Investment Thesis

I reaffirm my strong buy rating on Infineon Technologies (OTCQX:IFNNY) and update my projections after it reported its Q2 earnings last week and positively updated its FY23 outlook once again. Yet, despite this incredibly strong performance, the share price is down an additional 6% since my previous article on the company a month back, further discounting the shares to unreasonable levels.

The excellent quarterly result of the company means my investment thesis remains essentially the same as a month ago. This is what I wrote about the company back then:

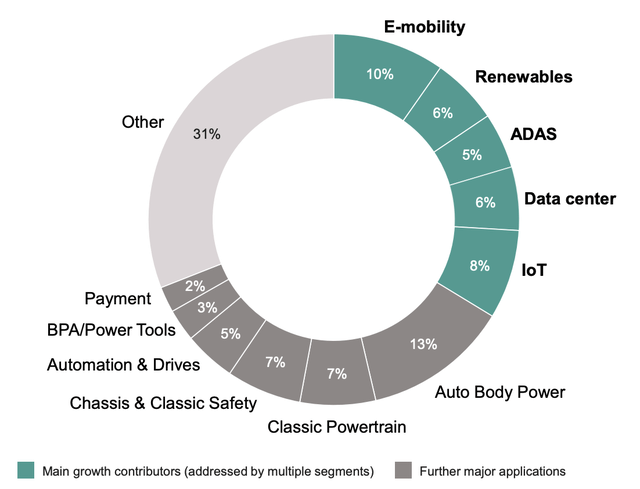

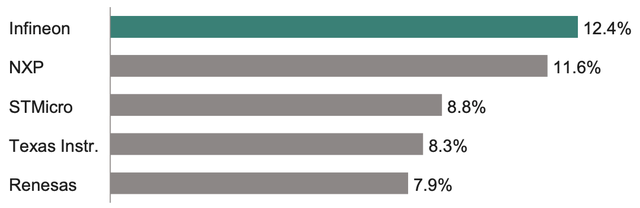

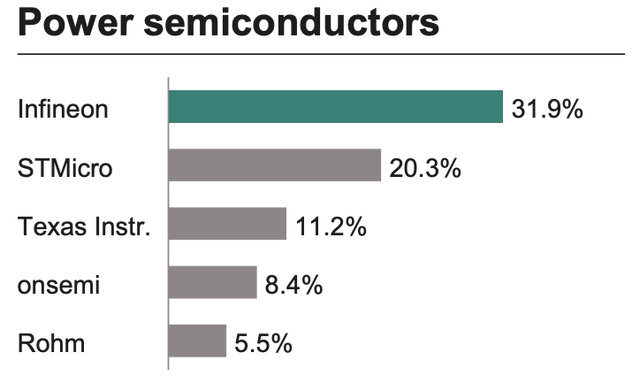

The excellent competitive positioning of the company makes it a winner in the semi(conductor) industry. Tailwinds from its automotive and industrial segments are driving better-than-expected results for this year and most likely also for the years after. Infineon even holds an impressive 31% market share in the power semiconductor market, a very important product for many different industries. These industries include automotive, renewables, datacenter, and IoT (Internet of Things). And Infineon is not just a player in these industries, but it holds a significant market share in these fast-growing markets with it holding the largest market share in automotive semiconductors at 12.4%, and its power semiconductors being responsible for powering 50% of currently installed solar and wind energy systems. The broad product portfolio of Infineon covers all verticals of the energy conversion and usage business and the automotive semiconductor industry, which positions it well for impressive above-average growth in the coming years.

Add to this a strong management team that knows exactly where it needs to steer the company and which segments it needs to invest in to boost growth, and we end up with an excellent opportunity for investors. Yet, this does not seem to be entirely recognized by the market. Also, with additional funding from the European Union and the US government to increase domestic semi production, Infineon is poised to benefit as it plans to increase manufacturing capacity in both regions.

In this article, I will take you through the latest developments and update my estimates and view on the company accordingly.

Infineon simply keeps on delivering

Only a little over a month ago, Infineon management issued a press release with an updated outlook as Infineon was seeing a more robust performance for its automotive and industrial business segments, driving higher revenue for its fiscal second quarter and FY23. I discussed this outlook upgrade here and updated my own estimates, upgrading my price target as well. Infineon was still showing an impressive performance with its products still in high demand. And this was once more visible when Infineon released its fiscal Q2 results last week, outperforming its updated estimates and raising its outlook for the full year.

During Q2, Infineon saw no change in market sentiment compared to three months ago, which is very much a positive. Infineon is seeing no impact of the macroeconomic challenges going on worldwide as demand in automotive and industrial applications continues to be robust as the secular trends in these industries turn out stronger than economic volatility.

