The IIPR and Cannabis Investment Thesis Remain Highly Speculative

We previously covered Innovative Industrial Properties (NYSE:IIPR) in May 2023 rating it a Hold, discussing its uncertain prospects as headwinds grew and put further downward pressure on its valuations/ stock prices.

As a quick summary, the cannabis market was unlikely to be federally legalized in the near term, with funding capital similarly drying up as the macroeconomic outlook remained uncertain.

As more states legalized some form of medicinal and/ or recreational cannabis, Multi State Operators faced intensifying competition from the nonlicensed sellers, naturally compressing ASPs and impacting IIPR tenants’ profitability/ cash flow.

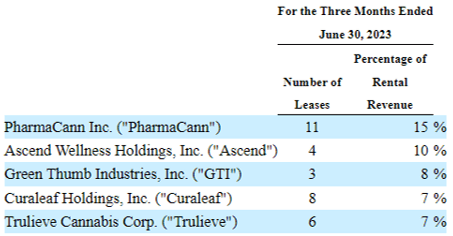

IIPR’s Top Five Tenants

Seeking Alpha

For now, it appears that we have been proven right again. While there is still no further information on IIPR’s largest tenant, PharmaCann, three of its largest tenants, Ascend Wellness Holdings (OTCQX:AAWH), Curaleaf Holdings (OTCPK:CURLF), and Trulieve Cannabis (OTCQX:TCNNF) remain unprofitable in the latest quarter.

In addition, while the IIPR management may report 98% of rental collection and $151.44M (+12.9% YoY) of rental revenues/ tenant reimbursements in H1’23, investors must also note that approximately $3.1M of security deposits have been applied for the leases with Parallel and Kings Garden.

There appears to be cash flow issues with Temescal Wellness of Massachusetts as well, with IIPR opting to temporarily reduce its base rent while applying part of the security deposits through January 2024.

So, while the cannabis REIT may have reported expanding rental/ other revenues of $76.45M (+1.2% QoQ/ +8.4% YoY) in FQ2’23, investors may also want to closely monitor its tenants’ financial health moving forward.

For now, the IIPR management appears to have taken advantage of the elevated interest rate environment, by generating a robust $2.31M (+3.5% QoQ/ +298.2% YoY) of interest income in the latest quarter.

This has naturally contributed to its growing profitability of $40.93M (inline QoQ/ +2.6% YoY), despite the intensified operating costs of $33.03M (+1% QoQ/ +25.3% YoY) in FQ2’23.

Therefore, while its tenants may continue to face cash flow headwinds, we suppose IIPR’s prospects remain decent for so long that it is able to maintain healthy liquidity with FQ2’23 cash/ equivalent of $92.6M (+145.9% QoQ/ +103.8% YoY). The management has already moderated its overall investment activities as well, with no debt maturities through 2026.

So, Is IIPR Stock A Buy, Sell, or Hold?

IIPR 5Y EV/Revenue and AFFO/ Per Share Valuations

S&P Capital IQ

For now, IIPR trades at NTM EV/ Revenues of 8.52x and NTM AFFO/ Per Share valuation of 9.60x, impacted compared to its 1Y mean of 9.26x/ 10.15x and pre-pandemic mean of 18.61x/ 23.76x, respectively.

However, investors must also note that IIPR still retains its premium compared to the cannabis REIT peers, such as NewLake Capital Partners Inc (OTCQX:NLCP) at 5.18x/ 7.00x, and AFC Gamma (AFCG) at NTM AFFO/ Per Share valuation of 5.52x, respectively.

Based on IIPR’s valuations and consensus FY2024 adj AFFO per share estimates of $8.21, we are looking at an intermediate term price target of $78.81, suggesting that most of its upside potential is already baked-in.

IIPR 5Y Stock Price

Trading View

For now, while potential easing on cannabis restrictions may have temporarily halted the declining cadence, it remains to be seen when the reclassification from Schedule I to Schedule III drug may actually occur, especially due to the multiple failures thus far.

With some analysts expecting the US cannabis legalization to be a “decade away,” we believe that there may be minimal catalyst for IIPR’s sustainable recovery over the next few years.

Combined with the unlikely passing of the SAFE Banking Act, we believe that IIPR may (at best) trade sideways at these levels moving forward, if not further retracing to test its May 2023 support levels of $65.

For now, based on its annualized FQ2’23 AFFO per share of $9.04 (inline QoQ/ +5.6% YoY) and annualized dividend payout of $7.20, we are looking at 79.6% in payout ratio and 8.56% in dividend yield.

While the latter may seem drastically improved compared to the 4Y average of 4.35%, we are not convinced if anyone should be adding here indeed.

Depending on investors’ buy in point and dollar cost averages, the IIPR stock has also lost -70% of its value since the November 2021 peak, triggering massive capital losses for its long-term shareholders.

While new investors may consider adding a small position here, the portfolio must also be sized appropriately since it remains to be seen if the May 2023 support level may hold, until its tenants fully resolve their cash flow issues and the federal legalization occurs in the far future.

Assuming further cash flow headwinds, it is not overly bearish to project a potential dividend cut as well, one that we have observed with Medical Properties Trust (MPW) thanks to its troubled tenants.

As a result of the potential volatility and capital losses, we prefer to err on the side of caution and rate the IIPR stock as a Hold (Neutral) here.

Read the full article here