Out here on the barren baking sun-charred plains, all of the animals must compete tooth and claw for their meagre scraps. No niche exists that has not already been exploited. Even the droppings are divvied, rolled into little balls and then spirited away by industrious armies of dung beetles. Within moments after the heat, hunger and thirst claim yet another fragile life, predators and opportunists descend rapidly to pick the carcass clean to a cacophony of whooping hoots, cackles, grunts and roars. As the desultory herd shambles past, eager and unsympathetic amber yellow eyes follow the slightest detail of their every move. Nothing goes unobserved in this place. Not one stumble, not one limp, not one distracted laggard.

Such is life in the stock market.

Rarely do I reallocate capital. I gave up long ago on my search for under- appreciated, overlooked areas of the market to arbitrage. My aptitude for bringing down the big game is poor and my interest in attempting to do so, minimal. On the contrary, my investment approach is to plant little seeds of capital, rain or shine, every single time I reinvest our dividend income. Whenever I do, I generally look through my existing portfolio for stocks in companies with six dividend growth and safety characteristics. I’ll use Pfizer (NYSE:PFE) as an example since that happens to be one of the companies I’ve recently put back on the menu as my portfolio dividends continue to trickle in over the coming month or two.

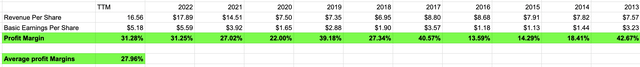

(1) High and durable profit margins

Based on earnings data from Seeking Alpha, PFE has shown impressive (albeit somewhat volatile) net profit margins over the past decade, averaging in at nearly 28%. This company’s profit margins are robust to say the least, which suggests that PFE has plenty of room to maintain and grow dividends even if operating expenses were to rise and revenues were to fall. High and durable profit margins point to lasting dividend safety, and PFE passes this criterion.

(PFE) Profit Margins (SeekingAlpha data, incorporated into Author’s spreadsheet)

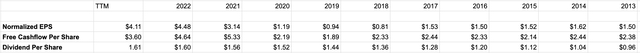

(2) Consistently profitable and cash flow positive

According to Seeking Alpha, PFE has been consistently profitable every year over the past decade, but with somewhat volatile earnings that received a very significant boost during the Covid19 epidemic. Because of the company’s R&D expenses and the very long-term runway for developing and bringing new therapies to market (or acquiring companies in the process of doing so), it can be more useful to look at free cash flow per share alongside the company’s normalized EPS. By doing so, it’s clear that the company has covered the dividend consistently with free cash flow, and with a very significant margin for error. Criterion number two: check.

Cash flow and EPS (SeekingAlpha data incorporated into Author’s spreadsheet)

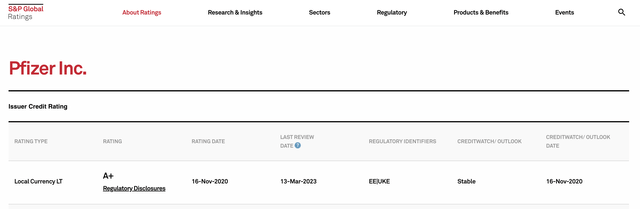

(3) Strong credit ratings

PFE has A-rated credit according to Moody’s, although with a negative outlook. S&P Global ranks PFE with a more generous A+ credit rating and stable outlook. Risk to the PFE dividend from bankruptcy appears remote.

(PFE) credit ratings (S&P Global)

(4) Share buybacks for the past ten years

Fewer shares means more free cash flow and earnings for the remaining shareholders and in turn, higher prospects for future dividend safety. According to Seeking Alpha, PFE share count has dropped by over 16% for the past decade. The share buyback has been generous, and as the data show, the company has reduced share count most years over the past decade.

(PFE) buybacks (SeekingAlpha.com)

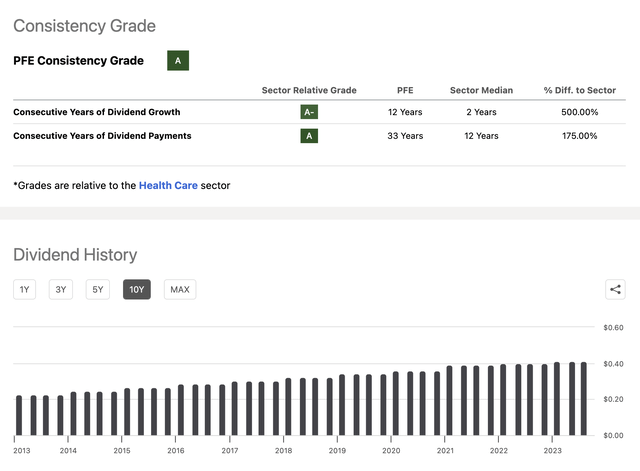

(5) Dividend growth history

It’s easy to see why PFE scores a dividend consistency grade of A on Seeking Alpha. Thirty-three years of consecutive dividend payments and ten-year dividend growth of 78% amount to a solid dividend track record.

