Co-produced by Austin Rogers.

Investors today have no shortage of buying opportunities to generate passive income.

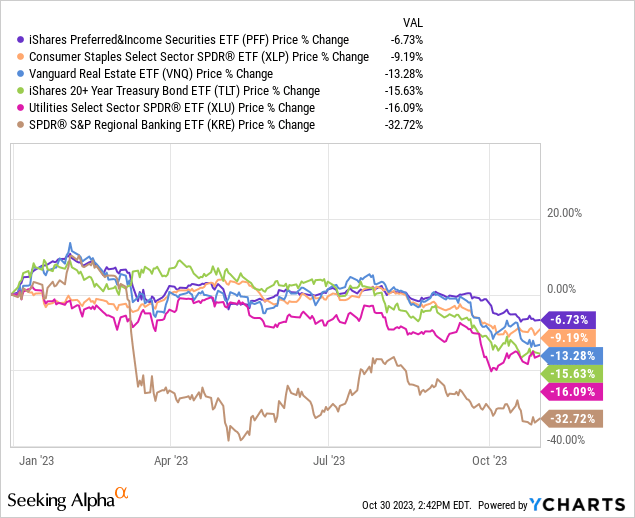

As interest rates have risen this year, the yields on traditionally income-producing assets/sectors such as long-term Treasuries (TLT), preferred equities (PFF), real estate (VNQ), consumer staples (XLP), utilities (XLU), and regional banks (KRE) have all spiked higher.

These assets/sectors have dropped in price this year anywhere from ~7% to ~33%.

While painful for those who already held these stocks and exchange-traded funds, or ETFs, this selloff creates an attractive entry point for long-term investors looking to generate passive income from their investment portfolios.

That, of course, assumes that one has cash to invest that isn’t already invested.

One of the joys of investing for passive income is the ability to use that passive income to reinvest in the most attractive opportunities available at the time. We are not market timers and admit to having no ability to consistently buy at the very bottom, and thus we usually remain close to fully invested.

However being heavily invested in passive income-generating stocks gives us a constant stream of income with which to invest in the best opportunities.

Let’s say, though, that you have been cautious and kept a large cash position in reserve. Or perhaps you recently inherited a large sum of money. Or maybe you sold a property and netted a tidy amount of cash from the sale.

However you obtained it, let’s assume you have $100,000 in cash and feel that now is the right time to deploy it into long-term investments that generate passive income.

Let’s explore some ways you might go about doing so.

Understanding Your Options

We would categorize investors’ publicly traded passive income opportunities into three basic groups:

- Fixed income

- Dividend ETFs

- Common stocks.

Fixed income refers to bonds and preferred equities. These are public securities that have a face value at which they will be redeemed in full at a set date, and they pay a fixed interest or dividend income stream that does not grow.

Bonds are considered the safest type of capital in which one could invest because they are the most senior and highest priority form of capital. Bondholders are paid first, before any other investor.

Preferred equities are another form of fixed income that is lower in priority than bonds but higher than common stock.

Fixed income is certainly the safest form of capital in terms of the risk of permanent loss, but there are other forms of safety to think about. The last few years have reminded investors that there is also the risk of inflation.

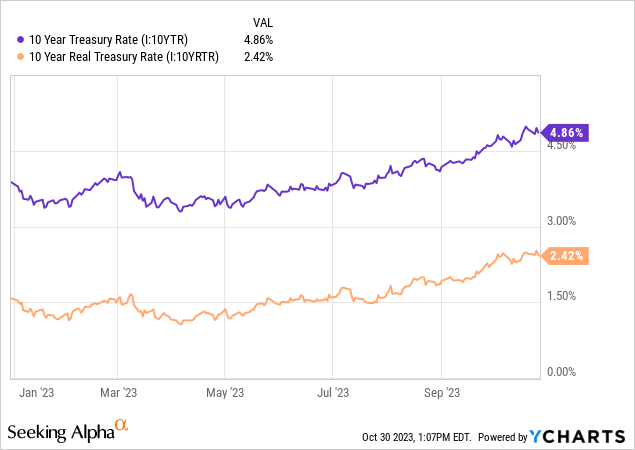

While it may sound appealing to buy the 10-year Treasury bond (US10Y) at a yield of almost 5%, the highest level in over 15 years, one should also consider inflation.

