Intel (NASDAQ:INTC) announced on Tuesday that it was completing a secondary stock sale for its investment in Mobileye Global (MBLY), a company that focuses on the development of advanced driver-assistance systems. The secondary stock sale comes at a time when Intel’s core business is under intense pressure from a decline in consumer demand for PCs, Notebooks and tablets. According to Gartner, PC shipments declined 30% in the first-quarter of 2023, showing an accelerating decline of shipments compared to the fourth-quarter (shipments declined 28.5% in Q4’22). Since Intel owns a considerable share in the start-up and Mobileye Global’s shares are now expensive based off of P/E, investors may see further stock offerings as Intel is cashing in on the AI boom.

Second stock offering and Mobileye Global outperformance

Intel bought Mobileye Global, an Israel-based start-up focused on self-driving technology in 2017, for $15.3B. Intel listed Mobileye Global on the stock market as an independent enterprise in the fourth-quarter of 2022, raising $861M from the IPO. Intel owns approximately 94% of Mobileye Global (Source) and owns the majority of Class B shares which have ten times the voting rights than Mobileye Global’s Class A shares.

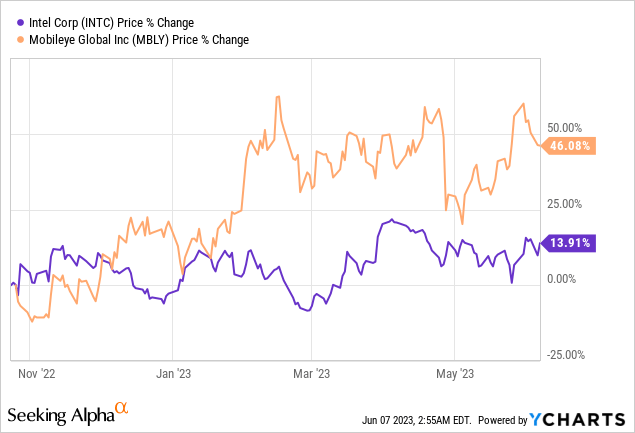

Shares of Mobileye Global soared 37% on their first day of trading and have greatly out-performed shares of Intel which have suffered from broad-based weakness in demand for consumer electronics products as well as excess inventories in the PC industry. While Intel’s shares have not performed well, Mobileye Global benefited from buzz around artificial intelligence applications. Nvidia’s blow-out outlook for Q2 due to exploding demand for AI chips (which are used in the autonomous driving industry) has further stoked hopes of massive growth for companies that are involved with this emerging technology, including Mobileye Global. Therefore, it makes sense for Intel to cash in on the AI buzz and sell some of its significant Mobileye Global’s shareholding into the strength.

Intel announced on Monday that it was selling 35M of its Class A shares for an estimated $1.5B in a secondary stock offering. All proceeds from the stock offering will go to Intel with Mobileye not receiving any proceeds.

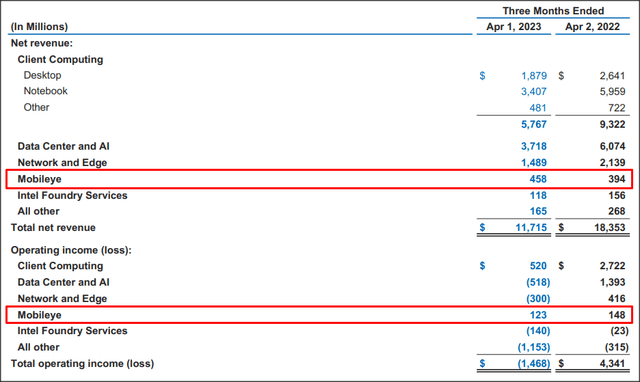

Mobileye Global has been a bright spot for Intel in the last quarter that has seen steep declines in revenues due to the contraction in the consumer PC market. Mobileye Global generated $458M in net revenues for Intel in Q1’23, showing 16% year over year growth and the autonomous driving company made a positive operating income distribution of $123M in the most recent quarter.

