When the heart speaks, the mind finds it indecent to object.”― Milan Kundera

I posted my first article on an intriguing concern called Humacyte (NASDAQ:HUMA) back in mid-October. The conclusion of that piece around this company focused on developing bioengineered regenerative human tissues was the following:

With little in terms of catalysts before year-end, and a very poor overall market environment, HUMA probably merits a small “watch item” holding at best for now. However, the company’s story is intriguing enough that we will probably circle back on it sometime in the first half of 2023.“

Given we are near the end of the first half of this year and the company just received a financial lifeline, it seems a good time to circle back on Humacyte. An update analysis follows below.

Company Overview

Humacyte, Inc. is headquartered in Durham, NC. The company is focused on developing and commercializing off-the-shelf, implantable, and bioengineered human tissues for the treatment of diseases and conditions across a range of anatomic locations in multiple therapeutic areas. The stock currently trades just above four bucks a share and sports an approximate market capitalization of $430 million.

December Company Presentation

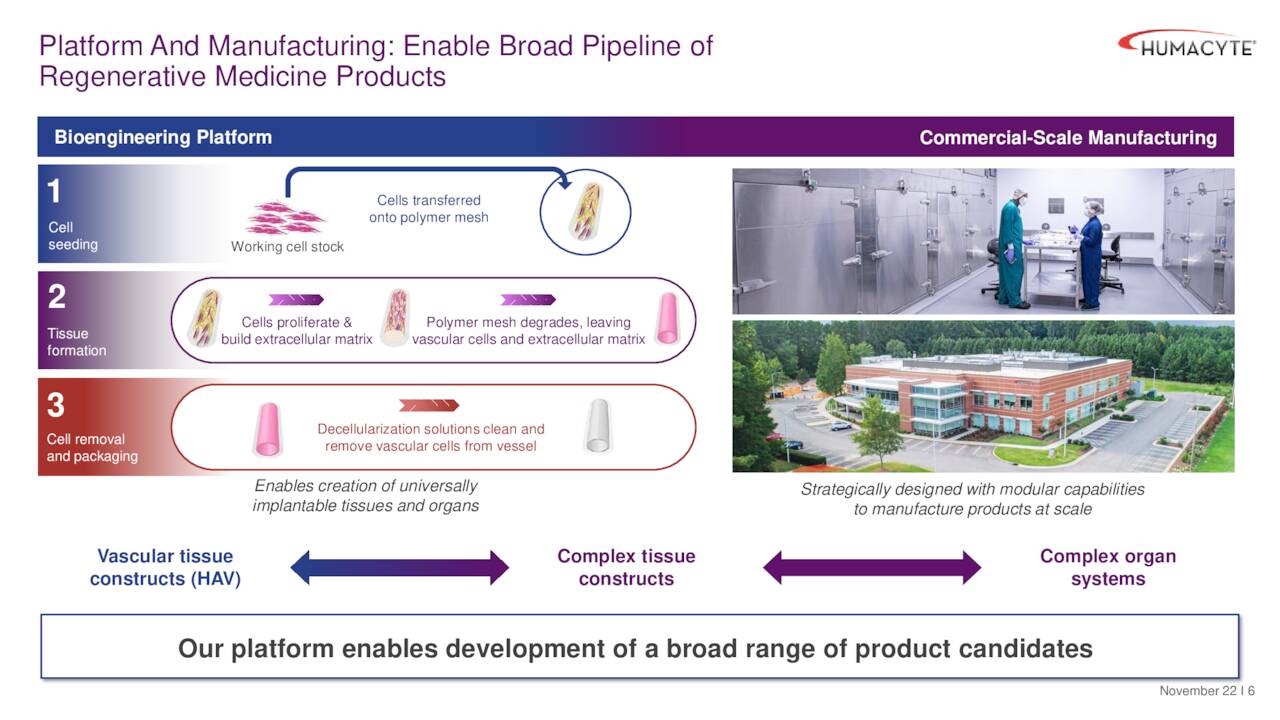

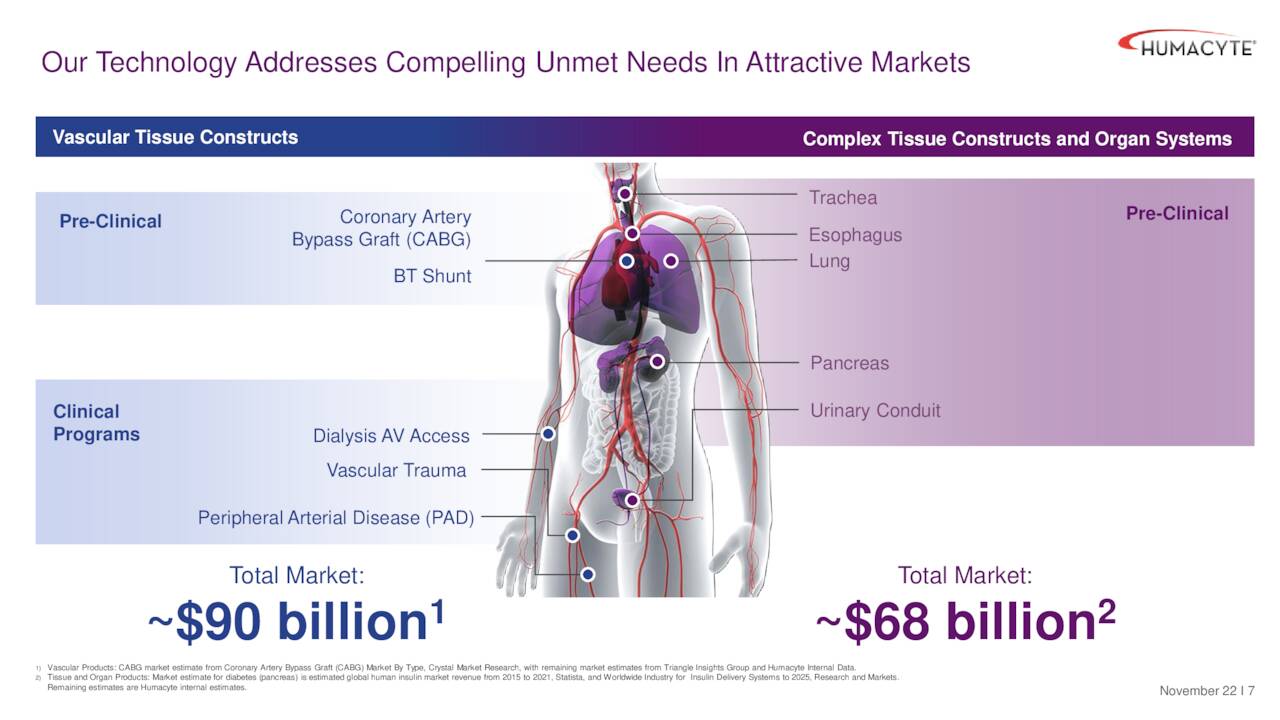

As I noted in my first article on Humacyte, the company’s developmental approach/pipeline consists of:

Humacyte’s pipeline consists of output from its novel development platform that employs human aortic vascular cells that are isolated from donor tissues and cryopreserved. The working cell stock is expanded using traditional cell culture techniques and then transferred onto a biocompatible, biodegradable polymer mesh in the shape of a blood vessel, all inside a bioreactor bag. The cells proliferate to form a bioengineered blood vessel as the polymer mesh degrades. It is then decellularized using a proprietary combination of solutions, producing a human acellular vessel [HAV] that will not induce immune rejection following implantation. All of these processes occur in the aforementioned bioreactor bag, which is then shipped to hospitals and other critical care facilities where it can be stored at refrigerated temperatures and opened when a patient needs HAV transplantation. This a potentially paradigm-changing alternative to autologous vein harvesting, which is a time-consuming and difficult procedure with a ~40% morbidity rate that includes wound infection, pain, and reduced patient mobility; or expanded polytetrafluoroethylene (ePTFE) grafts, which are effective but are dogged by high infection rates and lower efficacy after one year.”

