Gulfport Energy (NYSE:GPOR) reported solid Q2 2023 results and increased its full-year production guidance while also indicating that operating costs would come in lower than previously expected. Gulfport is also projected to generate $135 million in free cash flow (not including changes in working capital) during the second half of 2023 despite adding $40 million in discretionary spending for acreage acquisitions.

I had already modeled Gulfport’s production at 1.04 Bcfe per day before, but have bumped this up to 1.045 Bcfe per day now. When combined with lower costs, this increases my estimate of Gulfport’s value from $110 per share to $114 per share.

Q2 2023 Results

Gulfport’s Q2 2023 results exceeded expectations. It averaged 1,039.3 MMCFE per day in production during the quarter, which was approximately 2% lower than its Q1 2023 production. However, Gulfport had previously commented that Q2 2023 was expected to have the lowest quarterly production of the year.

In addition to the solid production results, Gulfport’s per unit operating costs were pretty good at $1.16 per Mcfe, not including G&A.

Gulfport reported $144.5 million in adjusted EBITDA and incurred $129.3 million in capital expenditures. It also currently has around $14 million to $15 million per quarter in interest costs and preferred dividends, so its adjusted free cash flow was essentially near zero for the quarter.

Gulfport’s free cash flow should improve during the second half of 2023 though due to a combination of lower capex, higher production levels and higher commodity prices though.

Improved Guidance

Gulfport had previously mentioned that its full-year production was trending towards the high-end of its 1,000 to 1,040 MMCFE per day guidance range. It has now increased its full-year guidance to 1,035 to 1,055 MMCFE per day, which makes the midpoint of its revised guidance slightly above the high-end of its original guidance.

Gulfport’s strong production comes with no change to its $425 million to $475 million capital expenditure budget, although it is now allocating an additional $40 million to discretionary acreage acquisitions, which is outside of its maintenance capex for leasehold and land. Gulfport mentions that the acquisitions would extend its high-quality inventory by approximately 1.5 years.

In addition to its production guidance increase, Gulfport also lowered its operating cost guidance. It now expects operating costs (not including G&A) to end up at $1.16 to $1.24 per Mcfe, down 4% from its original guidance for $1.21 to $1.29 per Mcfe in operating costs.

The only negative change to Gulfport’s guidance is that it now expects to realize 35% to 40% of WTI for its NGLs in 2023, down from original expectations for 40% to 45% of WTI. This was expected due to the mid-year weakness in NGL prices.

2H 2023 Outlook

For Gulfport to hit the midpoint of its full-year guidance, it will need to average around 1.042 Bcfe per day in production during the second half of 2023.

At current strip prices, Gulfport is projected to generate $554 million in revenues before hedges. Gulfport’s 2H 2023 hedges have approximately $77 million in positive value.

| Type | Units | $/Unit | $ Million |

| Natural Gas [MCF] | 172,555,220 | $2.50 | $431 |

| NGLs (Barrels) | 2,440,897 | $27.00 | $66 |

| Oil (Barrels) | 754,400 | $75.50 | $57 |

| Hedge Value | $77 | ||

| Total Revenue | $631 |

Including $40 million for discretionary acreage acquisitions, Gulfport’s 2H 2023 capex budget may end up around $214 million. Gulfport’s 2023 capex budget was more heavily weighted to the first half of the year.

| Expenses | $ Million |

| Transportation, Gathering, Processing and Compression | $176 |

| LOE | $31 |

| Taxes Other Than Income | $23 |

| G&A | $23 |

| Interest and Preferred Dividends | $29 |

| Capex | $214 |

| Total Expenses |

$496 |

This results in a projection of $135 million in free cash flow for Gulfport in 2H 2023.

Share Repurchases And Valuation

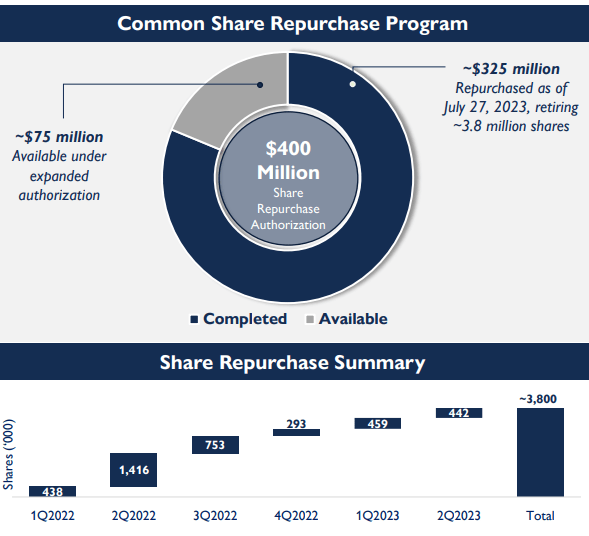

Gulfport may put some of that free cash flow towards share repurchases. It repurchased 0.442 million shares in Q2 2023, bringing its total share repurchases up to 3.8 million since the start of 2022. It also has approximately $75 million remaining under its current share repurchase program.

Gulfport’s Share Repurchases (gulfportenergy.com)

Gulfport also has $99 million in remaining credit facility debt (at the end of Q2 2023), so it may also use some of its free cash flow to reduce that debt. It mentioned it was primarily focusing on share repurchases though.

Due to Gulfport’s improved guidance (both for production and cost), I have increased its estimated value to $114 per share (at long-term $3.75 NYMEX gas and $75 WTI oil). This is an increase from my previous $110 per share valuation estimate.

Conclusion

Gulfport has been performing well operationally, result in it providing improved guidance around both production and operating costs. Gulfport is now projected to generate $135 million in free cash flow during 2H 2023 despite adding $40 million for discretionary acreage acquisitions.

Gulfport is expected to allocate most of that free cash flow towards share repurchases, and I now estimate its value at $114 per share at long-term $3.75 gas and $75 oil.

Read the full article here