q2 results or more importantly, Q3 guidance may set the stock up for a rally.

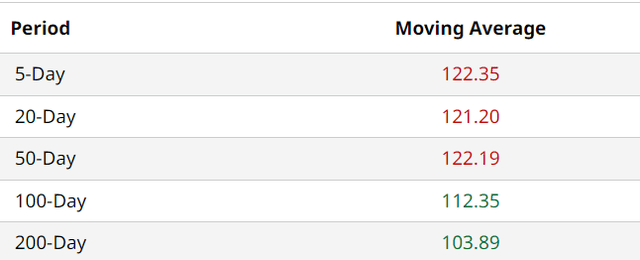

Technical Strength – Sitting On A Solid Base

GOOG stock has broken above the all-important 100-Day and 200-Day moving averages as shown below. The other shorter term averages are not far off from the current price either. So, this sets the stock up with a solid base heading into earnings. A positive earnings report and/or strong guidance should help the stock move further away from these averages, thereby establishing a new base.

GOOG Moving Avgs (Barchart.com)

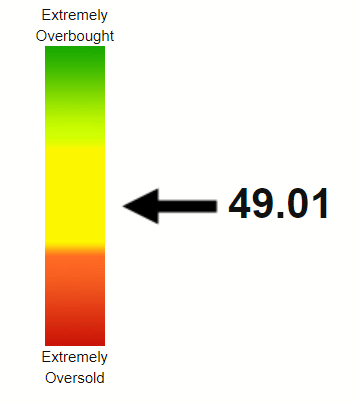

The stock’s Relative Strength Index (“RSI”) is a little low for my liking as it shows there may not be much excitement around it yet. But once again, it looks strong enough that a good report and guidance is likely to spark a rally.

GOOG RSI (Stockrsi.com)

Conclusion

Despite the stock’s run up since my last review, I am sticking with my “Buy” rating as I believe Google’s ecosystem is not yet as appreciated as Microsoft’s or even Amazon’s prime ecosystem. Google can leverage AI across its entire suite of products and services to improve productivity of its consumers and its own profitability. And let’s not pretend like Google does not have a significant moat in advertising and search, even with all the excitement around AI.

What’s your take on Alphabet’s upcoming Q2 and its future in general?

Read the full article here