Overview

Dividend ETFs present such a crossroads because on one hand, you get a basket of quality holdings that are actively managed for you all while collecting consistent dividend payments. At the same time though, there are so many different dividend focused funds to choose from and a lot of them don’t provide the best results. Also, there are a ton of individual holding strategies that can be used to construct an income producing portfolio so it becomes difficult to know which route: a dividend ETF or a self crafted portfolio of dividend stocks.

I think that funds like iShares Core High Dividend ETF (NYSEARCA:HDV) do have a time and a place but it ultimately depends on the investor’s risk tolerance and willingness to manage their portfolio. Some investors would rather invest in an ETF because it provides a sense of greater safety and can certainly be less stressful than actively managing your own basket of stocks. As an investor that prefers to manually manage a few dozen individual holdings instead of ETFs, I will provide a nonbiased perspective on whether or not HDV deserves a spot in your portfolio or not.

Structure

iShares Core High Dividend ETF (HDV) is an exchange-traded fund (ETF) introduced by BlackRock in 2011. It seeks to invest in companies operating across various sectors, encompassing both growth and value stocks. Obviously, the fund also puts an emphasis on high quality dividend-paying stocks.

The fund has an impressively low expense ratio of 0.08% due to its passive management approach. When I say passive, this means that once the list of dividend stocks are filtered and chosen, the holdings stay relatively stable over time, requiring minimal adjustments. There are some downsides to this that I will share a bit further into this analysis.

The fund incorporates a screening process for company quality and financial health and limits the total holdings to only 75 high yielding stocks.

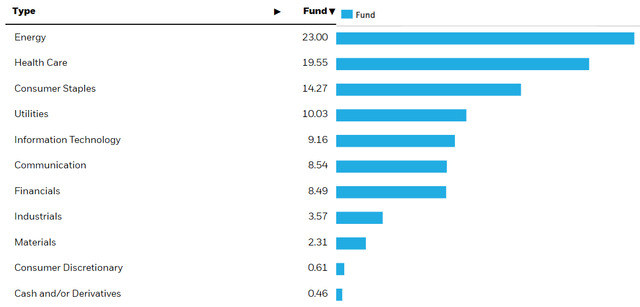

iShares.com

The top sector of HDV is energy making up 23% of the holdings closely followed by health care and consumer staples. 20% of the fund is comprised of the top three holdings: Exxon Mobile (XOM), Johnson & Johnson (JNJ), and AbbVie (ABBV).

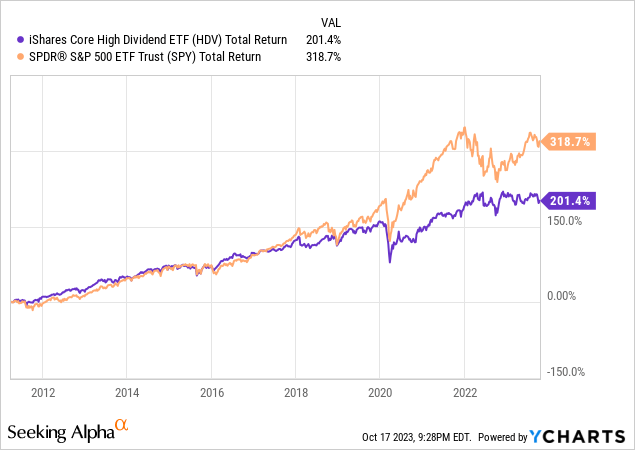

Something I dislike about the holdings makeup is the lacking allocation to tech. I fully understand that this is a dividend focused ETF and tech stocks generally either do not pay a dividend or they pay a very small one. However, the reason I dislike this makeup is because the tech sector is the home to a lot more “growthier” companies that can help capture larger upside price movement. If larger portion of the portfolio were to be allocated to tech, we possibly could see a performance that is more on par with the S&P 500 (SPY).

Granted, the performance gap rally only started to drastically widen after the covid crash of 2020. This is where we saw a large amount of tech stocks deliver some sky-high returns. Putting the S&P aside though, I believe that the portfolio makeup of HDV also leaves the fund’s performance falling a bit behind some of the more popular competitors within the dividend ETF community. So with that, let’s take a look at how HDV holds up against some of its peers.

Comparing Dividend Funds

There are a plethora of dividend focused ETF funds to choose from. Each of them have their nuanced differences but generally speaking, they tend to have very similar makeups. We will compare the performance of some of the most popular high dividend ETFs against HDV.

- Schwab’s U.S Dividend Equity ETF (SCHD)

- Vanguards High Dividend Yield ETF (VYM)

- Fidelity High Dividend ETF (FDVV)

- SPDR Portfolio S&P 500 High Dividend ETF (SPYD)

