Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Intel stock dropped as much as 5.5 per cent Thursday after the US chipmaker gave a downbeat revenue outlook, citing “industry-wide” supply chain constraints hampering its growth.

The Santa Clara, California-based company reported that revenue fell 4 per cent to $13.7bn in the quarter to the end of December compared with last year, slightly ahead of Wall Street expectations of $13.4bn compiled by Visible Alpha.

But Intel said it expected between $11.7bn and $12.7bn in revenue for the quarter ending in March, with a midpoint below the $12.6bn expected by Wall Street.

David Zinsner, Intel chief financial officer, said Intel was dealing with “industry-wide supply shortages”.

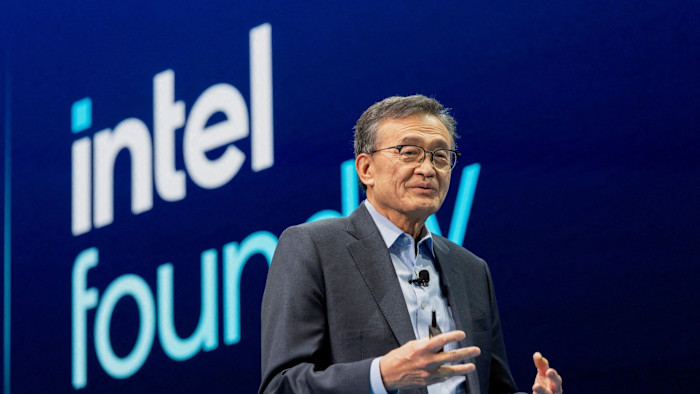

Chief executive Lip-Bu Tan said the company was “working aggressively to grow supply to meet strong customer demand” and hailed the launch of its new personal computer chip as an “important milestone”.

Intel’s shares, which have surged nearly 150 per cent over the past year after backing from President Donald Trump, were boosted this month by the launch of the new “Panther Lake” PC chips. The stock dropped in after-hours trading in New York.

Trump at the time praised Tan, celebrated the launch and said the government had already made “tens of billions of dollars” from the 10 per cent stake it agreed to take in Intel in August.

However, the chipmaker faces pressure to turn around its manufacturing business after investing billions of dollars in a push to lure big customers such as Apple and Nvidia away from Taiwan Semiconductor Manufacturing Company. Nvidia made a $5bn investment in Intel last year.

Intel’s foundry business had $4.5bn in revenue, slightly above the $4.2bn expected. The group reported a net loss of $591mn for the December quarter — worse than consensus estimates.

Intel’s product division, which includes its PC and traditional non-AI data centre chip business — and represents the bulk of its revenue — reported $12.9bn in revenue for the quarter, ahead of the $12.7bn analysts had forecast. It continues to face tough competition in its PC chip design business from the likes of AMD and Qualcomm.

Read the full article here