Interest rates at higher levels for longer. That seems to be the prevailing market sentiment right now, causing stocks in general, and certain sectors in particular, to sell off quite hard. However, we believe that this view is overlooking some key macro trends that will very likely push interest rates lower next year. As a result, we think that the growing “higher for longer” market consensus is mistaken. In this article, we discuss why this is and what implications this has for the SPDR® S&P 500 ETF Trust (NYSEARCA:SPY).

Why Higher For Longer Sentiment Is Taking Hold

Initially, the yield curve inverted sharply as investors had been convinced that a hard landing was coming for the economy in response to the Federal Reserve’s sharp interest rate increases, but with the unemployment rate remaining surprisingly low and resilient consumer spending propping up the economy, GDP growth numbers have been revised upwards, widening the path to a soft landing for the economy. As a result, the 10 and 30-year treasury yields have been rising this year – particularly over the past three months – as the sharply inverted yield curve has started to flatten a bit in response to an improving outlook for economic growth.

Investors initially dismissed these rising Treasury yields as a sign of economic growth. However, they are now growing increasingly worried that the Federal Reserve will keep interest rates elevated longer than previously expected, with oil prices soaring and Core CPI still having a ways to go to reach the Fed’s target 2% rate:

3 Reasons Why Interest Rates Will Not Remain Higher For Longer

While the sharp rise in oil prices does seem at first to deal a fatal blow to the case for meaningful interest rate cuts in the near future, there are five reasons why we believe that interest rates are still likely headed lower in 2024.

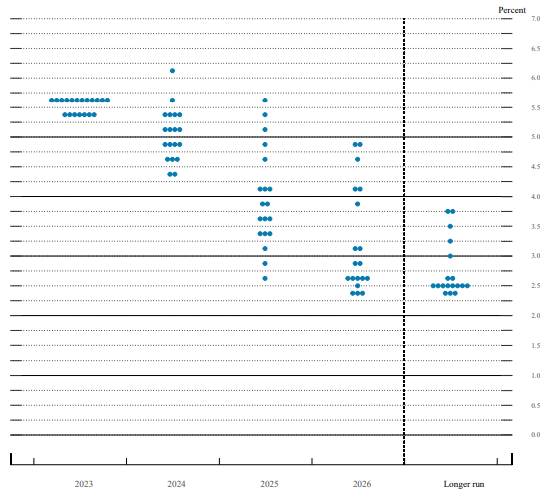

First, the Federal Reserve’s own dot plot still indicates that this will happen, with only one member of the FOMC expecting a single interest rate hike next year and the vast majority expecting one or more rate cuts:

FOMC Dot Plot (September Summary of Economic Projections)

Moreover, this committee also overwhelmingly expects even deeper cuts in 2025 and 2026. Granted, the dot plot should not be taken as formal guidance, but it is a meaningful indicator because it reveals the current thinking of those individuals who have the most impact on the future direction of interest rates.

The second reason why we do not think that interest rates will remain higher for longer is that the already heavily indebted Federal Government continues to spend money far faster than it is bringing it in. Moreover, there are strong catalysts for sustained levels of elevated spending, such as the war in Ukraine, the growing arms race with Communist China, and the growing commitment by those on the U.S. political left to subsidize renewable energy and redistribute wealth. As a result, the Federal Reserve will feel immense political pressure to cut interest rates sooner rather than later, otherwise the interest expense on the Federal debt will become overwhelming.

Third, we think that a recession is increasingly likely to hit if interest rates remain elevated. After a decade-plus of very easy monetary policy, the economy has become addicted to low-cost debt and nearly the entire real estate industry is going to face a world of hurt if interest rates remain elevated as nearly $1.5 trillion in debt matures in the next few years. Moreover, the consumer is heavily indebted, and – given that much of their consumption is debt-financed as is much of corporate growth spending – higher interest rates for longer will cause the economy to come to a screeching halt if pressed too far.

Fourth, 2024 is a major election year in the United States. The Federal Reserve will likely feel pressure to not risk breaking the economy and potentially impact the election’s outcome in the process.

Fifth, technological innovation – particularly the rapid advance of artificial intelligence and robotics – should prove to be very deflationary for the economy. While it may not be enough on its own to overcome the runaway spending of the government, it will give some flexibility for monetary policymakers to cut interest rates.

