By William J. Luther

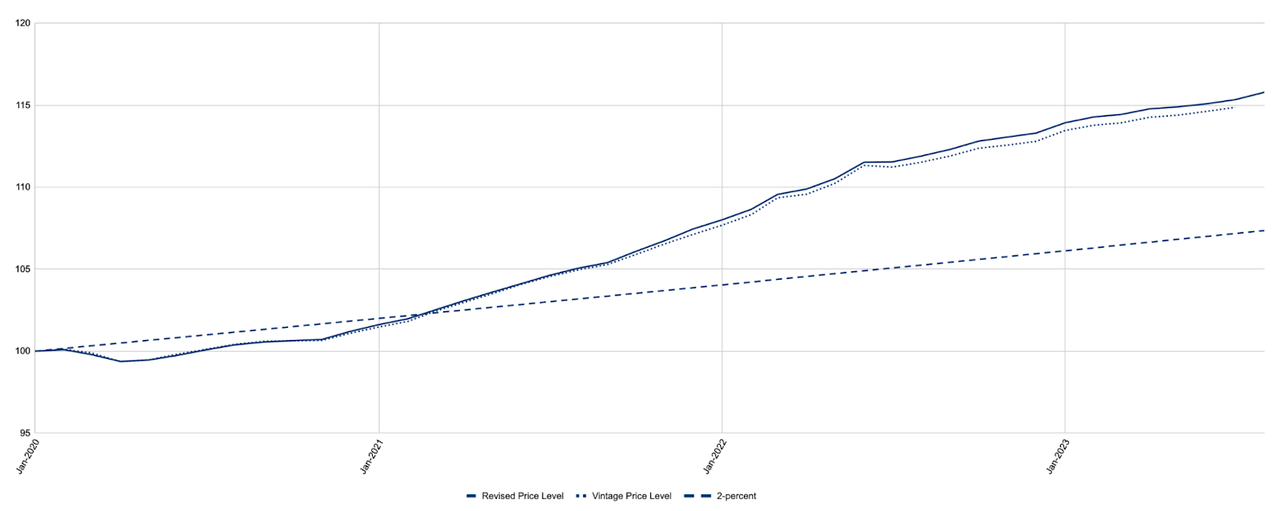

The Bureau of Economic Analysis has revised its estimates of inflation. The bad news: prices have risen faster than was previously thought. The Personal Consumption Expenditures Price Index (PCEPI), which is the Federal Reserve’s preferred measure of inflation, grew at a continuously compounded annual rate of 4.1 percent from January 2020 to July 2023. The BEA’s previous efforts put inflation at 4.0 percent. In July 2023, prices were 8.2 percentage points higher than they would have been had the Fed hit its 2-percent inflation target over the period, compared with the previous estimate of 7.7 percentage points.

Figure 1. Revised and Vintage Personal Consumption Expenditures Price Index, January 2020 – August 2023

More bad news: inflation picked back up in August 2023. The PCEPI grew at a continuously compounded annual rate of 4.7 percent in August, compared with 2.6 percent in the prior month. The PCEPI grew 3.4 percent over the 12-month period ending August 2023. Prices today are 15.8 percent higher than they were in January 2020, and 8.4 percentage points higher than they would have been had inflation averaged just 2 percent over the period.

The recent uptick in inflation was largely due to a surge in energy prices. The price of energy goods and services grew at a continuously compounded annual rate of 70.7 percent in August.

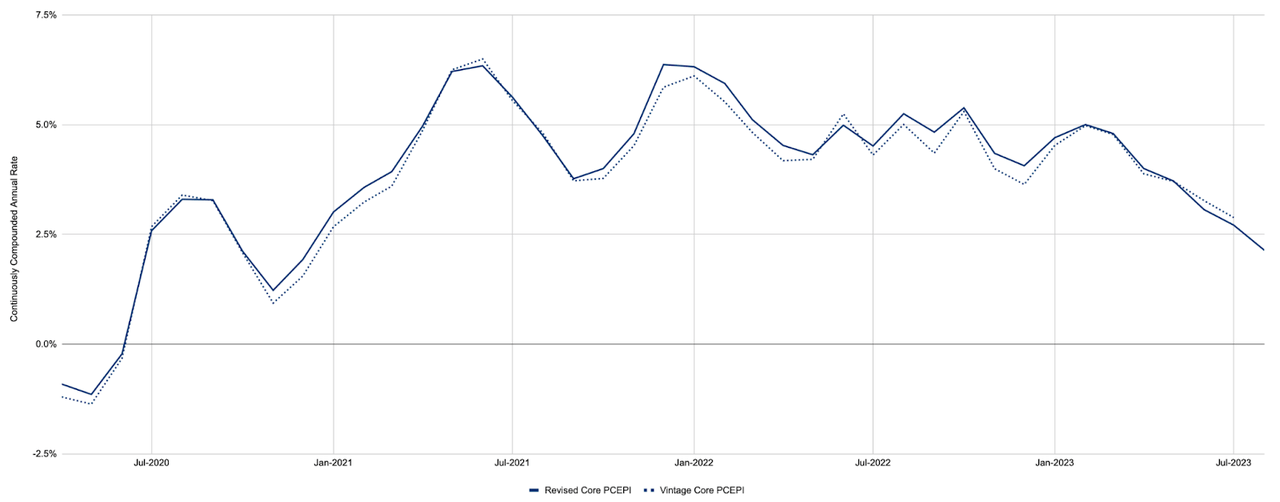

Fortunately, the most recent release was not all bad news. Core PCEPI inflation, which excludes volatile food and energy prices, has continued to decline. Core PCEPI grew at a continuously compounded annual rate of just 1.7 percent in August 2023, compared with 2.6 percent in the prior month. Core PCEPI has grown at a continuously compounded annual rate of 3.8 percent over the last twelve months, and 3.8 percent per year since January 2020.

More good news: the BEA’s recent revision shows that core PCEPI inflation has declined more than previously thought over the last six months. Prior to the revision, the BEA said core PCEPI inflation had grown at a continuously compounded annual rate of 3.7 percent over the three-month period ending in May, 3.3 percent over the three-month period ending in June, and 2.9 percent over the three-month period ending in July. Now, it says core PCEPI inflation averaged 3.7 percent, 3.1 percent, and 2.7 percent over those periods – and just 2.1 percent over the three-month period ending in August 2023.

Figure 2. Revised and Vintage Core Personal Consumption Expenditures Price Index Inflation, Continuously Compounded Annual Rate Over Last 3 Months, April 2020 – August 2023

Although Fed officials were late to tighten monetary policy, their efforts over the last year appear to have worked. The risk today is that monetary policy is too tight – and will remain so for too long.

The nominal federal funds rate target range stands at 5.25 to 5.50 percent. Assuming energy prices will not continue to rise as rapidly as they did in August, the prior month’s core inflation rate serves as a reasonable estimate of expected inflation over the current month. That suggests the real federal funds rate target range is roughly 3.55 to 3.80 percent. For comparison, the highest estimate of the natural rate offered by the New York Fed is just 1.14 percent. Even if one were to use the average core PCEPI inflation rate over the last three months, the resulting estimate of the real federal funds rate target range at 3.15 to 3.35 percent would still suggest monetary policy is very tight.

Inflation has been too high over the last few years. And the BEA’s recent revision reveals it was even higher than we thought. Fortunately, high inflation now appears to be behind us. Unfortunately, Fed officials do not seem to have realized that yet – and may overtighten monetary policy as a consequence.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here