As markets turn more volatile, it’s good to start keeping an eye on hedging strategies that can potentially mitigate downside risks. There are a few funds out there that do that, but one that caught my eyes is the JPMorgan Hedged Equity Laddered Overlay ETF (NYSEARCA:HELO). This exchange-traded fund offers investors a unique blend of capital appreciation and risk mitigation. As the name suggests, it employs a laddered options strategy aimed at decreasing the downside risk in falling markets. The ETF maintains characteristics similar to the S&P 500 (SP500), signifying a broad representation of the U.S. equity market.

What is a laddered option strategy? It’s a sophisticated financial approach designed for managing risk and potentially increasing profits, particularly in volatile markets. It involves purchasing multiple options contracts with staggered expiration dates, effectively creating a “ladder” of investment opportunities over time. By doing so, investors can capitalize on different market movements and conditions, as each “rung” of the ladder provides a chance to adjust the overall portfolio strategy based on prevailing market trends. This method not only allows for a more flexible response to market changes but also helps in spreading the risk across various time frames, potentially smoothing out returns and providing a more stable investment outcome.

Certainly easier to have an experienced team doing this rather than on your own, which is one of the reasons this fund is interesting to consider.

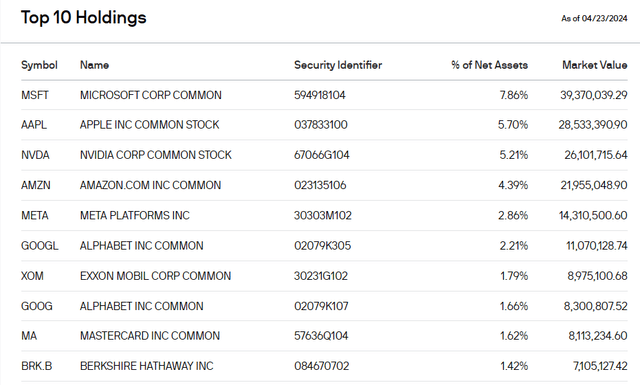

ETF Holdings

When we look at the top holdings of the fund, we see all the familiar ones you see in large-cap market-cap weighted averages. The mix of the top 10 stocks, though, is a bit atypical, with no position making up more than 7.86% of the fund. HELO, in addition to using the laddered options overlay, does attempt to identify over or undervalued stocks, making it active while still trying to somewhat track the passive S&P 500. An interesting approach, I think, and one that conceivably could reduce some of the concentration risk you see in more classic passive market averages.

jpmorgan.com

Sector Composition and Weightings

The HELO ETF is not limited to the tech sector. It also invests in various other sectors. The makeup is similar to the S&P 500 overall, which means it’s still concentrated in Tech more than any other sector.

- Communication Services: 8.6%

- Consumer Discretionary: 11.6%

- Consumer Staples: 5.1%

- Energy: 4.2%

- Financials: 13.6%

- Health Care: 12.2%

- Industrials: 9.1%

- Information Technology: 28.6%

- Materials: 2.2%

- Real Estate: 1.9%

- Utilities: 2.3%

Comparison With Peer ETFs

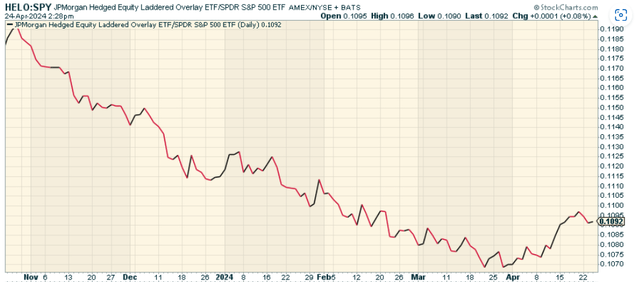

When considering an investment in HELO, it’s beneficial to compare its features and performance with other similar ETFs. While HELO’s unique laddered options strategy sets it apart, other ETFs might offer different investment styles, sector focuses, or risk levels that may be more suitable for certain investors. Having said that, despite its short history, it’s worth comparing HELO to the SPDR® S&P 500 ETF Trust (SPY). We’ve been in a nice uptrend for large caps up to mid-March. In other words, there’s been no reason to really hedge as it took away from returns. More recently though, with volatility rising, HELO is clearly showing how it can perform against the S&P 500, as the price ratio turns higher. I suspect this can continue.

stockcharts.com

Pros and Cons of Investing in HELO

Like any investment, HELO comes with its own set of advantages and drawbacks.

Pros

HELO’s diversified equity portfolio and laddered options strategy can provide investors with capital appreciation potential while reducing overall market exposure. This can be particularly attractive during volatile market conditions, where the hedging strategy can mitigate losses.

Cons

However, this same hedging strategy can also limit the fund’s upside during rising markets. The fund’s returns could lag those of unhedged investments in a strong bull market. Furthermore, the fund’s use of derivative instruments like options can introduce additional complexity and risk.

Conclusion

The JPMorgan Hedged Equity Laddered Overlay ETF is a unique investment opportunity that combines the potential for capital appreciation with a hedging strategy to mitigate market risk. However, its complex strategy and potential limitations in strong bull markets mean it may not be suitable for all investors. At this time, I think opportunistically it might make sense given volatility rising, and would certainly consider this as an option for the equity portion of a portfolio.

Read the full article here