December Company Presentation

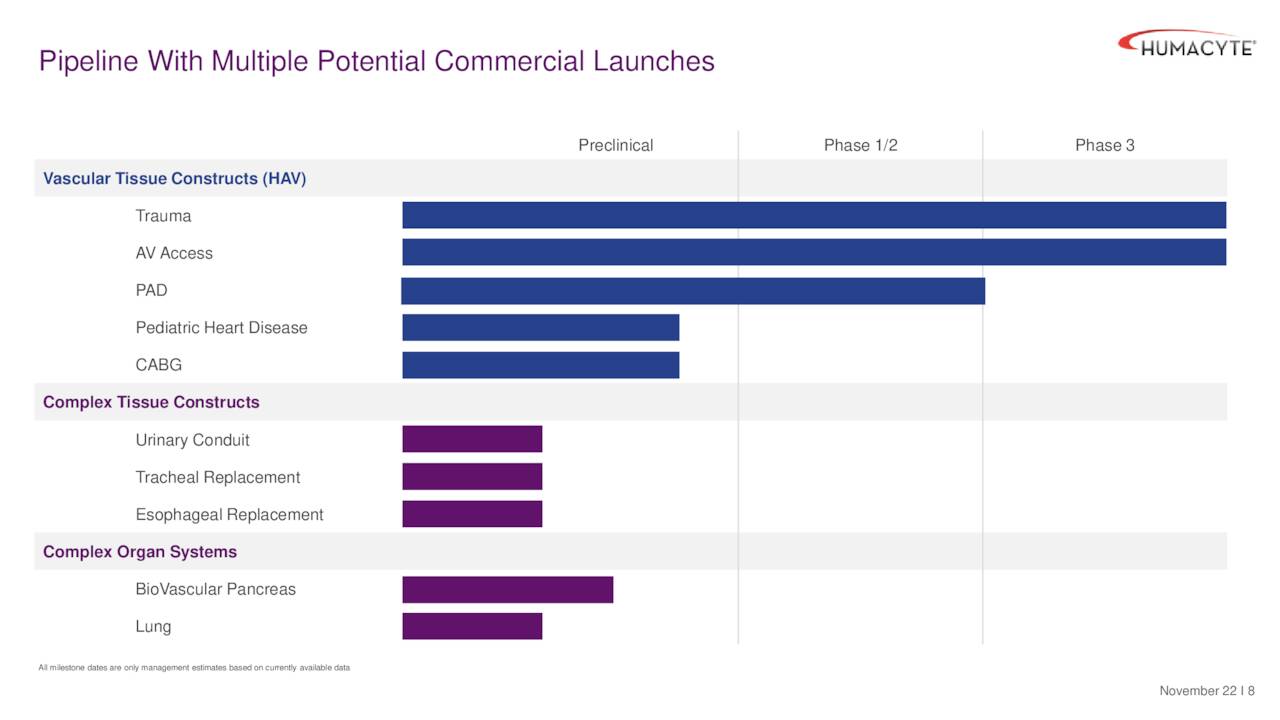

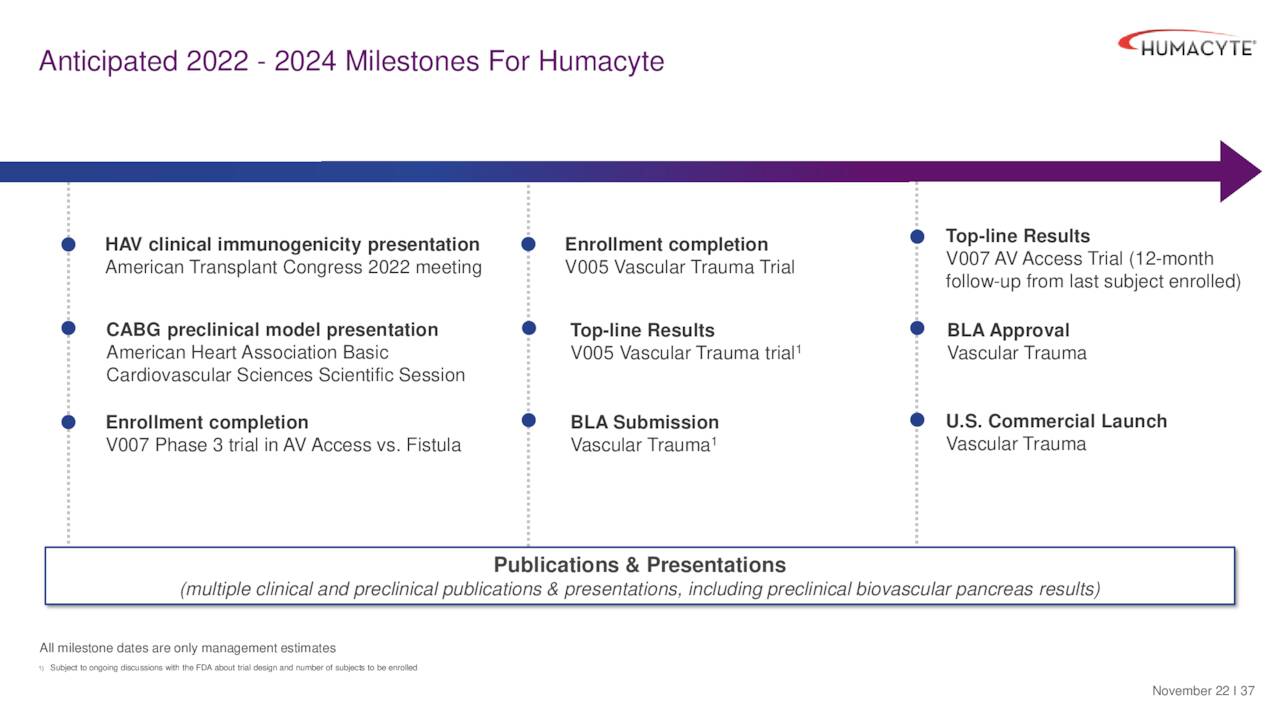

The company has several developmental efforts underway including one that is projected to have a Biological License Application filed on it this year. We will focus on the company’s clinical stage efforts for the purpose of this analysis.

