Investment summary

A full 11 months since my last bullish publication on IRadimed Corporation (NASDAQ:IRMD) the investment thesis has been vindicated with a 37% appreciation in equity capital. Those who ‘held’ through the November ’22 publication and then sized up following the latest buy rating in February have been rewarded handsomely. Whilst it wasn’t ‘expected’ per se, a close inspection of IRMD’s economic characteristics added a layer of confidence in the company’s ability to drive market value for its shareholders.

Subsequently, the company’s Q1 FY’23 numbers were an added delight on an already delicious offering. It clipped $0.30 in earnings on 26% YoY growth in quarterly revenues, with upsides throughout the core portfolio. An educated view of the company’s operations suggests a good part of the growth is yet to come for IRMD, and management now aims to do $63.5mm of business in FY’23 on $1.34 in earnings, calling for 19% and 23% YoY growth respectively.

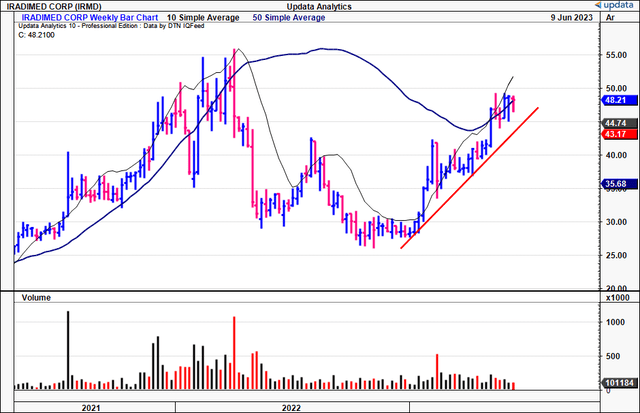

Figure 1

Data: Updata

Q1 numbers illustrative of FY’23 momentum

A quick recap of the bullish points from the February publication- talk around the company’s 510(K) application on its 3870 MR IV pump was priced in with tremendous effect. That, and the firm’s 25% top-line growth rate, 600% return on incremental capital, and 13% growth in intrinsic valuation were recognized by observers of the market, with strong hands holding the stock since November FY’22 at least.

Fundamentals

Results were equally as pleasing to get things rolling in FY’23. IRMD booked top-line revenue of $15.5 mm, another 26% YoY growth on Q1 FY’222 on core EBITDA of $4.2mm and earnings of $0.30. Growth was underscored by upsides in the firm’s domestic and international markets. Specifically, domestic sales were up 20% to $11.9mm, while ex-US sales skyrocketed by 50% to $3.5mm. The following implications are applicable to investors from this:

- Both sets of growth percentages illustrate the rapid uptake in the firm’s core pump offerings. Furthermore, the volume/price in international sales suggests the firm is penetrating into its international markets.

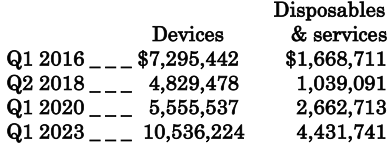

- I’d point you to the growth in quarterly device segment revenue. It increased by 24% to $10.5mm, and I would underline in thick bold the 69% YoY increase in pump revenue that drove this.

- Such a spike was the result of the shipment of previously booked pump orders dating as far as back to Q4 last year. Additionally, income from disposables and services experienced a significant growth of 34% to $4.4mm. Collectively, these two segments have exhibited an impressive revenue growth record since 2016, compounding at 11% and 15% per annum to Q1 FY’23:

Data: Author, IRMD SEC Filings

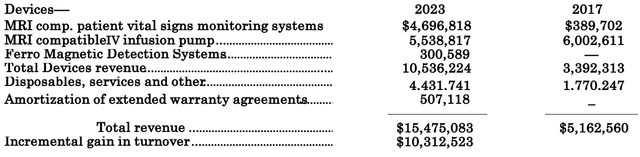

The incremental performance of all segments since 2017 is tabulated below.

Table 1

Data: Author, IRMD SEC Filings

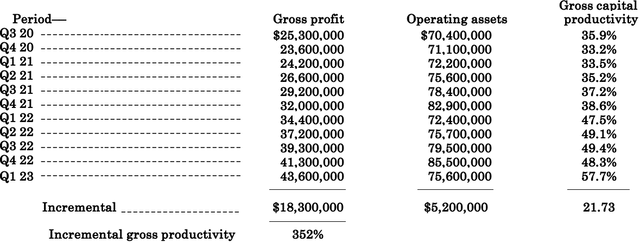

- While IRMD enjoyed a marginal 50bps YoY decrease in gross margin to 75.7% in the quarter, it remains relatively high and in line with the 5-year range. Gross capital productivity has been a major feature for the company since 2020 at least. In that time, the firm’s operating assets have added another $18.3mm in TTM gross profit from just $5.2mm growth in assets. Furthermore, OpEx came to 49.7% of revenue, compared to 51.2% last year, adding another 30% in quarterly operating income.

Table 2

Data: Author, IRMD SEC Filings

Capital productivity, economic earnings

So much effort is spent these days on extrapolating ‘growth’ without a thoughtful analysis of how this relates to the economic characteristics of a business. Economic earnings, those profits above/below the market’s hurdle rate (in this report, 12%) are more telling of a firm’s earnings power and asset factors than accounting profits are.

Since Q4 FY’21 we’ve observed the firm produce a cumulative $19.8mm in economic earnings (TTM figures), and produce an additional $4.65mm in economic growth. These are tremendously attractive profitability metrics that suggest the company’s new pump placements are more profitable than existing ones, an absolute delight to investors looking to position against asset-efficient companies.

