Evergy (NASDAQ:EVRG) is a Topeka, Kansas, and Kansas City, Missouri-based electric utility company. The firm is currently the largest electric company in Kansas, servicing upwards of 1.7mn residential, commercial, and industrial clients.

Evergy Q2’23 Presentation

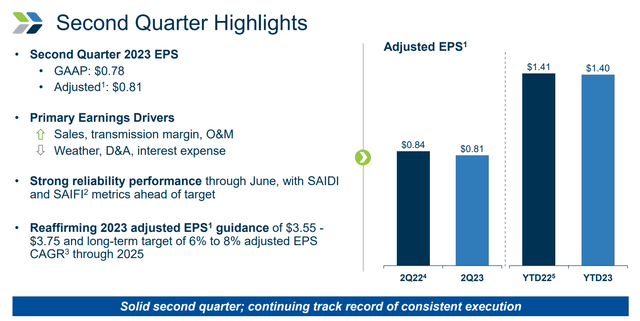

Through its activities, Evergy has recorded Q2 revenues of $1.35bn- a 6.38% YoY decline-alongside a net income of $179.10mn- a 7.92% decline- and a free cash flow of -$224.20mn, a 16.31% increase driven by rising financing and operating cash flows.

Introduction

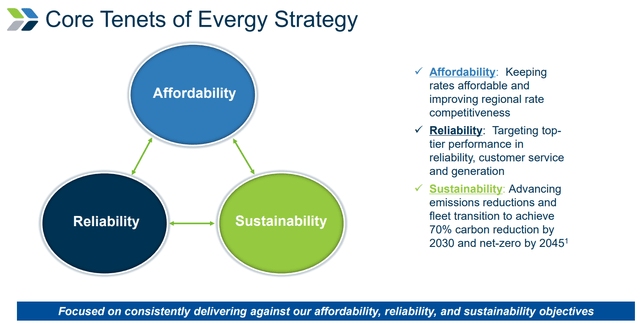

Central to Evergy’s operational strategy remains its trifold framework, which emphasizes scalability and rate-base expansion through affordability and price competition, reliable performance to reduce overhead and sustain margin expansion, and cost-effective ESG inclusionary objectives oriented towards sustainability.

Evergy Q2’23 Presentation

The combined accretive effect of the latter multi-pronged strategy, alongside a general undervaluation and strong forward guidance, leads me to rate Evergy a ‘buy’.

Valuation & Financials

General Overview

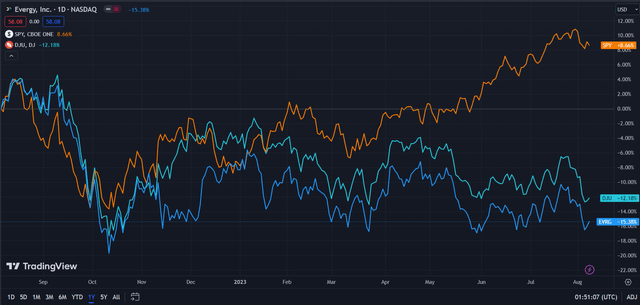

In the TTM period, Evergy’s stock-down 15.38%- has experienced poorer price action to both the Dow Jones Utility Index (DJU)- down 12.18%- and the broad market as represented by the S&P 500 (SPY)- up 8.66%.

Evergy (Dark Blue) vs Industry and Market (TradingView)

I believe Evergy’s overall underperformance is a product of its relative, risk-adjusted attractiveness to higher-interest bonds. And the DJU, being composed of larger utility companies, has experienced less volatility.

Nonetheless, I believe Evergy has built-in long-run growth when assessing operational capacity and valuations.