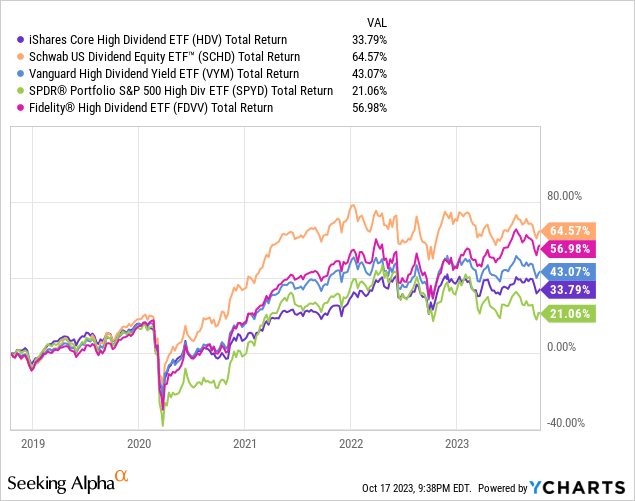

Comparing the total return over a 5 year period we can see that SCHD comes out on top with a total return of 65% in comparison to HDV’s 34%. The dividend fund that performs the second best would be Fidelity’s High Dividend ETF which I previously discussed here. The portfolio allocation of FDVV addresses my prior concern of not capturing upside price movement by including a batch of holdings that are more skewed towards tech. Remember when tech took off after the pandemic?

Well, HDV has zero exposure to some of the more popular tech stocks that might pop into your mind. Tech stocks such as Nvidia (NVDA), Microsoft (MSFT), Broadcom (AVGO), and Apple (AAPL) would be great dividend additions to these ETFs. Unfortunately, HDV has no exposure to any of these whereas FDVV does. Therefore, I strongly believe that the upside will forever be limited for HDV. I believe my perspective is further reinforced since the fund is not actively managed, meaning the holdings rarely change over time.

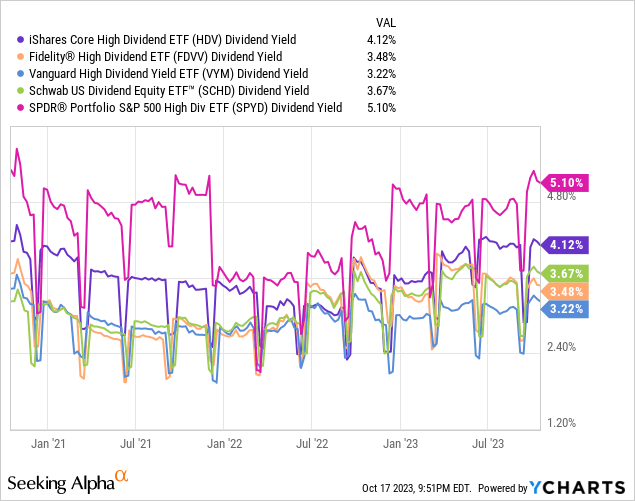

Fortunately, the starting yield of HDV comes in a bit higher than most of the peers at 4%. Whereas the previous total return chart had HDV and SPYD on the bottom, this dividend yield chart has them on the top now. It seems like the tradeoff here is that in the case of HDV & SPYD, a higher starting yield means that you are sacrificing a higher total return potential in exchange for a higher dividend payment. I still won’t be a martyr and rate HDV as sell for this reason. I understand that total return just isn’t something that every investor sets out to achieve. There are a lot of investors who are okay with a lower total return in exchange for a higher cash flow from their holdings.

Dividends

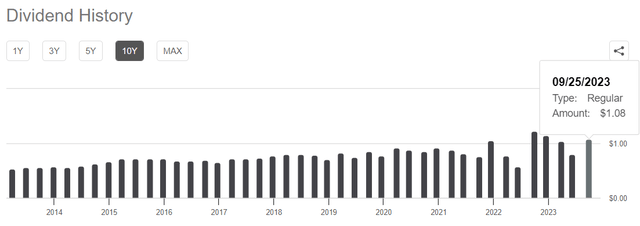

The latest declared dividend payment was $1.078 per share. This makes the starting dividend yield attractive for an ETF, coming in a bit over 4% annually. HDV has done a solid job at raising the dividend distributions as the 5 year dividend growth rate is currently over 5% and they have done a good job at growing it over time. Even though payments may not have grown consistently YoY, at least they have been trending upward over time and avoided any major cuts during the recent economic downturns.

Seeking Alpha

As previously stated, although the starting dividend yield is higher with HDV compared against the competitors, this may also mean that you are getting a lower total return going into the future. If you need consistent cash flow, the by all means HDV will work just fine. On the flip side of that, if you are perhaps a younger investor and don’t need the dividend income at this point of your life, then going with a different dividend fund such as SCHD may be a better choice for you.

Takeaway

Despite it’s shortcomings, I believe HDV will be just fine going into the future. The portfolio may be lacking the exposure to growthier companies, impacting the upside. However, the fund is comprised of a lot of quality blue chip names that have a strong history of increasing their dividend distributions year after year which still makes it a solid choice for investors looking for a stress-free investing experience.

Comparing HDV to other high-dividend ETFs reveals differences in total return, with some competitors outperforming HDV over a five-year period. While HDV starts with a higher yield, it may trade some total return potential for the advantage of higher dividend payments. The fund’s dividend history shows consistent growth trending upward, even though payments may not have increased consistently year over year.

This dividend ETF is probably less suited for investors in the accumulation phase of their life and instead more suited for investors nearing retirement or investors who rely on the income that is produced from their portfolio. This makes HDV a suitable choice for investors seeking steady cash flow. However, investors looking to maximize their total return should probably choose one of the other dividend funds that have a better holding makeup in my opinion.

Read the full article here