As guided by management, the automotive and industrial segments indeed reported impressive growth while already accounting for the largest part of revenue for Infineon. This strong performance was also reflected in the operating margins which came in above 30% in these segments last quarter, showing strong pricing power and high demand. Of course, Infineon is not seeing similar strength in consumer computing and communications businesses as these are far more exposed to cyclical trends.

For its Q2, Infineon grew revenues by an impressive 25% YoY and 4% sequentially, reaching €4.12 billion. At the same time, expenses for Infineon in Q2 were essentially flat to down slightly, which positively affected the bottom line and supported faster EPS growth of 80% YoY to €0.63.

Moreover, Infineon reported a segment result was €1.18 billion with the segment result margin coming in at 28.6%, significantly above the 23.1% reported in the same quarter last year and in line with management’s expectations of high-20s. As a result of the improved profitability, FCF was €193 million or €772 million annualized which means the $447 million in annual dividends is also well supported. Furthermore, net debt stood at just under €2 billion as Infineon maintains a healthy balance sheet.

Finally, the product backlog is continuing its downward trend as expected with buying patterns normalizing and the supply chain improving. At the end of Q2, the backlog stood at €36 billion, down from €38 billion in the previous quarter. Still, this decrease is smaller than I expected Infineon to report and is still more than 2x annual revenue, offering a solid buffer.

On that, let’s dive further into the individual business segments and quarterly developments.

Automotive will remain a growth driver for Infineon

Revenues for the Automotive segment came in at €2.01 billion, up 11% sequentially and up a whopping 40% YoY. As a result, this segment now accounts for 49% of total revenue, making it a strong growth driver for overall revenue. While I would prefer a bit more diversification for Infineon, the strong growth outlook for automotive is looking solid, driven by electrification and autonomous driving taking off over the remainder of the decade. This poses a great growth opportunity for Infineon with these two key applications specifically already accounting for 15% of revenue.

Infineon exposure to end markets (Infineon)

Profitability for the automotive segment was also showing strong growth as the margin increased from 28.4% in Q1 to a very impressive 31.1% in the latest quarter, showing strong pricing power and high demand. This can also be seen from the fact that Infineon again topped the list of automotive semiconductor manufacturers with a 12.4% market share. It is especially in automotive power semiconductors where Infineon is incredibly strong with a 31.9% market share, positioning it well to capture semiconductor growth in the automotive industry which, according to Allied Market Research, is set to grow at a CAGR of 11.8% until 2030.

Automotive semiconductors market share (Infineon) Infineon Power Semiconductor market share (Infineon)

And it is not just power semiconductors in which Infineon is seeing strong growth in Automotive but driven by its exposure to EV and autonomous driving, Infineon has also climbed to the number two position in automotive microcontrollers, illustrating the strength of its product portfolio.

Infineon continues to see tightness for Microcontrollers and power semiconductors for automotive applications. And while this should ease for Microcontrollers by the end of the year, Infineon expects this to remain a long-term problem for power semiconductors, driven by the ongoing EV adoption and increasing demand for renewable energies. With Infineon leading in these product segments, its products are obviously in high demand, driving solid long-term growth and stability.

And that Infineon, indeed, is a leader in the automotive industry and well positioned to take market share through its superior product portfolio can be seen by its recent design wins in the automotive industry. For example, Chinese EV giant BYD (OTCPK:BYDDF) has awarded Infineon to deliver both MCU and intelligent power switches for its new architecture which should eventually be found in all new electric BYD cars. Also, Infineon has expanded its relationship with Hyundai (OTCPK:HYMLF) to which it will also start supplying silicon carbide components over the following years.

Overall, Infineon should see strong continued growth from automotive over the remainder of the decade, driven by the overall increase in semiconductors found in cars as a result of more digital applications and electrification. With Infineon being the leader in this industry and expanding its market share as it has been doing over previous years, there seems to be little doubt about performance for this segment, boosting my bull case for Infineon. I believe Infineon will further increase its automotive market share over the next several years, driven by its broad and superior product portfolio (which is discussed more in-depth here) and exposure to ADAS and EV. Therefore, Infineon should be able to outpace industry growth and deliver solid double-digit growth for many years in this segment. Of course, growth will slow down from current levels as demand and tightness will ease off slightly.

Decarbonization drives industrial revenues for Infineon

The second strong revenue driver for Infineon was Industrial or Green Industrial Power (GIP) as Infineon calls this segment due to its focus on power semiconductors for efficient energy supplies. This is another segment that has shown impressive growth for years now but going forward will primarily be driven by the decarbonization trend, which is another secular driver boosting growth for Infineon.

