Stock market investing: First you get bitten by what you don’t know, then you are eaten alive by what you do know.”― Garry Fitchett.

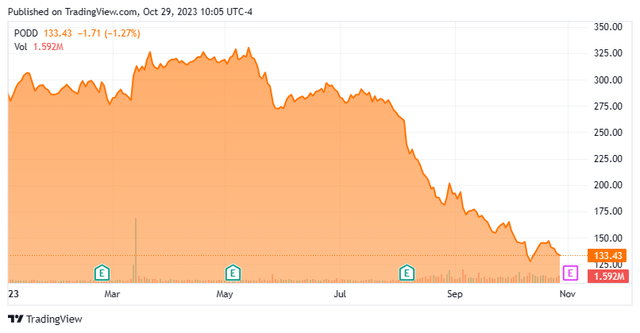

Today, we put Insulet Corporation (NASDAQ:PODD) in the spotlight for the first time. The stock has lost some 60% of its value since its recent highs in early May. The trigger for the loss is the growing belief that GLP-1 increasingly popular weight loss drugs such as Ozempic and Wegovy will significantly cut the demand for insulin injections in people with diabetes.

Seeking Alpha

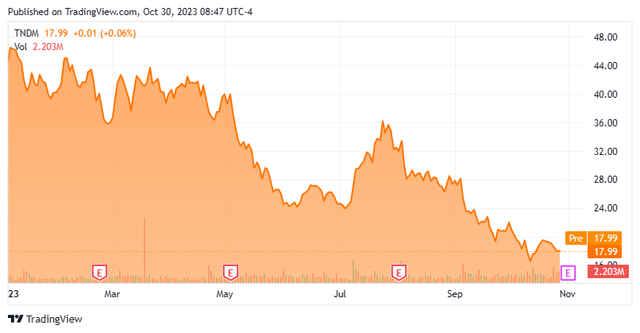

The stocks of other names in the space such as Tandem Diabetes Care, Inc. (TNDM) have been similarly impacted in recent months. Is the Insulet Corporation selloff an overreaction or is there more pain to come? An analysis follows below.

Seeking Alpha

Company Overview:

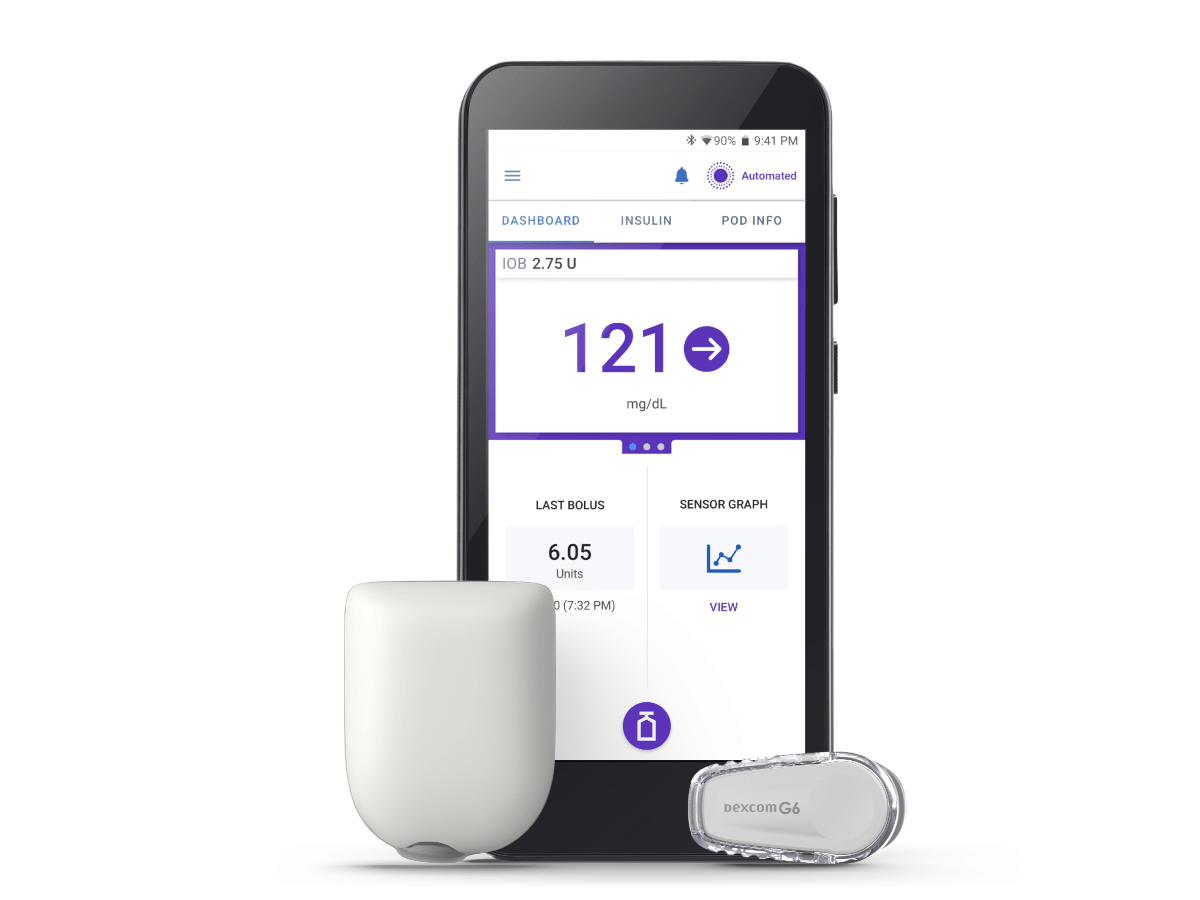

The company is headquartered outside of Boston in Acton, MA. This medical device concern is focused on developing and marketing insulin delivery systems for people with insulin-dependent diabetes. Its main product is the Omnipod System. This consists of a self-adhesive disposable tubeless device that is worn on the body for up to three days at a time, as well as its wireless companion, the handheld personal diabetes manager. The stock currently trades around $133.00 a share and sports an approximate market capitalization of $9.3 billion.

Ominpod 5 Insulin Delivery System (Company Website)

The company’s vision is to revolutionize the insulin delivery market. Insulet’s tubeless disposable Pod system provides up to three days of non-stop insulin delivery, without the need to see or handle a needle. Insulet’s flagship Omnipod 5 is also the only FDA-approved fully disposable, pod-based automated insulin delivery system.

Second Quarter Results:

Insulet Corporation reported its second quarter numbers on August 8th. The company posted non-GAAP earnings of 38 cents a share, 11 cents above the consensus. Revenues grew over 32% on a year-over-year basis to $396.5 million, some $11 million over expectations.

Growth was primarily driven by the U.S., which saw Omnipod revenue growth of almost 41% from the same period a year ago to $276.8 million. International revenues came in at $103.7 million, up 16% from 2Q2023. The company did recently launch its Omnipod 5 in the United Kingdom and plans to roll out the Omnipod 5 in Germany before the end of this year, with major other countries in Europe following in 2024.

The company and just garnered FDA clearance for an iPhone app for its Omnipod 5 insulin delivery system here in the United States. This spring, Insulet also had its Omnipod GO approved by the FDA. The GO is an insulin delivery device for people with type 2 diabetes aged 18 years or older that will begin to be marketed in the United States in 2024.

It was a solid quarter, and management also upped FY2023 revenue guidance to between 22% to 25% from 18% to 21% previously.

Analyst Commentary & Balance Sheet:

The analyst community is mixed on the company’s prospects right now. Since second quarter results were posted, eleven analyst firms including Citigroup and Wells Fargo have reiterated Buy/Outperform ratings on the stock. It should be noted over half of these had significant downward price target revisions. Price targets proffered ranged from $162 to $355 a share. Five analyst firms including UBS and Morgan Stanley with price targets ranging from $185 to $257 a share.

Notably, Piper Sandler was out two weeks ago stating that:

“it sees GLP-1 drugs as having only a limited impact on the market for devices to treat type 2 diabetes and virtually no impact on those to treat type 1, at least for the next several years.”

In addition, the recent pullback in these names were a buying opportunity for investors that could wait several quarters for this narrative to dissipate. The CEO of Abbott Laboratories (ABT) had basically the same take a few days later.

Just over five percent of the outstanding shares are currently held short. Several insiders unloaded just over $16 million worth of shares in the hundred days of 2023 collectively when the stock traded in the high $200s/low $300s. The CEO did add just over $1 million to his stake in the firm at just over $181.00 a share late in August. The company’s CFO announced his departure from the company earlier this month.

The company ended the second quarter of this year with approximately $660 million worth of cash and marketable securities on its balance sheet according to its 10-Q filed that quarter. Long-term debt stood at some $1.368 billion.

Verdict:

The stock made $1.28 a share in FY2022 on $1.31 billion in revenues. The current analyst firm consensus has the firm earning $1.63 a share as sales rise nearly 25% in FY2023. They also see profits topping $2.25 a share in FY2024 on 20% sales growth.

I have to admit, I have been most amused by the selloff in these names as well as such diverse economic sectors as snack food concerns on the belief that the new GLP-1 drugs like Ozempic and Wegovy are going to turn America into a much more svelte nation. In my opinion, that has as much chance of happening as a vaccine developed in record time against a quickly mutating virus being 95% effective.

That said, even after the huge selloff in the stock of Insulet Corporation, the shares are hardly in the “bargain basement” at north of 80 times forward earnings and nearly six times forward revenues. Even if an investor assumes long term earnings and revenue growth in the low 20s, that gives the stock a PEG ratio of nearly four. Even in a ZIRP environment, that would be a stretched valuation. In an environment where the 10-Year treasury yield (US10Y) is nearly five percent for the first time since 2007, it is a non-starter.

If you have a farm and you have a bad year, nobody quotes your farm 50% below its actual intrinsic value. But in stocks, this does happen and happens very often.”― Naved Abdali.

Read the full article here