I recently published a bearish article on Warner Bros. Discovery (NASDAQ:WBD), “WBD.” However, after additional analysis, I admit I was wrong. My conclusion was hasty. Instead of focusing on WBD’s free cash flow, I focused more on its higher-than-expected losses. However, much of the new company’s losses are due to its merger and one-time charge-offs. I want to present a more objective analysis. Also, I recently reopened an initial position in WBD, intending to increase my holdings in the coming weeks.

By the way, I was at the Warner Bros. Studio Tour in London one year ago. While I am not the biggest Harry Potter fan, my wife is, and we had an excellent time there. What amazed me most was the studio’s money-making ability, as the Harry Potter merchandise is off the charts. I left there with three magic wands and several presents for friends and family (of course, my wife made me buy them). Nonetheless, we had a fantastic time, and I plan to return there soon.

Aside from the Harry Potter adventure, WBD is a unique company with significant potential. I’ve long been a fan of Warner Bros. and HBO’s content. Warner Bros. is the most incredible movie studio ever, and HBO makes the best shows and series globally. Therefore, while Netflix (NFLX) is a close second, WBD has (arguably) the best original content. To bring it all together, WBD’s streaming platform, Max, streamlines the best original content to viewers globally.

Max has significant growth potential and should improve monetization as we advance. Max offers Discovery content and CNN, making it an exceptional bundle worth subscribing to. While WBD’s debt load is significant, its free cash flow should cover its debt payments, enabling WBD to pay down debt efficiently. Furthermore, WBD’s revenue growth should improve, increasing income and EPS in the coming quarters. Also, WBD’s valuation should increase as sentiment improves. WBD’s stock is dirt cheap here, and its share price should increase as the company expands and continues optimizing operations in the coming years.

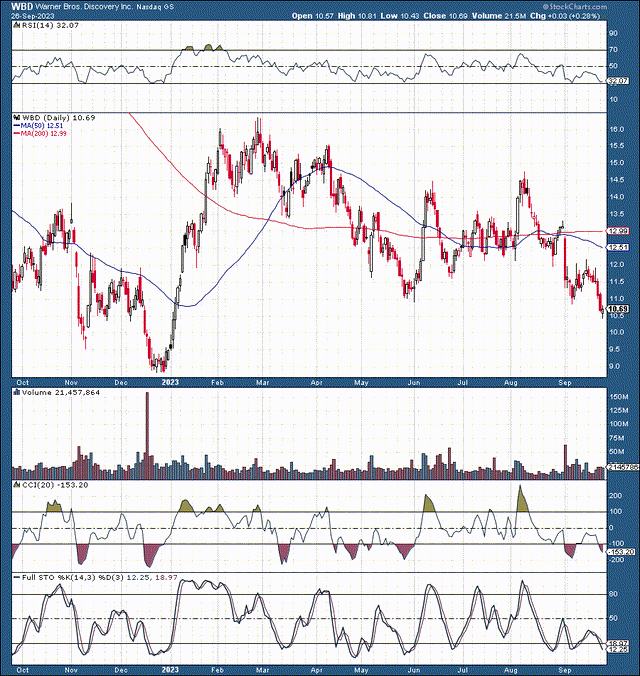

WBD – Technical Image

WBD (StockCharts.com )

WBD’s stock has been in a relatively tight range over the last year. However, with the RSI approaching 30, its stock price is oversold. We’ve seen rebounds off the 30 RSI level before and may see another move higher soon. On a longer-term basis, WBD could break out of its $9-$15 range as its fundamentals improve and sentiment improves surrounding its stock. Once WBD breaks out above $15, we could see a melt-up to the $20-$25 range soon.