December Company Presentation

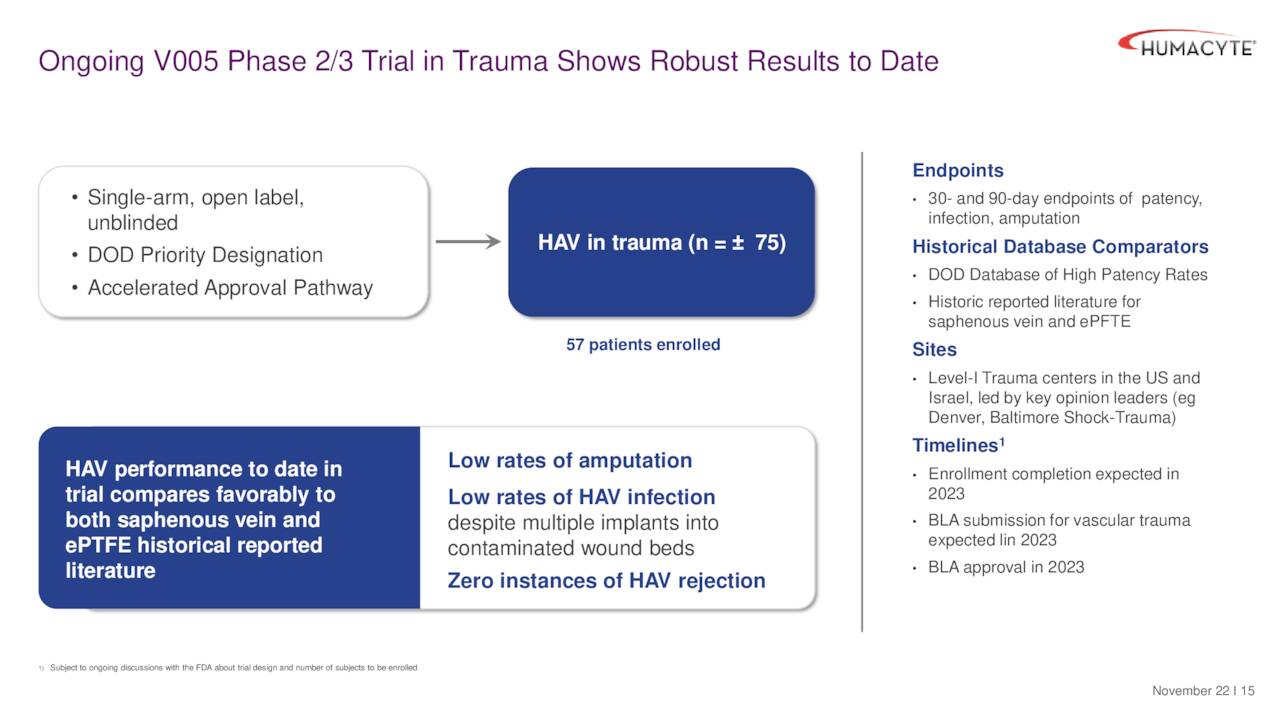

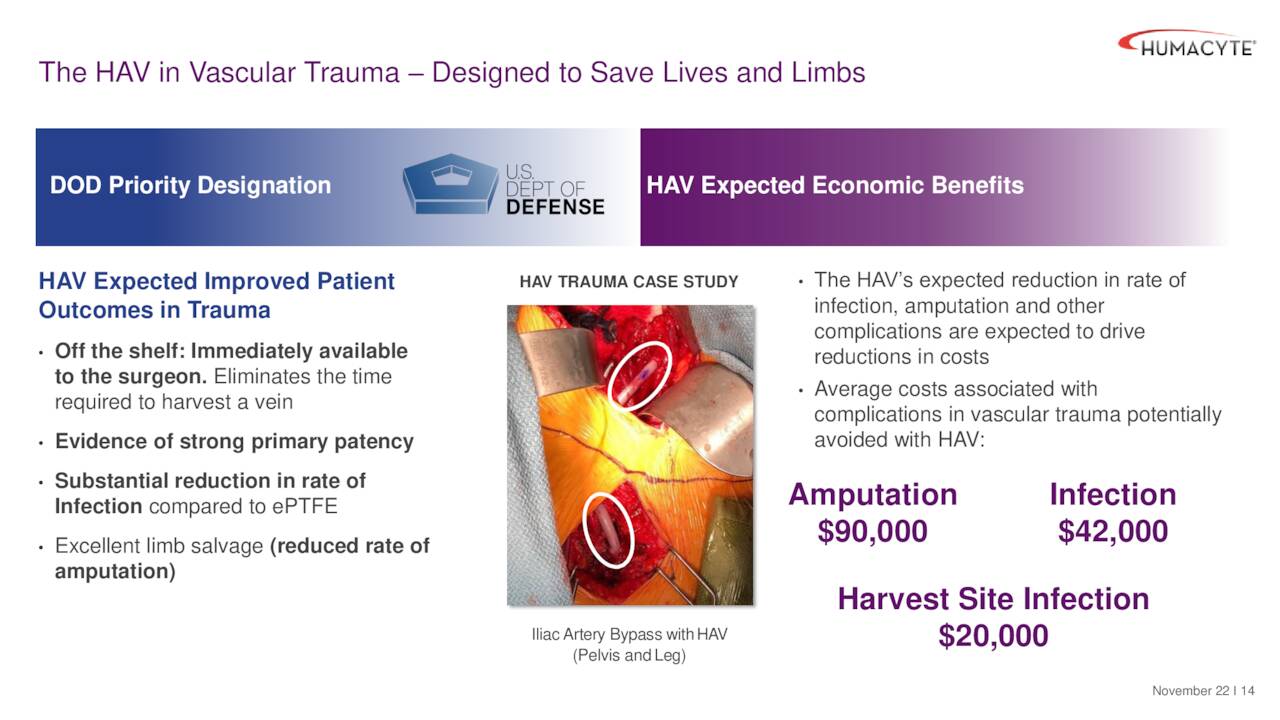

The company’s HAVs are targeting three indications in the clinic. They are trauma repair, arteriovenous [AV] access, and peripheral arterial disease (PAD). A 75-person pivotal Phase 3 study became is close to fully enrolled and has many patients in Ukraine due to the conflict there. Key endpoints include 30 and 90-day patency – i.e., the HAV is still “open” and functioning. So far, study results have been encouraging. The company plans to file for accelerated BLA approval within four months of getting 30 day data from 50 patients (what was agreed to with the FDA).

