Introduction

Canada-based IAMGOLD Corporation (NYSE:IAG) reported its first quarter of 2023 on May 11, 2023.

Note: I have followed IAG quarterly since 2014. This new article is a quarterly update of my article published on February 21, 2023.

1 – 1Q23 results snapshot and commentary

The company recorded $226.2 million in total revenues (not including Rosebel, sold in January and classified as discontinued) and posted an income per share of $0.02 or $17.0 million. However, the company received $386.4 million for the sale of Rosebel and $197.6 million (pre-tax) for the sale of its Boto Gold Project in Senegal.

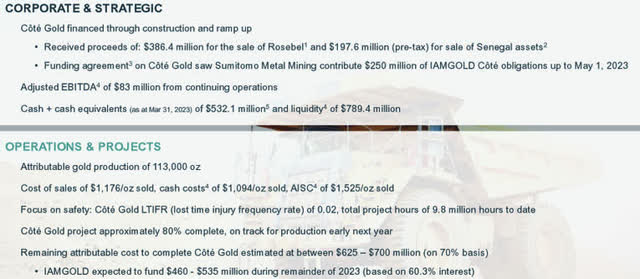

IAG 1Q23 Highlights (IAG Presentation)

Attributable Production for 1Q23 was 138K Au oz (including 25K Au ounces at Rosebel) compared to 174K Au oz produced in 1Q22.

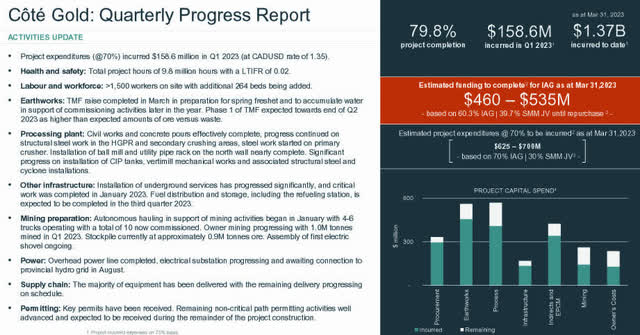

The Côté Gold project was 80% completed at the end of March 2023. The cost incurred so far was $1.37 billion, with estimated funding for IAG alone of $460-$535 million, unchanged from 4Q22 guidance. CapEx for Cote Gold in 1Q23 was $158.6 million.

IAG Cote Gold (IAG Presentation)

The financing of this huge project has been a concerning issue that affected the stock significantly in H2 2022 when the company was showing financial weakness that could eventually put the company in financial jeopardy.

Since then, IAMGOLD has sold Rosebel and Boto Gold. Furthermore, IAMGOLD amended the Joint Venture with Sumitomo, resolving the financial bottleneck that spooked investors in October 2022. The stock is now significantly up from its low.

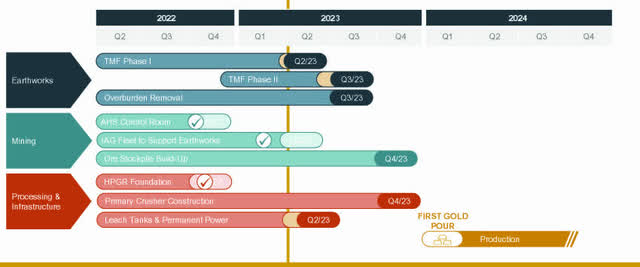

As a reminder, the first gold is expected in late 2023 or early 2024.

IAG Cote Gold Schedule (IAG Presentation)

Renaud Adams – President and CEO, said in the conference call:

The impact of Cote Gold on this company will be absolutely substantial, with a long-life low-cost asset shifting our production base to Canada. I’m excited and eager to turn our and market focus from looking back to looking ahead of what is to come. We will soon be making the transition from fixing operations and managing constructions towards the real value drivers in our business and demonstrating execution success, operation optimization, and unlocking gross potential. All for the benefit of all our stakeholders.

2 – Investment thesis

The investment thesis for IAG is turning more into a bullish story after the company managed to resolve the Côté Gold project financing situation.