The orange line above shows the real (inflation-adjusted) 10-year Treasury yield, using a forward estimated inflation rate of about 2.4%.

But this doesn’t accurately illustrate the effect that inflation has on bond interest payments, because bonds pay a fixed income stream, while inflation is the rate of price growth — or the rate at which the purchasing power of that fixed income stream declines.

The risk of permanent capital loss from owning individual bonds may be low, but the risk of purchasing power erosion from inflation is high.

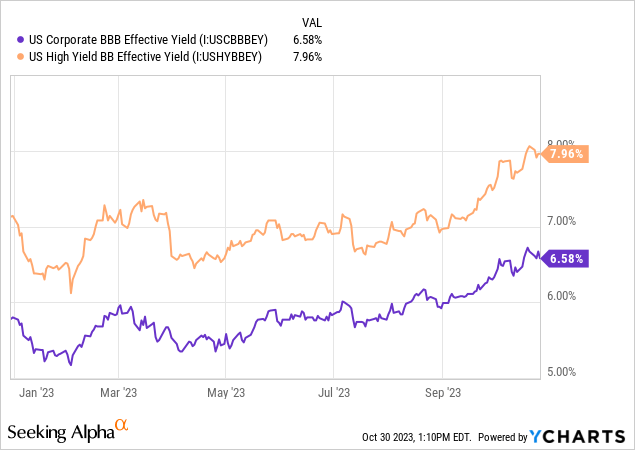

You could also look at corporate bonds, both from investment grade corporates (LQD) and high yield or “junk”-rated corporates (HYG).

The yields you can find in the realm of corporate bonds range from around 6% all the way to 8% and higher.

With corporate bonds, you have the same low risk of capital loss but moderate risk of purchasing power erosion from inflation. But as you can see above, you get paid much higher yields to compensate for the risk of inflation.

In some ways, investment-grade corporate bonds offer the best of both worlds. You get a very low risk of losses from defaults, and you also get higher yields.

The further you go up the risk curve into the high yield or “junk bond” space, though, the more you are basically taking equity-like risk in terms of potential for capital losses in exchange for an income stream that is guaranteed to remain flat.

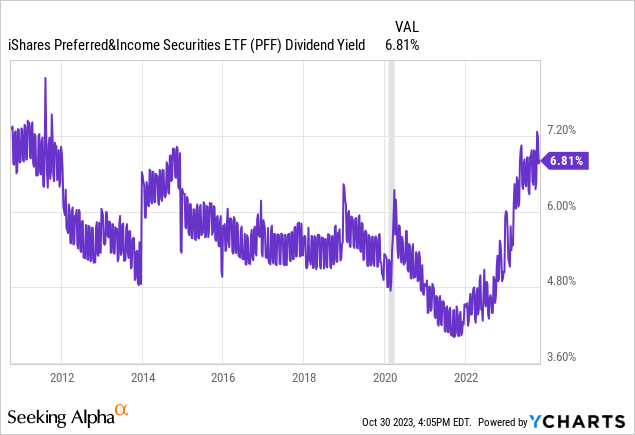

Much the same could be said about preferred equities, which are often perpetual with no required redemption date. The iShares Preferred & Income Securities ETF (PFF) currently offers a higher yield than at any time since the immediate wake of the Great Financial Crisis in 2010-2011.

The advantage of preferreds is that they trade on major exchanges similar to common stocks, making them easy to invest in. Plus, their face values are typically either $25, $50, or $100, making them more approachable for small-dollar investors than bonds, which typically trade in $1,000 (or more) increments.

While it may be a good idea for income investors to have some level of allocation to fixed income, we would caution against allocating too heavily into fixed income, even at current yields.

