A Quick Take On Invea Therapeutics, Inc.

Invea Therapeutics, Inc. (INAI) has filed to raise $75 million in an IPO of its common stock, according to an SEC S-1 registration statement.

The firm is a clinical-stage biopharma developing drug treatments for immune-mediated inflammatory diseases.

I’ll provide an update when we learn more about the IPO terms and assumptions.

Invea Overview

Guilford, Connecticut-based Invea Therapeutics, Inc. was founded to develop treatments for chronic inflammatory diseases such as atopic dermatitis and chronic urticaria.

Management is headed by president, Chairman and CEO Krishnan Nandabalan, Ph.D., who has been with the firm since its inception in October 2021 and was previously the founder of BioXcel, LLC.

The firm’s lead candidate, INVA8001, for the treatment of atopic dermatitis, was in-licensed from Daiichi Sankyo Company.

The company is preparing to submit an IND application for the drug candidate for moderate to severe atopic dermatitis and, separately, for chronic urticaria.

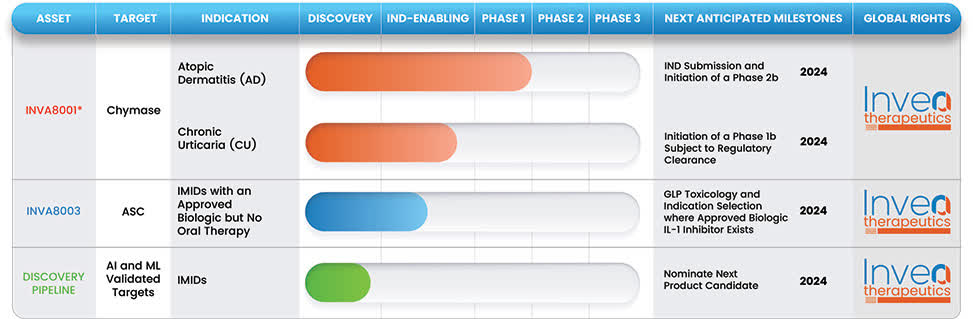

Below is the current status of the company’s drug development pipeline:

SEC

Invea has booked fair market value investment of $5.66 million as of December 31, 2022, from investors, including InveniAI LLC and others.

Invea’s Market & Competition

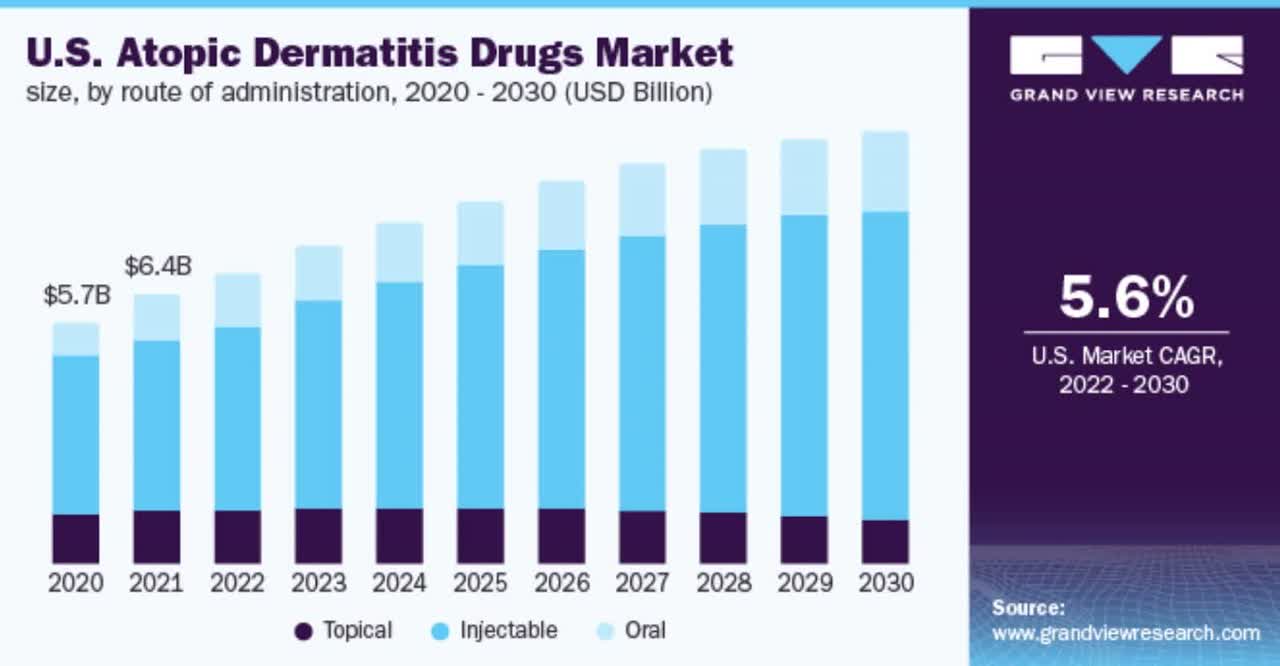

According to a 2022 market research report by Grand View Research, the global market for atopic dermatitis drugs was an estimated $12.7 billion in 2021 and is forecasted to reach $27.6 billion by 2030.

This represents a forecast CAGR (Compound Annual Growth Rate) of CAGR (Compound Annual Growth Rate) of 9.0% from 2022 to 2030.