Comparable Companies

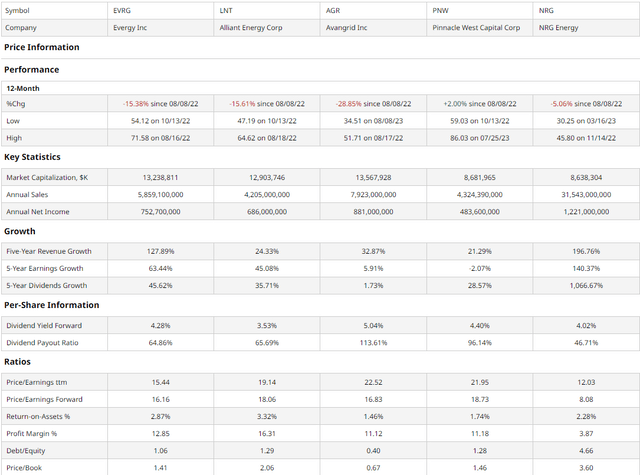

The utility industry remains consolidated at a regional level, with the inherent natural monopolism of utilities aggravating this effect. However, on a national level, the industry remains fragmented between service regions. As such, I sought to compare Evergy with similarly sized peers with similar operations but not necessarily in direct competition. This cohort includes Madison, Wisconsin-based electricity and natural gas utility Alliant Energy (LNT), New England-servicer and energy delivery firm Avangrid (AGR), Phoenix, Arizona-based utility, Pinnacle West Capital Corporation (PNW), and Houston, Texas-based multi-sided utility, NRG Energy (NRG).

barchart.com

As demonstrated above, Evergy has experienced the joint second-poorest YoY price action, likely a combined product of rising interest rates and declining net income, with Evergy putting a premium on rate-base affordability.

Despite this, Evergy demonstrates superior growth-related capabilities, multiples-based value, and sustainable shareholder return capacities.

For instance, Evergy maintains the second-lowest trailing and forward P/E ratios, alongside the second-lowest P/B ratio, demonstrating value across the income statement and balance sheet.

Additionally, Evergy maintains outsized growth aptitude, with the second-highest 5Y revenue and earnings growth metrics alongside the second-highest ROA and the second-lowest debt/equity, enabling greater reinvestment opportunity.

Moreover, investors can expect consistent return programs, with Evergy retaining the third-highest dividend with a disciplined payout ratio and the second-highest dividend growth.

Valuation

According to my discounted cash flow valuation, at its base case, the net present value of Evergy is $70.01, meaning, at its current price of $58.10, the stock is undervalued by 17%.

My model, calculated over 5 years without perpetual growth built-in, assumes a discount rate of 9%, balancing low equity risk with a >1 debt/equity ratio and rising rates. To remain conservative, I additionally calculated a forward revenue growth rate of 8%, lower than the 5Y trailing revenue growth rate of 20.15%.

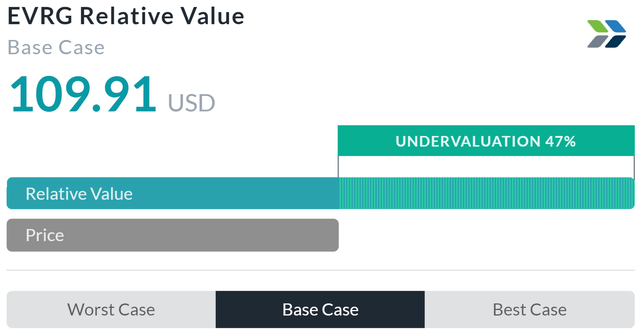

Alpha Spread

Alpha Spread’s multiples-based relative valuation tool more than supports my thesis on undervaluation, estimating a base case undervaluation of 47%, with a fair price of 47%.

However, Alpha Spread’s relative valuation model fails to discount Evergy’s significant dividends or account for forward risks.

As such, taking a weighted average of my NPV and Alpha Spread’s relative valuation-skewed towards my model-the fair value of Evergy is $76.92, with the stock currently undervalued by 25%.