December Company Presentation

If approved, this indication could have an approximate target market of 75,000 individuals in the United States and help reduce the fatality rate from severe injuries. It obviously also would have significant benefit to the military especially in times of conflict. This is why Humacyte’s HAVs have garnered a priority designation from the Department of Defense. The product has a long shelf life (18 months) and is expected to greatly reduce infection and amputation.

December Company Presentation

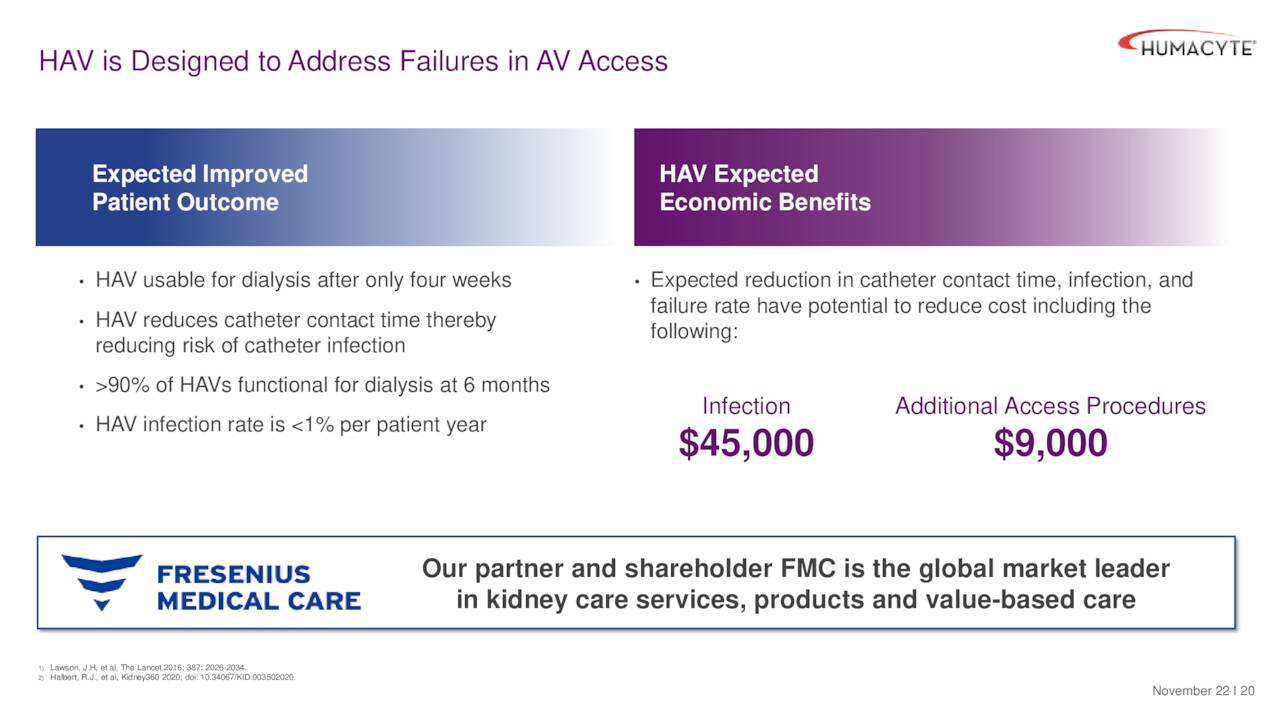

The HAVs also have potential benefits in dialysis compared to the current standard of care.

