Author’s Notice: This article was first published on iREIT on Alpha in July 2023.

Dear subscribers,

I’ve reviewed Highwoods (NYSE:HIW) a few times in the past, some in mixed articles, and some in specific articles to the company. Since the company has gone up in the last 1-2 months, I’ve seen good RoR for the company. The overarching thesis – both in upside and risk – hasn’t materially changed, but I believe the latest results and the latest trends are a confirmation that things are far from as bad as the bears would have you believe.

Because of that, I think a case can be made as to why it is more interesting here to invest in the company again.

When it comes to Office Properties, my picks are the four that I view as the highest quality.

They are, in no particular order at this time, Alexandria (ARE), Boston Properties (BXP), Highwoods Properties, and Kilroy (KRC).

I own all three companies in my portfolio – and I have zero intention to change that.

Here is why Highwoods Properties remains a solid main pick for me.

Highwoods Properties – The upside is undeniable, if Office remains attractive

Highwoods Properties is a REIT with an interesting geographical exposure for its properties – meaning it primarily focuses on the attractive southeast with exposure in areas like Nashville, Atlanta, Raleigh, Tampa, and Orlando, which together account for around 80% of the company’s overall geographic mix of properties.

The company tends to focus on, as much as its geographical exposure allows this, the top overall real estate markets. With its focus on Raleigh, Nashville, Charlotte, Orlando, Atlanta, and Tampa, it focuses on 5 out of the ten 2022 top real estate markets out there. Take special notice of the fact that their actual impacted east or west-coast exposure is really quite minimal when it comes to geographies that have been receiving flak for their current trends.

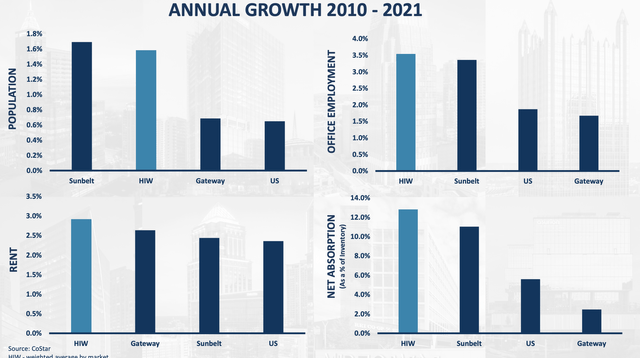

Highwoods is extremely focused on growing real estate markets and has outpaced or averaged the annual growth in real estate by markets for the past 10 years.

HIW IR (HIW IR)

That is not to say that the company hasn’t had challenges with parts of its portfolio. But the core flaw that bears have here remains the assumption that Highwoods does not react to this (or other office REITs). This is demonstratively false.

REITs always have a very close eye on their asset operating performances, and they continually rotate/divest/invest to ensure that their asset portfolio remains at a high quality and as resilient as they can possibly make it.

That is why recently, in May 2023, the company sold over $40M of non-core assets in a difficult market, most of which will go towards shoring up an already iron-clad balance sheet with a BBB rating.

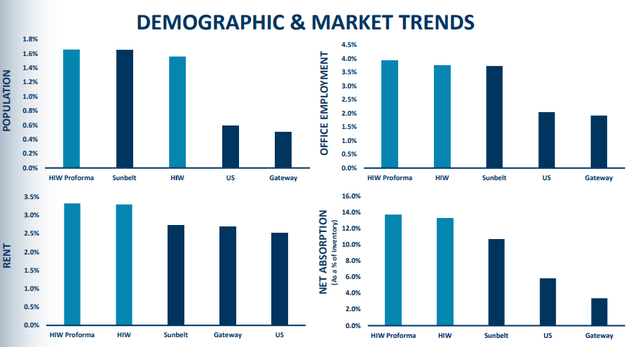

The 95%-sunbelt is one of the primary arguments here, with 85% of the NOI in top markets. HIW has one of the strongest market trends out there in terms of demographics, rent, and absorption.

