What happened?

It isn’t unheard of for a company to throw shade at competitors on an earnings call, but it is unusual. This is precisely what it appears CrowdStrike’s (NASDAQ:CRWD) CEO George Kurtz did on the earnings call last week, seemingly alluding to SentinelOne’s (NYSE:S) troubles.

First, a little background.

SentinelOne came out swinging in the endpoint protection market against CrowdStrike when it went public in 2021. When I Googled “CrowdStrike” back then, I would always see a pay-per-click ad by SentinelOne. Those ads have disappeared now.

A Reuters report two weeks ago asserted that SentinelOne was exploring sales options, and other reports said it could be sold to a private equity firm. This is mixed news for SentinelOne investors.

Positively, the stock price has jumped as a sale price would almost certainly be above where it was trading before the rumors. The stock is still down over 35% in the last year, so many investors still have heavy losses.

On the other hand, companies sell to private equity when they are in trouble or just not performing well. Private equity firms like to drastically cut costs, streamline operations, and sell the company for a profit shortly after. They aren’t always successful; in fact, The Atlantic points out that companies bought by private equity are ten times more likely to go bankrupt.

For its part, SentinelOne denies the rumors.

Still, there is no doubt that SentinelOne is struggling. Yes, they reported 47% annual recurring revenue (ARR) growth last quarter to $612 million, but this isn’t as impressive as it seems.

- Percentages can be misleading. SentinelOne’s ARR increased by just $49 million in the quarter, while CrowdStrike’s ARR increased by $196 million.

- SentinelOne is still not generating positive cash from operations (CFO), posting negative $40 million so far this year despite stock-based compensation (SBC), which is 38% of sales. (CrowdStrike’s CFO is $546 million through Q2, SBC is 21% of sales).

- SentinelOne’s ARR per customer is $56,000. CrowdStrike’s is well over $100,000. SentinelOne’s dollar-based net retention is 115%, and CrowdStrike’s is over 125% ( and over 120% dating back to 2019).

- And on and on.

Why the disparity? CrowdStrike’s Falcon platform is comprehensive and seamless and attracts more lucrative clients (the majority of the Fortune 500 along with 23,000 others) who want the best rather than a discount product.

What did CrowdStrike CEO George Kurtz say?

Here are the quotes with my emphasis in bold and comments in italics:

We are also observing substantial changes in the competitive landscape, uniquely benefiting CrowdStrike… Working in cybersecurity for the past 30 years, I have recognized and created tectonic shifts in this industry, and we are in the midst of one right now. Organizations need better, faster, and more cost-effective protection for a digital society. Organizations need seamless, not stitched-together (jab) automation to break down legacy data silos.

The competitive battlefield of cybersecurity today reflects these realities, separating the wheat from the chaff. Those who have platforms versus those with point products masquerading as platform stories. (right hook)

What was a market littered with dozens of companies is quickly consolidating to several vendors. Smaller, narrower point product companies are being left behind. These companies are quickly going the way of legacy AV, already in the hands or looking for the safe hands of strategic or private equity buyers. (knock-out punch and an apparent direct shot at SentinelOne).

Point products, single-feature cloud security companies are learning the hard way (insult to injury) that platforms built by design win at scale.

Of course, Kurtz did not mention SentinelOne by name, but the comment about private equity buyers really cements who he was referring to in my mind.

Is CrowdStrike stock a buy?

CrowdStrike has perfected the art of making spectacular results look ho-hum. I have often written that the right cybersecurity companies are terrific investments in this environment. Cybersecurity is absolutely essential, an ounce of prevention is worth 100 pounds of cure, and companies cannot afford to cut their budgets here.

Don’t believe me? Amazon’s (AMZN) AWS growth is down to 12% this year (after being over 30% for years) because companies are decreasing data usage budgets. But CrowdStrike’s ARR growth was 37% last quarter, with net new ARR increasing from $174 million in Q1 to $196 million in Q2.

And CrowdStrike isn’t cutting prices to do it, as evidenced by the GAAP gross margin of 78% and non-GAAP gross margin of 80% in Q2. Both are up compared with last year. The company is also GAAP profitable this year for the first time.

