On our coverage of Icahn Enterprises (NASDAQ:IEP) exactly three months back, we were not too optimistic for the prospects of the company.

The math is still not in your favor. The option pricing now suggests a distribution elimination by March 2024, so we will double down on our prior verdict. You will see a sub 50 cents distribution soon and an elimination or a virtual elimination (say 10 cents a quarter), is the most likely outcome.

Source: Distribution Cut, Don’t Get Too Comfortable With The 18% Yield

Of course no one believed that, like no one believed the option pricing which was close to certainty on the first distribution cut.

The put-call parity model suggests that you are definitely going to get one more large distribution and then the odds imply a cut for the November payment, by 75% or so.

Source: 2 More Rate Hikes Could Seal The Deal On The Distribution

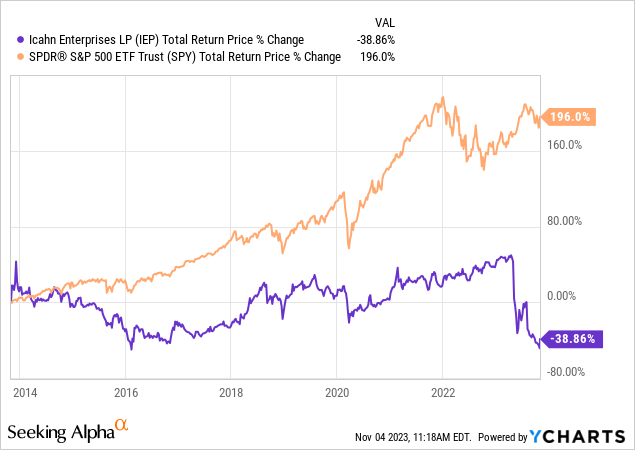

The stock has predictably fallen and total returns have been quite poor.

Seeking Alpha

The company did maintain the distribution in the most recent quarter and that was a pleasant surprise to the bulls. We examine the Q3-2023 numbers and update our outlook.

Q3-2023

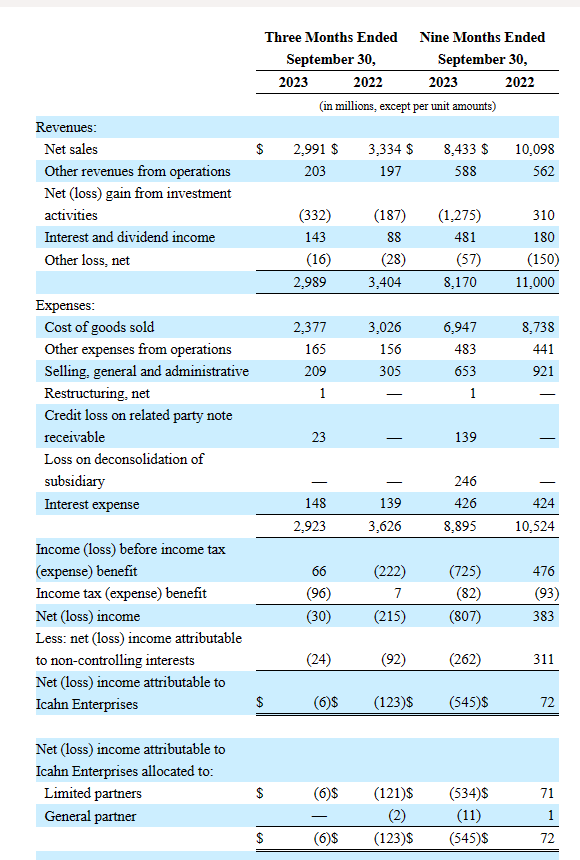

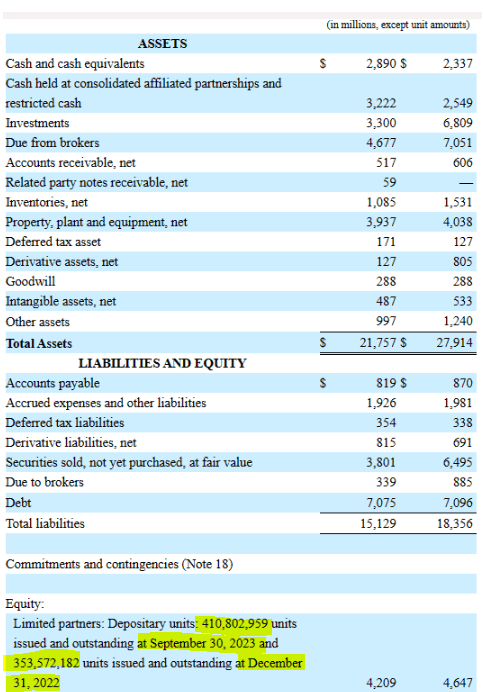

Investors tend to skip past the standard GAAP numbers these days and adjusted figures are all they care about. But these standard numbers are instructive as they go to show just how difficult it is for some companies to actually make money. IEP fell in that category this quarter and you can see the small losses after accounting for the net investment losses.

