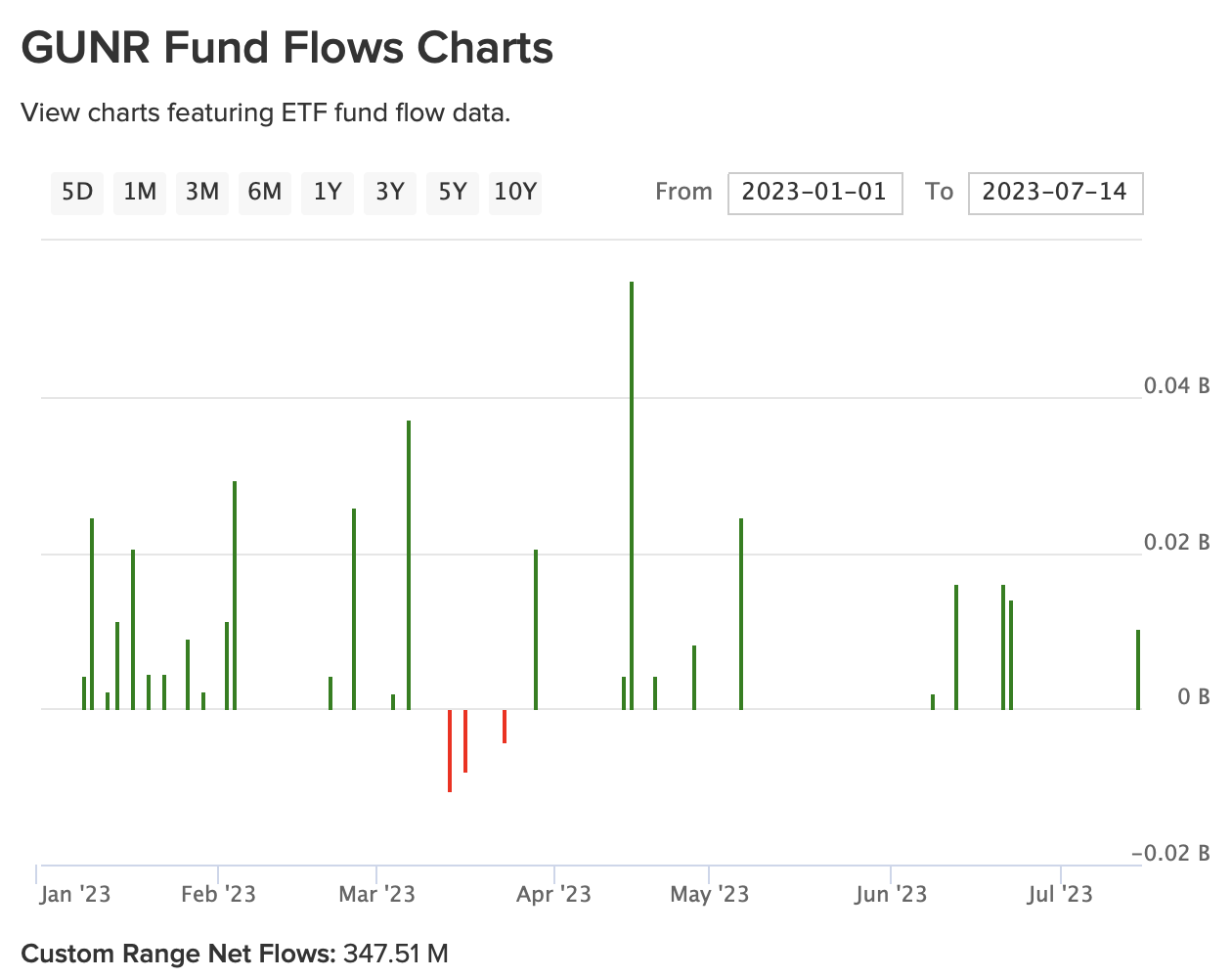

Recently, sticky inflation and energy transition are driving investors towards gaining exposure on critical commodities dealing with immense demand, such as natural gas and lithium. The FlexShares Morningstar Global Upstream Natural Resources Index Fund (NYSEARCA:GUNR) aims to provide such exposures to equities involved in ‘management/ production of energy, agriculture, precious or industrial metals, timber and water resources sectors as defined by Morningstar’s industry classification standards.’. Year-to-date, the fund mostly experienced inflows with a total net inflow of $347.5mn, while the fund sits at $7.3bn.

ETF Database

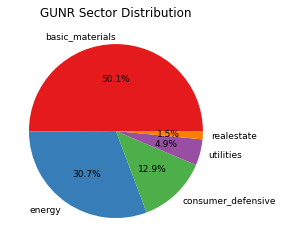

As it was well-received by investors, it is worth diving into understanding the risk and return drivers of the portfolio, as well as some of the underlying fundamentals. As an overview, the portfolio has about half of its total weight exposing to basic materials, 30% exposure to energy stocks and ~13% in consumer defensive.