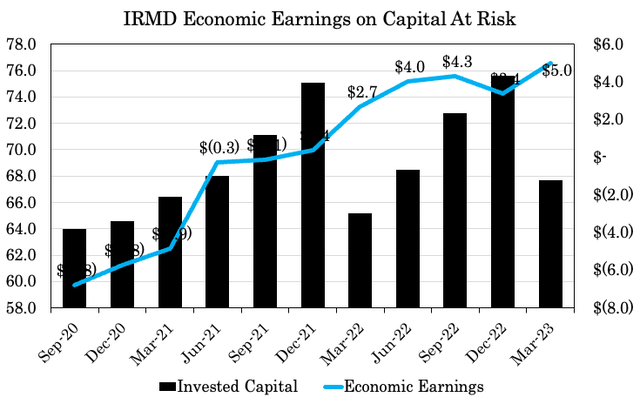

Figure 2

Data: Author, IRMD SEC Filings

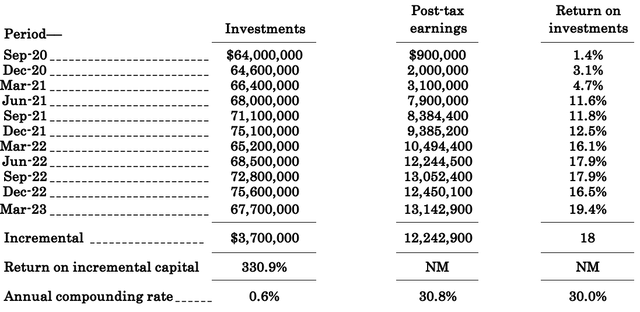

Economic gains must also be measured against the existing capital that generates them. On this point, two points are worth mentioning related to IRMD’s outstanding business economics:

- Looking back to 2020 on a rolling TTM basis, IRMD has increased the return on its existing capital from 1.4 % to 19.4%, an 18-percentage point gain.

- The return on incremental capital amounted to a delicious 331%.

- It compounded trailing post-tax earnings at a 30.8% growth rate each period to Q1 FY’23.

- This equates to an additional $12.24mm from a $3.7mm investment- outstanding value for the firm’s shareholders in my estimation.

Table 3

Data: Author, IRMD SEC Filings

Note that this forms the crux of my investment thesis on IRMD. That the incremental returns on capital are above the trailing numbers tells me its new investments are creating a lengthy tail of asset returns that is rotating back into market valuation. There couldn’t be a more attractive proposition, in my opinion. For one, it’s been a combination of capital efficiency and profitability gains driving the returns on capital in IRMD’s case. Invested capital turnover has ratcheted up from 0.53x to 0.83x, and post-tax margin is at 23.3% in the TTM. Second, investors are well-aware of IRMD’s earnings power in the market, paying a higher market value on the revised expectations of faster and higher earnings growth into the future.

As to what this means for IRMD moving forwards, consider the following:

- A firm’s return on existing capital is the sustainable growth rate of the company (excluding external capital).

- Because IRMD is generating an ROIC above the cost of capital, it is generating free cash for its investors.

- Most critically, because these earnings are economically profitable, it can generate free cash for its owners without jeopardizing growth. Said another way, it can focus on growth without destroying value for its shareholders (i.e., create value instead).

This is accretive to IRMD’s intrinsic value in my opinion and must be heavily factored into the investment debate.

Valuation and conclusion

At the current price of 37.5x forward earnings, some might label IRMD a ‘growth’ stock, although to me this term is loosely applied in modern financial markets. IRMD qualities as a growth company in my opinion, given the 199% incremental gain in turnover and 188% earnings growth since 2017 (discussed earlier in the report). It would appear that investors are willing to pay these exorbitant prices as the stock trades above all three moving averages and market value has appreciated 70% in the past 6 months and 20% in the past 3 months.

Looking at the current market capitalization of $607mm and a 12% hurdle rate, the market expects $73mm in pre-tax earnings from the company in FY’23 (73/0.12 = $608). From the trailing pre-tax figure of $16.7mm, the market expects 63.5% annual compounding growth over the coming 3 years (16.7x(1+0.635)^3/0.12 = $607).

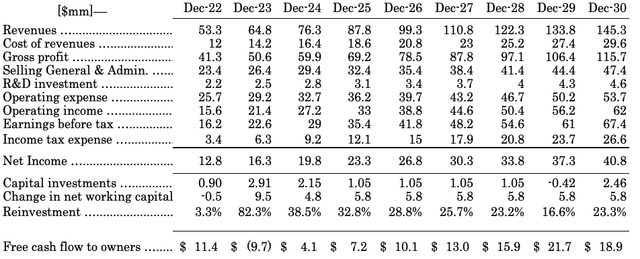

Following the company’s latest numbers, I have revised my estimates on the company’s future cash flows higher (Appendix 1) and value the company at $1.2Bn, around $100mm on my previous valuation estimate. Hence, my estimates are above the market’s consensus, suggesting a potential mispricing. This supports a buy rating in my opinion.

Appendix 1

Data: Author Estimates

Net-net, the fundamental data continues in support of an investment towards IRMD stock. The firm’s growth strategy is evidenced in its tremendous economic earnings that stem as a result of its strong incremental returns on capital. As far as business economics go, this is the kind of firm I am seeking, one that has the potential to scale up profitability over the coming 3 years. In that vein, I am reiterating the buy rating on the company and revising the price target to $95 per share, ~100% upside potential at the time of writing.

Read the full article here