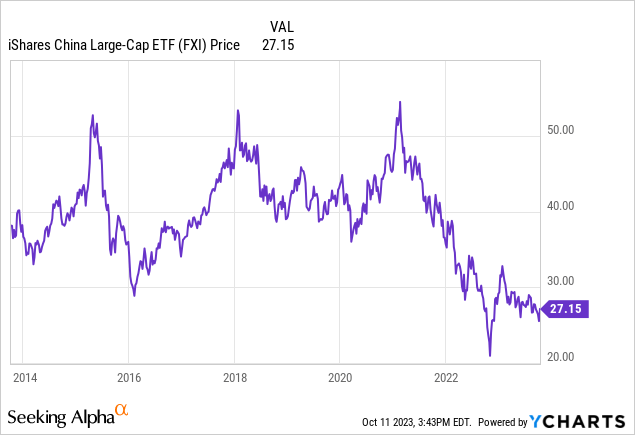

China has undoubtedly been a standout story over recent decades, brimming with the promise of incredible growth. But it’s important to recognize that not all growth leads to anticipated returns, and the Chinese stock market is quite illustrative of this fact. In my view, the considerable risks associated with investing in China have persistently played a pivotal role in this growth narrative, which has witnessed its share of fluctuations during the past twenty years. These risks have consistently loomed in the backdrop of Chinese investments, and yet, investors have often chosen to overlook them, only to be confronted by their consequences at a later stage. This phenomenon is quite evident when you look at the performance of Chinese equities (FXI) in the last decade.

As things have come to a head in the last few years, investors and companies are increasingly looking at reducing their exposure to China (Including companies reducing their supply chain exposure).

-

Regulatory Uncertainty: China’s regulatory environment can be unpredictable. Changes in rules and regulations can impact various industries, potentially affecting the profitability of businesses. This was quite evident in China’s recent crackdown on the technology sector.

-

Geopolitical Tensions: Ongoing geopolitical tensions between China and the United States, and their ambitions in Taiwan can lead to uncertainty and potential risks for investors and international firms operating in China

-

Governance and Rights: Chinese companies may have different corporate governance standards, which could lead to issues related to transparency and shareholder rights. Chinese stocks are listed as ADRs (American Depository Receipts) and offer exposure to Chinese companies but work differently for regular shareholders because of their structure. Investors owning Chinese stocks have no rights as a shareholder.

There are multiple countries that are beneficiaries of the changing sentiment. But the one country that could take the lion’s share of the disinvestment from China would be India.

There’s concern that assets could be frozen or otherwise become difficult to sell, like what happened to Russia after its invasion of Ukraine. Investing directly in mainland Chinese stocks is risky

– Hiroshi Matsumoto, senior fellow at Pictet Asset Management

Diversifying into India:

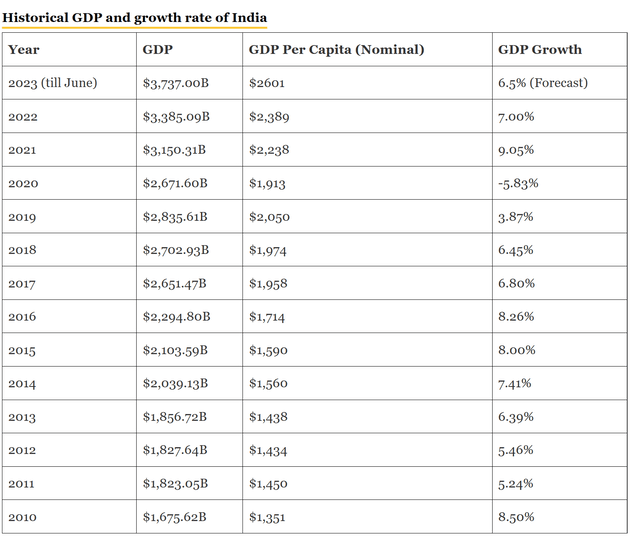

Growth Potential: India offers a large and rapidly growing consumer market. Its youthful population, increasing urbanization, and rising middle class are driving consumption and economic growth.

