Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

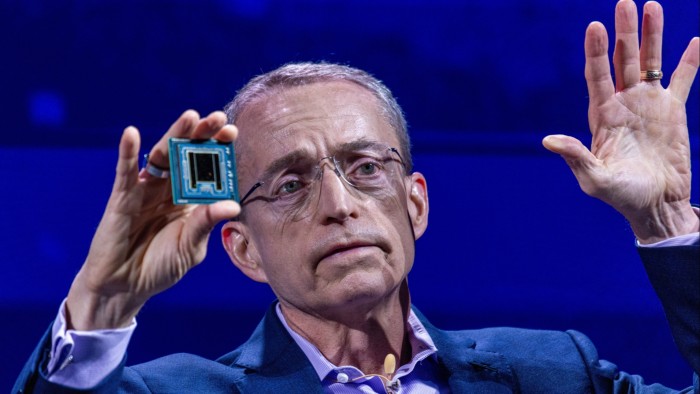

Pat Gelsinger is to stand down as Intel chief executive, deepening the crisis at the once-dominant US chipmaking group, which has fallen behind rivals such as Nvidia.

The California-based company said on Monday that the 63-year-old would be replaced by chief financial officer David Zinsner and executive vice-president Michelle Johnston Holthaus, who will be interim CEOs until a permanent appointment is made.

Gelsinger described the decision as “bittersweet”, adding that it had been “a challenging year for all of us as we have made tough but necessary decisions to position Intel for the current market dynamics”.

Appointed chief executive in 2021, Gelsinger was more than three years into his five-year plan to turn Intel into a chipmaking powerhouse to rival Taiwan Semiconductor Manufacturing Company.

Under his direction, the group announced plans to build new factories in the US and Europe, sought to catch up with the most advanced manufacturing processes, and separated the company’s chip design business from its manufacturing arm.

But the strategy had come under increasing pressure, with the company rocked by the departures of executives, thousands of lay-offs and a plunging share price.

Over the past year, Intel’s share price has dropped more than 40 per cent, falling to a market capitalisation of just over $103.7bn. By contrast, shares in Nvidia, which has cornered the market for cutting-edge AI chips, have risen more than 200 per cent over the same period, reaching a market cap of $3.35tn.

Intel’s share price jumped almost 4 per cent in pre-market trading following the news of Gelsinger’s retirement.

In October, Intel announced $18.7bn in restructuring and asset impairment charges in its latest effort to rebuild its competitiveness.

The charges included $2.8bn of expenses tied to a previously announced reorganisation and cost-cutting programme designed to cut spending by $10bn a year. Intel also took $15.9bn of impairment charges on equipment and goodwill writedowns.

Attention had recently turned to Gelsinger’s relationship with his board, from which Lip-Bu Tan resigned in August. The former chief executive of chip design software company Cadence had been charged with overseeing its crucial chip manufacturing strategy.

As part of the changes announced on Monday, Johnston Holthaus will take a newly created position as chief executive of Intel Products, a unit that encompasses its AI, data centre and client computing groups.

Frank Yeary, who was independent chair of Intel’s board but will become interim executive chair as it looks for a new chief, added: “While we have made significant progress in regaining manufacturing competitiveness and building the capabilities to be a world-class foundry, we know that we have much more work to do at the company and are committed to restoring investor confidence.

“As a board, we know first and foremost that we must put our product group at the centre of all we do,” he said. “Our customers demand this from us, and we will deliver for them.”

Read the full article here