WBD – The Old Content King Is Back

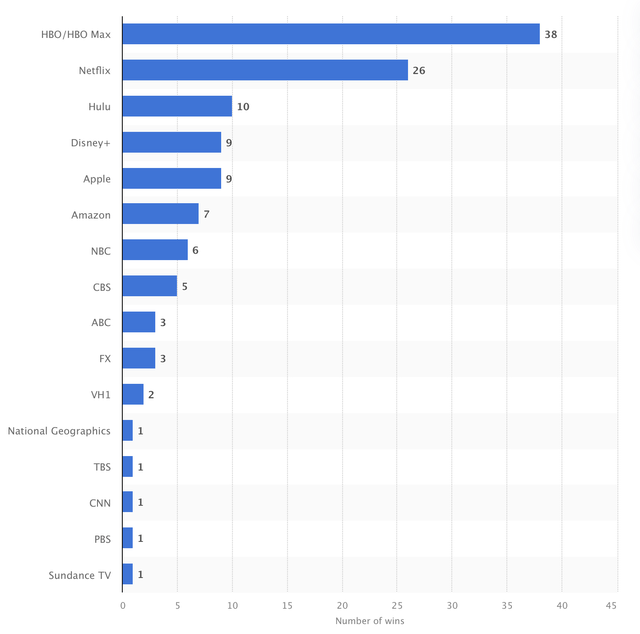

While Netflix experienced success with Squid Game, Ozark, and other series, 2022 was HBO/Max’s year. Comedies Hacks and Barry won multiple awards, and HBO clawed back the honors for Best Drama Series with Succession and Best Limited Series with White Lotus.

2022 Emmy Award Wins

2022 Emmy wins (Statista.com )

The Emmys are a continuous battle for dominance between two content giants, HBO and Netflix. With 38 Emmy wins, 2022 was HBO’s year. Moreover, 2023 could bring more of the same. HBO/Max has a robust library of exciting shows and series with multiple nominations in top categories for 2023.

The bottom line is that HBO/Max produces some of the highest-quality content globally, making it a must-have on your streaming list. Moreover, Warner Bros. Studios produces (arguably) the best movies. The Harry Potter films, The Dark Night movies, Joker, Aquaman, and others have grossed nearly $1 billion or more for WBD.

However, WBD’s most recent blockbuster, Barbie, is its highest-grossing movie. Barbie has grossed a whopping $1.4 billion, and the money should continue flowing in. The Barbie returns are fantastic, considering the movie’s budget was only around $145 million. WBD has about a tenfold return on the film, which should continue increasing. Moreover, with this remarkable success, we may see a sequel and a possible Barbie 3.

Additionally, Warner Bros. has a new Aquaman movie in its 2023 pipeline. Also, The studio should release a Joker sequel, a Beetlejuice remake, a new Lord of Rings film, and several other blockbusters in 2024. Therefore, WBD’s movie lineup is stacked, which helps the company remain ahead of its competition, enabling its streaming platform to expand in future quarters and the coming years.

WBD’s Streaming Growth Potential

It’s excellent that WBD has (arguably) the best content globally, as it should enable its streaming service to expand. Max, WBD’s streaming platform, is highly appealing. Prices range from $9.99 to $19.99 per month, providing several plan options that should enable WBD to continue improving the monetization of its streaming platform. Additionally, WBD provides the “Discovery bundle,” integrating channels like Discovery, A&E, The Food Network, Animal Planet, TLC, and more. This integration allows Max subscribers to get the best of docuseries, reality, and other entertainment in addition to the best movies, shows, and series on TV. Oh, and of course, if you want to watch the news, WBD offers CNN, another exciting addition to an already great platform.

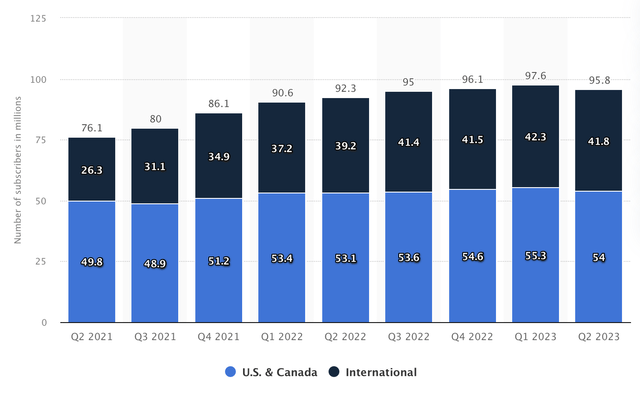

Max/WBD Subscribers Growth

WBD subscribers globally (Statista.com)

