Financial markets have had a bumpy ride lately, inspiring fresh concerns that this year’s rebound from 2022’s sharp loss has run its course. It’s premature to dismiss that possibility, but a review of several sets of ETF pairs for markets still leave room for debate, based on prices through yesterday’s close (Sep. 5).

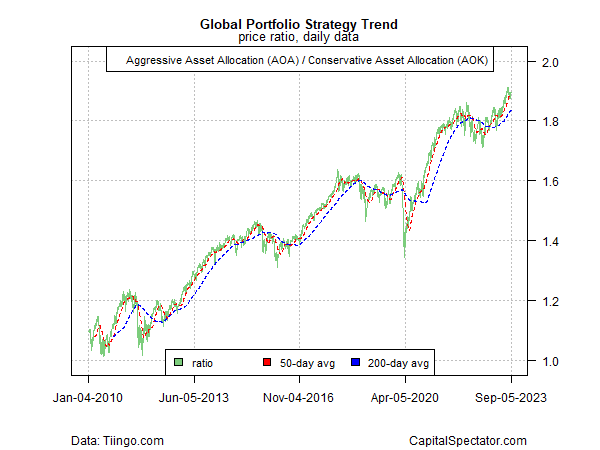

Let’s start with the ratio for aggressive (AOA) and conservative (AOK) asset allocation ETFs. For the moment, this global proxy of risk appetite suggests that a bullish trend remains intact. The latest downturn may turn into a deeper rout, but for now the upside bias endures.

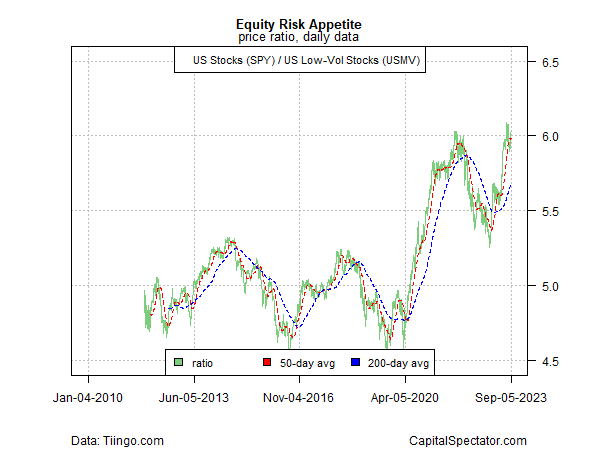

The risk appetite for US shares also looks solid, based on the ratio for US stocks (SPY) vs. low-volatility shares (USMV), the latter being a proxy of demand for a relatively conservative/defensive equities strategy.

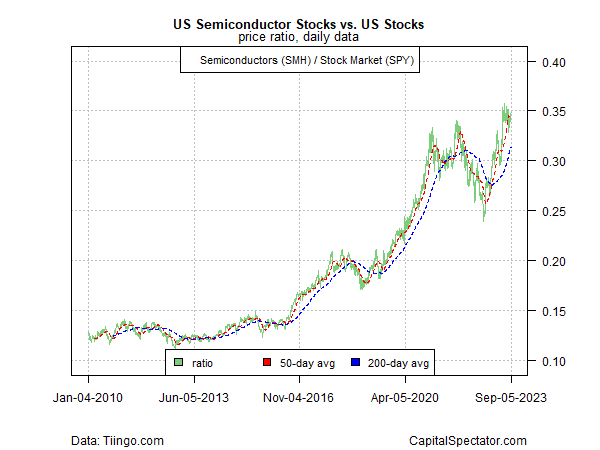

The bias in favor of risk-on is also quite strong based on shares for semiconductor firms (SMH) vs. the broad US equities market (SPY). Semi stocks are considered a proxy for the risk appetite and the business cycle.

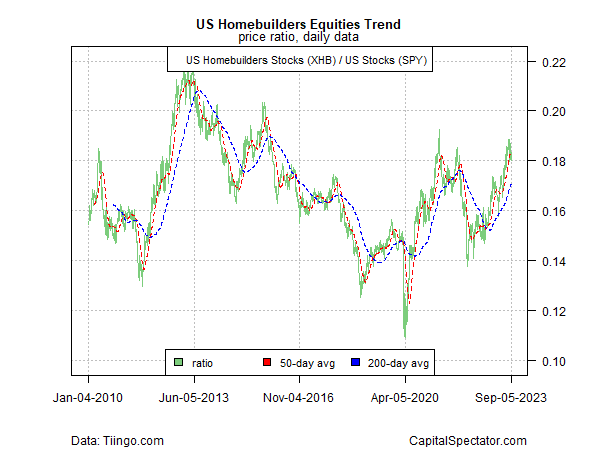

The relative strength for cyclically-sensitive homebuilder stocks (XHB) vs. the US equities market (SPY) also signals ongoing strength for the risk appetite.

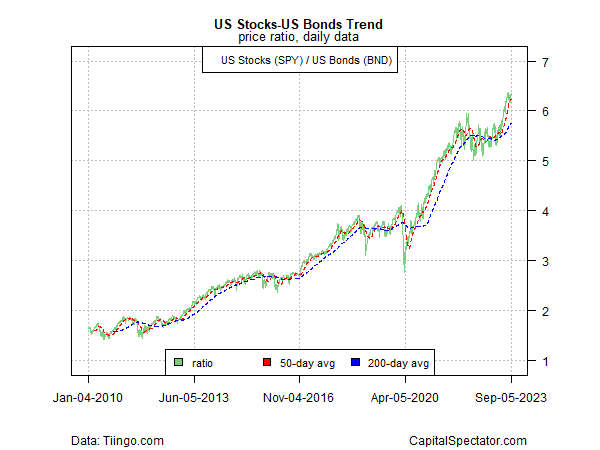

The rise in bond yields recently suggests that the allure of fixed income threatens the outlook for stocks. Why take the risk of the equities market when you can earn a safe yield in government securities? That view is starting to resonate, but price action of late has yet to reveal a clear reversal for the risk appetite. Note that the relative strength for US shares (SPY) vs. US bonds (BND) continues to indicate a strong upside bias.

The caveat is that market trends end eventually, but calling the exact point when a genuine reversal begins is impossible. Only with hindsight will major tops and bottoms become obvious. For the moment, it’s not clear that this year’s recovery in the demand for risk has run out of road. A turning point will become obvious in time, but for now the trend signals for risk still skew positive.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here