An interesting aspect of the recent real estate investment trust, or REIT, market crash is that it affected all REITs: the good, the bad, and the average.

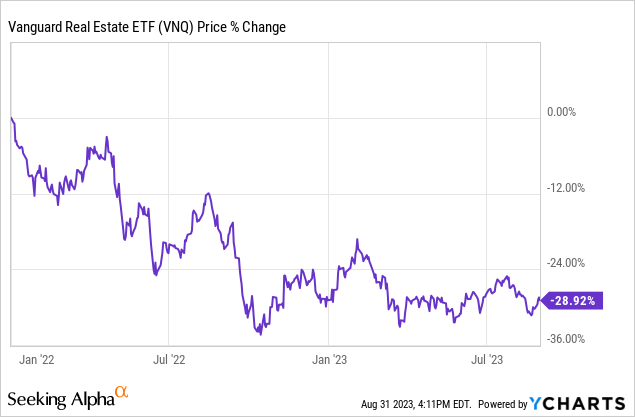

Nearly all REITs (VNQ) dropped in lockstep as if they were all equally affected by the recent surge in interest rates:

This is odd, because REITs can differ very materially from one to another:

- Some REITs are heavily leveraged. Others have fortress balance sheets…

- Some enjoy rapidly growing rents. Others are struggling to maintain…

- Some have great management teams. Others are conflicted…

And despite that, the market has reacted as if all REITs were facing significant pain and should be avoided.

We think that this is an opportunity.

Some of the highest-quality blue-chip REITs are now priced at their lowest valuations and highest dividend yields in years, and that’s despite not being heavily affected by the recent surge in interest rates.

In fact, it could be even argued that some of these high-quality REITs will ultimately benefit from this unusual period because:

- Their strong balance sheets mitigate the impact of rising interest rates.

- However, interest rates surged due to high inflation, which has resulted in rapid rent growth.

- The high inflation also increases the replacement cost of their properties.

- Finally, the high-interest rates will dampen future supply, increasing future rent growth even further.

And therefore, this is often just a case of “short-term pain for long-term gain.” The market only sees one side, which is the surge in interest rates but has forgotten about the bigger picture, which is that rents are rising and balance sheets are the strongest they have ever been.

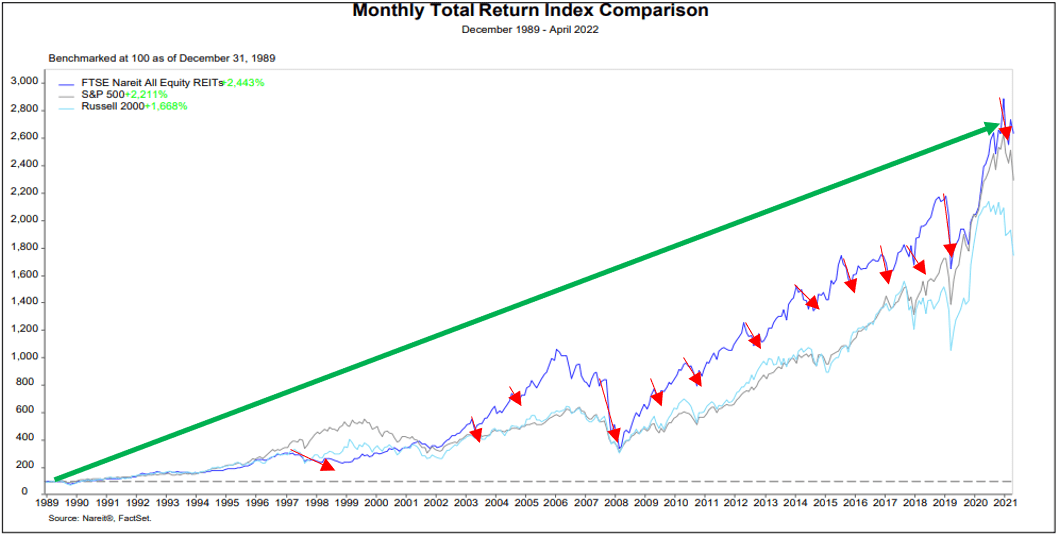

What will happen when the market finally realizes this is that REITs will recover, just as they always do:

YCHARTS

You will note from the chart above that REITs have recovered from every single crisis in history.

This time won’t be different and we are today busy accumulating high-quality REITs that have been unfairly punished by the market.

W. P. Carey Inc. (WPC)

WPC is one of the highest-quality REITs in the world, often compared to the likes of Realty Income Corporation (O).