December Company Presentation

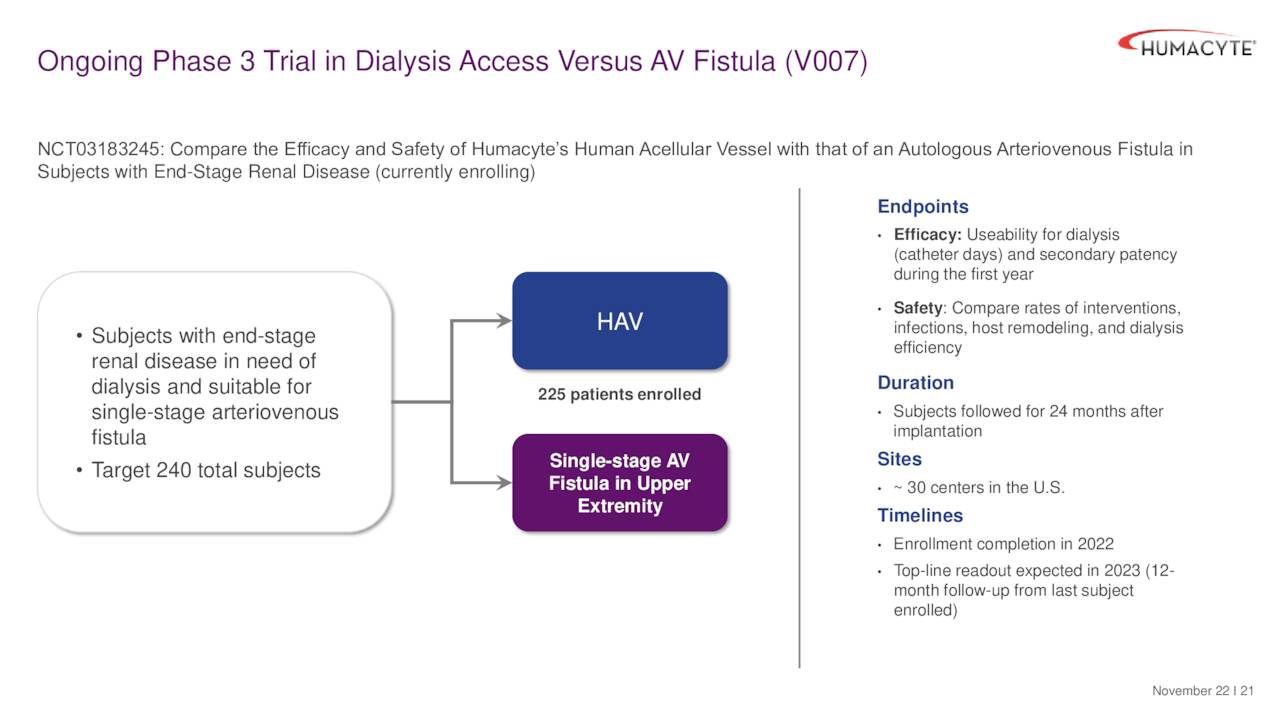

Currently the company has a late stage ‘V007’ trial that became fully enrolled in April. This study is designed to assess the usability of the HAV for hemodialysis in comparison to autogenous fistulas. This will be evaluated in up to 240 patients with end-stage renal disease. Top line results are anticipated around April of next year based on the one year follow-up period that’s built into the study. If positive, the data from this trial will support a BLA filing for a secondary indication in dialysis access.

