Main Thesis / Background

The purpose of this article is to evaluate the Amplify Online Retail ETF (NYSEARCA:IBUY) as an investment option at its current market price. The fund’s objective is “to provide investment results that, before fees and expenses, correspond generally to the price performance of the EQM Online Retail Index. The Index is a globally-diverse basket of publicly-traded companies that obtain 70% or more of revenue from online or virtual sales.”

I only cover this fund about once a year and the last time I did so was in early 2022. At that time I thought IBUY lacked value and investors would be wise to hold off on buying it. In hindsight I was right – but I should have been more bearish as the fund has lost 26% of its value since then!

Fund Performance (Seeking Alpha)

Given the large drawdown in this fund that I had once recommended, I thought it was time to take another look at it. After review, I continue to believe caution is warranted. I don’t see a lot of value – despite the sharp drop – and I will explain why in detail below.

Bulls Have Been Winners In 2023

Before I dig in to why I do not like IBUY at this juncture I want to take a moment to discuss the short-term performance. As I showed in the prior paragraph this fund has been a bit of a dog over the longer term. But for those who may be watching this ETF in 2023 – the story is overwhelmingly positive. Risk-on plays have been rewarded for the most part and IBUY is no exception. The fund is actually beating the S&P 500 and has seen a rise over 27% YTD:

YTD Performance (IBUY) (Seeking Alpha)

I bring this up because the bulls are firmly in control since January. This means IBUY is a bit of a momentum play and that could entice some, especially swing traders. While I personally feel the gains are a bit too far, too fast and due for a correction – I could very well be wrong. Often times we see momentum plays carry on for a long time and IBUY has that opportunity. This is a key risk to consider and central to why I wouldn’t suggest selling and/or shorting this fund at the moment. “Hold” seems more appropriate in this climate.

Share Of Online Shares Has Moderated

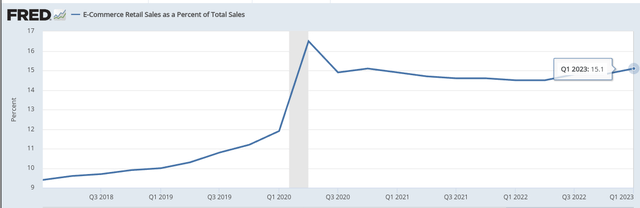

My first point of concern looks at online purchases and their share of total retail spend. This has long been a bullish case for the sector as a whole – and IBUY as an extension. The “e-commerce” retail play has been a long talked about trend that investors have wanted to take advantage of and IBUY played directly into that attitude. Then, when Covid hit in 2020, this sector took off as people sheltered at home and greatly increased their online spending habits.

While this gave a huge boost to the sector, now that countries have (finally) opened back up, the trend has moderated. To be fair, I still believe online spend will continue to grow as a category, but it probably won’t be a boom (or bust) phase now that the world has re-adjusted:

E-Commerce Share of Total Retail Spend (US) (St. Louis Federal Reserve)

This is very relevant to IBUY in particular because, as discussed in the opening paragraph, this fund owns companies that generate a majority of their revenue in online sales. The logic here is that as online spend moderates and grows more slowly, these companies are going to see future expectations come down a bit. Does this mean they won’t perform well in the future? Of course not. But it does suggest to me that the price multiple investors will be willing to pay will re-adjust to reflect this slower growth reality.

This is key to why I see “hold” as the right rating. I am not predicting a dire scenario for this sector or fund. But I am seeing slowing growth and a less favorable consumer backdrop. With IBUY’s recent gains pricing in a lot of upside, the tone from me would be caution.

Total Retail Sales Seeing Modest Gains

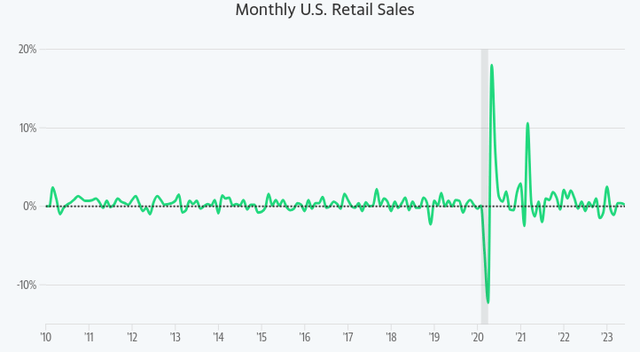

Looking beyond just online spend, I also see some reasons for less optimism. While IBUY is focused primarily on online spending, it is not 100% exclusive to this area. Further, total spending and consumer sentiment still impact online spend in similar ways. If households are stretched and/or if they lack a positive outlook for the future, spending is likely to fall both in-store and online. So understanding the broader macro-backdrop is also important.

