A Quick Take On Hesai Group

Hesai Group (NASDAQ:HSAI) went public in February 2023, raising approximately $190 million in gross proceeds in an IPO that was priced at $19.00 per share.

The firm develops and sells LiDAR solutions for a range of applications.

I previously wrote about Hesai’s IPO with a Neutral outlook.

Hesai Group’s operating losses remain high, and its gross profit margin has been falling, indicating no path to profitability in the near term.

I’m therefore Neutral [Hold] on HSAI until we see improvement in its operating metrics.

Hesai Group Overview And Market

Shanghai, China-based Hesai Group was founded to develop three-dimensional light detection and ranging [LiDAR] systems for vehicle and robotic environments.

Management is headed by co-founder and CEO Yifan Li, who has been with the firm since its inception and was previously principal engineer at Western Digital.

The company’s primary offerings by application area include:

-

Passenger & commercial vehicle systems

-

Autonomous vehicle fleets

-

Robotics.

The company also generates a small percentage of revenue from gas detection products.

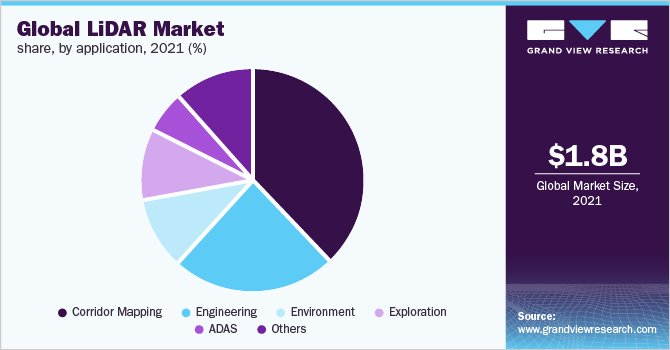

According to a 2022 market research report by Grand View Research, the global market for LiDAR products was an estimated $1.8 billion in 2021 and is forecast to reach $4.2 billion by 2030.

This represents a forecast CAGR of 9.8% from 2022 to 2030.

The main drivers for this expected growth are continued innovation in resolution and other performance aspects, and a growing demand for 3D imagery across numerous application areas.

Also, the chart below shows the breakdown of the global LiDAR market by application market share in 2021:

Global LiDAR Market (Grand View Research)

Major competitive or other industry participants include:

-

Velodyne

-

Luminar

-

Ouster

-

Faro Technologies

-

Leica Geosystem Holdings AG

-

Teledyne Optech Incorporated (A part of Teledyne Technologies)

-

Trimble Navigation Limited

-

RIEGL USA

-

Quantum Spatial

-

Sick AG

-

YellowScan

-

GeoDigital.

