Edmond de Rothschild Group was in trouble. It was the end of 2015 and, after months of turmoil, the Swiss private bank owned by a branch of the Rothschild dynasty was closing in on a multimillion-dollar settlement with the US Department of Justice for its part in helping rich Americans hide their assets.

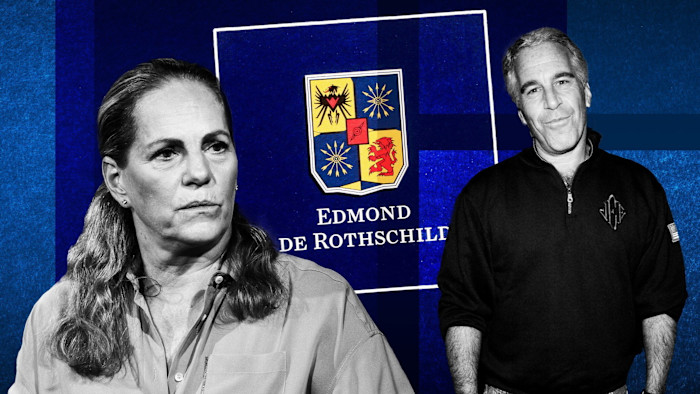

Behind the scenes, the group’s French chief, Ariane de Rothschild, had tasked Jeffrey Epstein and the lawyer he had introduced her to, Kathy Ruemmler, with closing the deal.

“45 mio [million]?” de Rothschild asked Epstein in a December 2015 email exchange. He replied that, counting a $10mn fee for the lawyers involved and $25mn for him, “I think you will find that . . . all less than 80 pretty good”. “Deep thks for your amazing help,” de Rothschild answered.

Days later, the US DoJ announced a $45mn settlement with Edmond de Rothschild.

Epstein’s pivotal — and lucrative — role in the DoJ deal is just one example of the deep ties he cultivated with the Baroness, who had married into the Rothschild family but now ran a financial group which as of 2024 had SFr184bn in assets between its private banking and asset management arms.

Over the six years of their relationship from 2013 until shortly before his arrest in 2019, Epstein became a personal confidant as well as a key business adviser, giving him a privileged position of influence at the heart of one of Europe’s most powerful banking families.

“I know Baroness Ariane de Rothschild is VERY important,” Epstein’s assistant Lesley Groff wrote in 2014.

In Geneva, Edmond de Rothschild occupies a distinctive position — neither a universal bank like UBS nor a pure boutique, but a storied private banking house with deep roots in the city’s wealth-management ecosystem.

At the start of 2015, when Benjamin de Rothschild handed operational control of his father’s bank to his wife, it was, however, in crisis.

Ariane de Rothschild later told the FT that “it wasn’t my aim to be chief executive of Edmond de Rothschild”, insisting that she only agreed to step into the role to show the family’s commitment as shareholders amid the DoJ probe and a wider restructuring.

But she had discussed the move with Epstein in advance. “Had a long talk with him [Benjamin]. He accepts: leaving all the subsidiaries’ boards and stay on Holding, Gva, paris, me as interim Ceo with a strategic committee,” de Rothschild wrote in December 2014, weeks before the announcement.

“Good,” Epstein replied. “Next discussion estate plan.”

Benjamin de Rothschild remained chair of the group until his death from a heart attack in 2021 at the age of 57. But from the time of her appointment as president of the executive committee in January 2015, it was clear that Ariane was in charge.

After securing the DoJ settlement, in the months that followed de Rothschild led efforts to restructure the bank’s operations, moved to cement her power internally and launched a lawsuit against her husband’s cousin David de Rothschild over who could use the family name — all with Epstein advising in the background.

In 2023, de Rothschild characterised her relationship with Epstein to the Wall Street Journal as one in which she had solicited his advice on “a couple of occasions”. The hundreds of emails and other messages between the pair now made public by the DoJ paint a different picture, in which the French banker shared private confidences with Epstein.

“I’m freaking out and scared I won’t be up to the job,” De Rothschild wrote in February 2015, shortly after taking over leadership of the bank. “You never have to hide from me, i can listen, and advise or just listen, there is nothign [sic] you can tell me that shocks me,” he said in another message in May that year in response to a comment about the difficulties in her marriage.

There were gifts, visits and dinners. They swapped lifestyle tips, contacts for her daughter’s university admission, holiday ideas and snippets of their daily lives, from the mundane — de Rothschild had a “fabric man” for Epstein’s upholstery projects and gardeners to send his way — to the eccentric. “Do you know anybody in Cuba that can help me buy tobacco land?” de Rothschild asked Epstein in 2015.