Evergy Seeks to Grow Rate Base With Accretive Infrastructure Investment

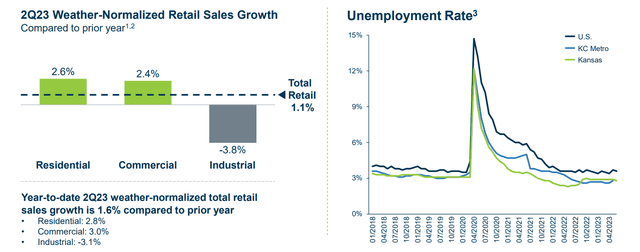

In spite of continued macro uncertainty, Evergy’s regional and rate-base positioning enables the firm to retain a level of growth combined with signs of economic recovery, enabling Evergy to later focus on margin expansion. For instance, falling unemployment and rising incomes enabled 2.6% growth across residential sales and 2.4% growth in commercial weather-normalized retail sales growth.

Evergy Q2’23 Presentation

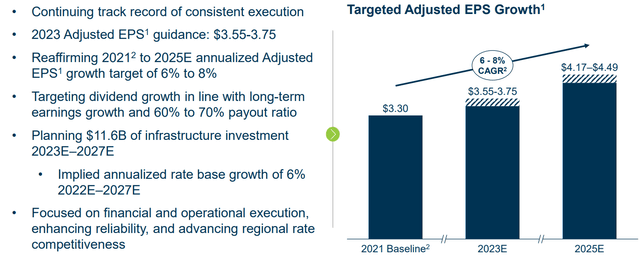

On a more granular level, Evergy is focusing on incremental EPS growth, sustained through a mix of stability, a judicious capital deployment strategy, and accretive infrastructure investments seeking to expand Evergy’s rate base. For instance, Evergy seeks to invest $11.6bn in infrastructure over the next 4 years, spurring annualized rate base growth of 6%. In conjunction with steadily rising rate increases, still slower rising than inflation- Evergy can support simultaneous scale and margin expansion.

Evergy Q2’23 Presentation

Wall Street Consensus

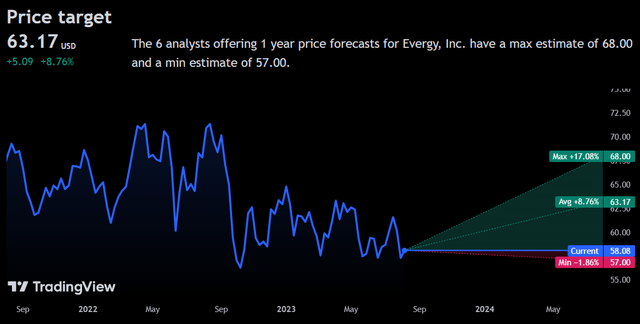

Analysts generally echo my positive view of the stock, estimating an average 1Y price target of $63.17, an 8.76% increase.

TradingView

Even at the minimum projected price target of $57.00, analysts project investors to remain net positive, when incorporating the firm’s 4.22% forward dividend.

I believe Wall Street either foresees rate cuts or understands that the market has generally overreacted to the risk-adjusted attractiveness of bonds relative to utilities.

Risks & Challenges

Rising Interest Rates Dampen Company’s Capabilities & Attractiveness

As discussed multiple times, utility stocks have seen relatively poor YoY price action, largely as a result of rising interest rates making similar dynamic bonds more attractive on a risk-adjusted basis. More so than that, however, rising interest rates also diminish Evergy’s ability to adequately invest in infrastructure. Although increased public and private investment in infrastructure may insulate Evergy from the worst of these effects, Evergy nonetheless may see rising costs and further declines in profitability in order to execute its plans.

Regulatory Complexities May Lead to Rising Compliance Costs

The ever-changing climate and weather patterns themselves increase the cost of business for Evergy, which must upgrade its infrastructure to maintain reliability. However, with increased government investment and subsidies in infrastructure comes increased government scrutiny. This combined increase in scrutiny alongside increased climate legislation may increase compliance costs and result in compressed free cash flows and position the firm for increased environmental litigation.

Conclusion

Looking forward, Evergy continues to guarantee income investors a strong dividend, sustained by an incrementalist investment approach seeing steady rate base expansion.

Read the full article here