Investment Thesis

Alphabet (NASDAQ:GOOGL) has shown strength in Q2, both on advertising and cloud market, despite wide industry slowdown. Company has announced several new products, especially focusing on AI and it will probably drive ARPU’s and revenue in the near term. Company also remains fast-growing cloud player and shows positive profitability dynamics. Anyway, according to our valuation current price potential is only 5%, so we remain a HOLD status on stock.

Advertising is rebounding already

Alphabet’s revenue is greatly dependent on the sentiment of customers in the digital advertising market, which is why it continues to be under pressure, in line with expectations, as marketing budgets have been given cuts across the board. As a result, the price of user acquisition is falling.

Even so, the catalyst for a faster recovery in the market (it’s largely artificial intelligence applications, which we covered in the previous report) has sprung into action. The management noted that customers had started to show greater activity, increasing marketing budgets, although the cost of user acquisition still remains below 2022 levels.

The AI-powered chatbot Bard is developing at a rapid clip. Although the product was released as recently as March, Bard is currently available in more than 40 languages in most of the world’s countries. Besides Bard and PaLM 2, Alphabet is working on another multimodal chatbot model, Gemini, and continues to integrate AI into all of its products, including search, targeting, cybersecurity, cloud computing, and more.

Though generative models are still new to the market and the future is uncertain, Dentsu assumes it will affect both user experience and monetization models. Mixed with strong consumer activity, this can lead to strong growth on specific ARPU’s for search engines.

Alphabet itself noted recovery in advertising spending, other advertising companies such as Pinterest said almost the same.

We earlier expected that marketing spending would start to rebound in 3Q-4Q 2023, so given the faster recovery of the digital advertising market, we are raising the forecast for Alphabet’s revenue in the advertising segment from $233.7 bln (+4.1% y/y) to $235.7 bln (+5.0% y/y) for 2023 and from $248.2 bln (+6.2% y/y) to $250.3 bln (+6.2% y/y) for 2024.

Invest Heroes

The performance of the Cloud segment was in line with our expectations in 2Q: Revenue jumped by 28.0% y/y to $8.0 bln, compared with the forecast of $8.2 bln. According to Canalys, in Q2 worldwide cloud infrastructure services spend totaled $72.4 bln, growing 16% YoY, which is serious slowdown compared to previous pace.

According to our calculation and Canalys data, Alphabet’s market share has increased to 11.1% (+1 p.p. YoY). We believe the trend will continue and the company will be outpacing with an average beta of 1.3x in FY23-25, despite tight competition due to strategical partnerships (e.g. Nvidia) and infrastructure and software investments.

Invest Heroes

Therefore, faced with a faster recovery of customers’ advertising budgets, we are raising the forecast for Alphabet’s revenue from $302.0 bln (+6.8% y/y) to $304.0 bln (+7.5% y/y) for 2023 and from $326.5 bln (+8.1% y/y) to $329.6 bln (+8.4% y/y) for 2024.

Invest Heroes

Higher added-value products will benefit margins as well

In Q4 2022 Alphabet has announced that they will reduce workforce and exit several leases as a part of restructuring strategy and they did in Q1 2023. Since 2022, the company has significantly decreased hiring pace and the effect already observed in margins.

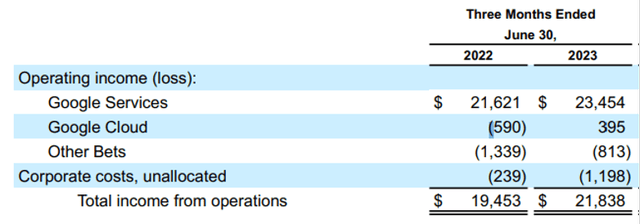

In Q2 EBITDA margin has increased by 0.31 p.p. YoY, despite Costs-per-click are still low compared to that in 2021 and early 2022.

With rebound of wide marketing activity, growing share of higher value-added products (such as L4 Tensor infrastructure for generative AI) and increasing margins in Cloud segment, Alphabet is on its way to pre-recession margins and even higher.

Alphabet

We believe that with rebound of marketing budgets and increase of cloud services, Alphabet will exceed its 2021 margins already in 2024.

Invest Heroes

Due to the increased revenue forecast, we are raising the EBITDA forecast from $97.8 bln (+7.7% y/y) to $99.1 bln (+8.1% y/y) for 2023 and from $115.2 bln (+17.8% y/y) to $117.5 bln (+18.6% y/y) for 2024.

Invest Heroes

Valuation

We are evaluating Alphabet target price based on FTM EV/EBITDA multiple & FCF Yield.

We are raising the target price of the shares from $127 to $140 due to:

- the increased EBITDA forecasts for 2023 and 2024;

- the shift of the FTM valuation period (we earlier included the period from 2Q 2023 through 1Q 2024 into the forward 12 months EBITDA forecast, while now the forecast period runs from 3Q 2023 to 2Q 2024).

Based on the new assumptions, we are maintaining the rating at HOLD. Our fair value price was obtained as the average price between EV/EBITDA multiple & FCF Yield methods.

Invest Heroes

Conclusion

We regard Alphabet as a promising company over the long term due to an intense monetization of YouTube Shorts and the development of the cloud technology market. However, the upside from the development of AI technologies and the recovery of customers’ marketing budgets is already built into the company’s market value, and we believe the potential for the share price to rise is now limited.

To manage the position, we suggest keeping an eye on financial statements of Alphabet and its competitors (Dentsu, eMarketer, McKinsey) and industry research.

Read the full article here