As the new CEO Renaud Adams said in the conference call, it is a terrific project that will improve the bottom line for IAG tremendously starting in 2024. Still, it has been a money pit that nearly annihilated the company.

It should serve as a crucial lesson on how difficult it is to successfully complete such a massive gold project, especially when the estimated initial CapEx totally misses the mark.

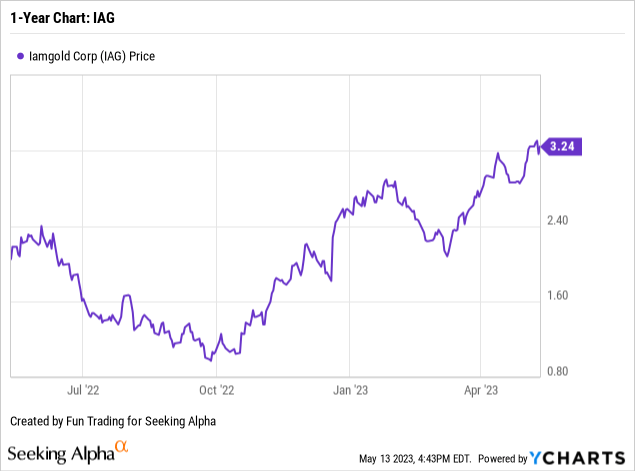

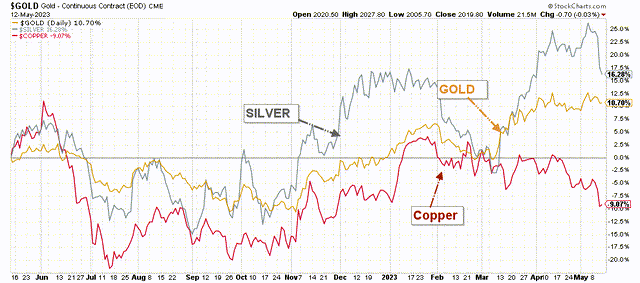

However, the recent rally in gold, with gold closing at over $2,000 per ounce, up 17% YoY, was what the company needed urgently.

IAG 1-Year Gold (Fun Trading StockCharts)

Côté is expected to produce 495K Au oz per year in its first six years and 365K Au oz over the life of the mine. It will be above 320K Au ounces net for IAG.

Also, the Gosselin deposit, located immediately adjacent to the Côté pit, contains 3.4 Moz in Indicated Mineral resources and an additional 1.7 Moz in Inferred Resources.

It will be more struggling ahead until the project is finally completed, and I expect more volatility. Still, I believe it is time to use the stock weakness to accumulate IAG expecting higher highs as we advance through 2023.

Hence, I recommend trading about 50% of your short-term LIFO and keeping a medium-core long-term position for a much higher target. Trading LIFO is the most adapted strategy that allows you to profit while waiting for a significant uptrend.

IAMGOLD Corp. – Financial history Snapshot ending 4Q22 – The Raw Numbers

| IAMGOLD | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 |

| Total Revenues in $ Million | 356.6 | 334.0 | 343.3 | 330.1 | 226.2* |

| Net Income in $ Million | 23.8 | -9.6 | -108.3 | 24.0 | 17.0 |

| EBITDA $ Million |

134.9 |

100.1 |

-44.4 |

105.4 |

82.8 |

| EPS diluted in $/share | 0.05 | -0.02 | -0.23 | 0.05 | 0.02 |

| Operating Cash Flow in $ Million | 142.3 | 81.9 | 117.7 | 66.8 | 28.8 |

| Capital Expenditure in $ Million | 169.1 | 270.0 | 240.1 | 212.7 | 223.3 |

| Free Cash Flow in $ Million | -26.8 | -188.1 | -116.4 | -145.9 | -194.5 |

| Total cash $ Million | 524.4 | 452.9 | 536.1 | 407.8 | 532.1 |

| Long-term Debt in $ Million | 463.3 | 612.0 | 844.6 | 918.7 | 661.8 |

| Shares outstanding (diluted) in Million | 482.4 | 478.9 | 479.0 | 478.9 | 483.1 |

