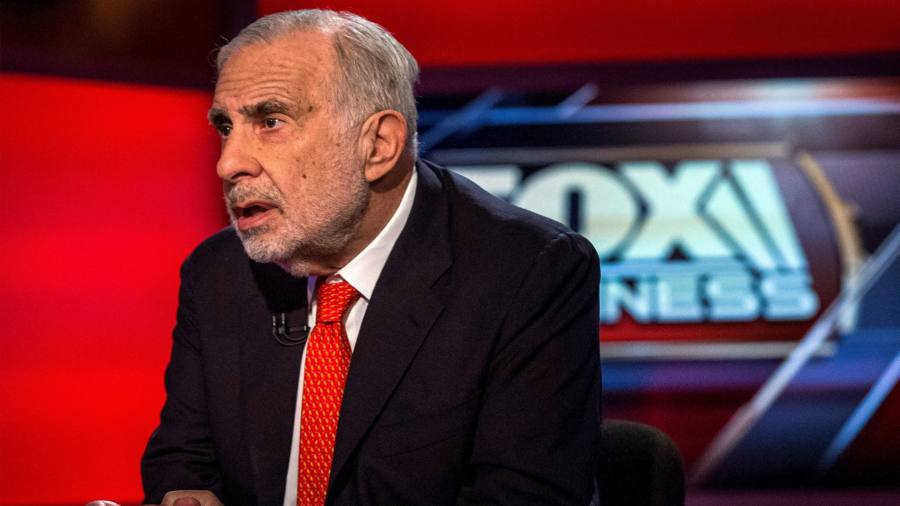

US short seller Hindenburg Research has unveiled a position against Icahn Enterprises, the publicly listed fund run by activist Carl Icahn, knocking its share price and setting up a battle between two of Wall Street’s most feared and outspoken investors.

Hindenburg said in a report on Tuesday that it believed Icahn Enterprises was overvalued and held some of its private assets at an inflated worth. Shares in Icahn’s group fell 15 per cent after the report’s release, cutting its market capitalisation to $15bn.

Icahn Enterprises, which is majority owned by Icahn, is the third high-profile company targeted by Hindenburg this year. The short seller and its founder Nathan Anderson were at the centre of an international media storm in January after Hindenburg alleged corporate fraud at Indian conglomerate Adani Group, which the company has denied.

Icahn, a legendary investor known for striking fear in corporate executives, has redefined how public companies are run and is at present embroiled in a bitter battle with genome sequencing company Illumina.

At the centre of Hindenburg’s thesis on Icahn Enterprises is the dividend the vehicle pays out to its shareholders, which it says has contributed to an “extreme” premium to its net asset value.

The short seller highlights that similar vehicles, such as those set up by Bill Ackman’s Pershing Square Capital Management and Daniel Loeb’s Third Point, trade at a discount to their NAV.

Icahn Enterprises pays shareholders an $8 per share annual dividend but Icahn controls about 85 per cent of the company and takes his payment in the form of newly issued stock. The remaining investors take their dividend payment in cash, which Hindenburg alleges is being funded by the company selling stock.

“In brief, Icahn has been using money taken in from new investors to pay out dividends to old investors,” Hindenburg states in its report.

The Financial Times last year highlighted that Icahn’s stock dividend payments had caused its outstanding shares to explode in recent years. The NAV of Icahn Enterprises has declined more than two-thirds over the past decade owing to the stock dilution and investment losses from market hedges Icahn maintained during a bull market.

“I don’t want to take the cash out. I like to use the cash to be my army, so to speak,” Icahn told the FT in February 2022.

Hindenburg also noted Icahn had taken a loan against 181.4mn shares, or the majority of his Icahn Enterprises holdings, which the business had disclosed in its annual report.

Icahn said in a securities filing in February that he had “sufficient additional assets to satisfy any obligations pursuant to these loans without recourse to the depositary units”.

A representative for Icahn did not immediately reply to an email seeking comment.

Read the full article here