HIW IR (HIW IR)

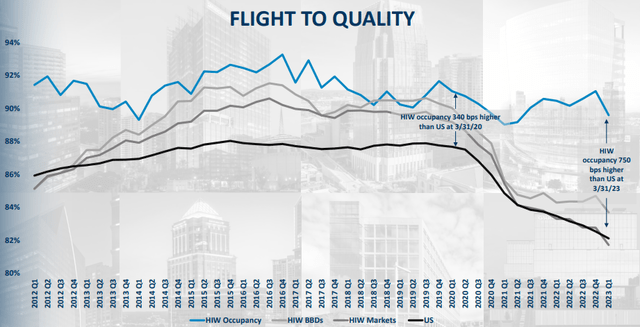

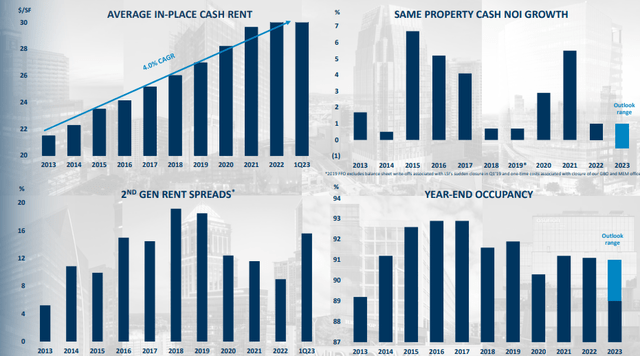

This portfolio is now below 90% occupancy – at 89.6%. This is still going strong with a 4% rent CAGR and less than a 20-year average asset age and a 6 WALT. In the so-called “flight to quality”, Office REITs have been forced to accelerate dispositions of non-core or non-attractive assets. These assets have been “fine” to hold and fine to finance in a better market – such as the market 1-2 years ago – but they are balance sheet poison in this environment.

However, what I want you to focus on is the degree of outperformance statistically relevant to HIW in the environment.

HIW IR (HIW IR)

The company has very impressive diversification going to finance, legal, insurance, healthcare, tech, manufacturing, and a mix where no single segment has more than 18% and only 3 have more than 10%. In terms of customer diversification, no customer has more than 3.8% of ABR, and the top 20 is at 28%.

While the outlook range does contain the possibility for a decline in NOI growth on a same-property basis, the company could on a historical basis see 1-2 years of this without impacting what I view as the strongest trends in the office REIT space.

HIW IR (HIW IR)

In terms of fundamentals, the company has 42.4% debt + prefs as a % of gross assets, bringing to us to a sub-6.0x net debt/EBITDAre at a weighted rate of 4.3% and a securitization percentage of below 10% with 82.5% unencumbered NOI. This leverage has gone down from what was above 6.5x 13 years ago post-GFC, to around 4.7x in 2016, but never above 6x again since.

Maturities? None until 2025. No $500M+ maturities until 2028, and the company still has nearly $800M on hand as of the 1Q23 period. The dispositions of $40M are also only the beginning of what HIW intends to do, which comes to a $400M disposition plan for 2023E. HIW has a proven track record of attractive market exits while providing consistent FFO growth.

Bear in mind that I am in no way arguing that there aren’t risks to HIW. Occupancy will no doubt be a future driver of performance, and this is what actually declined in 1Q23. But it’s equally important to note, that these declines did not come from all markets. Nashville and Charlotte, for instance, did extremely well with 95%+ occupancy stats.

The investors who consider the stock risky speak to the company’s lower leasing rate – around 250,000 less on average in 1Q together with a 5-7% FFO drop in this year. Then there are the “bears” on office, that expect a 25-40% office obsolete rate in the next 2030-2040.

Let’s just say that if you as an investor are bearish on office demand, you should not be investing in office REITs. I as an investor consider it unlikely that office demand will collapse – I consider it likely that office renters will have higher demands on the spaces they rent going forward – but this benefits a net quality landlord such as HIW.

My core argument is that even in the case of “Office oversupply”, Highwoods manages some of the best properties on the market, and coupled with the company’s active management and their focus on higher-quality markets as opposed to nearly collapsing markets, the outcome at this valuation will be positive for investors in a 3-5 year timeframe.