Author, Yahoo Finance

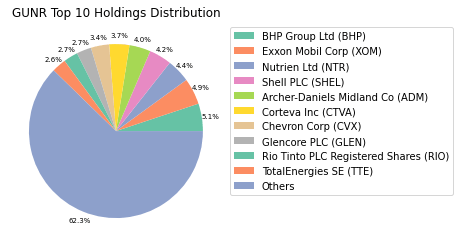

Meanwhile, GUNR is decently diverse with its top 10 holdings taking up less than 30% of the fund total weight – as the fund’s largest exposures include household names such as BHP (BHP), Exxon Mobil (XOM), and Shell (SHEL).

Author, Yahoo Finance

Performance Review

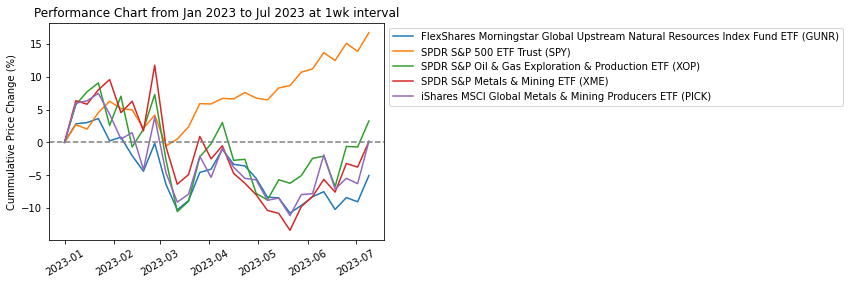

On a year-to-date basis, GUNR performs poorly against its peers which include indices which track similar stocks such as XOP focusing on Oil & Gas exploration, XME and PICK which both focus on the Metals & Mining sector. As defensive/ value stocks have significantly underperformed growth stocks, almost all indices tracking the upstream natural resources segment have returned negatively while SPY is up 15% YTD.

Author, Yahoo Finance

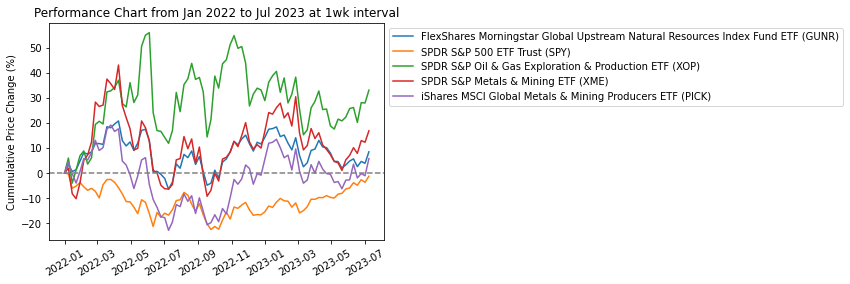

Meanwhile, taking a longer term view since January 2022 when energy stocks are still rallying, XOP significantly outperformed the peers while GUNR performance tracks closely between two metals mining indices, PICK and XME. SPY is barely recovering from the underperformance still.

Author, Yahoo Finance

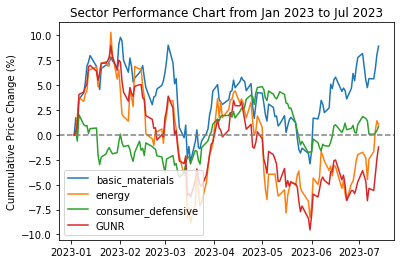

While GUNR looks highly correlated to the basic materials index (XLB), it trails behind the returns of the broader sector, as well as the energy and consumer defensive sectors. This may be driven by methodological differences when defining ‘upstream natural resources’, and its second largest exposure to the energy sector too, which seems to have dragged down its returns.

Author, Yahoo Finance

Risk Analytics

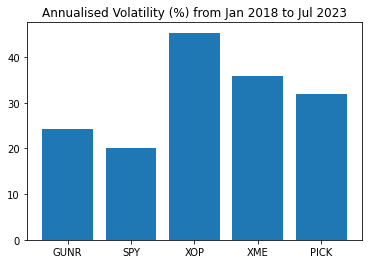

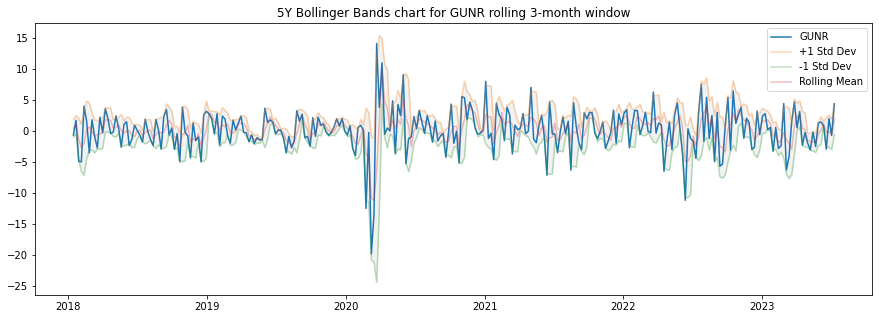

From the risk analytics standpoint, GUNR has lower annualized historical volatility as compared to its peers, but slightly higher than SPY, at around 25%. The 5Y Bollinger chart below also visualizes the price volatility of GUNR on a 3-month rolling basis, where it has been trading close to its +1 sigma above the rolling mean – indicating a potential overbought.

