Receive free Harry Markowitz updates

We’ll send you a myFT Daily Digest email rounding up the latest Harry Markowitz news every morning.

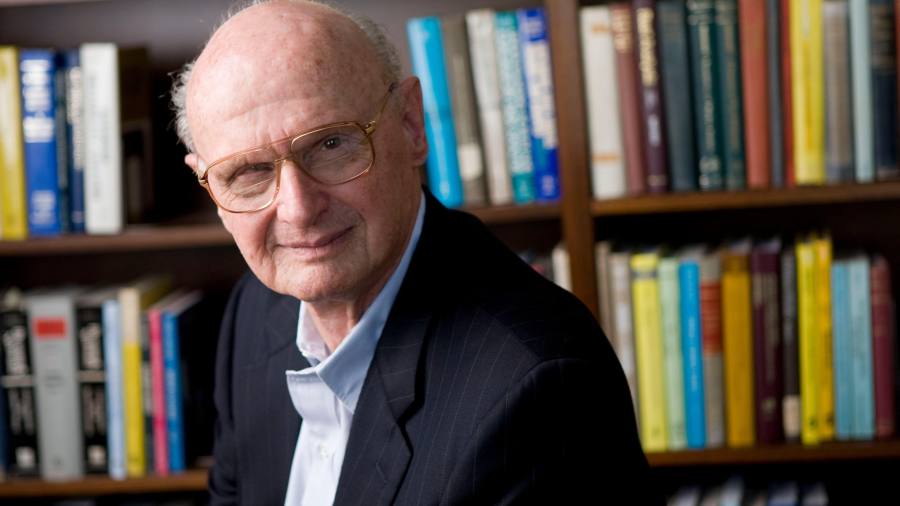

The study of finance can easily be split into two eras: before and after Harry Markowitz.

The economist, who died on June 22, was one of the first academics to introduce abstract mathematical concepts — and rigour — to investment decision-making. In doing so, he sparked a revolution in the way financial markets are understood.

“Everyone knew about diversification — not putting all your eggs in one basket,” said Andrew Lo, professor at the Massachusetts Institute of Technology and co-author of In Pursuit of the Perfect Portfolio. “But Markowitz told us more than that. He told us how many eggs we should put in the different baskets, and how to diversify in a systematic way.”

Markowitz had a key insight as he read that stock prices are the present value of future dividends. That definition failed to account for uncertainty, he realised; in reality, stocks could only be valued by their expected dividends. That thought grew into his PhD thesis, where he modelled the optimisation of investments across an entire portfolio.

This development caught on widely. Almost all modern professional investing is built on this type of quantitative analysis, with a focus on optimisation and concepts of risk management that may not exist in their current forms without Markowitz.

His innovation also helped create the trillion-dollar passive-investing behemoths such as Vanguard, and in the process displaced a cadre of fund managers and stockpickers who relied primarily on corporate fundamentals and received wisdom to manage money.

Markowitz’s work was built upon by William Sharpe, who invented the standard for modelling and measuring risk-adjusted returns. Sharpe, Markowitz and Merton Miller won the Nobel Prize for Economics in 1990. “Without Harry’s work, there was no way I would have gone down that path,” Sharpe said.

Markowitz, born in 1927 in Chicago, was the only child of Morris and Mildred, who owned a grocery shop. He said they always had enough to eat, despite the Depression. He first studied liberal arts at the University of Chicago and then turned to economics for his MA and PhD. He learnt from Milton Friedman, Leonard Savage and Tjalling Koopmans. He said Koopmans’ course on activity analysis was “a crucial part” of his education, as it defined efficiency and provided a framework to analyse efficient sets.

After Chicago he mixed academic and corporate work. Sharpe and Markowitz first met at the RAND Corporation in the late 1950s, where Sharpe worked while completing his PhD. “I was very much formed by the RAND Corporation,” said Sharpe. Markowitz also studied operations at RAND, another realm that has benefited from the real-world application of mathematical theories.

Rob Arnott, founder of Research Affiliates, felt Markowitz’s influence from the start of his career. In his first job at The Boston Company in 1977 he used the economist’s algorithm in a quadratic programming optimiser, he said. He has since built a systematic investing empire, managing about $130bn worldwide.

“He knew that he changed the finance world beyond recognition,” Arnott said. “Before Harry, investing was a bunch of rules of thumb . . . When somebody of his phenomenal stature dies, it’s easy to portray him as an intellectual giant because he was. But he was also a kind, gentle and fun-loving person.”

Many friends and colleagues spoke of Markowitz’s irreverent humour and open-mindedness. His distaste for received wisdom and intellectual rigour may have helped him radically alter the status quo in financial markets, they say. It’s rare for a mathematician to see their work have such a widespread impact within their lifetime. But the transition to systematic and passive investing didn’t go unchallenged.

“The industry was slower to embrace these ideas . . . [Markowitz and Sharpe] were certainly iconoclastic, but more importantly they threatened the livelihoods of the stockbrokers and the gunslingers who were charging fairly high fees, in some cases upwards of 5 to 10 per cent for their services,” said Lo.

But Markowitz was not an evangelist for passive management or systematic investing, however. He felt that quantitative strategies were only as good as the thinkers that built them, said Arnott.

“He was a patient, gentle man, but he wasn’t patient with wilful stupidity,” Arnott said. “If your inputs are carelessly crafted, optimisation becomes garbage-in, garbage-out. He was always fascinated when people just threw numbers into a formula without carefully thinking through.”

Read the full article here