The reason for this is that while fixed income provides safety from the risk of permanent capital losses, it does not provide safety from the risk of inflation.

We prefer to invest the bulk of our capital into assets that tend to both rise in value and grow their income streams over time. That brings us to the next two categories of passive income investments.

Dividend ETFs are simply baskets of dividend stocks, tradable on major exchanges, that you can buy as a bundle in exchange for a fee (the expense ratio) paid to the fund advisor.

This makes it very important to study the process the ETF uses to pick stocks. When buying an ETF, you take the bad with the good, the overperforming stocks and the underperforming ones. Hopefully, the stock-picking methodology it uses will minimize the number of stocks that end up cutting their dividends, but through some recessions, many stocks within a dividend ETF will cut their dividends, which causes the ETF’s distribution to decline.

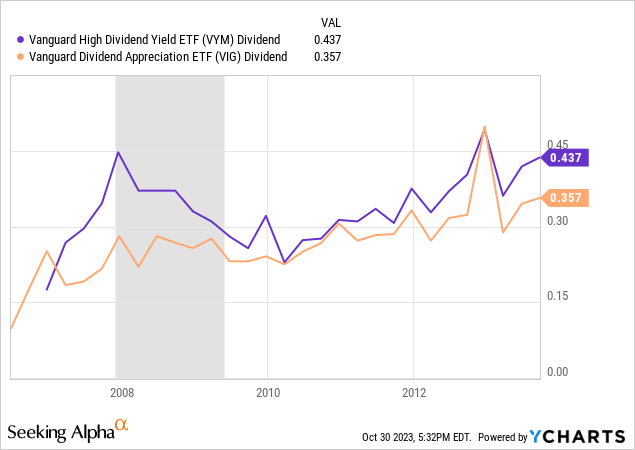

Compare, for example, the dividends of the Vanguard High Dividend Yield ETF (VYM) to its lower-yielding cousin, the Vanguard Dividend Appreciation ETF (VIG), through the Great Recession of 2008-2009:

VYM’s dividend dropped by about 40%, while VIG’s dividend barely declined at all.

But the downside of VIG is that it typically yields only a little over 2%, while VYM yields 3.5-4%.

As baskets of stocks, the dividend yields of ETFs are basically just the weighted average of all their constituent holdings’ dividend yields.

While we don’t believe the market is perfectly efficient, it isn’t stupid, either. Stocks with high dividend yields are priced that way for some perceptible reason, regardless of whether the market’s perception is 100% accurate or not.

That is why we think investors should be cautious with “high yield” or “high dividend” ETFs. You take the bad with the good in these vehicles, and you cannot pick and choose which holdings to include and which to exclude.

On the other hand, ETFs also provide instant diversification, allowing investors to gain exposure to dozens, hundreds, or even thousands of dividend-paying stocks across many sectors of the economy in one click.

At their best, dividend ETFs provide both dividend growth and dividend safety through a strong, thoughtful stock-picking methodology.

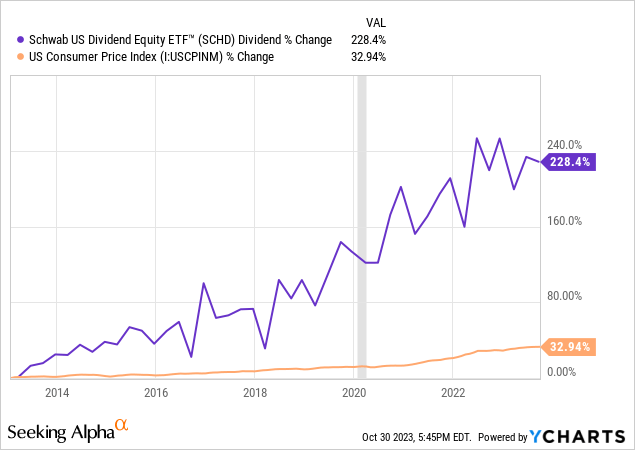

Take, for example, the Schwab U.S. Dividend Equity ETF™ (SCHD), which has handily beaten inflation with its dividend growth over time even while providing a dividend yield over twice as high as that of the S&P 500 (SP500).

