Introduction

Ever since 1998, Greystone Housing Impact Investors LP (NYSE:GHI) has focused on the real estate market where it acquires and sells mortgage revenue bonds in an investment portfolio. What seems to have set the company apart from others is the very high dividend yield sitting at nearly 10%. This has been achieved through a very high payout ratio, one that seems quite unsustainable at this point too.

As much of the appeal of GHI came from the dividend the likelihood of lackluster growth to it as the housing market cools off makes me worried about the true potential here with an investment. The last report from the company showcased they had $0.62 in CAD for shareholders. Where I am worried is the fact that some quarters produce quite varied CAD which makes it difficult to predict the actual potential of the dividend. A slowing real estate market makes it likely CAD will decrease and that suppresses any buy case in the company in my opinion. I think it’s wiser to look elsewhere, but collecting the dividend until better times comes seems advisable and I will be rating GHI a hold as a result.

Company Structure

As mentioned earlier on, GHI operates as a holder and seller of mortgage revenue bonds which are issued to provide construction and/or permanent financing for both multifamily and student housing. The company operates in the United States and has managed to build up quite the name for itself here so far. In terms of the valuation, it isn’t necessarily that high despite the massive run-up the residential market had in the last few years. This resulted in GHI distributing a very good dividend which appealed to many investors.

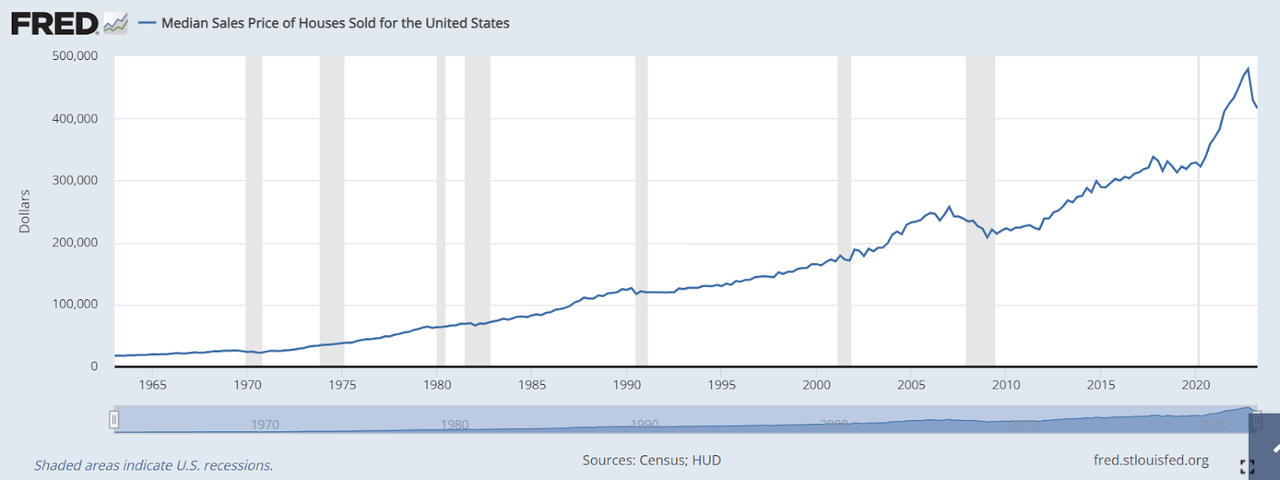

The real estate market still seems to be quite shaky and some predict further downward pressure for overall prices. This would hurt demand for GHI and likely result in softer revenue and earnings reports going forward.

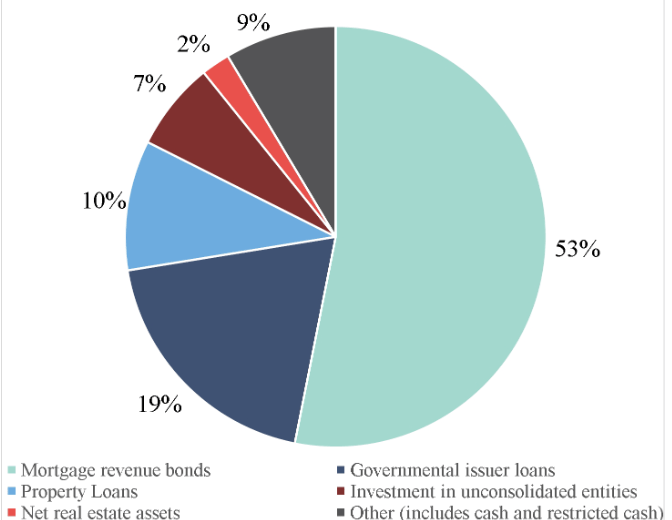

Portfolio (Investor Presentation)

The asset profile for GHI showcases however that they are very reliant on the revenues from mortgage bonds as it makes up 53% of the asset base. Besides that, a large portion sits in governmental issuer loans and property loans instead. In Q2 FY2023 the total assets amounted to $1.66 billion and it has to be said that GHI has done a decent job leveraging this into returns as the ROA sits at 3.2% using the TTM numbers.

Management Outlook

Greystone investors can find solace in the positive development of the company’s base business, which is showing signs of stabilization. While Greystone initially experienced some delay in adapting to the rise in interest rates, the subsequent efforts to establish effective hedges have borne fruit. This strategic response aimed at mitigating interest rate risks has helped to navigate the evolving financial landscape.