Political Stability: India has a well-established democratic system, providing a stable political environment for investors.

Business-Friendly Reforms: India has been implementing business-friendly reforms, such as the “Make in India” initiative, which aims to improve the ease of doing business in the country.

English Proficiency: English is widely spoken in India, making it easier for foreign investors to communicate and do business.

Technology and Innovation: India is a hub for technology and innovation, with a booming IT sector and a growing startup ecosystem.

In addition to Technology India offers opportunities in various sectors, in pharmaceuticals, manufacturing, and services, allowing for a well-rounded investment portfolio. The value of announced U.S. and European greenfield investment into India shot up by $65B between 2021 and 2022, while investment into China dropped to less than $20B last year, from a peak of $120B in 2018.

Morgan Stanley also recently mentioned that China is over-invested and India has room for opportunities. Lately, businesses have adopted a “China-plus-one” approach, seeking to enhance the resilience of their supply chains through diversification with India being a prime beneficiary. Multiple companies including AMD and Apple (AAPL) being some of the most prominent names are opening design centers and factories in India that would serve as essential links in their supply chains.

China is overinvested. It’s overleveraged and it’s oversupplied. And then it has this geopolitical cloud over it…

– Jitania Kandhari, Morgan Stanley’s deputy CIO for solutions & multi-asset and managing director

A minor lesson in History

India’s adoption of LPG (Liberalization, Privatization, and Globalization) represents a significant turning point in its economic history.

Pre-1991: Prior to 1991, India followed a policy of economic self-reliance, characterized by heavy state intervention and protectionist measures. The economy was largely closed to the global market, with high tariff barriers, import restrictions, and stringent regulations.

Post-1991: In 1991, India was facing a severe balance of payments crisis. To overcome this, the government, introduced a series of economic reforms.

Liberalization: The liberalization aspect involved opening up the Indian economy to foreign investment and reducing trade barriers. Key reforms included the devaluation of the Indian rupee, reduction in import tariffs, and measures to attract foreign investment.

Privatization: Privatization aimed to reduce the government’s direct involvement in economic activities. This involved the sale of state-owned enterprises to private companies, thus encouraging competition and efficiency.

Globalization: The globalization aspect aimed at integrating the Indian economy with the global market. India began actively participating in international trade, which led to an increase in both exports and imports.

From this point, it took a few years for the stock market to fully absorb the full extent of changes but the verdict was clear.

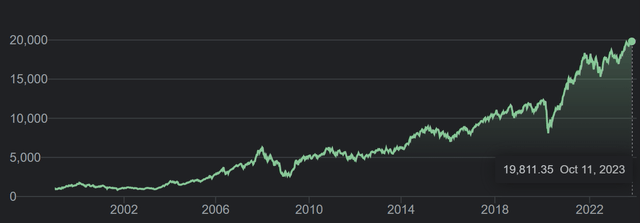

Nifty 50 Price History (Google)

Nifty 50 (The Benchmark Indian stock market index that represents the weighted average of 50 of the largest Indian companies listed on the National Stock Exchange) gained more than 2000% since its inception in the late 1990s largely benefiting from India opening its economy in the early 1990s.

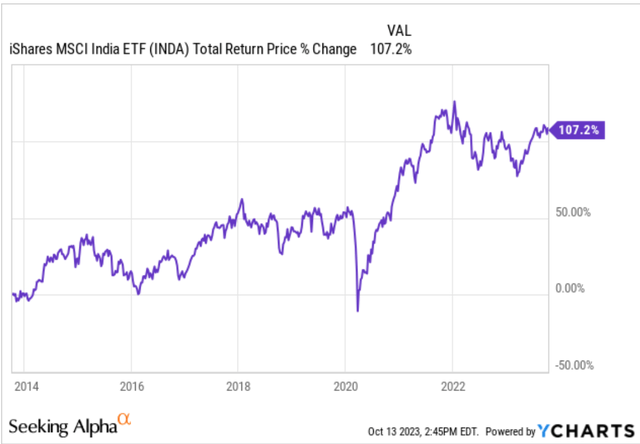

iShares MSCI India ETF Diving in..