GAAP profits are a terrific achievement; however, GAAP results aren’t the way to measure a company like CrowdStrike now. It should be measured against (1) its long-term target operating model, (2) cash flow, and (3) growth.

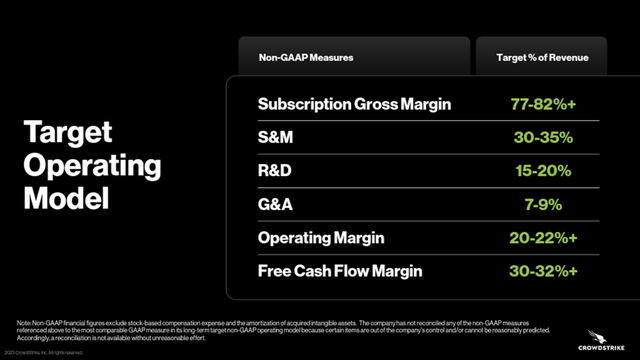

Source: CrowdStrike

1. CrowdStrike has achieved most of these already, although the operating and free cash flow margins are just short at 19% and 29%, respectively.

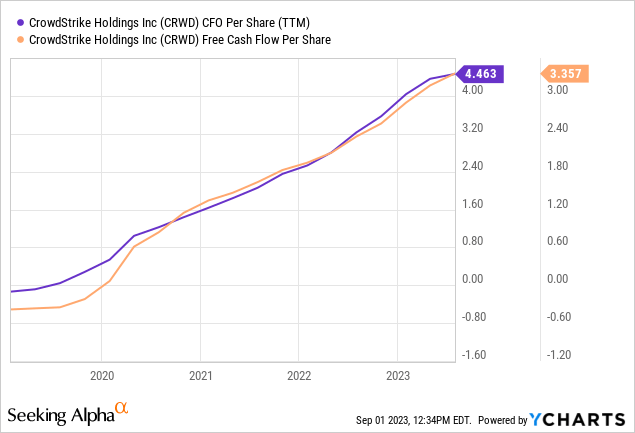

2. Free cash flow and cash from operations have skyrocketed as the company has scaled. Shown below is the trend on a per-share basis:

I use the “per-share” basis because we are all concerned about dilution.

The company’s stock-based compensation (SBC) continues to drop as a percentage of revenue, falling to 21% through Q2 this year from 23% for the same period of 2022.

3. We have already discussed growth. CrowdStrike keeps chugging along. It increased its guidance for this fiscal year guidance for this fiscal year to over $3 billion in revenue, a 34% increase over the prior fiscal year.

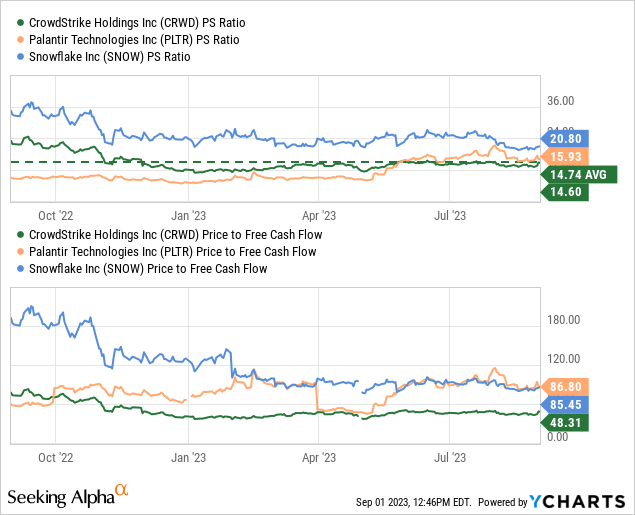

CrowdStrike stock isn’t cheap at 14.5x sales, but it is less expensive than some other high-growth favorite software-as-a-service ((SaaS)) companies, like Palantir (PLTR) and Snowflake (SNOW), as depicted below.

It is also trading near its recent average price-to-sales (P/S) ratio, so it will easily outpace the market if it continues to grow and maintains a similar valuation.

Still, it is wise for interested investors or current shareholders to take advantage of pullbacks.

The stock isn’t in the discount DVD bin, for sure. But I would much rather pay a slight premium for top-shelf quality. These are the companies that outperform the market over the long haul.

Read the full article here