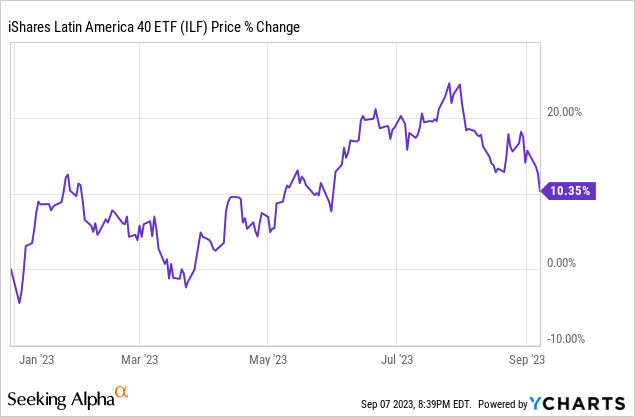

Value equities and equity segments have had a terrible year, with most moderately underperforming the S&P 500, significantly underperforming the Nasdaq-100. Latin American stocks and funds, including the iShares Latin America 40 ETF (NYSEARCA:ILF), have been one of the few exceptions, with these very slightly underperforming relative to U.S. equities YTD. Latin American equity fundamentals remain reasonably strong, with these securities trading at very cheap valuations, and strong earnings growth. Although dividends have declined, the fund’s 7.0% SEC yield / forward yield remains strong. A cheaper dollar means lower potential gains from currency price normalization, but the dollar remains expensive.

In my opinion, ILF’s fundamentals and overall value proposition remain quite strong, and so the fund remains a buy.

ILF – Quick Overview

A quick look at the fund before a more in-depth look at how its fundamentals have changed YTD.

Strategy and Holdings

ILF is an equity index ETF, tracking the S&P Latin America 40 Index. The index includes the 40 largest Latin American stocks, subject to a basic set of liquidity, trading, etc., inclusion criteria. These securities encompass over 70% of the region’s total market-cap, as Latin American public equity markets are relatively small and underdeveloped.

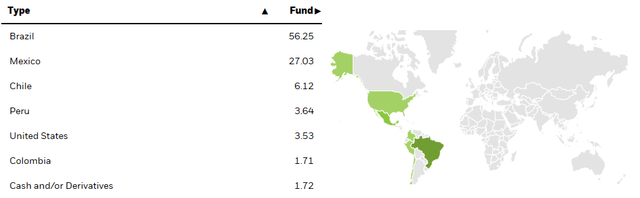

ILF invests in just five Latin American countries, as most of these have a tiny number of publicly-traded equities, and would have negligible weights in a market-cap weighted fund. Brazil and Mexico dominate the index, due to their comparatively large economies and public equity markets.

ILF

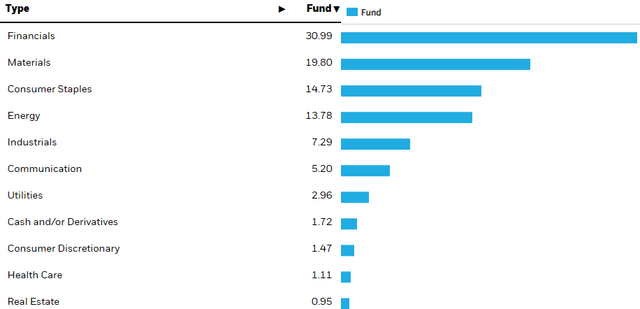

ILF provides exposure to most relevant industries, with the notable exception of tech. The fund is overweight financials, lots of large publicly-traded banks in the region, and materials / energy, lots of commodities and natural resources too.

ILF

Benefits and Investment Thesis

ILF’s investment thesis is quite simple, and rests on the fund’s strong dividends and cheap valuation.