WBD had 95.8 million subscribers at the end of Q2 2023. While we see a minor QoQ decline, the YoY subscriber count increased by approximately 4%. Despite the lackluster growth numbers for Max, we should consider several factors. First, we are in a slow economic growth environment, and consumers are cutting costs, resulting in a slower-than-expected growth atmosphere for Max and other streaming services. Second, Max is still recovering from the spin-off, integration process, rebranding, and other transitory elements. Max’s growth should improve as the economy improves and the temporary elements pass, and subscriber growth could enter a sustainable uptrend.

Another factor to consider is Max’s limited exposure outside of North America, a dynamic that should improve, contributing to growth in future years. 2024 should be a big year for Max as it pushes its streaming service across Europe, Latin America, and Southeast Asia. For instance, Netflix had around 238 million subscribers by the end of Q2 2023 (about 150% more than Max). However, most Netflix users live outside North America, with about 75 million users in the U.S. and Canada. Therefore, about 44% of WBD’s subscribers come from outside North America vs. Netflix’s 69%. An increasing number of international users should join Max, leading to significant growth for its streaming platform in the coming years.

WBD – Valuation to Improve

My previous analysis focused on issues in WBD’s income statement. However, most problems with WBD’s earnings are associated with one-time charges related to the merger and should stop plaguing the company soon. Also, while WBD has a substantial debt load, it generates significant cash flow, which should cover its servicing payments, enabling WBD to pay down debt efficiently. WBD generated over $3B in free cash flow in its TTM vs. $2.2B in interest expenses. Moreover, WBD recently raised its 2023 free cash flow guidance to at least $5B, suggesting it can service its debt and decrease its debt load efficiently in the coming years.

WBD’s forward revenue and EPS estimates are relatively depressed, and WBD could achieve higher annual sales growth than the current 3% consensus estimates predict. Additionally, WBD could achieve greater EPS than the consensus estimates suggest. If WBD earns the $1.34 that the consensus estimates indicate next year, its stock is dirt cheap, around a 7-8 forward P/E here. Furthermore, as WBD’s revenue growth improves and EPS increases, its multiple should expand, implying its stock price could go much higher in the coming years.

Where WBD’s stock could be in the future

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $45 | $48 | $51 | $53.5 | $56.6 | $59.5 | $62 |

| Revenue growth | 5% | 7% | 6% | 5% | 6% | 5% | 4% |

| EPS | $1.50 | $2.00 | $2.36 | $2.76 | $3.20 | $3.68 | $4.12 |

| EPS growth | 67% | 33% | 18% | 17% | 16% | 15% | 12% |

| Forward P/E | 12 | 13 | 14 | 15 | 14 | 13 | 12 |

| Stock price | $24 | $31 | $39 | $48 | $52 | $54 | $58 |

Source: The Financial Prophet

I’m using relatively low projections, as WBD’s sales growth could be in the 7-10% range or higher in future years. Additionally, WBD’s EPS growth could be higher than expected as the company pays down debt and becomes more efficient. Also, we could see a higher forward P/E ratio than my model illustrates (15-20). Despite these modest estimates, WBD’s stock could increase severalfold in the next several years. Therefore, the stock is exceptionally cheap and worth considering as a long-term buy and hold.

Risks to WBD

Despite the bullish estimates illustrated in the model, WBD could provide worse-than-anticipated sales and EPS growth, resulting in a lower-than-expected multiple. Additionally, WBD faces competition from Netflix and other streaming platforms. Also, WBD’s profitability could be impacted negatively due to poor management, a massive debt load, worsening economic conditions, and other elements. Therefore, while WBD offers upside potential, this investment carries various risks, which investors should consider carefully before investing in WBD shares.

Read the full article here