Ycharts

The primary goal of the iShares MSCI India ETF (BATS:INDA) is to closely track the investment results of an index composed of Indian equities. In essence, it aims to mirror the performance of the underlying Indian stock market and provides an efficient means for investors to obtain exposure to a developing economy. To elaborate –

-

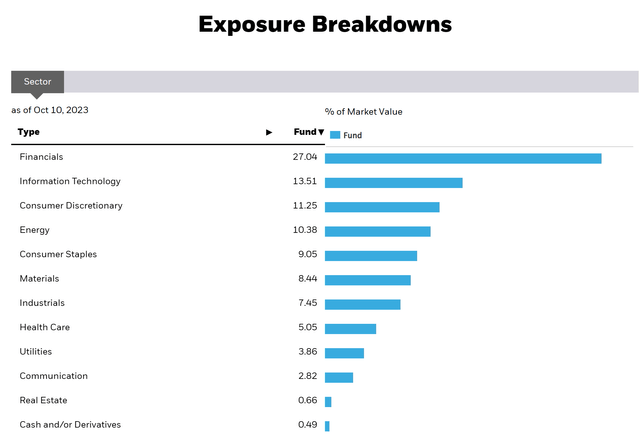

Exposure: INDA provides exposure to a broad spectrum of large and mid-sized companies in India. This diversification can be advantageous for investors looking to participate in the growth and potential of the Indian economy.

-

Uncomplicated Indian Market Access: INDA is specifically designed to target the Indian stock market. It offers a straightforward way to invest in Indian equities without the complexities of directly trading on foreign exchanges.

-

Focused Single Country View: For investors who have a positive outlook on the Indian market and want to make a single-country bet, INDA can be a suitable vehicle. It allows investors to express their views on India’s economic prospects and market performance.

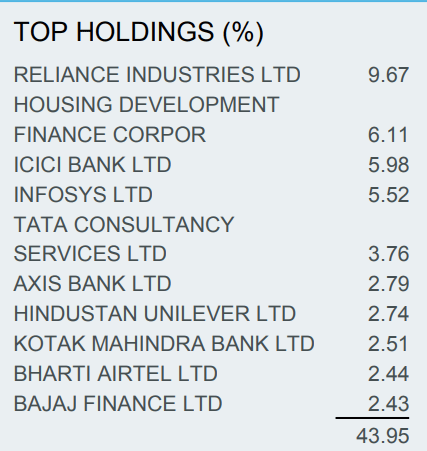

The investment portfolio of INDA comprises 122 holdings. The equity beta, a measure of its sensitivity to market movements stands at 0.52. The 30-day SEC yield, which provides an indication of income generated by the investments, as of August 31, 2023, is 0.38%, and the 12-month trailing yield for the same date is 0.18%. The standard deviation over the past three years, a measure of investment risk, as of September 30, 2023, is 14.65%. Furthermore, the price-to-earnings (P/E) ratio is 25.88, and the price-to-book (P/B) ratio is 3.60. These metrics offer valuable insights into the fund’s holdings and performance.

The fund’s net assets amount to $6B. The fund, which began its journey on February 2, 2012, is listed on the Cboe BZX exchange (formerly known as BATS). It uses the MSCI India Index as its benchmark and its expense ratio is 0.64%

iShares iShares

Conclusion

I believe an investor should have exposure to INDA for the following reasons –

1. Provides a hedge against Chinese exposure (India is likely to be a big beneficiary of any disinvestment from China)

2. Diversification into an emerging or developing economy. Fifth largest economy in GDP ranking

Forbes India

3. Low correlated exposure to the US index SP500

Read the full article here