December Company Presentation

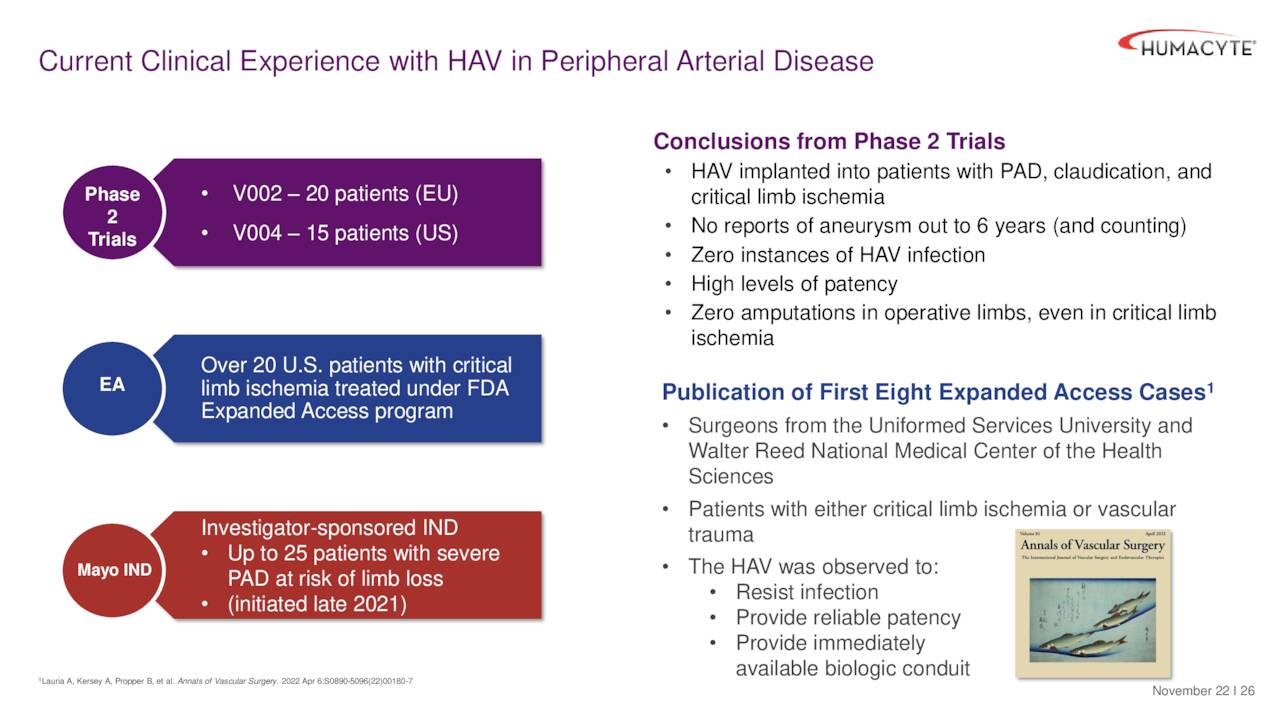

PAD development is behind the other two indications. However, the company did recently publish some Phase 2 trial data around PAD in the Journal of Vascular Surgery, Vascular Science.

December Company Presentation

Financial Lifeline

On May 12, 2023, the company announced a key financial deal that will provide the company much-needing funding to move its projected first approved product to commercialization. Humacyte reached an understanding with private investment firm Oberland Capital Management. This capped funding arrangement around future sales of the company’s Human Acellular Vessel [HAV] product. Humacyte hopes to have this product approved and on the market in 2024. This agreement, worth up to $160 million, consists of three parts.

- A $40 million upfront payment

- $110 million in regulatory and sales-based milestone payouts

- A $10 million option Oberland can buy a stake in HUMA at $7.50 a share

This agreement addressed funding needs and I view it as a positive for the company.

Analyst Commentary & Balance Sheet

Humacyte has received sparse analyst coverage in recent months. So far in 2023, Benchmark Co. maintained their Buy rating and $16 price target on HUMA in late March. Then yesterday, BTIG reissued their Buy rating and $8 price target with the following commentary:

HUMA announced a few significant updates this quarter, its progress towards BLA filing in Vascular Trauma is inching closer with 49 patients (out of 52) in V005 for Vascular Trauma. HUMA completed enrollment for V007 AV Access in mid-April and that trial has a one-year endpoint with top-line results expected in 2024. The second major update was the announcement of a structured financing agreement which provides HUMA with up to $160M over multiple years dependent on successful milestone completion. In the near-term HUMA takes in $40M upfront and alleviates potential financing overhang risk.’

Just under 10% of the outstanding shares in Humacyte are currently held short. There has been no insider activity in this equity so far in 2023. The company ended the first quarter of this year with just over $130 million in cash and marketable securities on its balance sheet. With the just announced financing agreement, management now believes ‘funding is adequate to fund operations past the anticipated timelines for potential approval and commercialization of the HAV in vascular trauma.’

Verdict

December Company Presentation

The company has several potential milestones on the horizon. The company has one potential BLA submission this year and another in 2024. Approval would help further validate Humacyte’s approach and establish it as a leader in regenerative medicine which is a broad and growing market. This week’s financing agreement is one more step towards that journey and why Humacyte is a story worth watching. HUMA stock continues to merit a small ‘watch item‘ position within a well-diversified biotech portfolio until the company hits the commercialization stage, at which time I will reevaluate it once again.

December Company Presentation

“The heart has its reasons which reason knows not.”― Blaise Pascal

Read the full article here