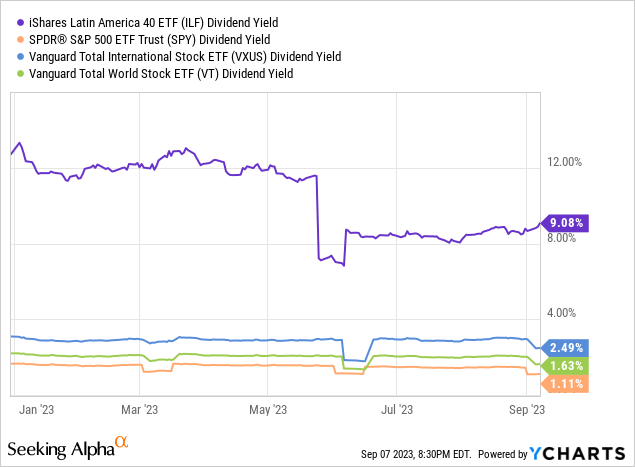

The fund currently yields 9.1%, more than U.S., international, and global equity indexes.

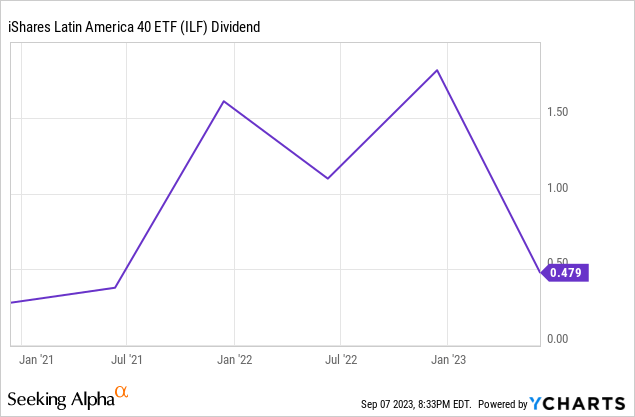

ILF’s dividends have seen strong growth since inception too, but with heavy volatility, and recent cuts.

Seeking Alpha

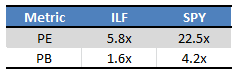

ILF trades with an incredibly cheap valuation, at close to a 75% discount to the S&P 500.

Fund Filings – Chart by Author

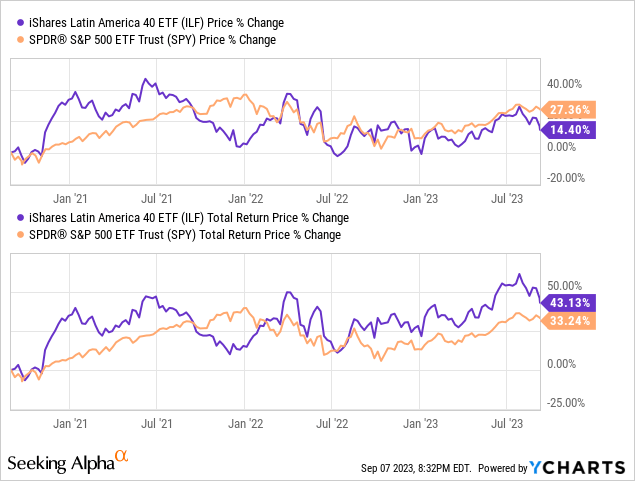

ILF’s cheap valuation could lead to significant capital gains and market-beating returns moving forward, contingent on valuations normalizing. ILF has seen good capital gains for the past three years or so, although lower than those of the S&P 500. The combination of good capital gains and strong dividends led to outperformance, however.

Risks and Downsides

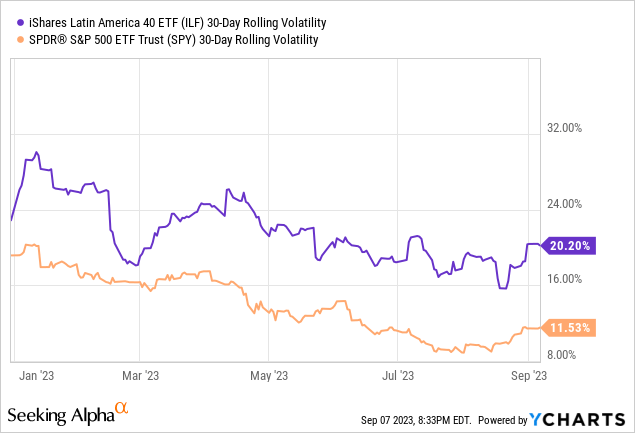

ILF’s Latin American stock holdings are incredibly risky, due to corporate governance issues, foreign currency exposure, excessive reliance on volatile commodity prices, and market perceptions of risk.