Data Source: Company release

* Revenue represents

Gold Production And Balance Sheet Details

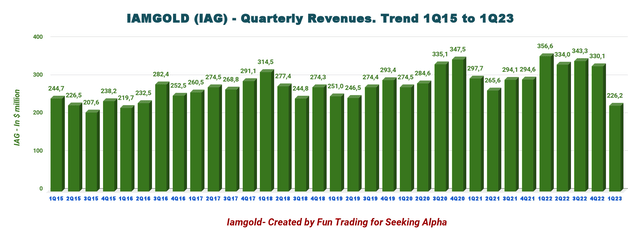

1 – Revenues were $226.2 million (Continued operations only) in 1Q23

IAG Quarterly Revenue History (Fun Trading) For the first quarter that ended March 31, 2023, quarterly revenues came in at a record $226.2 million. The revenue indicated excludes the Rosebel revenues considered a discontinued operation which was sold on January 31, 2023. The net earnings attributable to equity holders were $0.02. Also, EBITDA was $82.8 million.

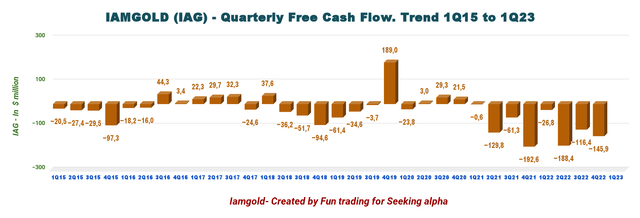

2 – Free cash flow was a loss of $194.5 million in 1Q23

IAG Quarterly Free Cash Flow History (Fun Trading)

Free cash flow is again a significant loss this quarter for IAMGOLD, and this trend will persist until the Côté Gold project is completed at the end of 2023.

IAG’s trailing 12-month free cash flow is now a loss of $539.1 million and another estimated loss of $194.5 million in the first quarter.

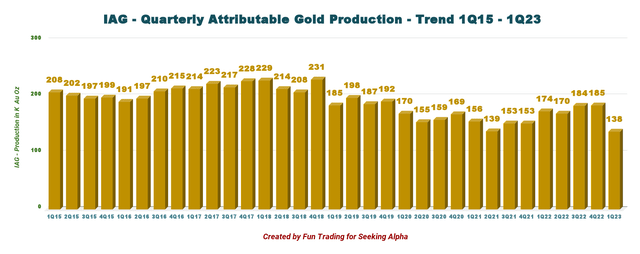

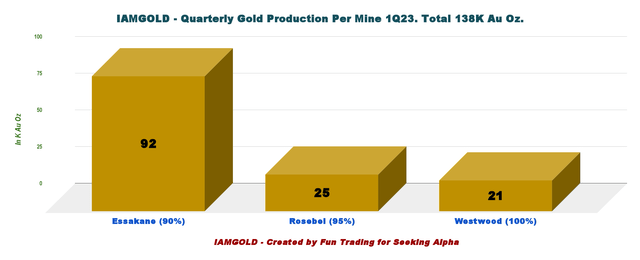

3 – Gold Production Details; Total Production Was 138K Au Oz in 1Q23 (including part of Rosebel production)

3.1 – Gold production details

IAG Quarterly Gold Production History (Fun Trading)

IAMGOLD produced 138K Au oz during the first quarter of 2023 (including Rosebel), compared to 174K Au oz during 1Q22, as shown in the graph below.

IAG Quarterly Production per Mine 1Q23 (Fun Trading) IAMGOLD’s flagship mine is Essakane in West Africa, representing 66.7% of the company’s total output in 1Q23.

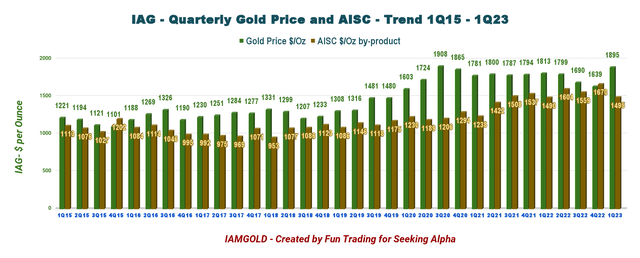

3.2 – Quarterly AISC and Gold price

AISC is now $1,495 per ounce. High AISC is due to Cote Gold construction.

