Chocolate has a special place in many people’s hearts around the world for years due to a variety of reasons. Why our love affair?

- Sweet Indulgence – The rich, sweet taste of chocolate is hard to resist for many. The smooth melting texture and sugary hit make it a highly craved treat.

- Mood Booster – Chocolate contains compounds like phenylethylamine and anandamide that can improve mood and provide a feeling of euphoria. The sensory pleasure of eating chocolate boosts happiness.

- Versatility – Chocolate can be consumed in many forms – candy bars, cakes, drinks, desserts, etc. This versatility makes it easy to incorporate into diets and enjoy in different ways.

- Energy Boost – Chocolate contains stimulants like caffeine and theobromine that provide an energy lift. This makes chocolate a popular pick-me-up.

- Nostalgia – Chocolate is often associated with childhood treats, holidays, gifts of affection. This gives it a nostalgic, comfort food appeal.

- Affordability – Compared to other indulgences like wine or caviar, quality chocolate is relatively affordable for the masses. This helps drive its popularity.

- Unique Flavor – The complex blend of tastes and textures chocolate provides is difficult to replicate. Consumers around the world are hooked on its unique food experience.

So in essence, chocolate’s taste, effects on mood, associations with childhood/celebrations, and mass availability combine to make it one of the world’s most beloved foods. The global passion for chocolate continues unabated.

The present El Nino event and record global warm ocean temperatures have the potential for this “addictive” food to see record high prices.

Unwanted rains during West Africa’s normally dry season cause more disease issues for cocoa

This is the end of West Africa’s dry season and they need sunshine and dry weather for pods to develop properly. The Ivory Coast and Ghana produce 70% of the world’s cocoa crop. The cocoa crop is one of the worst in recent memory and this rain will increase disease issues. A combination of fertilization problems a year ago means that farmers did not take care of their groves, as well as they normally do. Now you have cocoa rotting in parts of the fields of Ghana and perhaps a bit in Ivory Coast.

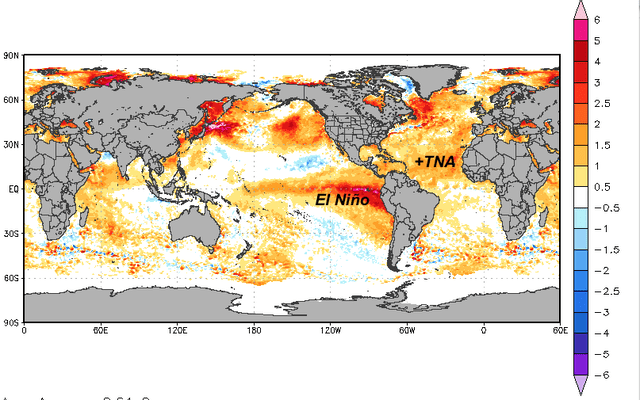

You will notice both El Niño and what we call a positive Tropical Atlantic Index, responsible for the active tropics. Record warm oceans surrounding West Africa increase evaporation and pour unwanted rains on cocoa pods.

El Nino and +TSA index (WeatherWealth newsletter) WeatherWealth Newsletter (bestweatherinc.com)

My ClimatePredict program in my WeatherWealth newsletter has been suggesting for months that it will be too wet in West African with more disease issues.

When cocoa prices surge due to weather events like El Nino, the stocks that tend to rally the most are:

- Hershey (HSY) – As the largest North American chocolate producer, Hershey benefits from being able to pass on higher cocoa costs through price increases on its chocolate bars and candies. Its profit margins expand.

- Nestle (OTCPK:NSRGY) – The global confectionery giant can also pass on cocoa price hikes. Its diverse portfolio of chocolate brands gives it pricing power.

- J.M. Smucker (SJM) – A key supplier of baking ingredients, Smucker can charge more for its cocoa and chocolate products. Higher prices boost its revenues.

However, there are some negative effects as well:

- Retailers like Walmart (WMT) may see lower volumes as chocolate becomes less affordable. Their confectionery sales may drop.

- Restaurants using chocolate can see lower foot traffic if they raise prices on desserts. So restaurant stocks like Darden (DRI) may be impacted.

- Cocoa processing companies face margin compression as raw material costs rise faster than finished product prices. ADM (ADM) is one example.

Conclusion

I still like the long side of cocoa longer term, as well as options. Unfortunately, Barclays retired the ETF (NYSEARCA:NIB) last June.

Overall, sharply higher cocoa prices due to weather are a net positive for large chocolate brand owners who have the power to pass on costs to consumers. But it can strain retailers, restaurants and ingredient suppliers who cannot raise prices proportionately. The equity impact depends on a company’s position in the cocoa-chocolate supply chain.

I expect prices of cocoa to potentially make new all time highs sometime this year or in 2024.

Read the full article here