It owns a diversified portfolio of Class A net lease properties with a large emphasis on industrial properties, which are today in high demand as a result of the growing trends of e-commerce and onshoring:

W.P Carey

It is commonly perceived to be a “blue chip” because of the following attributes:

- Strong BBB+ rated balance sheet

- Multi-decade track record of steady dividend growth

- History of significant market outperformance since IPO

- Primarily invested in rapidly growing industrial properties

- Unique capability to originate its own net lease deals with superior terms

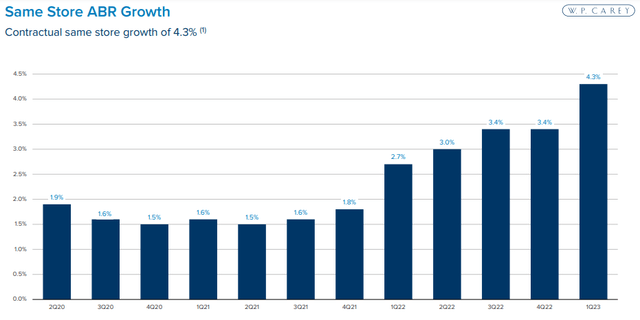

- Sector-leading lease quality with CPI adjustments resulting in rapid organic growth in today’s high inflation world:

W.P Carey

Despite that, it is today heavily discounted following its recent crash and trades at just 12.5x AFFO and a 6.5% dividend yield.

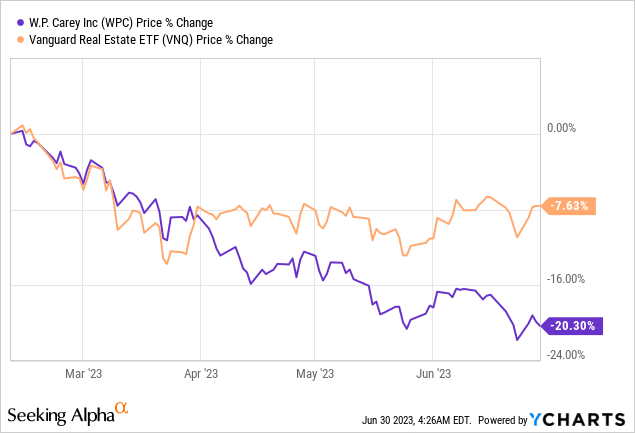

We think that now is a particularly good time to buy more shares of WPC because it has recently massively underperformed the average of the REIT sector for no apparent reason:

YCHARTS

We have previously argued that the market will likely reward WPC with a materially higher valuation in the coming years as it:

- gets rid of its U-Haul properties

- continues to increase its industrial exposure

- unwinds the rest of its small asset management business

- and accelerates its dividend growth rate.

Getting the U-Haul Holding Company (UHAL) headwind out of the way should also help its market sentiment. Its lease will expire next year, and it includes an option for U-Haul to buy back these assets at an 8.2% cap rate. The market knows that it is likely to exercise this option, reducing WPC’s rent by 2.7%.

But this isn’t the significant headwind that the market makes it seem to be.

WPC has been getting 7.2% cap rates on its transactions so far this year and it is today already buying replacement properties with its credit facility, increasing leverage, which it will then pay down next year with the proceeds from U-Haul. So, the difference is not even 100 basis points since WPC will earn some cash flow between now and then and the rents of these new acquisitions will also be hiked by then.

It seems to us that the market is overreacting by pricing such a high-quality REIT at a lower valuation than the average of the REIT sector. We think that as interest rates return to lower levels and WPC finishes its transformation, the market will likely reprice it at closer to 18x AFFO, potentially unlocking up to 44% upside from here.

This is particularly compelling when you consider that you also earn a 6.5% dividend yield that’s been growing since 1998.

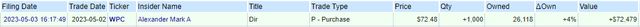

A director recently made a purchase in the open market. Since then, the share price has dropped by another 10%:

Openinsider

Crown Castle Inc. (CCI)

CCI is a cell tower REIT, and it is considered to be a blue chip because:

- It owns a large portfolio of cell towers that generate steadily rising cash flow that’s recession-resistant.

- It has a strong BBB-rated balance sheet with low debt and long maturities.

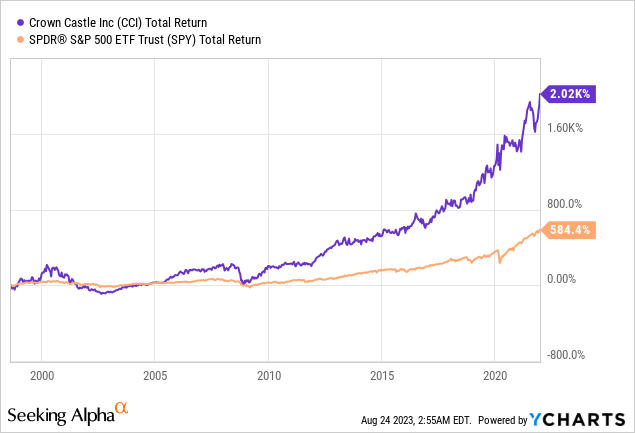

- It has one of the best track records of any REIT:

Typically, it is priced at an expensive valuation with a funds from operations, or FFO, multiple in the 20-25x range and a low dividend yield of just 3%.