Key elements driving this expected growth are a strong pipeline of treatment options and a growing prevalence of diagnosed conditions due in part to increased handwashing resulting in “cracked and dry skin prone to infections among atopic dermatitis patients.”

Also, the chart below shows the historical and projected future growth trajectory of the atopic dermatitis treatment market in the U.S. from 2020 to 2030:

Grand View Research

Major competitive vendors that provide or are developing related treatments include the following companies:

-

Pfizer (PFE).

-

AbbVie (ABBV).

-

Regeneron Pharmaceuticals (REGN).

-

Sanofi S.A. (SNY).

-

LEO Pharmaceuticals.

-

Novartis (NVS).

-

Genentech.

Invea Therapeutics, Inc. Financial Status

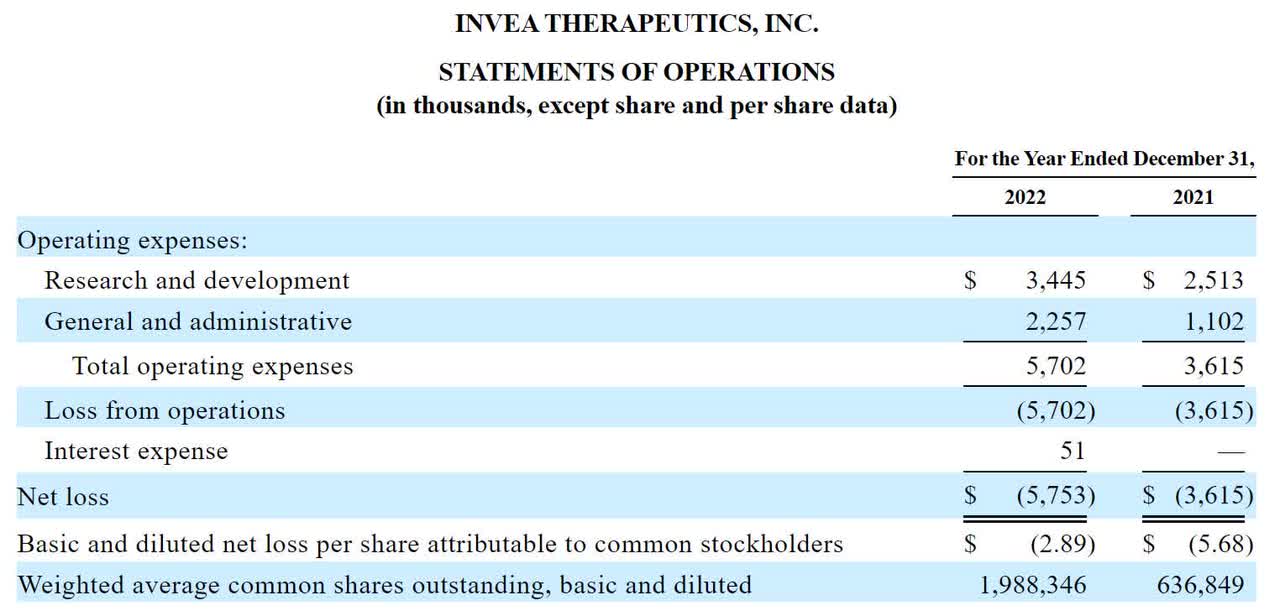

The firm’s recent financial results are typical of a clinical-stage biopharma firm at IPO; they indicate material R&D and G&A expenses and no revenues.

Below are the company’s financial results for the past two years:

SEC

As of December 31, 2022, the company had $588,000 in cash and $2.9 million in total liabilities.

Invea Therapeutics, Inc. IPO Details

Invea intends to raise $75 million in gross proceeds from an IPO of its common stock, although the final figure may differ.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

to advance the development of INVA8001, including the initiation of a Phase 2b trial and the expected data readout for AD and initiation and completion of a Phase 1b trial for CU, each subject to regulatory clearance;

to advance the development of INVA8003;

to be repaid to InveniAI pursuant to the repayment terms under the line of credit […]

to be repaid pursuant to the repayment terms under the Secured Note with the Nandabalan 2020 Trust, or the Secured Note, which is due on September 19, 2024 […];

$2.5 million to be paid to InveniAI pursuant to the Contribution Agreement;

$1.5 million to be paid to InveniAI under the license agreement with InveniAI; and

the remainder for general corporate purposes, including working capital, operating expenses and other capital expenditures.

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said ‘no third parties to our knowledge have initiated legal proceedings against’ it to date.

Listed bookrunners of the IPO are BofA Securities, Citigroup, Truist Securities and ThinkEquity.

Commentary About Invea’s IPO

INAI is seeking U.S. public capital market funding to advance its pipeline of drug treatments.

The firm’s lead candidate, INVA8001, for the treatment of atopic dermatitis, was in-licensed from Daiichi Sankyo Company.

Management is preparing to submit an IND application for the drug candidate for moderate to severe atopic dermatitis and separately for the treatment of chronic urticaria.

The market opportunity for the treatment of atopic dermatitis is large and expected to grow in the coming years, but the firm faces significant competition from large industry players.

Management hasn’t disclosed any major pharma firm collaboration agreements or academic research relationships.

The company’s investor base does not include any well-known institutional life science venture capital firms among its members.

Invea is relatively thinly capitalized in its present form and, after the IPO, is likely to remain a controlled company by its current parent firm.

When we learn more about the Invea Therapeutics, Inc. IPO’s details, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Read the full article here