ILF itself is more volatile than the S&P 500.

As are the fund’s dividends.

Losses tend to be very high during downturns and recessions, as was the case in 1Q2020.

Data by YCharts

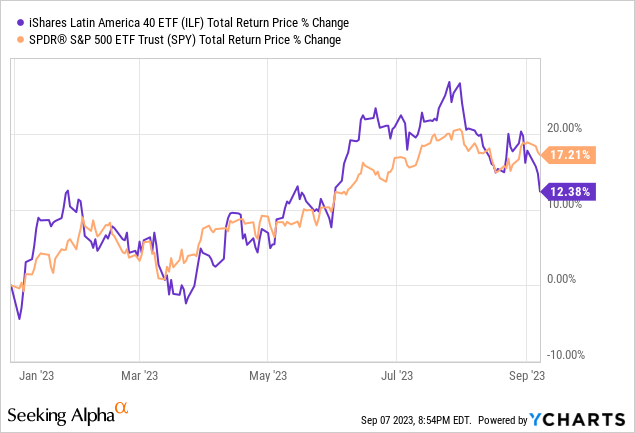

ILF’s volatility is an obvious, significant risk and negative. An issue I’ve found with the volatility is that it makes fund performance strongly dependent on timing. As an example, ILF has achieved reasonably good double-digit returns YTD.

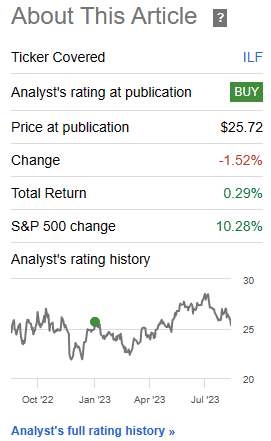

Returns have been much lower since I last covered the fund, in January of this year.

ILF – Previous Article

Returns were much stronger when my article was first published.

Investors are looking at double-digit differences in performance for just a few weeks / months differences in timing. Bear in mind, returns for the S&P 500 were much tighter.

ILF is a cheap, high-yield, risky fund. On net, I think the fund is a strong investment opportunity, but risks are definitely quite high.

With the above in mind, let’s have a look at some of ILF’s more recent developments.

ILF – Recent Developments

Dividend Cuts

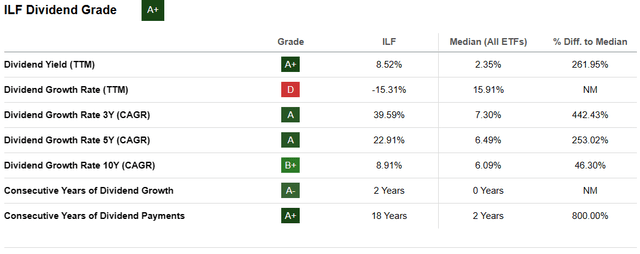

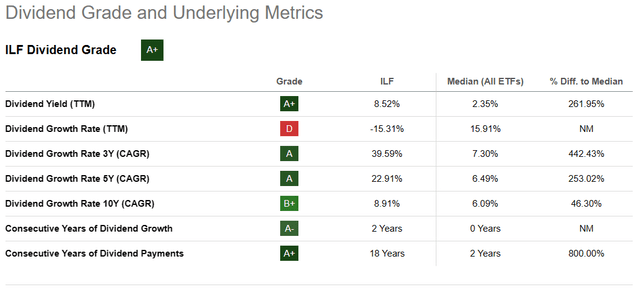

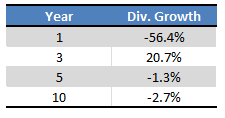

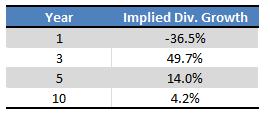

ILF’s dividends are down over 15% these past twelve months. Longer-term dividend growth remains positive, and very strong, however.