IEP 10-Q

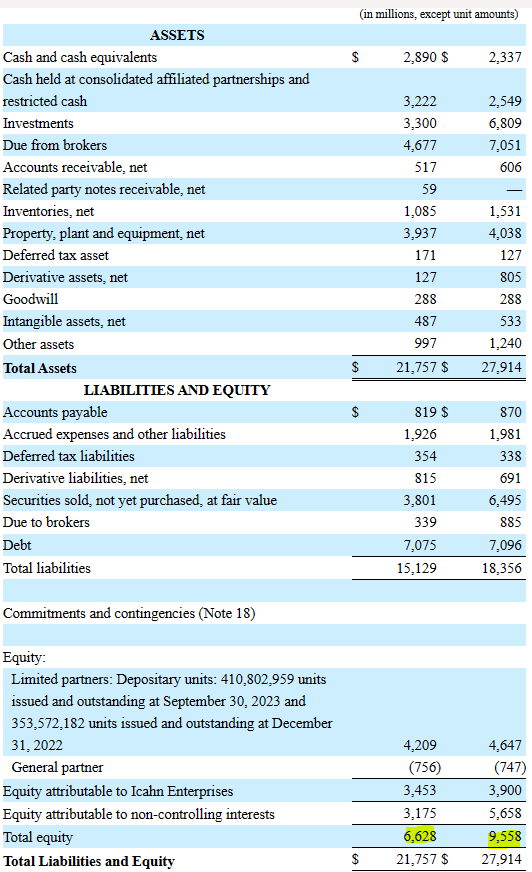

At the balance sheet level as well, you can see the general decrease in total equity, though granted that a lot of that was for non-controlling interests.

IEP 10-Q

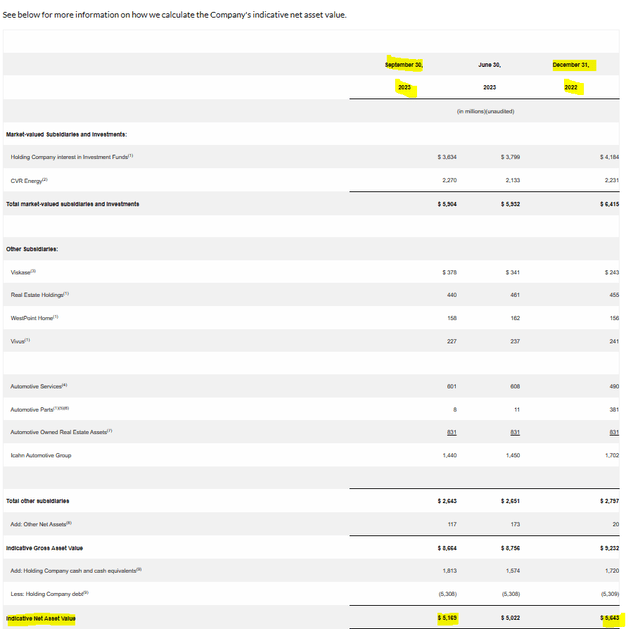

So none of the standard statements show valuation creation or ability to pay that hefty distribution. Of course for the ones that do take the Net Asset Value or NAV seriously, the company did report a rather interesting increase in that figure quarter over quarter.

As of September 30, 2023, indicative net asset value increased $147 million compared to June 30, 2023, and decreased $474 million compared to December 31, 2022, respectively. The year-to-date figures include non-recurring losses in connection with Auto Plus bankruptcy. The change in indicative net asset value includes, among other things, changes in the fair value of certain subsidiaries which are not included in our GAAP earnings reported above.

Source: IEP Press Release

That $147 million was primarily composed of $137 million movement in the fair value of CVR Energy (CVI). The stock is quite volatile and as of today has retraced those quarter over quarter gains. Still perhaps some investors may take solace in the fact that NAV increased while the company paid the large distribution of $1.00 this quarter.

Outlook

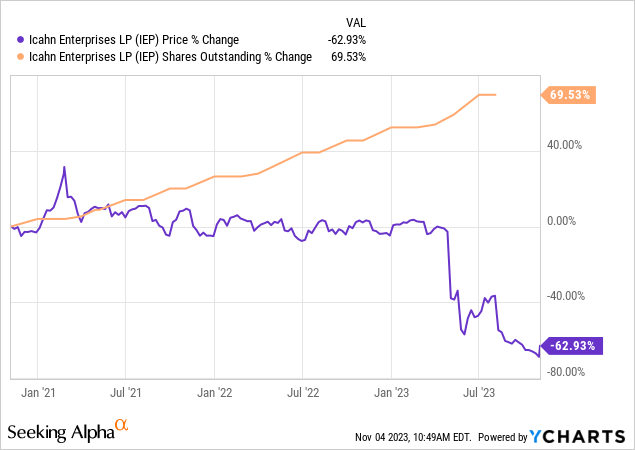

That below is the three year chart of the unit price and units outstanding.

