Is now a good time to buy stocks?

The mood surrounding the stock market underwent a fundamental shift recently. Talk of recessions, inflation, and debt ceilings turned on a dime to artificial intelligence (AI) and dreams of new market highs. Some are now saying we will avoid a recession altogether (although I have my doubts).

Companies like NVIDIA (NVDA) are Palantir (PLTR) are soaring, up 205% and 191% in 2023, respectively. Many stocks that have been lifted by AI enthusiasm are trading at unprecedented valuations.

But the economy still faces challenges as the rapid rise of interest rates and the predicted exhaustion of stimulus savings have yet to hit full force. It’s critical for investors to be aware of valuations.

So when Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL) released Q2 earnings on July 25th, all eyes seemed focused on AI. But I was looking elsewhere.

A false dilemma

Alphabet does not have to choose between a high-margin model and investments in the future.

The battle over margins at Google has raged for years. In fact, when Google changed its moniker to Alphabet, it was because the company wanted to better reflect its initiatives beyond advertising. The promise at the time was that the company would invest in moonshots but be fiscally responsible at the same time. But margins suffered.

Many of the company’s “other bets,” like fiber internet, smart-home products, health sciences, and delivery drones, haven’t moved the needle. But others, like YouTube, paid off wonderfully.

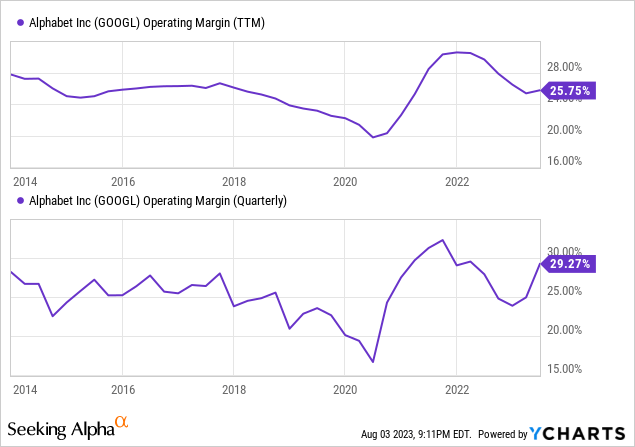

Still, Alphabet’s operating margins were in a downward-moving channel for several years before the pandemic, as depicted below.

Google’s operating margin exploded during the pandemic boom as the economy was flush with stimulus cash, and sales rose 55% from $183 billion in 2020 to $283 billion in 2022. Then inflation and some over-exuberant spending threatened to lead the company right back to declining margins.

The operating margin dipped to 24% in Q4 2022 as CEO Sundar Pichai vowed to make the company 20% more efficient.

So far, so good.

Let’s be clear: Other Bets are critical to Alphabet’s future. The company’s AI research hub Google DeepMind is arguably its most important long-term investment now. But every once in a while it’s necessary to prune back some of the dead leaves.

AI initiatives are going to cost money – a LOT of money. So trimming the fat in other areas is vital to the success of the stock.

Alphabet took $2.6 billion in restructuring charges in Q1 as it began to make changes. Operating expenses rose 9% year-over-year (YOY) but would have been capped at a 4% without the charges. This is a huge win considering rising costs economy-wide.

Then in Q2 the operating margin jumped to an outstanding 29%, exceeding the prior year. Research and development expenses rose 8%, but general and administrative costs declined. This proves that Alphabet can invest heavily in the future and produce tremendous value for shareholders.

CFO Ruth Porat’s comments further cement this goal:

We continue investing for growth, while prioritizing our efforts to durably reengineer our cost base company-wide and create capacity to deliver sustainable value for the long term.” – Q2 earnings release.

Cash is flowing…to shareholders.