Seeking Alpha

Although the figures above are accurate, excessive dividend volatility and recent reductions in income make them somewhat uninformative. Comparing the latest semi-annual dividend to those in prior years gives me much worse figures.

Seeking Alpha – Chart by Author

On the other hand, ILF’s latest semi-annual dividend was much lower than expected. Said dividend annualizes to 3.6%, but the fund generated 7.1% in income last month, as per its SEC yield. Said gap should result in an above-average dividend payment in late 2023, as occurred in 2022 and 2021. Assuming that this will indeed be the case, I arrived at the following dividend growth figures.

Seeking Alpha – Chart by Author

In my opinion, the above figures are the most informative, indicative of the dividends / dividend growth realized by the fund. Still, excessive dividend volatility makes it difficult to know for certain, as the figures are strongly dependent on assumptions made / time periods analyzed.

In any case, it seems certain that ILF’s dividends have decreased YTD, but that the longer-term dividend growth track record is stronger.

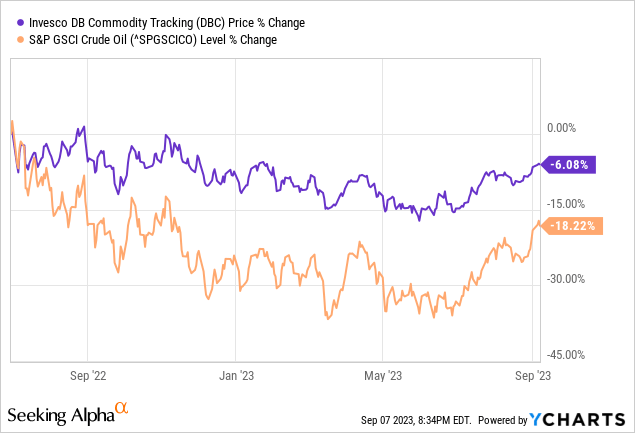

ILF’s dividends were cut as commodity and energy prices declined from 2H2022 onwards, leading to lower earnings and dividends for many of the fund’s holdings.

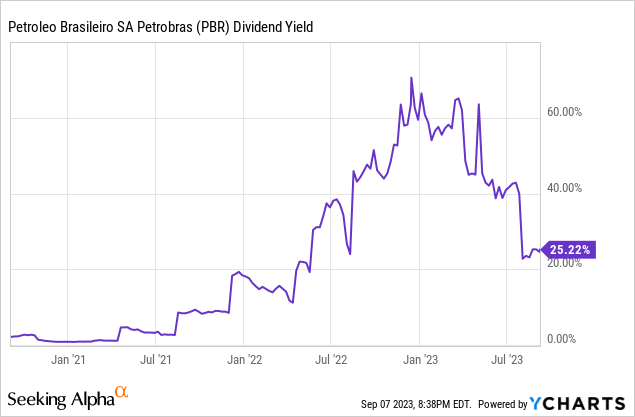

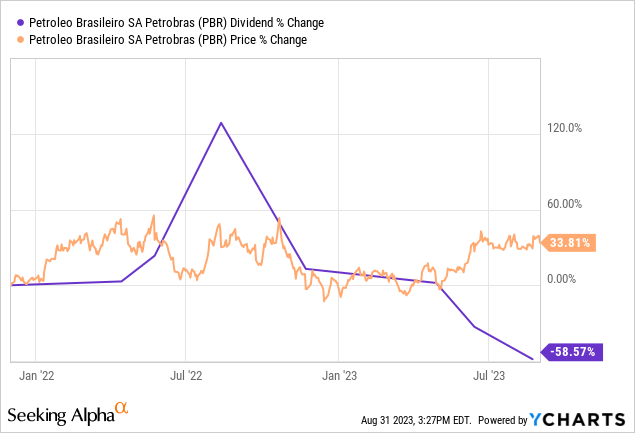

Some of the dividends were so high, that cuts seemed almost certain to happen. Petrobras (PBR), the fund’s largest holding, was yielding over 60% for a couple of months in late 2022, which seemed unsustainable.