Hesai Group’s Recent Financial Trends

-

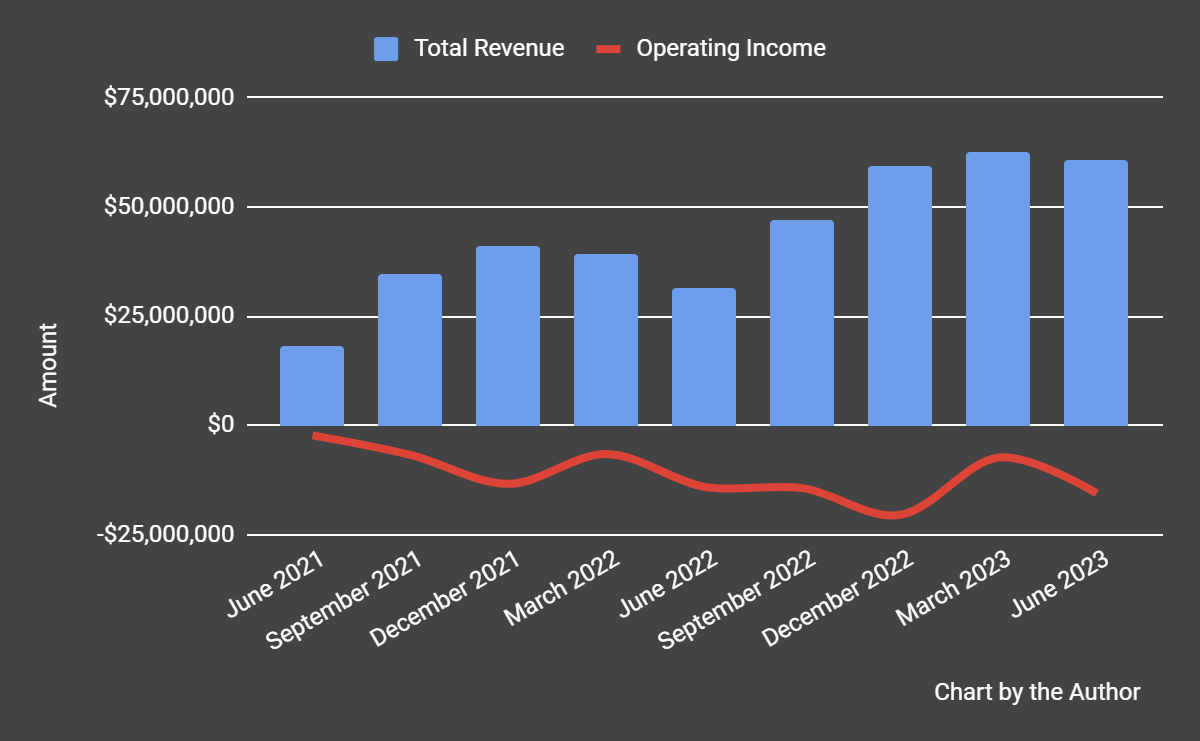

Total revenue by quarter has risen markedly in recent quarters; Operating income by quarter has remained materially negative.

Total Revenue and Operating Income (Seeking Alpha)

-

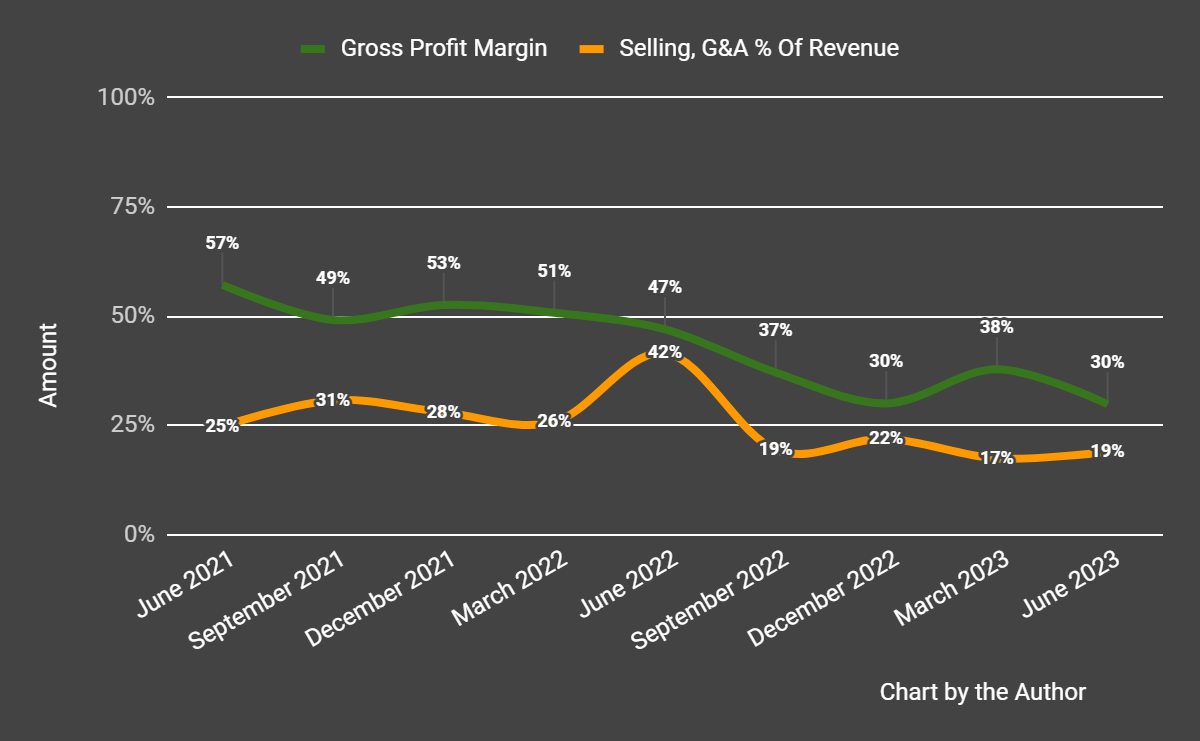

Gross profit margin by quarter has trended lower; Selling and G&A expenses as a percentage of total revenue by quarter have also trended lower in recent quarters.