She even forwarded private emails from the patriarch of the London wing of the family, Lord Jacob Rothschild, in the midst of the sensitive dispute over who could use the family name for their banking business; messages signed “Love Jacob”. (Edmond de Rothschild is separate from the London and Paris Rothschild & Co. It would take three years before they agreed each group had to use their full name.)

De Rothschild and Epstein also discussed concerns about Benjamin de Rothschild. In several emails to Ariane de Rothschild, Epstein suggested that private investigators were digging into her husband’s alleged substance abuse issues. He pushed her to further sever corporate ties.

“i think you should prepare a custodian motion against benjamin, and give him the choice of you filing the motion or he resigning,” Epstein wrote in April 2015. “he is out of control and a danger to you and family.” Benjamin de Rothschild remained in place.

Ariane de Rothschild met Epstein as “part of her normal functions” at the bank, Edmond de Rothschild Group told the FT. “Ariane de Rothschild was the only one at that time to understand the magnitude of the issue in the DoJ matter,” it added, and Epstein was “compensated for providing strategic consulting and support in the bank’s overall business development”.

“In particular, [he] provided strategic advice on managing the dispute resolution process” with the DoJ, Edmond de Rothschild said. De Rothschild had no knowledge of Epstein’s personal conduct or the allegations against him, her representatives said. “She unequivocally condemns these behaviours and the crimes he committed. She obviously deeply regrets not having known all of this,” they said.

Epstein would help guide de Rothschild through a further period of tumult for the private bank, which included a reshuffle of its leadership, a police raid and €9mn fine from Luxembourg regulators for money laundering failures in relation to the Malaysian 1MDB scandal. “Shit is hitting the fan,” she wrote to him in 2016.

Epstein had his own ideas about how to reshape the Swiss family group. He encouraged a 2015 approach from UBS, orchestrated early-stage conversations with Rockefeller & Co in 2016 and Julius Baer in 2017, and had suggestions for senior hires. (Julius Baer said the talks brokered by Epstein were preliminary, the matter was never pursued in detail and was soon dropped.)

He pitched her the idea of recruiting Jes Staley, then the chief executive of Barclays and another frequent correspondent of Epstein, to the Swiss bank. In an earlier 2015 exchange, Epstein pushed de Rothschild to hire Ruemmler, who was then a partner at Latham & Watkins and had previously been a White House counsel under the Obama administration, permanently. Neither Staley nor Ruemmler joined Edmond de Rothschild. Ruemmler is now general counsel at Goldman Sachs; she declined to comment for this article.

“It kills me to see you spending your amazing talents as part of the working class. I am sensitive to the family obligations. But you need HELP . . . over and over, I hear that the bank and its reputation, powerful, is you but as a one man band,” he wrote in 2017.

“I know you’re totally right and I know I have to find a way out of this upwards. Also way too fragile to have me only,” she said.

Epstein also pointed de Rothschild towards another promising American contact in his Rolodex: Apollo Global Management, the private equity firm whose co-founder Leon Black counted Epstein as a trusted consigliere.

In January 2016, Epstein arranged a corporate conclave between the two parties at his Manhattan townhouse. (De Rothschild’s representatives said the meetings were part of “normal business”, and fell under the rubric of Epstein’s various strategic consulting and business development missions for the group. Apollo has acknowledged that a meeting took place but said that Epstein did not attend and that it had never done any business with him.)

Epstein saw the value the two parties could bring to one another: Apollo with its extensive suite of private investment funds, Edmond de Rothschild with a distribution network of wealthy European clients yearning for a slice of higher-yielding American investments.

But he also appeared to pitch a grander scheme: a corporate tax “inversion” at Apollo involving Edmond de Rothschild. Whether Edmond de Rothschild was a potential merger target or merely an adviser is not clear from the communications, but the fabled tax inversion proved elusive — as did any broader co-operation between Apollo and Edmond de Rothschild.

“[Ariane] de Rothschild is fully committed to the unique and independent family model of the Edmond de Rothschild bank,” the company said.

Epstein’s own problems occasionally surfaced in the messages. But in large part the exchanges portray a concerned adviser offering unique solutions — and comfort — to an executive in need of a trusted confidant among a circle of unreliable associates.

At one point in 2015, Epstein consulted the lawyer to whom he had introduced her, Kathy Ruemmler, about how to provide de Rothschild with moral support without appearing paternalistic. Ruemmler counselled: “Just be her friend. You are good at that.”

In another exchange that year, de Rothschild mused to Epstein on friendship. “I’ve had my share of disappointments too with friends who turned out to be shits,” she wrote to Epstein in 2015. “never mind.”

Additional reporting by Harriet Agnew, Ortenca Aliaj and Mercedes Ruehl

Read the full article here