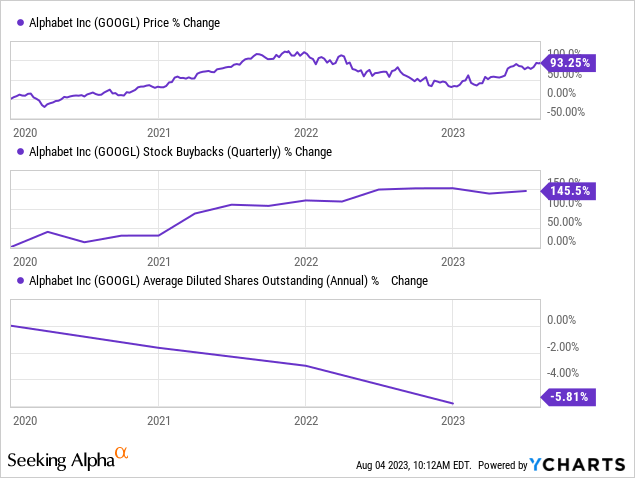

The focus on efficiency pushed cash from operations up 17% so far this year, leaping from $44.5 billion to $52.2 billion. Alphabet spent $29.5 billion buying back stock through Q2. The buyback program has been terrific for shareholders, lowering the share count (which raises earnings per share) and supporting them in the market, as shown below.

Is Google stock a buy?

Many see Alphabet as behind in the race to develop and monetize AI. This isn’t the case. The company may have been caught napping when OpenAI released ChatGPT, but it has been investing heavily in AI for years. For example, people can try Google’s chatbot Bard here. The company is integrating machine learning (ML) into Search, Google Lens (search from a picture), Google Translate, and Google Workspace.

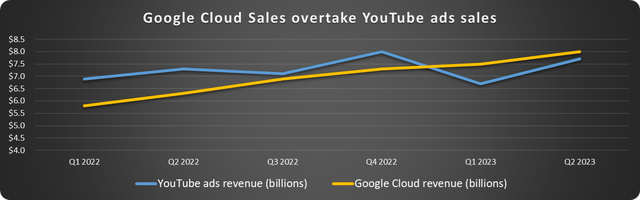

Google Cloud will be an immediate beneficiary. The platform provides the infrastructure and tools for companies to build and deploy AI applications. This should keep the cloud segment booming as companies experiment with and adopt solutions.

The cloud segment has turned profitable this year for the first time (with a little help from an accounting change), grew revenue by 28% in Q2, and has a long runway.

Google Cloud revenue has overtaken its YouTube ads revenue, as shown below, and will likely continue to pull away on the strength of AI.

Data source: Alphabet. Chart by author.

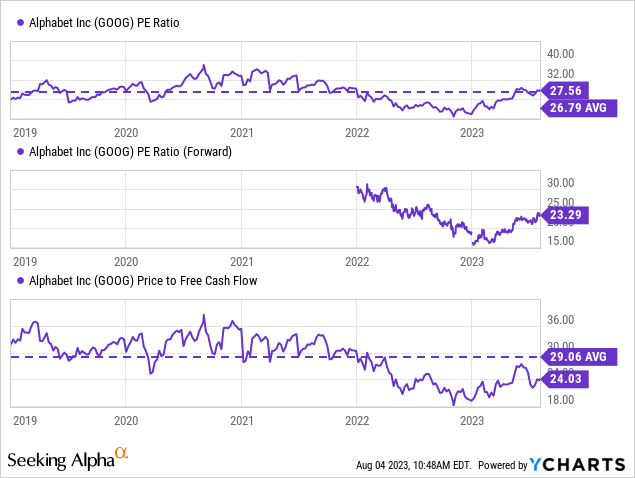

Alphabet stock is up 47% in 2023 but only 10% over the last year. The price-to-earnings (P/E) ratio recovered but is still attractive on a forward basis. The stock is 21% undervalued historically based on free cash flow, as shown below.

Alphabet has exceeded expectations in 2023, defying the advertising slowdown to grow revenues and EPS and, most importantly, cash flow. The terrific performance and investments in “what’s next” make the stock an excellent long-term investment.

Can Alphabet invest in the future and bolster margins for shareholders? Yes, and Q2 shows that the executives appear fully committed to the endeavor.

Read the full article here