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

-

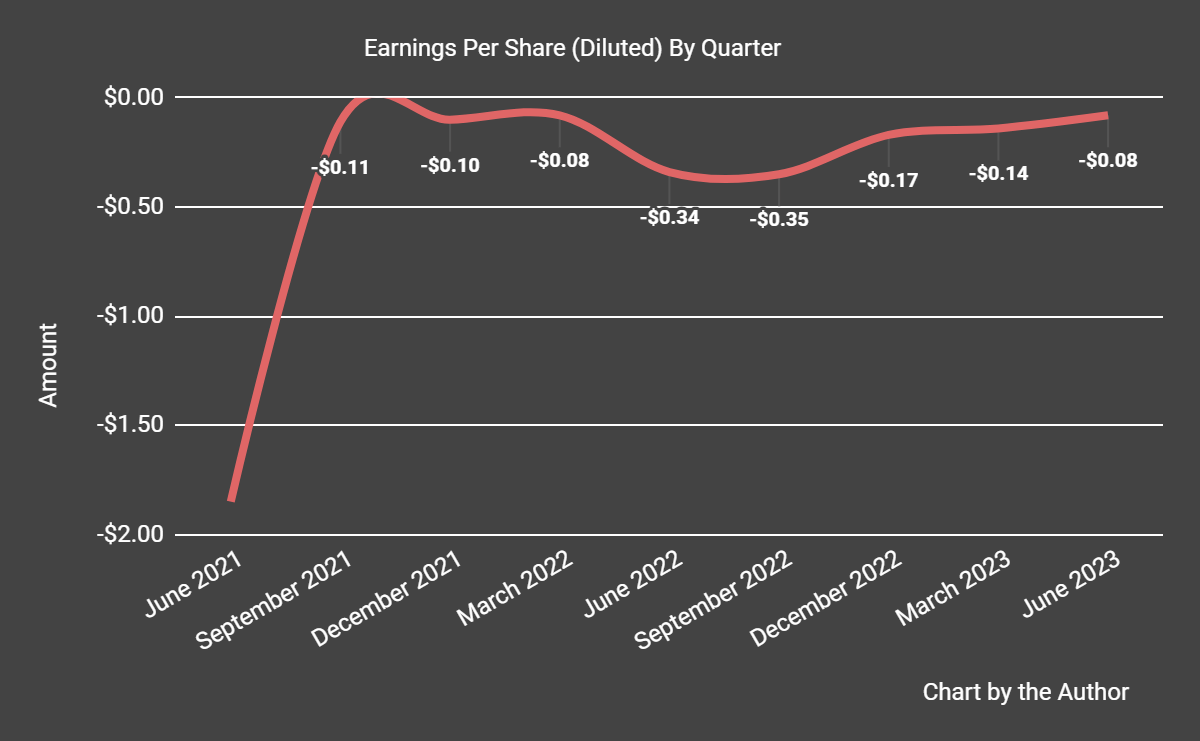

Earnings per share (Diluted) have remained negative, as the chart shows below.