Historically, SCHD has provided all the benefits of a dividend ETF with minimal drawbacks.

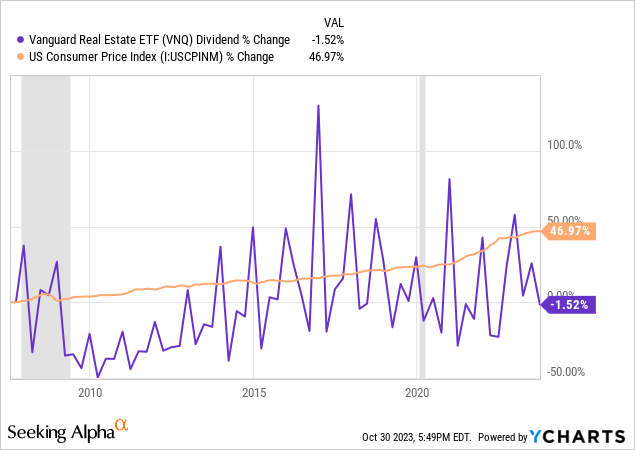

On the other end of that spectrum, consider the Vanguard Real Estate ETF (VNQ), which owns well over 100 real estate investment trusts (“REITs”) and other real estate-related companies, providing diversification across all sub-sectors of real estate.

This is a sector known for paying generous dividends and increasing those dividends over time, but there is a wide variation between the highest quality and best managed REITs and the lower quality, poorly managed REITs. That is why VNQ’s dividend has not even managed to keep pace with inflation over time.

There are many great REITs within the VNQ that not only offer above-average yields but have also grown their dividends faster than inflation over time. But the average reflected in VNQ cannot boast such a record.

Selectivity is key.

Finally, dividend-paying common stocks are the third category of passive income investments. Buying individual stocks provides the selectivity necessary to avoid the pitfalls of certain ETFs.

Common stocks have the opposite risk profile as bonds, exposed to some risk of permanent capital losses (depending on the individual stock) but often protected from the risk of purchasing power erosion via dividend growth.

Of course, companies don’t have to pay dividends. This is a capital allocation decision. Sometimes management teams will choose to reduce or eliminate dividend payouts, whether because of a drop in profits or simply a desire to allocate that capital differently.

To mitigate this risk, investors can look at stocks with long-established records of paying and annually growing their dividends to shareholders. It obviously takes many years to establish these records, and management teams will usually fight hard to preserve them.

Within the realm of REITs, here are a few high-quality names to consider:

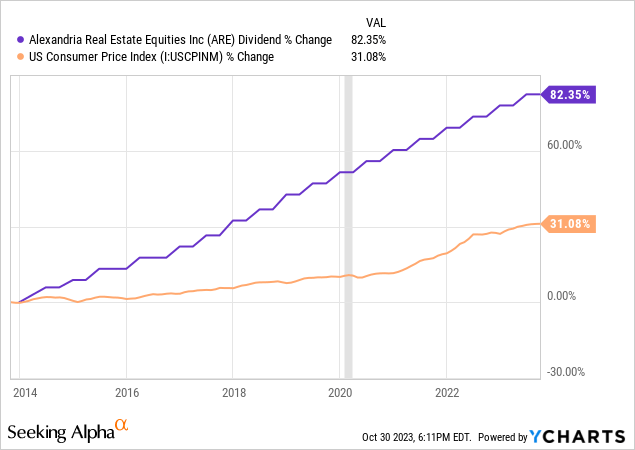

- Alexandria Real Estate Equities (ARE), which owns Class A life science facilities located in the nation’s top research clusters. ARE currently yields 5.3% and has a long record of growing its dividend at 6% per year.