But today is an exception.

The company is now priced at just 14x FFO and a 6.3% dividend yield, which is the highest yield ever for the company.

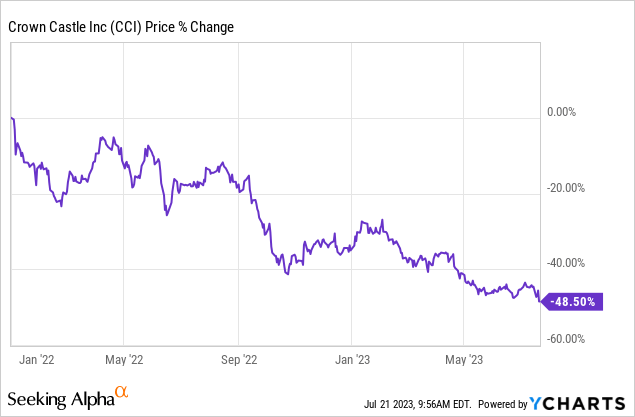

It is priced at such a low valuation because its share price has crashed over the past year. It has dropped even more than the rest of the market!

YCHARTS

It has dropped so much because CCI faces slower-than-usual growth over the next 2 years as it is dealing with some lease cancellations as a result of the recent T-Mobile (TMUS) acquisition of Sprint.

However, we think that the market is overreacting to short-term news and overlooking the company’s very favorable long-term outlook.

On the most recent conference call, the management repeated three times that they expect their dividend growth to return to 7-8% per share beyond 2025.

First statement:

“Additionally, we have reduced our risk by increasing the resiliency of our business through our long-term customer agreements and improving the strength of our balance sheet. As a result of these actions, despite a significant reduction in tower activity in the back half of 2023, we continue to expect 5% organic tower revenue growth, 10,000 small cell node deployments, and 3% fiber solutions growth by the end of this year. This resilient underlying growth across our business underpins our expectation of returning to our long-term annual dividend per share growth target of 7% to 8% beyond 2025.”

Second statement:

“As a result, we believe we are positioned to return to our long-term annual dividend per share growth target of 7% to 8% beyond 2025 as we get past the remaining large Sprint cancellations.”

Third statement:

“In a normal go forward period of time over a multi-year period we’re going to see about 5% tower organic revenue growth. And it’s likely to move a little above, a little below that in certain periods. But I think generally that’s what our expectation would be and that’s what’s driving our longer term. If we think about value creation, when we talk about being able to get back to a point where we’re growing the dividend 7% to 8%, once we’re beyond the Sprint site rationalization process that we’re in the middle of once we’re past that point, returning to being able to grow the dividend at 7% to 8% over a long period of time, underlying that is our assumption around top line growth.”

Businesses should be valued based on many decades of expected cash flow, and so the impact of a single year is limited.

Yet, the market is quick to overreact, and I think that this is what has happened here.

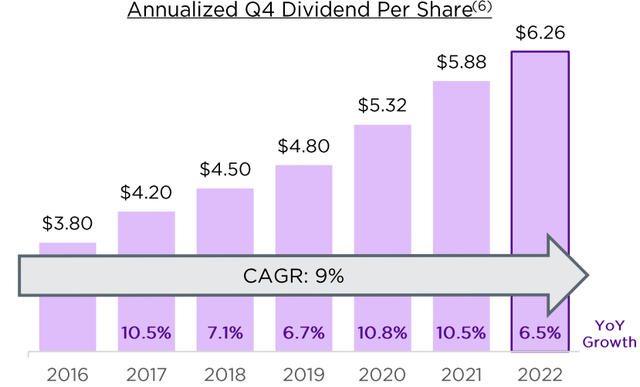

CCI is now priced at its highest dividend yield ever, surpassing 6% for the first time in its history, which is quite exceptional for a company with a track record of 9% annual dividend growth and a clear path to 7-8% annual growth beyond 2025.

Crown Castle

We think that this is a very compelling opportunity for both: more aggressive total returns seeking investors as well as more conservative income-driven investors.

As the company’s growth reaccelerates beyond 2025 and/or interest rates return to lower levels, we expect 50% upside in addition to compelling returns from the dividend yield and growth alone.

Therefore, as long as the long-term growth outlook remains unchanged, we will keep accumulating a larger position.

This is arguably the safest and fastest growing ~6% yielding REITs that you will find in today’s REIT market.

Bottom Line

Not all REITs are created equal.

The market has run away from REITs as if they were facing an existential threat, but that’s really not the case.

There are some exceptional opportunities in the rubble, and investors who are able to separate out the good REITs from the bad will likely earn very strong returns in the coming years as they recover.

Read the full article here