This is another area where I see a mixed story. Again, this is not meant to be alarmist. Consumers have remained resilient despite rising interest rates, ongoing war in Europe, and the threat of a recession. In that sense the story is quite good. But we have to bear in mind that retail sales have been up and down in terms of growth this year. That isn’t really a scenario to be wildly bullish:

Monthly Change in Retail Sales (US) (Yahoo Finance)

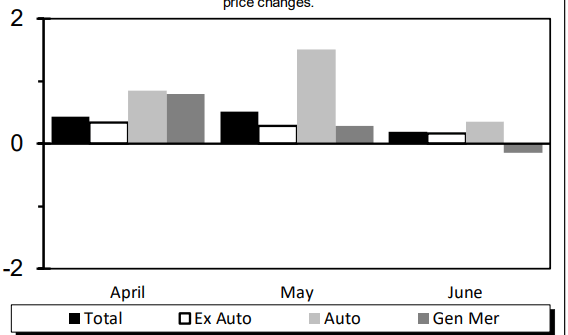

What I take away from this is to be selective with opportunities in the retail/consumer discretionary sector. Consumers are clearly spending in some areas but are very picky in others. This has been the case for a very and was highlighted in the Census Bureau’s June trade survey released last week:

Advanced Monthly Retail Trade Survey (US Census Bureau)

This could mean that an ETF or other fund may not be the right approach. These passive products hold a lot of companies – the good and the bad – and I think this environment calls for a more proactive approach to retail investing. This makes me lukewarm on IBUY, but not in isolation. This outlook extends beyond just this fund and to most of the sector. With consumers “resilient” but also picky, investors should mirror that strategy with what stocks they buy in my view.

Rising Gas Prices Will Dent Spending

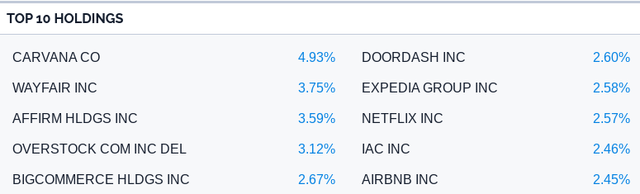

My next thought is about the future. I think consumer spending is about to take a little bit of a hit over the next few months because gas prices are starting to creep back up again. This limits what consumers and households can pay for discretionary and “want” items (as opposed to needs). IBUY is filled with more discretionary companies – those focused on goods we don’t really “need” and travel, as shown below:

IBUY’s Top Holdings (Amplify)

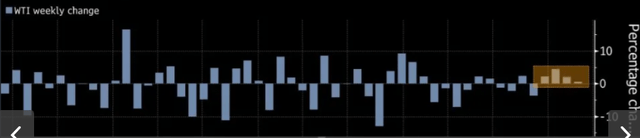

With this understanding it should be fairly clear why I see oil’s move as potentially hurting the fund. While oil had taken a big drop in 2022, the bulls are back in control. In fact, WTI crude has risen for four consecutive weeks, which is quite unusual based on historical trends:

WTI Crude Weekly Price Changes (Bloomberg)

The conclusion I draw here is that crude has been continuously rising and that is going to creep into the price at the pump and into consumer goods and services in the coming weeks. Can this reverse course? Absolutely. Each reader should evaluate their own outlook for crude and how that is going to impact consumer sentiment and spending. But in the immediate term crude is rising continuously and that is going to have an impact on retail in some capacity. That is another supporting factor for not upgrading my outlook on IBUY.

Bottom-line

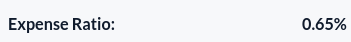

IBUY has been a winner in 2023 but a loser longer term. This continues to be an expensive way to access the retail sector with a subpar history and a lofty expense ratio:

IBUY’s Expense Ratio (Amplify)

The simple truth is there are much cheaper ways to play the retail sector and – if one is inclined – to pick up some of the individual online names that they deem attractive. That would be the strategy I would take, rather than paying this steep expense ratio for a handful of foreign names that may or may not boost the fund’s total return.

With common retail/consumer discretionary ETFs from State Street (STT) and Vanguard offering a better value proposition in terms of fees, I would have to be very bullish on online commerce to justify taking a position in IBUY. Given that sales have been posting only small monthly gains, e-commerce’s share has moderated, and oil prices are going to put a dent in consumer’s pockets, I think a neutral rating on IBUY is appropriate. Therefore, I am reaffirming my “hold” stance and suggest readers approach this fund carefully at this time.

Read the full article here