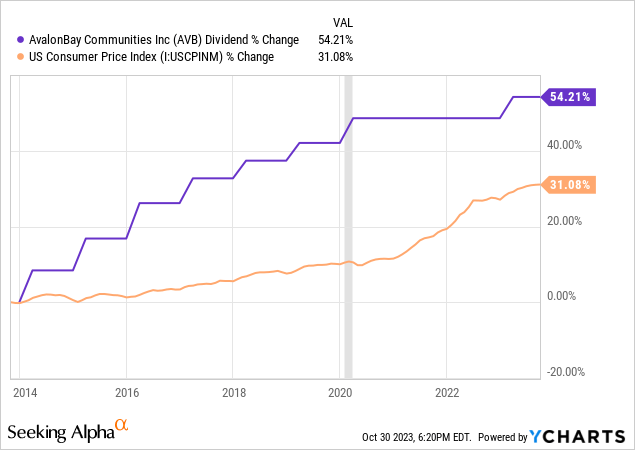

- AvalonBay Communities (AVB), the largest multifamily REIT in the US with a vast portfolio of primarily Class A apartments in suburban areas of coastal cities but a growing presence in fast-growing Sunbelt markets like Texas, Florida, and North Carolina. AVB yields over 4% and has paid a generally growing dividend for 28 years. Even with a pause in its dividend growth during COVID-19, the REIT’s dividend has still risen faster than inflation in the last decade.

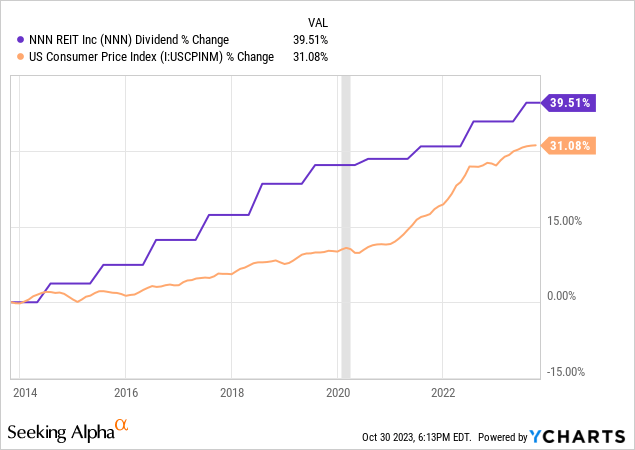

- NNN REIT (NNN), formerly National Retail Properties, owns a large and diversified portfolio of single-tenant net lease retail properties like convenience stores, fast food restaurants, and car washes. NNN yields 6.4% and boasts a 30+ year record of raising its dividend annually at a rate that has beaten inflation in the last decade.

Bottom Line: How We Would Invest $100,000 For Passive Income Today

Everyone’s situation and goals are different, so it is always hard to give general thoughts like this.

But for those who wish to invest in long-term investments for passive income, opportunities today are vast and immensely attractive.

If it was our money, we would allocate a portion of it to all three categories of passive income investments discussed above. How much exactly is up to one’s personal discretion, but here is one possible allocation arrangement that simultaneously generates a high yield and inflation-beating income growth:

| Allocation | Yield | Dividend Growth | |

| Investment Grade Bonds / Preferreds | 25% | 7% | 0% |

| Dividend ETFs | 25% | 4% | 6% |

| Dividend-Paying Common Stocks | 50% | 5% | 5% |

| WEIGHTED AVERAGE | 5.25% | 4% |

If you invested $100,000 this way, you would generate $5,250 in the first year, but we estimate that income stream could grow at a rate of about 4% per year from dividend growth.

Here’s how the passive income from that invested $100,000 would theoretically grow over time:

| Year 1 | $5,250 |

| Year 2 | $5,460 |

| Year 3 | $5,678 |

| Year 4 | $5,905 |

| Year 5 | $6,142 |

| Year 6 | $6,387 |

| Year 7 | $6,643 |

| Year 8 | $6,909 |

| Year 9 | $7,185 |

| Year 10 | $7,472 |

This is only a hypothetical scenario, of course, but we think it is entirely plausible and realistic.

The bottom line is that if you are looking to invest a lump sum of cash for passive income, consider all categories of investments.

Read the full article here