(PFE) dividend history (SeekingAlpha.com)

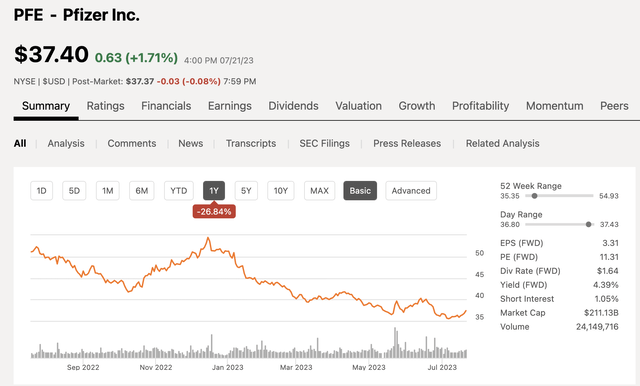

(6) Low stock valuation and high current yield

What is the absolutely most important factor to dividend growth investing? Simple. You have to actually get the dividends, and the more you receive up front, the better. PFE offers a very generous forward dividend yield of 4.39% according to Seeking Alpha and at a relatively generous price earnings ratio of just 11.

(PFE) yield and forward PE ratio (SeekingAlpha.com)

Based on my six dividend safety criteria, PFE seems like a high quality business trading at a fair or possibly compelling stock price – a fact which in itself should give pause to the wary investor. What’s the catch?

Downside Risk? Or a Free Meal?

The main risk that I foresee with PFE is the potential for legal and regulatory action on prescription drug prices in the United States that could restrict profit margins in the future. Companies like Pfizer haven’t even begun to feel the full impact of the Inflation Reduction Act, and it remains unclear whether or to what extent they will be able to recoup any lost pricing power by passing along costs to customers outside of the United States. Court challenges to new Medicare pricing regulations could persist for years to come. This uncertainty over the trajectory of prescription drug prices may go a long ways towards explaining Pfizer’s falling stock price over the past year and there is no way to guess whether or when the stock price will recover.

But just how significant a risk are falling stock prices if you’re a long-term investor looking to grow portfolio dividends? Let’s find out.

Imagine a portfolio of 300 shares of PFE. According to PortfolioVisualizer.com, the average annual CAGR for PFE since 1985 clocks in at 8.37% per year.

(PFE) portfolio (Googlefinance.com)

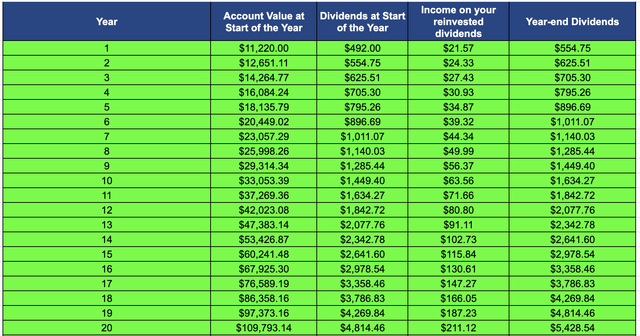

Imagine now that the stock price continues rise, and dividends continue to grow, at 8.37% per year for the next 20 years and over that timeframe, you reinvest all dividends into more shares. Starting at the current stock price, you would end up with a portfolio worth $109,793 on those assumptions and annual dividends of $4,814 by the start of year 20.

(PFE) hypothetical dividend reinvested portfolio (AUthor’s spreadsheet)

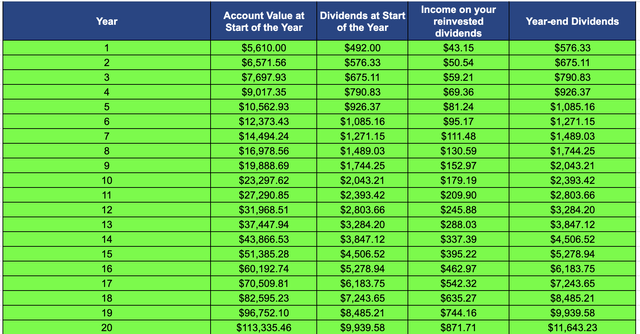

But what happens if the stock price crashes by 50% and doesn’t recover its past high for another nine years? In that case, your portfolio will be worth $113,335 with annual dividend income of $9,939 by the start of year twenty. Far from presenting a risk, falling stock prices might initially appear as manna from heaven for the stalwart dividend compounder.

(PFE) Hypothetical Dividend Reinvested Portfolio (Author’s spreadsheet)

Unfortunately, that math is probably deceptive.