The units outstanding don’t go all the way as Y-charts has not updated for the most recent quarter. But you have that number in the balance sheet.

IEP 10-Q

410.8 million units is a 16% increase over the units outstanding on December 31, 2022. Quarter over quarter we see about a 4.4% increase in units.

Depositary units: 393,458,414 units issued and outstanding at June 30, 2023 and 353,572,182 units issued and outstanding at December 31, 2022

Source: IEP Q2-2023 8-K.

A key fact here is that the pace of unit dilution (17.34 million units added) has remained almost the same in Q3 versus Q1 and Q2 (average of 20 million each). This is despite the distribution being cut in half. Think about how problematic that is. The key reason is of course the lower unit price as that is the price people reinvest the distributions at. On a longer timeframe, even if you believe the NAV as being scrubbed of all sins, and completely disregard the short side thesis, the dilution is very visible.

IEP Press Release

IEP’s own calculated NAV per unit was $15.96 in December 2022 and has fallen to under $13.00 as of Q3-2023. If you are banking on IEP continuing the distribution at this rate, you are in essence betting that the company can generate a $4.00 of real owner’s earnings on $13.00 of NAV. Very few investors have compounded anywhere close to 25% per annum and that is what is needed here. In fact, over the last decade, IEP’s total return has been about negative 3.5% annually.

Even if take the absolute peak price, you get to about 6% compounded returns (inclusive of distributions). That era included the ZIRP (zero interest rate policy) bubble and complete disregard for underlying NAV. So when you have 5.5% risk free rates, it might be quite a reach to expect IEP to suddenly start delivering 25% annual returns.

Verdict

There are two big risks here. The first is that this finally catches up to NAV. This is hardly a preposterous idea and the stock came down as low as $16.04 recently. We have several quality CEFs trading at big discounts to NAV and the only thing holding IEP back is the distribution. Do note that this NAV is constantly going lower as well, thanks to unlimited stock issuance. So when it catches up, you lose multiple years of distributions.

The second risk is that we go right through that NAV when the distribution is cut again. Investors can ignore the writing on the wall after the first cut, but they are likely to go into full panic on the second one. When should we expect it?

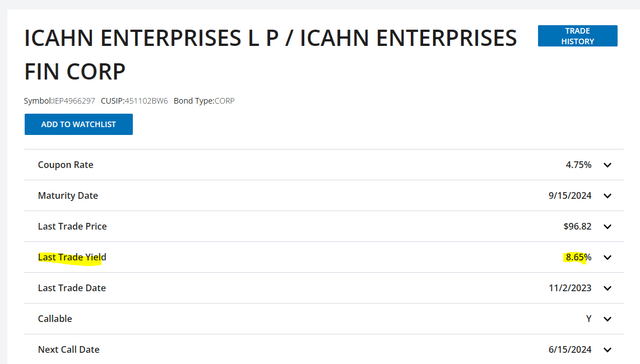

Well, the company’s nearest dated bonds are yielding 8.65%.

FINRA

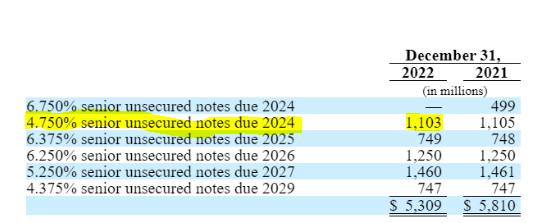

That is a big tranche worth $1.1 billion.

IEP 10-K 2022

We doubt this gets refinanced at less than double digit rates so a pay down is probable. IEP has cash on the balance sheet, but the refinancing issues are big over the next 3 years.

So that first bond maturity would be our upper limit for how long things can go on. Even the cash amounts paid to the few that don’t reinvest, will become too much of a drain by then. Interestingly enough, option pricing has become a bit mixed and is no longer having a clear signal as to when the cut occurs. So we might actually get one or two more distributions at the current rate before the rug pull.

Also note here that IEP is trading well above its NAV and that gives it a chance to do a secondary offering which boosts liquidity and also boosts NAV. So we would not get too bearish right away. The stock is also 40% below its 200 day moving average so some advancement is probable as the immediate cut risks fade. But the next one is coming and all that remains for the dividend chasing crowd to do, is to time the exit.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here