SPY Implications

Rising treasury yields and growing concerns about interest rates remaining higher for longer have weighed on SPY, pushing it about 7% lower since its peak in late July:

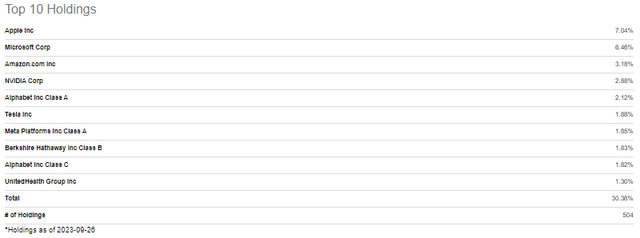

Up until then, the A.I. driven mania had fueled a strong rally in SPY as its largest holdings are mega-cap technology companies that are investing heavily in the new technology:

SPY Top Holdings (Seeking Alpha)

However, higher interest rates will likely continue to weigh heavily on these companies for the following reasons:

- A.I. investments are not producing much cash flow today and are expected to deliver outsized cash flows well into the future as the research and development investments of today pay off in years to come with new technological breakthroughs and increased consumer and corporate adoption. As a result, the higher discount rate being applied to valuing these companies from higher interest rates will result in lower intrinsic value estimates today.

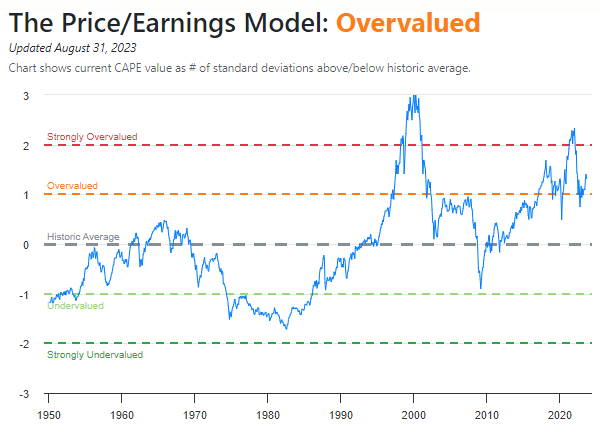

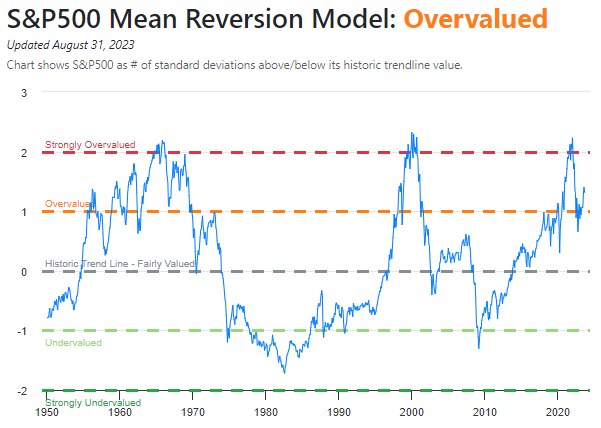

- These stocks currently trade at elevated valuations. As a result, they have a higher threshold of future performance to cross in order to validate the current valuations being assigned to them. This has carried over to SPY in general, leaving it considerably overvalued according to several leading metrics, including the Price-to-earnings model and the S&P 500 mean reversion model pictured below:

P/E Model (currentmarketvaluation.com) S&P 500 Mean Reversion Model (currentmarketvaluation.com)

What this means is that if/when interest rates reverse course, SPY should enjoy some strong tailwinds that could push it higher. However, it also means that the risk-reward may not be favorable for SPY given that it already has so much positivity priced into its current valuation. If interest rates do not move lower, SPY is positioned for an outsized crash. Moreover, if interest rates do fall, SPY may underperform subsectors – such as REITs (VNQ) and some utilities (XLU) – that are trading at deep discounts to historical averages and are poised to rocket significantly higher in the event that interest rates do decline next year.

Investor Takeaway

The higher-for-longer narrative has crushed certain sectors of the market and is finally beginning to weigh on SPY as well. While its year-to-date performance remains impressive thanks to the bullishness on AI stocks that make up its largest constituents, SPY is now positioned such that it trades at a large premium to its historical average valuation. As a result, while we think that the likelihood of falling interest rates in 2024 should provide it some support, it will likely underperform subsectors of the market like REITs and utilities in such a scenario. Moreover, if interest rates do indeed remain higher for longer, SPY is positioned to experience a major correction if not a crash given its tech-exposure and elevated valuation. As a result, we rate it a Sell.

Read the full article here