IAG Quarterly Gold Price and AISC History (Fun Trading)

3.3 – 2023 Guidance – unchanged.

Total production is expected to be between 410K and 470K Au ounces in 2023. AISC is expected to be between $1,625 and $1,700 per ounce.

IAG 2023 Guidance (IAG Presentation)

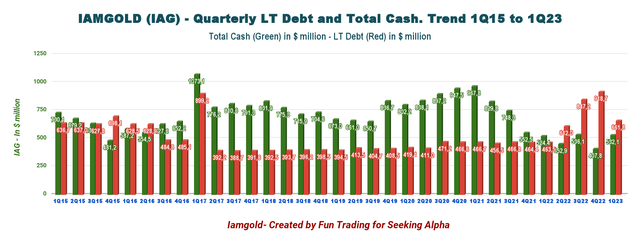

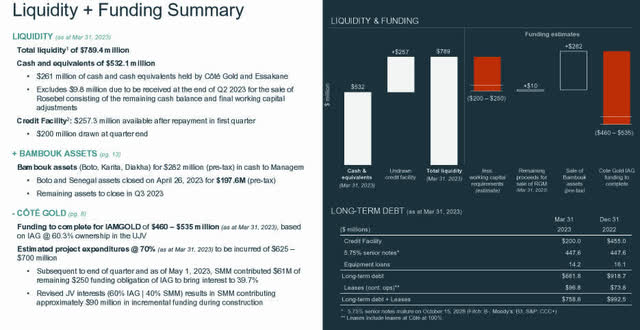

4 – The company had $129.7 million in net debt and strong liquidity of $789.4 million on March 31, 2023.

IAG Quarterly Cash versus Debt History (Fun Trading) IAMGOLD has a net debt of $129.7 million and total liquidity of approximately $789.4 million as of March 31, 2023. Total cash is now $532.1 million. Long-term debt plus lease is $758.6 million. At March 31, 2023, the Company had available liquidity of $789.4 million comprised of $532.1 million in cash and cash equivalents and $257.3 million available under the Credit Facility. As at March 31, 2023, $261.0 million of cash and cash equivalents was held by the Côté Gold UJV and Essakane. The Côté Gold UJV requires its joint venture partners to fund, in advance, two months of estimated future expenditures. IAG Liquidity (IAG Presentation)

Technical Analysis (Short Term) and commentary

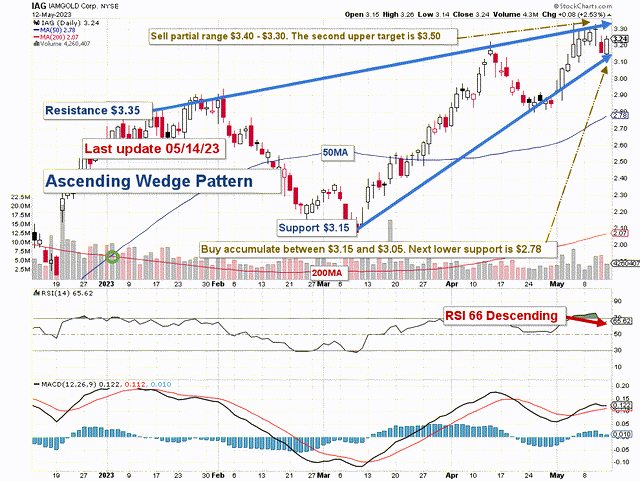

IAG TA Chart short-term (Fun Trading StockCharts)

IAG forms an Ascending Wedge pattern with resistance at $3.35 and support at $3.15.

A rising wedge is a bearish stock pattern that begins wide at the bottom and contracts as trading range narrows and the prices move higher. This indicates slowing momentum and it usually precedes a reversal to the downside, meaning that traders can identify potential selling opportunities.

The short-term trading strategy is to trade LIFO for about 50% of your position. I suggest selling between $3.40 and $3.30 with possible higher resistance at $3.50 and waiting for a retracement between $3.15 and $3.05 with lower resistance at $2.78.

Watch the gold price like a hawk.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Read the full article here