BlackSky Technology Inc. (NYSE:BKSY) is strategically positioned in the growing geospatial analytics sector. While its current revenues indicate significant growth potential, BKSY’s blend of innovation and technology earmarks it as a potential disruptor in the industry. However, there are inherent risks, particularly its relatively small scale and concentrated client base. Despite these challenges, my valuation suggests that BKSY might be considerably undervalued, considering its growth trajectory and technological edge. The company’s financials, contract backlogs, and prospects present a compelling investment case for those eyeing the geospatial intelligence sector.

Business Overview

BlackSky Technology Inc. is a pioneering force in the geospatial analytics market, a sector poised to grow from $67 billion in 2022 to a staggering $120 billion by 2027. By comparison, the company’s annual revenues are not even $100 million, so there is significant growth potential. One of BKSY’s unique features is that it harnesses the power of its 14-satellite Low Earth Orbit (LEO) smallsat constellation and has shifted from static data to delivering high-frequency, real-time information. With satellites’ ability to revisit locations up to 15 times a day, BlackSky strategically targets regions that represent 90% of the global GDP in geographic terms.

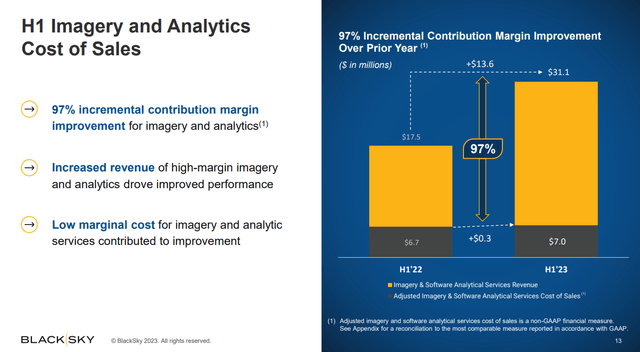

BKSY’s latest earnings call slides.

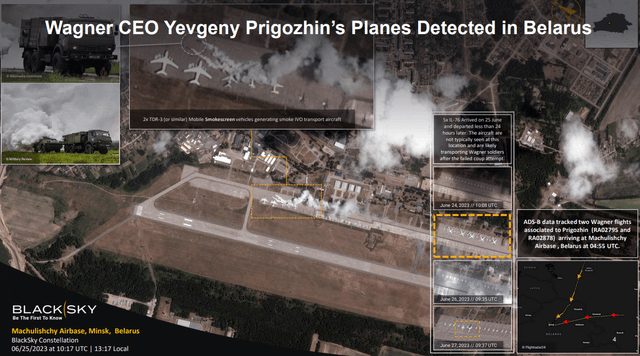

BKSY’s operational model hinges on Spectra AI, an engine that processes satellite data, collates information from the company’s proprietary satellite constellation, and integrates data from GPS-enabled terrestrial sources and IoT devices. This operational epicenter allows BlackSky to differentiate itself in the industry. The high revisit rates and extensive geographical coverage enhance the BKSY’s ability to deliver timely and accurate geospatial information, making it a compelling offering in the market.

Consequently, BlackSky integrates hardware and software. Also, beyond traditional satellite imagery, BKSY offers sophisticated analytics through a subscription-based model. This service delivers high-resolution imagery in under 90 minutes. In fact, I posit that one of BKSY’s main differentiators is its potential to expand its operations and revenue streams by leveraging this flywheel effect. As the volume of data the satellites collect increases, the Spectra AI model becomes progressively more sophisticated, amplifying the value for existing and potential clients.

Moreover, one of the most striking elements of BlackSky’s operational strategy is emphasizing high-revisit satellite constellations. Data collection latency has often hobbled conventional models in the geospatial industry. In contrast, BlackSky’s plan to focus on satellites with revisit rates as low as 60 minutes offers them an advantage in delivering ‘time-sensitive’ or ‘near real-time’ information. This positions them favorably in defense, disaster response, and economic forecasting sectors. Therefore, BKSY’s revenue model easily accommodates customer needs, from defense agencies to commercial entities. And since much of their offerings consist of subscription contracts and usage-based pricing, these factors further drive customer retention and ensure steady cash flow streams for future growth.

Analyzing BKSY’s Revenues

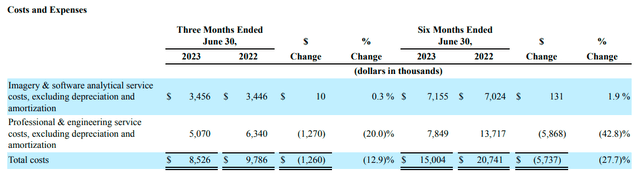

This quarter, BKSY had a significant uptick in its imagery and software analytical services revenue. The growth rates stand at 50.7% and 77.2% for the three and six months ending in June 2023, respectively. This is important because, as I’ll show later, BKSY appears undervalued even with lower growth rates than these. Still, there also was a downturn in BKSY’s professional and engineering services. As per BKSY’s most recent 10Q report, this decline in revenue can be attributed to the maturation of two engineering services contracts, which led to a reduced quarterly completion percentage year-over-year. I believe this is important because it showcases BKSY’s main problem: it’s still a relatively small operation.