Either PBR’s dividends decreased to more sustainable levels, or increased investor demand led to higher share prices, and lower yields. Both ended up occurring, with tons of volatility.

Data by YCharts

In my opinion, ILF’s dividend cuts are a negative for investors, but not a significant one. Prospective dividends remain strong, with the fund sporting a 7.1% SEC yield. ILF’s long-term dividend growth track record remains somewhere between reasonable and strong (volatility makes it difficult to know for certain).

Valuation Remains the Same, Earnings have Grown

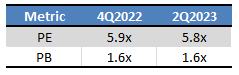

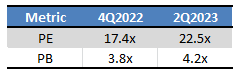

ILF’s valuation has not materially changed YTD. The fund’s PE ratio decreased by under 0.1x, while its PB ratio increased by around the same (not shown due to rounding).

Fund Filings – Chart by Author

On the other hand, most U.S. equity indexes have seen their valuations rise, including the S&P 500.

Fund Filings – Chart by Author

Although ILF’s valuation itself has not changed, the valuation gap between the fund and most U.S. equity indexes have widened. Wider valuation gaps mean comparatively greater yields, make buybacks more accretive, and could lead to significant capital gains moving forward, all important benefits for the fund and its shareholders.

As ILF’s share price has increased YTD, and unchanged valuation implies strong earnings growth for the fund’s underlying holdings, assuming no significant portfolio changes.

The S&P 500, on the other hand, has seen stagnant, even declining, earnings YTD, due to narrower margins and a tech recession. FactSet says earnings have declined 5.2% YTD, although figures are in flux. Analysts expect 0.8% earnings growth for the entire year.

The comparatively strong earnings growth of ILF’s underlying holdings is a benefit for the fund and its investors.

Performance Analysis

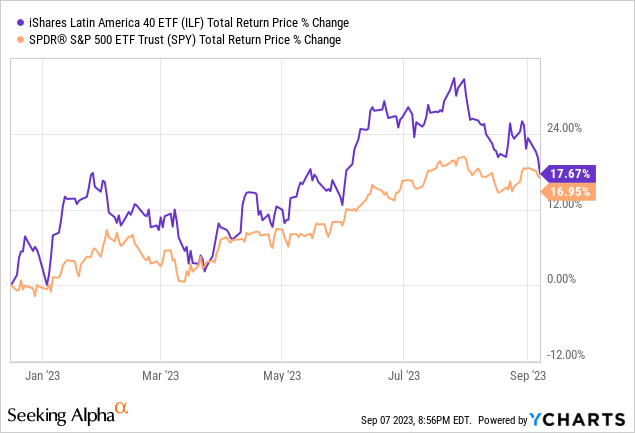

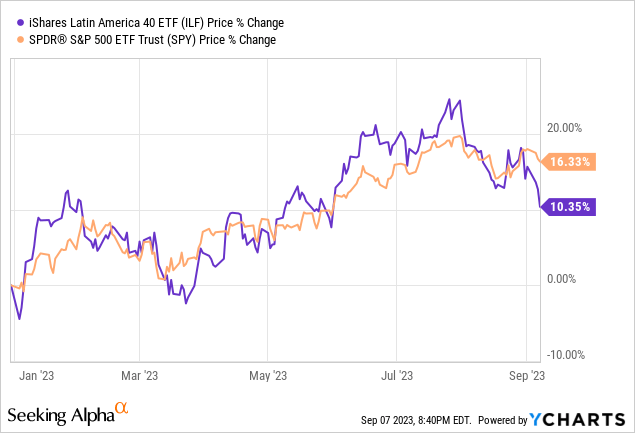

ILF has somewhat underperformed the S&P 500 YTD.