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

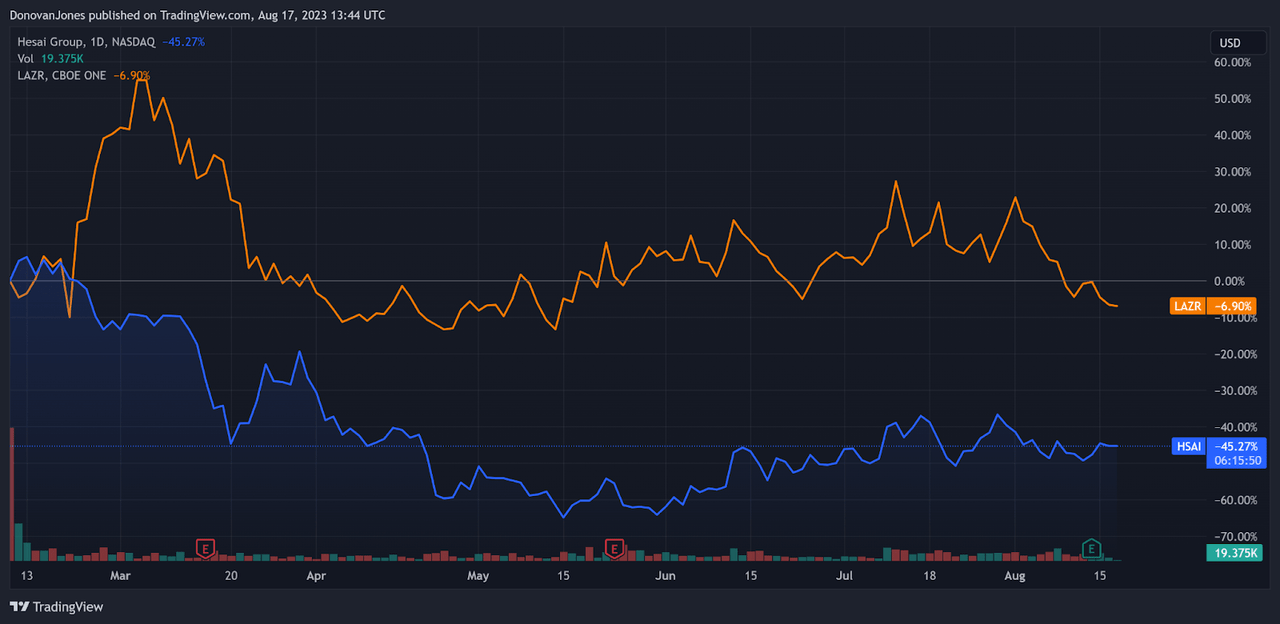

Since its IPO, HSAI’s stock price has fallen 45.27% vs. that of Luminar Technologies’ (LAZR) drop of 6.9%, as the chart indicates below:

52-Week Stock Price Comparison (TradingView)

For the balance sheet, the firm ended the quarter with $448.1 million in cash, equivalents and short-term investments and $42.3 million in total debt, of which $15.1 million was categorized as ‘short term’.

Valuation And Other Metrics For Hesai

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

4.8 |

|

Enterprise Value / EBITDA |

NM |

|

Price / Sales |

6.3 |

|

Revenue Growth Rate |

70.7% |

|

Net Income Margin |

-24.8% |

|

EBITDA % |

-24.5% |

|

Market Capitalization |

$1,460,000,000 |

|

Enterprise Value |

$1,060,000,000 |

|

Operating Cash Flow |

-$100,920,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.74 |

(Source – Seeking Alpha.)

As a reference, a relevant partial public comparable would be Luminar Technologies; shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

Luminar |

Hesai Group |

Variance |

|

Enterprise Value / Sales |

48.5 |

4.8 |

-90.2% |

|

Enterprise Value / EBITDA |

NM |

NM |

–% |

|

Revenue Growth Rate |

47.2% |

70.7% |

49.7% |

|

Net Income Margin |

NM |

-24.8% |

–% |

|

Operating Cash Flow |

-$261,020,000 |

-$100,920,000 |

–% |

(Source – Seeking Alpha.)

Commentary On Hesai

In its last earnings announcement (Source – Seeking Alpha), covering Q2 2023’s results, management highlighted its highest-ever net revenue and total LiDAR shipments.

The company also reported strategic development programs with “two leading automotive OEM partners from North America and Europe.”

Leadership is also seeking to integrate its sensors with the NVIDIA DRIVE and Omniverse ecosystems.

Total revenue for Q2 2023 rose 92.7% YoY and gross profit margin dropped 17.2%

Selling, G&A expenses as a percentage of revenue fell 22.6% year over year, a positive signal indicating greater efficiency in this regard, while operating losses worsened by 10.6%.

The company’s balance sheet is strong, but the firm did not disclose its cash flow activity other than saying that it produced positive operating cash flow for the second consecutive quarter.

Looking ahead, consensus revenue estimates for 2023 indicate revenue growth of 41.0% at the midpoint.

If achieved, this would represent a drop in revenue growth versus 2022’s growth rate of 57.95% over 2021.

Regarding valuation, in the past twelve months, the firm’s EV/Sales valuation multiple has fallen 72%, as the chart from Seeking Alpha shows below:

EV/Sales Multiple History (Seeking Alpha)

Although the firm is growing revenue impressively, the U.S. market appears largely unimpressed by its progress.

HSAI’s operating losses remain high, and its gross profit margin has been falling, indicating no path to profitability in the near term.

I’m therefore Neutral on HSAI until we see improvement in its operating metrics.

Read the full article here