Intel Corporation’s (NASDAQ:INTC) second-quarter or FQ2 earnings release and outlook in late July corroborated my belief that Intel bears were too pessimistic. INTC has outperformed Advanced Micro Devices, Inc. (AMD) and Taiwan Semiconductor aka TSMC (TSM) stock since its May 2023 bottom.

With the PC market bottoming, as inventory adjustments are slowing down, market leader Intel is expected to benefit significantly as investors reassess whether their pessimism in the execution prowess of INTC CEO Pat Gelsinger and his team was overstated.

Intel has also made progress in data center AI accelerators and at the edge, corroborating its ability to keep pace with AMD and Nvidia (NVDA). While the recent termination of the deal to acquire Tower Semiconductor (TSEM) represents an untimely setback for Intel Foundry, partnership opportunities still exist. Intel Foundry remains in catch-up mode on TSMC, and that’s irrefutable. However, the company’s “five nodes in four years” strategy remains on track, with the most significant CapEx committed earlier. As such, I assessed that its margin profile is expected to bottom out this year as it gains significant operating leverage through FY25.

In other words, if you added INTC at its lows between October 2022 and May 2023, I don’t expect INTC to revisit those well-battered levels as it climbs out of its long-term bottom. The critical focus for Intel remains on execution, as it aims to protect further market share losses against AMD in data center CPUs while exploiting Nvidia’s supply chain shortfalls (in advanced packaging) in AI accelerators.

At the same time, the company is gaining traction against TSMC, as its 18A process snagged recent wins with the US government. As such, it could “squeeze potential orders for TSMC’s Arizona fabs,” leveraging the tailwinds of technological sovereignty to Intel’s advantage. While that likely isn’t enough to secure a decisive victory against the Taiwan-based pure-play foundry, Intel could be on track to surpass Samsung (OTCPK:SSNLF) by 2024.

Recent market sentiments on INTC suggest buyers have conviction about Intel’s execution against its peers. Bolstered by robust consumer spending despite macroeconomic uncertainties, I parsed that Intel is well-positioned as the market leader to recover in the second half.

Intel management didn’t deny the well-publicized potential “AI cannibalization” from Nvidia against data center CPUs budget at its July earnings call. However, Intel has confidence in its holistic end-to-end strategy that should help its customers achieve a lower total cost of ownership or TCO over time. Nvidia’s leadership in the space is undisputed, given its software ecosystem. With AMD nearing the launch of its MI300 accelerators in the fourth quarter, I believe it sets up an exciting battle between Nvidia and the rest to determine whether customers want alternatives.

The “alternative” thesis was highlighted by management. Gelsinger stressed that “there is a demand for alternatives and more capacity.” As such, “Intel is actively engaged with both Tier 1 and next-generation cloud providers.” Therefore, I believe it’s important for Intel to continue scaling and executing well, as the demand surge from AI applications could produce a broad tailwind that benefits the industry beyond just Nvidia. Customers could be concerned about getting locked into a partnership with Nvidia, considering the leading GPU maker also has its own DGX cloud ecosystem. As such, they could lose leverage, with Nvidia reportedly favoring cloud startups (including those that the company invests in) with AI chip supply.

As such, I believe the battle for AI supremacy is far from over, and Intel doesn’t seem far behind. Moreover, the battering and valuation likely reflect significant pessimism at INTC’s long-term lows.

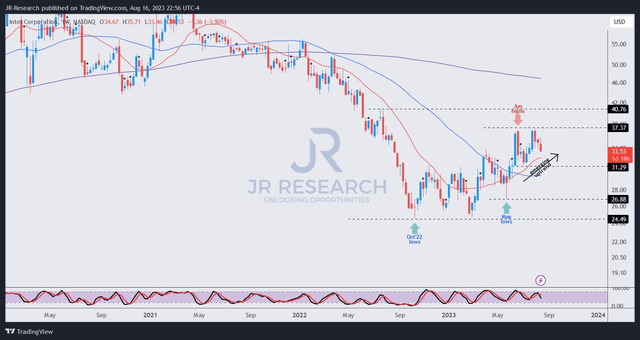

INTC price chart (weekly) (TradingView)

INTC was resisted in late July at the $38 level despite its initial post-earnings surge. As such, I urge investors to avoid adding close to that level until a decisive upside breakout has been ascertained.

Notwithstanding the rejection by sellers, the recent pullback in INTC over the past three weeks has opened up another opportunity for INTC to buy more shares if they missed adding earlier in the year.

I see the $31 support zone as constructive to add more aggressively. With INTC’s emerging medium-term uptrend bias unfolding, I don’t expect us to revisit the $27 level (May 2023 lows) moving ahead unless Gelsinger and his team miss their execution targets significantly.

However, buying sentiment on Intel Corporation stock suggests the market isn’t anticipating such a decline. As such, dip-buying setups are constructive, allowing more confidence for value investors to pick their spots without unduly worrying about catching falling knives.

Rating: Maintain Buy. Please note that a Buy rating is equivalent to a Bullish or Market Outperform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here