In Q1, this segment saw revenue come in at €558 million, up 30% YoY and 12% sequentially. Segment result margin also increased from 28.8% in Q1 to 32.4% this quarter following the higher revenue base. This solid segment performance resulted from strong continued demand for decarbonization-related applications which offset the decrease in consumer-related revenue like home appliances.

To also put Infineon’s market position in this industry into perspective, as explained in my previous article, Infineon is responsible for powering 50% of the currently installed capacity in wind and solar energy. In addition to this, Infineon’s power semiconductors are also used for 2/3 of the electricity grid infrastructure, including electric charging. Clearly, Infineon has great exposure to the decarbonization trend and is well-positioned to benefit from growth in green energy generation and electricity grid infrastructure growth going forward. This is how Infineon management described their exposure during the Q2 earnings call:

Infineon is making green cost-efficient electrical energy possible. We have a leading position in the fields of wind energy and solar power, with our power semiconductors setting the standard for higher efficiencies levels throughout the entire energy generation and conversion chain.

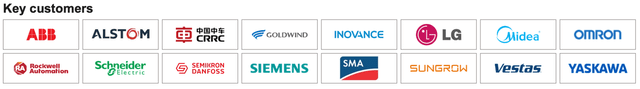

Its strong position in the industry was once more confirmed last quarter as the company reported a triple-digit-million deal for multiple offshore wind parks. This shows that Infineon is also a leader in this field due to its best-in-class power semiconductor offering which enables more cost and energy-efficient energy generation. Through this offering, I expect Infineon to continue driving solid growth for this segment as the decarbonization process has only just started and wind and solar energy solutions will see stellar growth over the remainder of the decade and far beyond. To put this into perspective, Grand View Research expects the global renewable energy market to grow at a CAGR of 16.6% until 2030. I view Infineon as a prime beneficiary due to its excellent product offering in this space. This is also illustrated by the fact that most of the world’s largest companies associated with green energy and electricity infrastructure are Infineon customers.

Key customers of Infineon (Infineon)

Other segments & quarterly developments for Infineon

The one operating segment that recorded a sequential decline was Power & Sensor Systems as the softness in consumer computing and communications applications impacted this one. As a result, revenue for this segment declined by 11% sequentially, while revenue was flat YoY and was €925 million. Still, considering the slowdown we have seen in the consumer computing industry and for other semiconductor companies, I think this is still a relatively resilient performance from Infineon.

Finally, the Connected Secure Systems segment grew revenues by a very solid 23% YoY and 4% sequentially to €550 million, driven by strength in end markets like payments and embedded security. The margin development for this segment was also strong with segment result margins increasing from 23.5% in Q1 to 28.2% today. Also, for this segment, there was some weakness in consumer applications. Still, Infineon remains optimistic about the long-term trend it sees in IoT and its strong design win trajectory in this field.

To illustrate how highly regarded Infineon is in this space, I want to point out that the company was awarded a 10-year contract by the U.S. to supply security solutions for the U.S. passport. This means Infineon will provide the chip, software, and packaging to support this electronic document.

As for interesting quarterly developments, an interesting development from last quarter was the news that Infineon broke ground on a new manufacturing plant in Dresden, Germany. This new factory should become operational in 2026 and should boost the total capacity for Infineon. It is no coincidence that Infineon broke ground here a few days after the European Union passed the €45 billion Chips Act to support semiconductor manufacturing on the continent. Infineon will most likely be one of the primary beneficiaries of this bill, in addition to Intel (INTC) and other German manufacturers. Therefore, I expect Infineon to invest more in its manufacturing capacity on the old continent to benefit from the incentives offered by the European Union. Infineon already announced that it plans to invest €3.5 billion into new major frontend buildings until 2027. Still, I expect this might increase over the next couple of years as the incentives allow for more capital investments from Infineon to support its targeted 10% growth CAGR. Last week, Seeking Alpha already reported that TSMC (TSM) looks to expand its global presence and is talking to Infineon and other European manufacturers to partner on a new German fab, estimated to cost €10 billion, and to focus on 28-nanometer chips. Overall, the incentives should function as a tailwind for the company over the remainder of the decade.

