Huntington Ingalls Industries, Inc. (NYSE:HII) is the largest military shipbuilder in the United States, additionally operating adjacent professional government and industry services. The firm is primarily comprised of three segments; Ingalls Shipbuilding, Newport News Shipbuilding, and Mission Technologies – HII’s fastest-growing vertical.

HII Q1’23 Investor Presentation

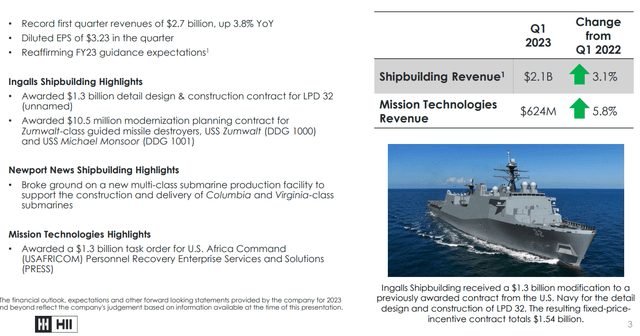

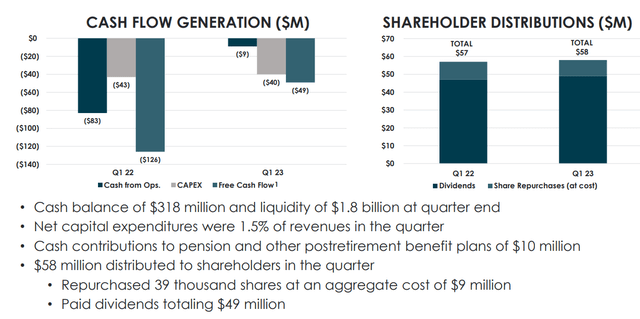

Through these activities, HII achieved Q1 revenues of $2.67bn- a 3.80% YoY increase- alongside a net income of $129.00mn – down 7.86% – and a free cash flow of -$52.00mn – a 58.73% increase driven by rising operational and financing cash flows.

Introduction

To maximize cash flow generation capabilities and potential shareholder returns, HII has maintained a fivefold investment thesis, encompassing its record backlog, which supports resilient long-run revenues, a distinctive shipbuilding profile and ability, a more stable and margin-expanding business in Mission Technologies, increasingly sustainable cash flow positioning, and a judicious capital deployment strategy emphasizing value creation, return and deleveraging.

HII Q1’23 Investor Presentation

As such, the combined accretive effects from HII’s peerless shipbuilding product mix and backlog, when combined with the rapid growth of the Mission Technologies platform, HII’s disciplined capital allocation strategy, and the firm’s undervaluation, lead me to rate the stock a “buy.”

Valuation & Financials

General Overview

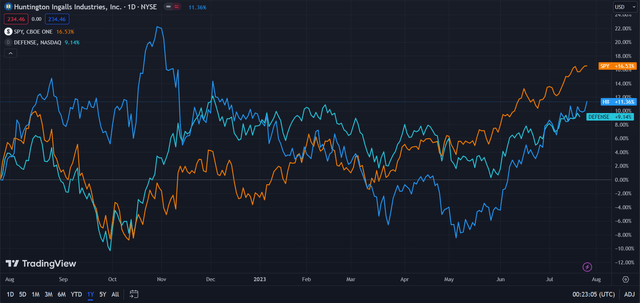

In the TTM period, HII’s stock – up 11.36% – has experienced middling performance between the NASDAQ’s Defense Index- up 9.14% – and the broad market – also up 9.14% in the same period.

HII (Dark Blue) vs Industry & Market (TradingView)

I believe HII’s performance, since it is now mostly in line with the price movements of the defense industry, is largely driven by macro themes around input inflation and debt-servicing costs. Additionally, the firm and the industry are not as responsive to recovery tailwinds, maintaining inelastic revenue streams.

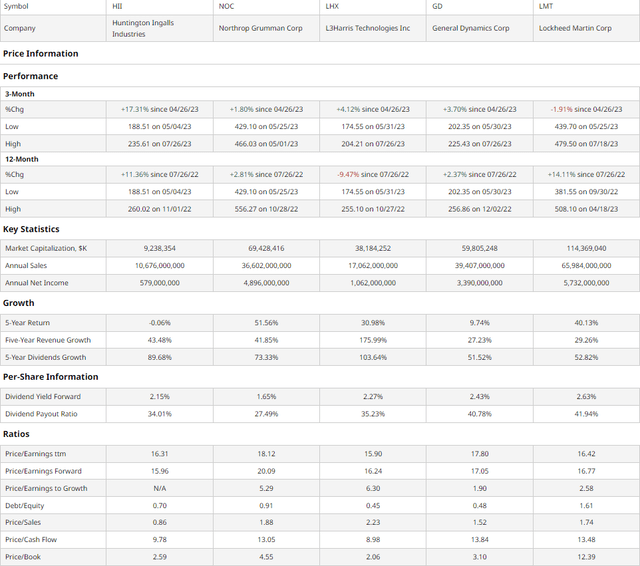

Comparable Companies

The US defense industry remains highly consolidated, generally with a single or handful of buyers, but the largest always being the U.S. Department of Defense. As such, rather than comparably sized foreign firms or firms which operate with higher growth prospects and such, I sought to compare – imperfectly – HII with other major U.S. defense contractors, who are generally larger than HII. These include the Virginia-based B-21 manufacturer, Northrop Grumman (NOC), Florida-based electronic warfare specialist, L3Harris (LHX), nuclear submarine manufacturer, General Dynamics (GD), and the world’s largest defense contractor, the Maryland-based fighter jet maker, Lockheed Martin (LMT).

barchart.com

As demonstrated above, HII has seen the second-best TTM price action, driven by best-in-class quarterly price performance. I believe that this is a product of an ever-increasing backlog for HII and subsequent analyst upgrades for the stock.