BKSY’s latest earnings slides

In fact, BKSY’s size is likely the main risk in BlackSky’s financials. You see, the U.S. federal government and agencies represent 73.5% of total revenues. This makes the company incredibly dependent on the government and potentially arbitrary decisions. Moreover, since BKSY operates in an industry where geopolitical tensions can significantly affect business, this client base is an even greater risk. For instance, ongoing conflicts in Ukraine could spike demand for real-time geospatial analytics or introduce new regulatory constraints that might impede operations. Likewise, peace agreements could significantly contract the need for BKSY’s services, negatively impacting its revenues all at once.

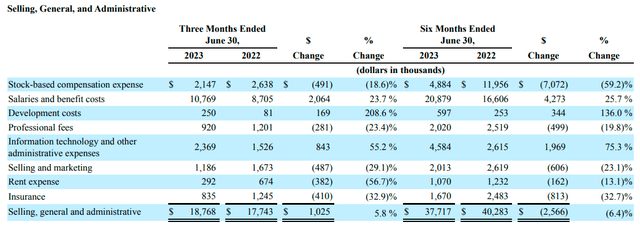

BKSY’s latest 10Q report.

Also, BKSY recently encountered $2.5 million in unanticipated costs for completing certain contracts. Given BKSY’s current scale, even minor financial deviations can noticeably impact quarterly results. While BKSY demonstrates operational efficiency, investors must scrutinize the company’s cost estimation accuracy. Consistent cost overruns could jeopardize the otherwise promising outlook. However, as BKSY expands, its subscription-based revenue model should help buffer against significant revenue fluctuations tied to individual clients or contracts, ensuring steady revenue growth. Furthermore, I’m optimistic about BKSY’s management capabilities due to the company’s healthy balance sheet and sustained high growth rates.

BKSY’s latest 10Q report.

Valuation

From a numbers perspective, BKSY’s strategic positioning within the burgeoning geospatial intelligence market is commendable and indicative of a bright future. Their historical revenue trajectory, which transitioned from a 54% growth in 2020 to a remarkable 91.5% in 2022, showcases their adeptness in navigating the market and their resonance within the global defense and intelligence sector. The secular tailwinds, combined with BlackSky’s subscription-based revenues, stand out as the most promising features of BKSY’s business model.

Furthermore, BKSY’s latest earnings Q&A session emphasized the company’s focus on renewing and cultivating new contracts. Additionally, BKSY’s alliance with SPIRE, targeting the enhancement of maritime solutions, is a testament to their forward-thinking approach and commitment to broadening their service horizons. The impending Gen-3 satellite deployments, boasting superior imaging capabilities, further fortify their market standing. Given all these initiatives, I believe the company is well-positioned for growth, solidifying its current revenues and aiming to secure new contracts in the upcoming years.

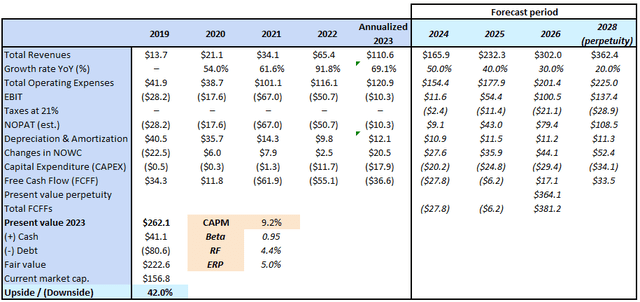

Seeking Alpha plus author’s elaboration.

However, forecasting BKSY’s future revenues remains somewhat challenging. So, I assumed a decelerating growth pattern: 50% in 2024, tapering to 40% in 2025, 30% in 2026, and stabilizing at 20% from 2027 to 2028. Then, using 2028 revenue figures, I valued them as perpetuity. I used BKSY’s CAPM estimated discount rate of 9.2% for this. I believe these are relatively reasonable assumptions given its seemingly steady growth over the past few years.

According to my valuation model, BKSY appears undervalued, especially given its unique business model and prospects. My DCF analysis suggests an equity valuation of approximately $262 million, hinting at a 42% upside potential from current levels. This potential upside positions the stock as a highly attractive investment opportunity when juxtaposed with BlackSky’s robust financial health, impressive contract backlog, and strategic initiatives.

Conclusion

BlackSky Technology Inc. stands out in the geospatial analytics landscape due to its technological advancements and market strategy. The company’s growth path, highlighted by robust revenue metrics and strategic endeavors, offers an optimistic outlook for potential investors. However, every investment carries risks, and BKSY is no exception, with challenges like its dependency on the U.S. federal government and the industry’s volatile nature. Yet, based on my valuation, there’s a case to be made that the company is undervalued, implying a favorable upside for investors. Given BlackSky’s solid financial standing, impressive contract commitments, and proactive strategies, I believe BKSY is a viable investment alternative in geospatial intelligence.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here