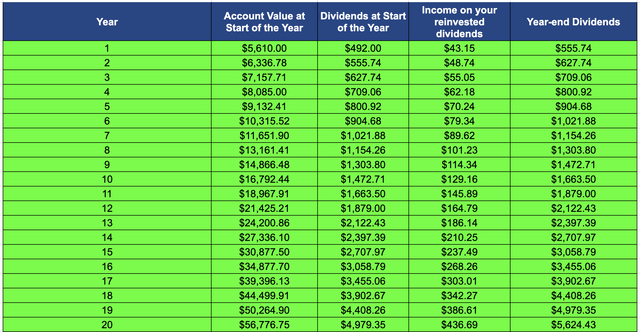

In my 25 plus years of experience as an investor I have yet to locate one single free lunch in any corner of this stock market. On the contrary. If PFE’s share price is down, then it seems safest to assume that the reason why is because forward earnings and dividend growth are likelier to slow than to remain constant. With that in mind, let’s now run the same experiment as before only this time, suppose that PFE’s stock price were to drop by 50% and the forward CAGR and dividend growth rate both drop by 50% as well for the next twenty years. In that case, what is the ending net worth and dividend yield on your portfolio assuming that you reinvest all dividends into more shares for 20 years?

(PFE) hypothetical dividend reinvested portfolio (Author’s spreadsheet)

Not surprisingly, your ending portfolio net worth would come to $56,776 at the start of year 20 – a substantial haircut from the $109,793 in the first scenario. What may come as more of a surprise is that your total portfolio dividends are slightly HIGHER than they’d be if the stock price, CAGR and dividend growth rates had remained constant – a total of $4,979 per year rather than $4,814.

Falling stock prices combined with falling dividend growth do not necessarily translate to lower portfolio dividends over the long term. In fact, when the rate of falling stock prices exceeds that of falling forward earnings estimates, dividend growth investors who reinvest dividends stand to earn HIGHER income over the long-term. Not otherwise.

So maybe the idea of a market niche for extremely long-term dividend growth investors isn’t necessarily so unrealistic after all? As long as you’re content with higher portfolio dividend income – even at the expense of a lower future portfolio net worth – there may be more leeway than you’d expect to absorb slower future earnings growth and lower stock prices. I wouldn’t call that a free lunch exactly, but perhaps it is a less risky lunch than it might have initially appeared.

And in a harsh, competitive environment of scarcity that we see in the equities markets, the best meal is always the least risky one.

Disclosures

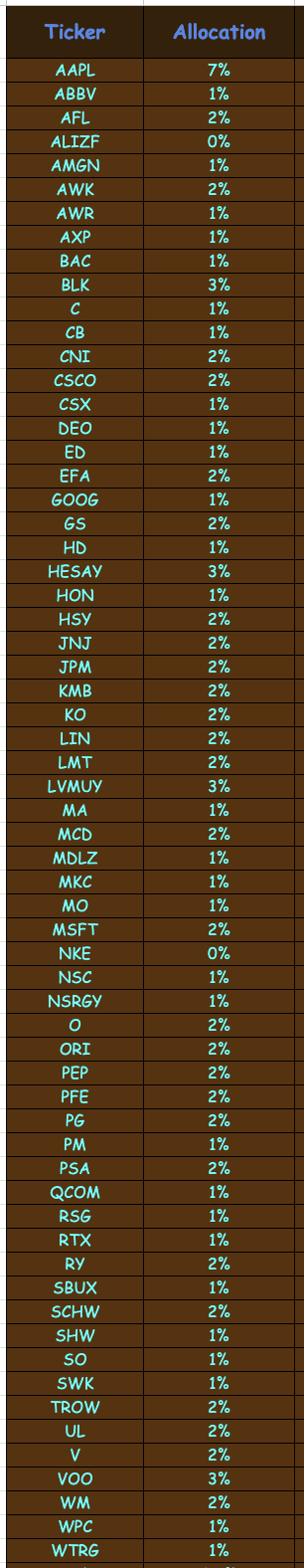

I plan to buy more shares of PFE in both the near term and intermediate term, unless the stock price rises significantly. My portfolio holdings are shown in the chart below, which reflects all public securities that I own.

Author’s portfolio (Author’s spreadsheet)

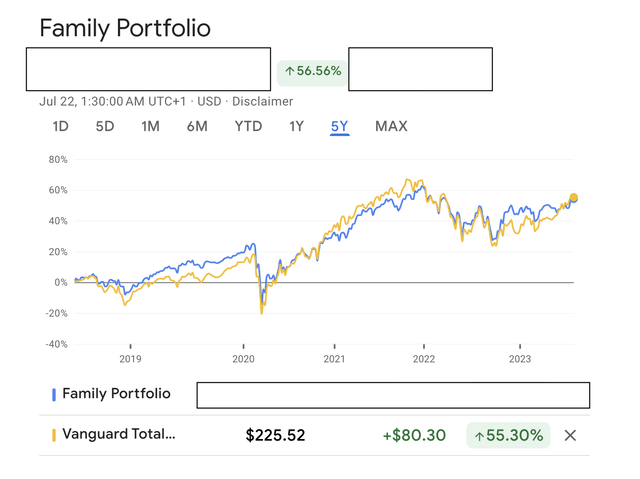

According to GoogleFinance.com, our portfolio performance over the past five years exceeds returns on the Vanguard Total Stock Market ETF (VTI) by about 1.25%, with an annual dividend yield of 2.56% compared to the dividend yield of 1.48% for VTI.

Author’s Portfolio Performance (Googlefinance.com)

Read the full article here