Source: Intel

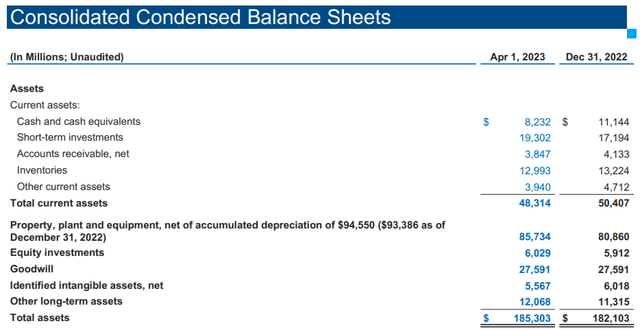

Intel has said that it was going to use net proceeds from its Mobileye Global IPO to build out its chip making capacity and become a foundry. Building foundries is capital intensive and although Intel has a considerable amount of cash on its balance sheet, I can see Intel offering more Mobileye Global’s shares in subsequent secondary stock offerings. Intel had more than $8.2B in cash on its balance sheet at the end of Q1’23 and the stock offering is set to add another $1.5B to this cash pile.

Source: Intel

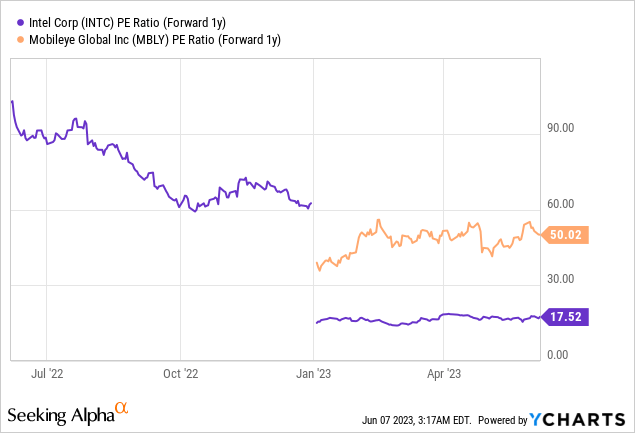

Intel’s and Mobileye Global’s valuation

I can see Intel offer more shares for Mobileye Global in the coming months or quarters as the current hype surrounding artificial intelligence has led to strong price appreciation for those companies that are active in the space… which makes it a good time for Intel to cash in on the AI buzz. Mobileye Global’s shares is now highly valued with a P/E ratio of 50X while Intel itself is trading at a P/E ratio of 17.5X.

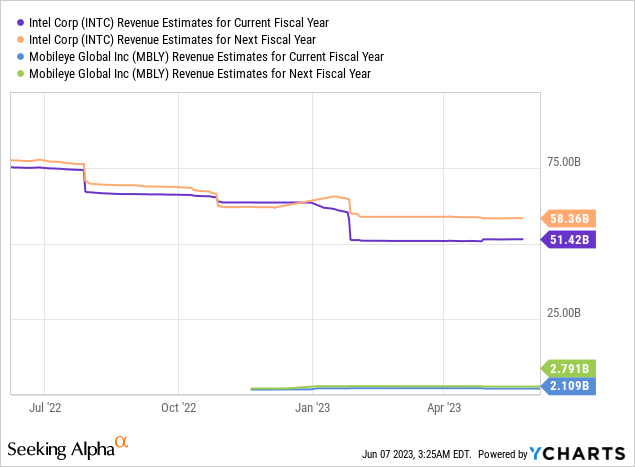

Mobileye Global also has much stronger top line growth prospects than Intel. Mobileye Global is expected to see 13% top line growth this year and 32% revenue growth in FY 2024 as more car companies are set to include autonomous driving technology. Intel, on the other hand, has much less attractive growth prospects with consensus estimates calling for (18)% revenue growth in FY 2023 and 13% in FY 2024.

Risks with Intel

The biggest risk for Intel, as I see it, is the continual degradation of the consumer electronics market which has seen a sharp fall in shipments of PCs, notebooks and tablets in the last year. There is also a considerable risk that Intel will have to cut its dividend if free cash flow does not recover. What would change my mind about Intel is if the company reported a stabilization of its revenues and saw a positive EPS revision trend.

Final thoughts

Intel’s secondary stock offering of Mobileye Global shares shows that the company is looking for ways to cash in on the AI buzz which has captured the imagination of investors, especially after Nvidia presented its blow-out outlook for the second fiscal quarter due to enormous demand for its artificial intelligence chips. As Intel transitions to build more foundries going forward and given the high valuations of companies such as Mobileye Global that are at the very center of the emerging AI revolution, I believe Intel is going to offer even more shares of Mobileye Global in the near future. Intel’s prospects, however, have not changed very much for because of the secondary stock offering and I continue to rate Intel as a sell due to demand weakness, top line pressure in its core market and dividend risks.

Read the full article here