Author, Yahoo Finance

Author, Yahoo Finance

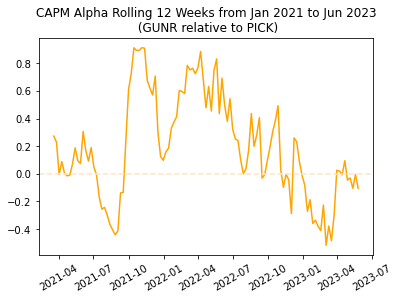

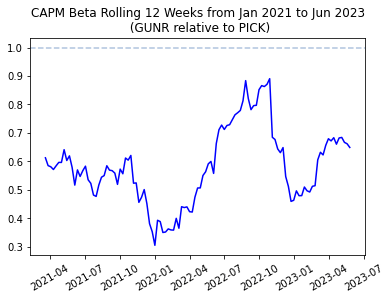

Relative to its peer index, PICK, GUNR has been underperforming since the start of year but gaining some traction to be equalling the returns of PICK. Meanwhile, the rolling-beta chart also demonstrates the low sensitivity of GUNR over PICK, as GUNR is also much less volatile than PICK despite being very correlated (year-to-date correlation is between 0.85 to 0.95).

Author, Yahoo Finance

Author, Yahoo Finance

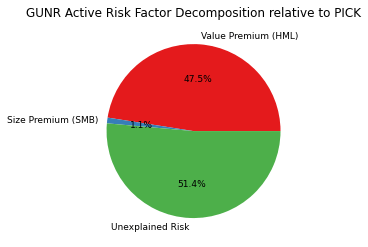

Applying the Fama-French 3 Factor Model, nearly half of GUNR active risk relative to PICK can be attributed to value premium, where GUNR favors equities with higher book-to-price ratios relative to PICK holdings. However, a significant portion of active risk is idiosyncratic/ unexplained through the model.

Author, Yahoo Finance

Fundamentals Deep Dive

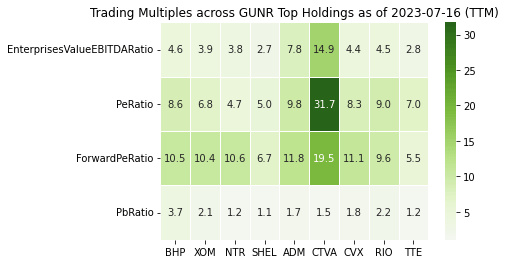

Diving into the underlying fundamentals of GUNR, the fund has a weighted-average P/E ratio of 7.4x, which is much lower than 23x in SPY, but similar to 7x by PICK. Across the top holdings, most stocks are deep value stocks with P/E ratio lower than 10x and P/E ratio lower than 2x. CTVA being the exception here as the most ‘expensive’ stock as a pure-play agriculture company focusing on enhancing crop protections.

Author, Yahoo Finance

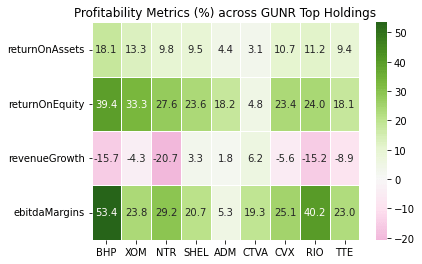

Looking across the profitability metrics, they are highly profitable with strong return on equity and significant EBITDA margins for few. However, revenue growth is expected to drop for most metal mining companies as prices for base metals and energy commodities fall from heights during Covid-era.

Author, Yahoo Finance

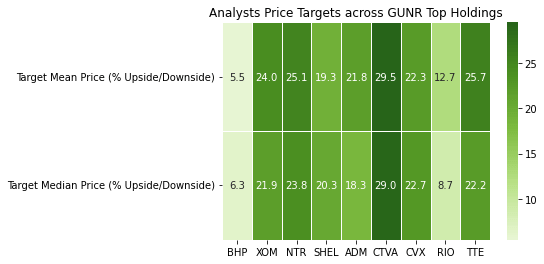

Analysts price targets are very positive, with expectations for two mining giants (BHP & RIO) being lower than average. With such strongly positive sentiment, GUNR could be a great investment for investors seeking to gain exposure to this field without exposing too much into non-systematic risks.

Author, Yahoo Finance

Conclusion

In short, GUNR provides investors with exposures towards natural resources in a fairly diversified manner. It has also achieved greater risk-adjusted returns over its peers in the past few years, with greater tilt towards value stocks. The underlying fundamentals of the top holdings look robust and healthy, where the market sentiment has been strongly positive. However, with the weakening macroeconomic backdrop, falling prices in broad commodities have the potential to hurt its performance for the short to medium term.

Read the full article here