Why Highwoods is set to outperform over 3-5 years in the future

Highwoods and its management know exactly what is happening in the market, and they are righting their ship in a very difficult environment. That this will be workable without some sort of negative impact is impossible, as I see it. We will see companies, including HIW, reporting stresses throughout their organizational structure as the seams and limitations of the company – both financially and otherwise – are tested.

But stress is how organizations are hardened. Tension and trouble is the solution to fragility, because organizations, like individuals, need to “change or die.”

When I look at these sorts of REITs, I am asking myself if they are changing fast enough or if they are trying to do everything as before and sticking their heads in the sand.

Highwoods is the former.

It becomes a question of whether the valuation rightly corresponds to the fundamental increase in risk.

HIW valuation (F.A.S.T graphs)

And let me just say that my answer to that particular question is a firm “no”.

You argue that HIW is in no way justified to trade at its historical premium in this market.

I agree with that.

You argue that HIW should definitely trade at a discount to reflect the ratcheted-up risk that we’re seeing from both macro and micro.

I agree with that as well.

So what Highwoods be worth?

How about half its historical premium?

Because if you forecast at 7.5x P/FFO, that nets you an annualized RoR of 13-14% based on current estimates of negative forward FFO growth rates.

So even at a despairing sort of valuation, ignoring most everything the company has to offer, including an 8% dividend that’s covered by a 52% post-5.7% FFO drop Payout ratio that was not cut in the dividend, that’s the upside you’re getting.

Me, I bought shares even cheaper, at closer to 20 bucks per share, which has already seen growth.

Personally, I believe that Highwoods given its exposure and quality is worth far more. And once you, if you, accept that premise, then your potential returns start looking relatively insane.

First off, no premium. I don’t expect net growth for the next few years. So a 10-11x P/FFO is really the most I would expect out of HIW, even in a slowly recovering market.

However, that 11x P/FFO is when the company, even at $25/share, starts touching triple-digit ROR.

The thing is though, at a range from almost 6x P/FFO to upwards of 11x P/FFO, which I view as the realistically impacted and discounted range for HIW, there is a very low chance of a long-term loss of capital in this investment. And this is what I look for when I invest.

I am not saying that I’ll go 10-15% in Office REITs. My overall portfolio allocation is and will remain below 5% in total. However, the most distressed and “hated” sectors are where the best bargains can be made – if you know what to look for, and if you know your risk/reward considerations.

I do – and you should as well.

Some of the analysts and models that estimate a fair value for Highwoods put the company as high as $40-$52/share in the longer term. I wouldn’t have an issue with this target – not in the longer term. The company is also considered to be one of the highest-quality office REITs still around, with the exceptions of specialty office REITs like Alexandria (ARE) where I own even larger stakes.

GuruFocus HIW Score (GuruFocus)

I do not follow one model or approach to a tee – I instead use multiple models and valuations, try to find their flaws, and then impact accordingly. That is why my target is lower than $50/share at this time. However, I consider any valuation below $40/share to not correctly account for this company’s strengths outside of this environment.

And if you argue below this, you’re either arguing that the downturn will last for a very long time, or that the company will not survive the downturn at all – I consider both of these stances to be flawed, as I believe the downturn may last perhaps 2-4 years, but no longer.

HIW is currently being valued at around 0.58x its NAV. The near-20-year mean for this multiple is 0.92x. I don’t even need to argue for that 0.9x+ – I can just say they should be valued at 0.75x, and it’d still be a significant upside at an average the company has never held for any extended period of time – not even in the GFC.

For those reasons, I view the company as being materially attractive here, and here is my thesis on Highwoods properties.

Thesis

- Highwoods Properties is one of the four strongest Office REITs that I invest in, and I consider it to be one of the office names one should focus on as a conservative investor in the space. The combination of portfolio and geographical quality together with proven management expertise and FFO growth will sustain the company in the face of significant forward pressure in this economy.

- The eventual upside to the company once things normalize within a 3-5 year period is no less than double digits on an annual basis, with full normalization having the potential to deliver triple-digit growth.

- For those reasons, I view HIW as a “BUY” here and set a price target of $42.5/share for the long term.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company fulfills every one of my criteria, making it a “BUY” here.

Read the full article here