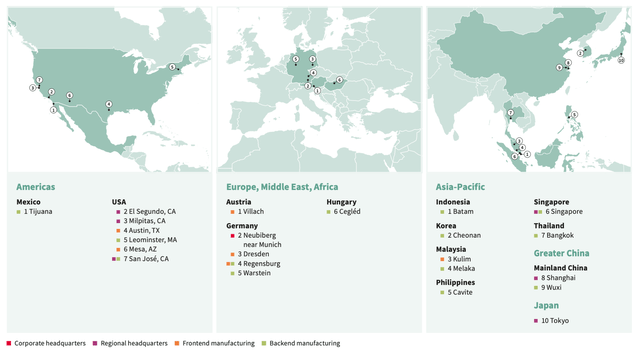

Infineon manufacturing facilities (Infineon)

Outlook & Infineon stock valuation

The improving supply chain, continued strong customer demand, and strong underlying trends in automotive and industrial resulted in Infineon management being incrementally more optimistic about the second half of the fiscal year. Therefore, for Q3, management guides for revenues of around €4 billion, relatively flat sequentially. For the separate divisions, management guides for a slight sequential increase in automotive, Industrial to be flat and a slight decline in the remaining two segments. The group result margin is expected to be around 26% and takes into account some cost increases.

For FY23, Infineon now expects to report revenues of around €16.2 billion, plus or minus €300 million, which is €700 million above what they guided for at the start of the year and shows a positive trend. And we can see the same for the margin development as gross margins are now expected to be 47% from the previous 45% and the segment result margin is now expected to be around 27% for the full year, from a previous 25%. As a result, FCF is projected to be €1.1 billion, and assuming an unchanged spend of around €700 million for major front-end buildings, the adjusted FCF should be around €1.8 billion or 11% of revenue.

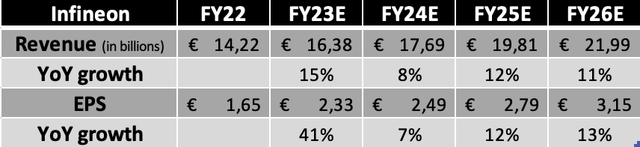

Following the quarterly results, updated FY23 outlook, and all the other quarterly developments, I now arrive at the following financial expectations for the years until FY26.

Own estimates

(3Q23 projections: revenue of €4.16 billion and EPS of €0.55)

Shortly explaining these estimates, these now reflect a slightly lower revenue expectation for FY23 after I ended up being slightly too positive for last quarter’s revenue (revenue was €200 million below my estimate), yet I maintain my EPS estimate as last quarter’s EPS was €0.01 above my own estimate. Furthermore, I upgraded my revenue outlook for FY24 due to continued strong demand and maintained my EPS estimate as not much changed over the last month. For the following years, my revenue estimates remain unchanged as I remain very bullish on the company’s long-term growth trajectory due to its exposure to several high-growth industries and secular trends and the potential for market share gains as discussed in this article. Also, with Infineon working on expanding its capacity by building new fabs in Germany and potentially the US, I believe the outlook is very solid. At the same time, I slightly lowered my long-term EPS estimates to account for slightly lower margins and higher investments.

Moving to the valuation, we can see Infineon continues to trade at a discount with it being valued at a forward P/E of 14x FY23 EPS as the share price has decreased a further 6% since my previous article. Yet, considering the expected solid growth outlook laid out above and it being valued below its 5-year average forward P/E of 24.5x, I believe the current valuation is unjustified and shares are poised for a revaluation once the market realizes its strong market position and growth potential.

In my previous article on the company, I discussed why shares deserve to be trading at a P/E of 20x when considering all aspects and my opinion remains unchanged. Therefore, based on a 20x P/E and my FY24 EPS estimate, I continue to calculate a target price of €50 ($55) per share, now leaving investors with an upside of 53% based on a share price of €32.74 ($36).

Conclusion

Infineon reported excellent financial results for its fiscal Q2, and the company impressed investors and analysts alike with another positive outlook update, indicating it is only seeing a minimal impact on the business from the cyclical slowdown in semiconductors. The continued strong growth rates are the result of robust performances in its industrial and automotive business segments as secular drivers in these industries offset the impact of economic weakness.

Overall, this quarter was roughly what I expected from it, and I see no reason to turn negative towards the rest of the year or the years after. Management continues to execute to perfection and Infineon is seeing excellent demand for its products. In addition, its strong positions in ADAS, EV, and decarbonization position it well for future growth. Add to this the government incentives that will help the company increase its production capacity, and there really are plenty of positive catalysts to remain optimistic about its future.

After reporting excellent financial results for its fiscal Q2 and guiding for a strong performance for the remainder of the year, I largely leave my projections unchanged, apart from some minor changes here and there. Therefore, I also maintain my €50 ($55) per share price target and continue to rate this company a strong buy on a massive undervaluation and impressive financial performance.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here