House Prices (Fred)

During the period from Q2-2022 to Q2-2023, there was a slight uptick in interest expenses, with an additional $2 million being incurred. However, this increase was met with a multi-faceted counterbalance that effectively neutralized its impact on the overall financial picture.

One pivotal aspect contributing to this balance is the concerted interest revenue generated during this period. Greystone’s focused efforts to optimize interest revenue streams have played a pivotal role in offsetting the growing interest expenses. This calculated approach not only underscores the company’s commitment to effective financial management but also reflects its responsiveness to changing market dynamics.

Valuation & Comparison

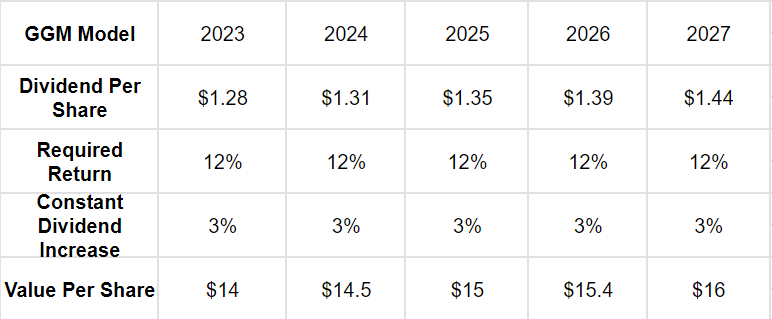

GGM Model (Author)

The model above here for GHI showcases some of the risks that are associated with an investment right now. The company I don’t think will be able to keep up the same amount of dividend it has previously. I started with a $1.28 dividend and then applied a quick low terminal increase of 3%, which make my targets more risk protected. I also apply a rather high 12% required return to further facilitate what I seek from GHI right now, but also because the market conditions seem shaky. This requires a higher risk assessment in my opinion. As we can also see, the target price isn’t necessarily where today’s price is. For me to be making an investment the share price would need to land under this for me to feel comfortable with the risk and rewards you are getting.

Risk Associated

In Q4-2022, a period marked by the absence of any gains from asset sales, the company generated a modest $0.09 of cash available for distribution. It’s noteworthy that this amount is considerably less than a quarter of the regular quarterly distribution. This stark contrast raises pertinent questions about the sustainability of the current distribution levels. This showcases that volatile CAD is a real possibility and this will likely result in shifting dividend yields if GHI doesn’t want to start diluting shares more frequently. Thankfully it doesn’t seem like debt has been the solution for the company here to continue the dividend at least, which of course would be a horrible route to go down.

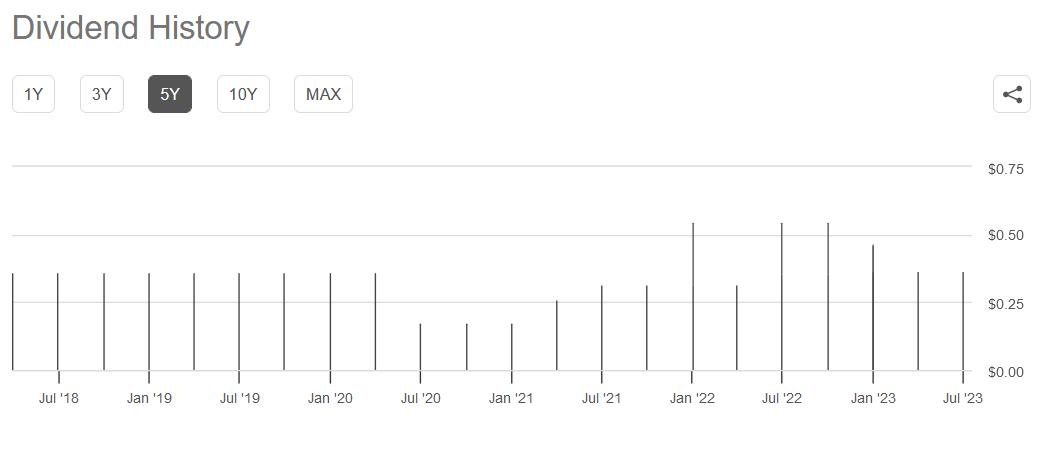

Dividend History (Seeking Alpha)

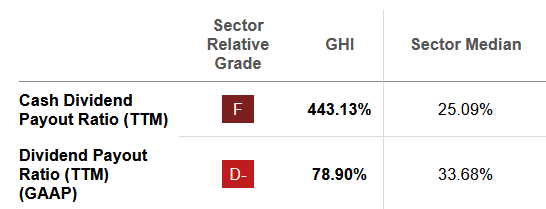

The ongoing concern revolves around the apparent misalignment between the cash generated by the base business operations and the substantial distributions being paid out. This dissonance becomes particularly evident when assessing the relatively modest cash available for distribution against the backdrop of a distribution rate that exceeds it by more than fourfold.

Cash Dividend (Seeking Alpha)

The situation prompts a pertinent inquiry: In the absence of a robust income generated by the core business, is the rationale behind GHI’s decision to maintain such elevated distribution levels warranted? With the backdrop of escalating borrowing rates, the company is confronted with a complex financial landscape, which poses challenges in terms of meeting the existing distribution commitments while navigating potential shifts in the broader economic landscape.

Investor Takeaway

GHI has been very appealing to dividend income investors as the yield is nearly at 10% supported by what seems like an almost constrained payout model. I think that the shakiness in the market is making GHI more reasonable to trade at a slight discount. As my target concluded the share price is above where I am comfortable paying and this results in me rating it a hold for the moment.

Read the full article here