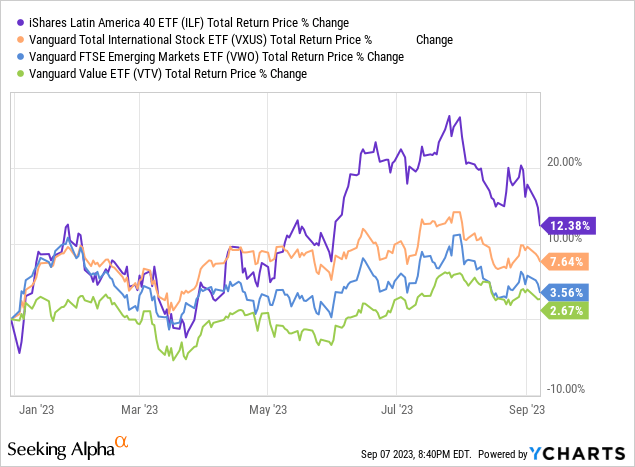

On the other hand, the fund has outperformed international, emerging market, and value indexes.

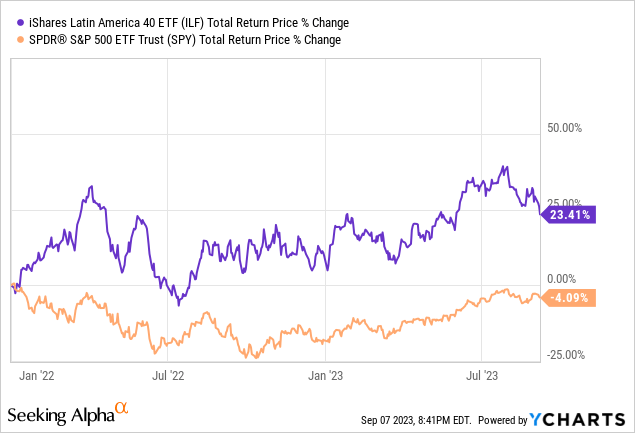

In my opinion, on net, the fund’s performance has been good. ILF has outperformed its more comparable indexes, and has only very slightly underperformed the S&P 500. Importantly, value and growth are cyclical factors, and ILF has outperformed the S&P 500 during the most recent cycle of 2022-2023.

To expand on the above, ILF significantly outperformed during 2022, a year during which most value indexes, industries, and equity market segments outperformed. The fund then slightly underperformed in 2023, a year during which value has significantly underperformed (on average). On net, these are strong recent results, in my opinion at least.

Dollar Prices

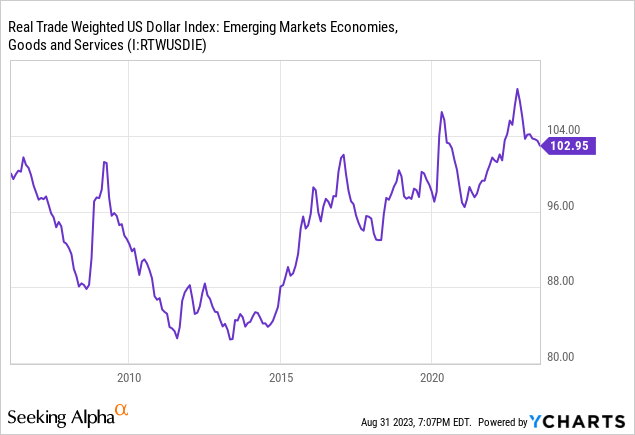

The U.S. dollar has lost some of its strength in the recent past, but remains elevated relative to its long-term historical average.

Data by YCharts

A cheaper dollar means lower potential for international equities and funds, including ILF. The dollar remains strong, however, so investors could see further gains moving forward.

Conclusion

ILF’s strong 7.0% dividend yield and cheap valuation make the fund a buy.

Read the full article here