Despite this growth, HII demonstrates relative value when considering the company’s multiples-based proposition, growth capabilities, and shareholder returns.

For instance, HII maintains the second-lowest trailing P/E and the highest forward P/E. In conjunction with the lowest P/S, second-lowest P/CF, and second-lowest P/B, exemplifies the firm’s fiscal strength and value respective to all three financial statements.

Moreover, although HII does not sustain the most remarkable dividend, the firm maintains a conservative payout ratio, and HII investors saw the second-largest 5Y dividend increase among peers.

Valuation

According to my discounted cash flow valuation, at its base case, the net present value of HII is $247.85, meaning, at the stock’s current price of $243.46, HII is undervalued by 5%.

My model, calculated over 5 years without perpetual growth built-in, assumes a discount rate of 9%, incorporating HII’s averaging debt levels and high long-run beta, which feeds into a higher ERP. Moreover, keeping in mind that backlog revenues are generally priced-in, I calculated a revenue growth rate of 5%, lower than the 5Y trailing CAGR, but in line with defense growth and potential recessionary impacts.

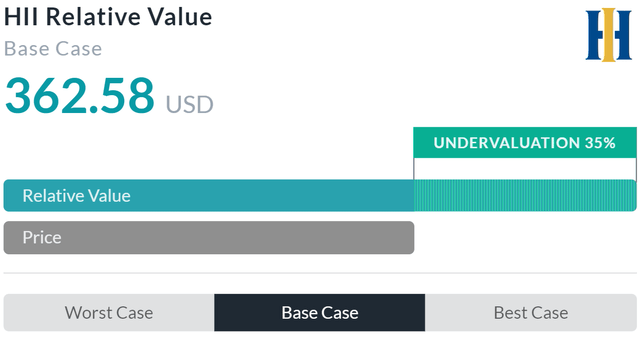

Alpha Spread

Alpha Spread’s multiples-centric relative valuation tool more than corroborates my thesis on undervaluation, estimating that HII is undervalued by 35%, meaning the stock’s relative value is $362.58.

Although Alpha Spread fails to adequately adjust valuations for dividends, a majority of comparable firms provide a similar yield, thus negating perversive effects.

Thus, taking an average of my NPV and Alpha Spread’s relative valuation, the fair value of HII should be $305.22, manifesting an undervaluation of 20%.

Strong Shipbuilding Portfolio Supports Accretive Cash Flow Generation

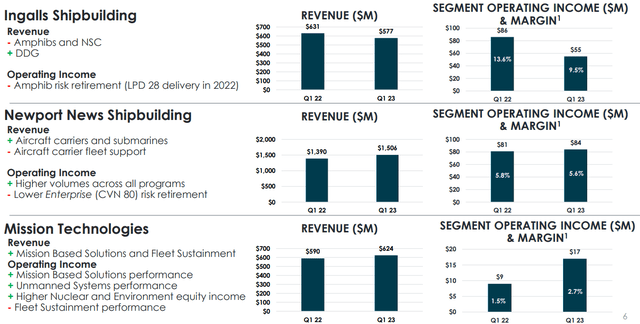

At the core of HII’s long-run strategy remains its trifold-segment strategy of fulfilling a record backlog and providing specialized naval products, ultimately supporting resilient revenues and derivative maintenance income streams. HII’s Ingalls Shipbuilding segment, for instance, is dedicated to amphibian navy products & destroyer-class ships. On the other hand, Newport News Shipbuilding builds and maintains aircraft carriers, submarines, and support vessels. And while the other two segments sustain recurrent and stable revenues, the engine of HII’s growth remains its Mission Technologies segment, which offers technological and advisory military solutions and has seen consistent scale and margin growth since its inception.

HII Q1’23 Investor Presentation

These three segments support HII’s disciplined capital deployment strategy, which emphasizes reinvestment into free cash flow generation through capex, alongside shareholder return through residually increasing dividends and opportunistic share repurchases, and gradual deleveraging with remaining free cash flow. The said balanced strategy ensures long-run value creation while ensuring sustainable shareholder returns and reduced debt servicing costs.

HII Q1’23 Investor Presentation

Wall Street Consensus

Analysts largely support my positive view on HII, projecting a 1Y price target of $247.10, a 5.39% increase.

TradingView

However, given the minimum price estimate, analysts predict a decline of 19.82%, to $188.00.

I believe the large range between prices reflects the firm’s dependence on U.S. DoD revenues and shifting cost perspectives given inflation and rising interest rates.

Risks & Challenges

Single-Client Model Poses Business Risk

On a primary level, the only buyer for HII’s products and services remains the U.S. military, which also happens to principally regulate HII’s industry and operations. As such, given shifts in political priorities or any reduced national interest in HII’s products, HII may be faced with existential risks of revenue and cash flow declines, materially harming investor prospects.

Manufacturing & Overall Production Delays May Lead to Reduced Free Cash Flows

Central to HII’s operational fortitude remains its strong product portfolio and subsequent backlog. However, an inability to adequately fulfill this backlog or sustain innovation in shipbuilding may lead to penalties, increased costs, and otherwise reduced profitability. Additionally, production delays may lead to HII incurring reputational harm and not being considered for future contracts and projects.

Conclusion

With its record backlog and superior shipbuilding portfolio, as well as a general lack of direct competition, HII maintains a position which should enable sustainable profitability and growth for years to come.

Read the full article here